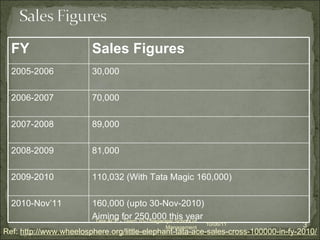

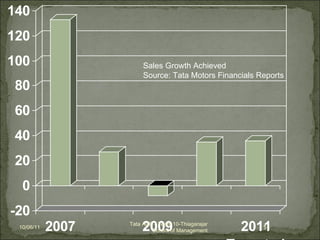

Tata Ace is a mini commercial vehicle launched by Tata Motors in 2005. It was inspired by successful Japanese and Korean mini trucks. Priced between Rs. 2.25-2.35 lakhs, it is powered by a small and efficient diesel engine, making it suitable for both rural and urban use. Since its launch, Tata Ace sales have grown steadily, reaching over 160,000 vehicles by 2010.