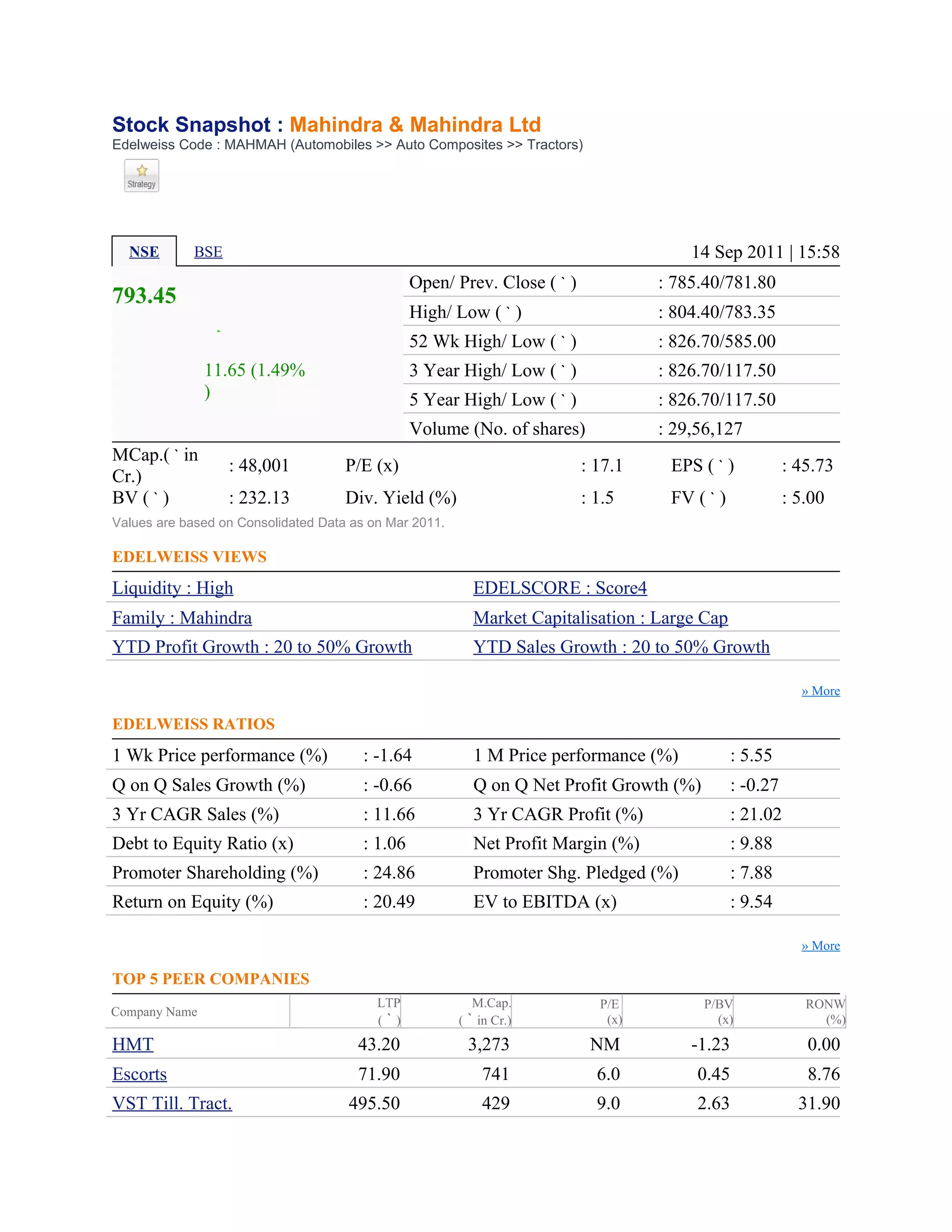

1) Mahindra & Mahindra Ltd is an Indian automobiles and tractor manufacturing company with a market capitalization of Rs. 48,001 crores.

