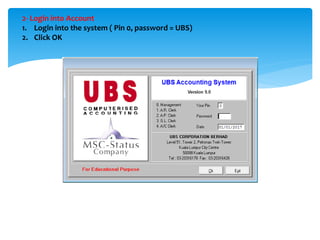

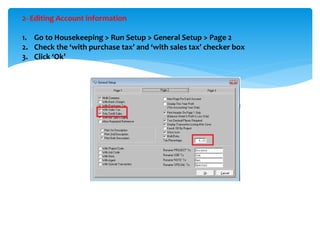

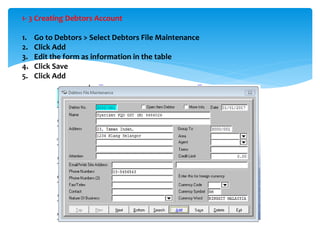

The document provides a step-by-step guide for using UBS 9.0 accounting software, detailing how to create and manage various accounts including company, debtors, and creditors. It also covers tasks such as organizing batches, adding sales transactions with goods and services tax (GST), and printing a trial balance report. The instructions are organized by sections and include specific navigation paths within the software.