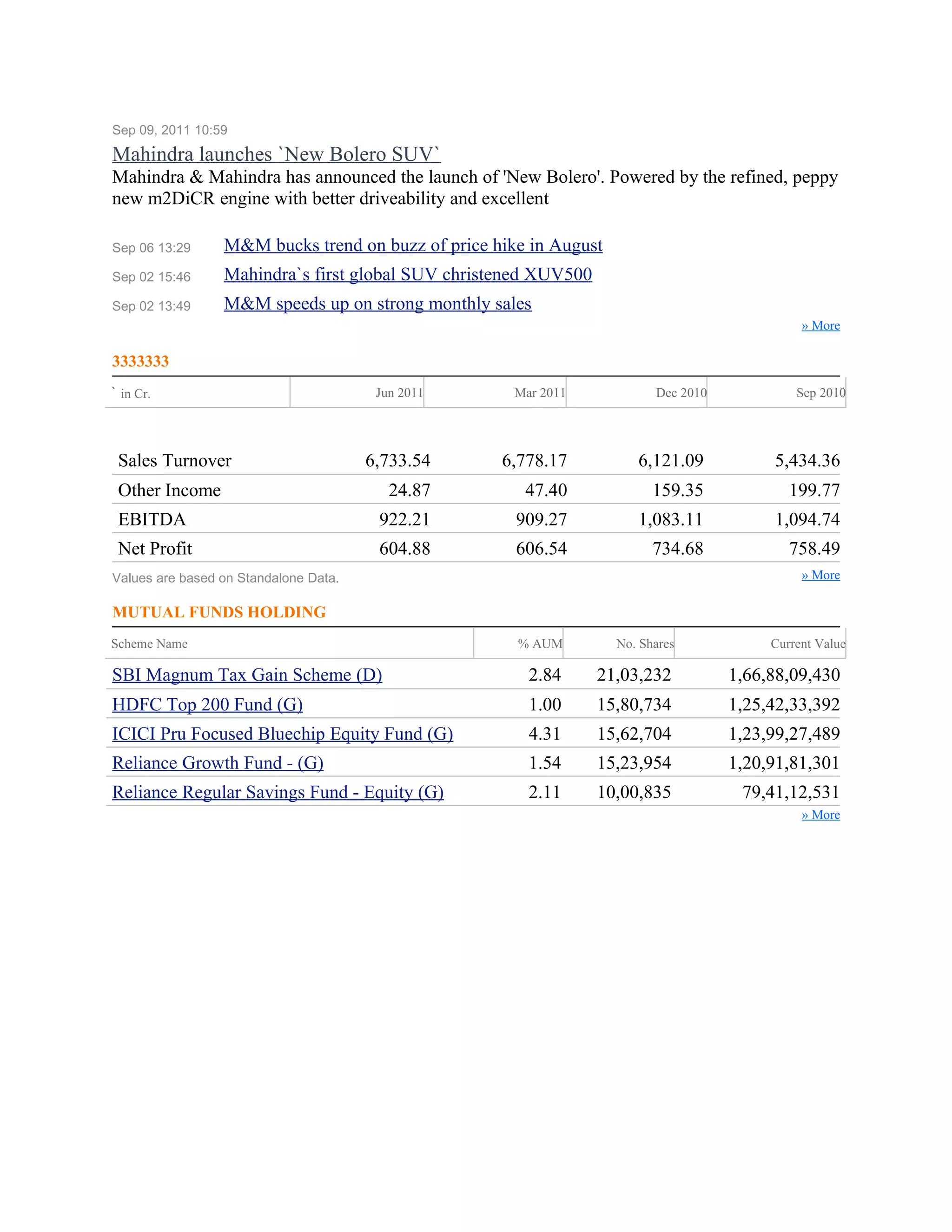

2) In the quarter ending June 2011, the company reported sales of Rs. 6,733.54 crores and a net profit margin of 11.12%.

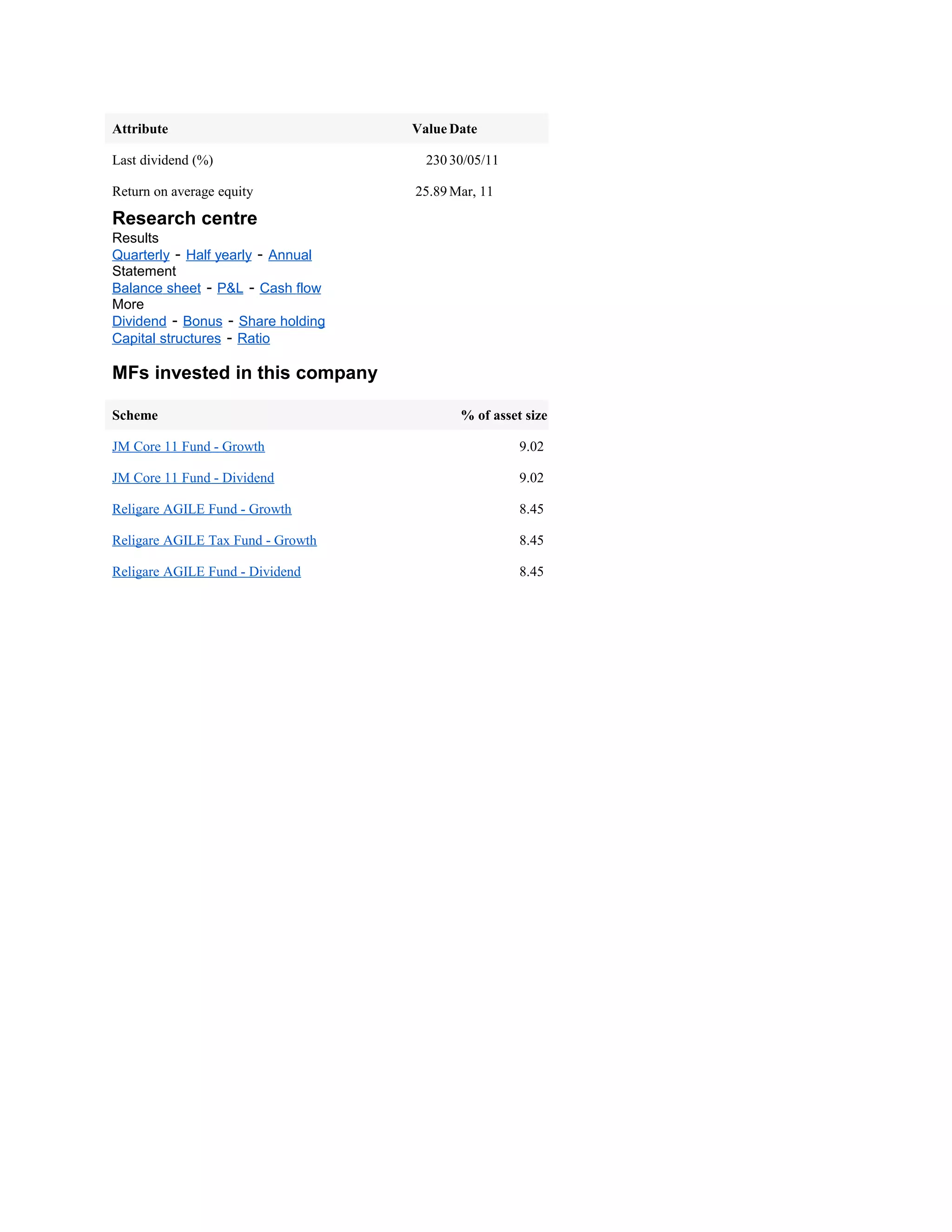

3) Several mutual funds have significant holdings in Mahindra & Mahindra, including the JM Core 11 Fund and Religare AGILE Fund, reflecting over 8% of their total asset sizes.