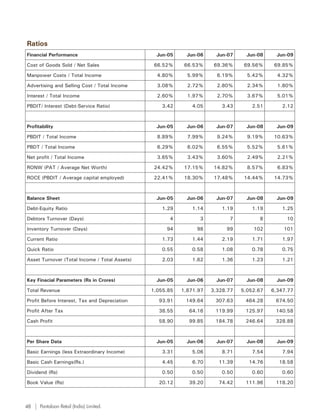

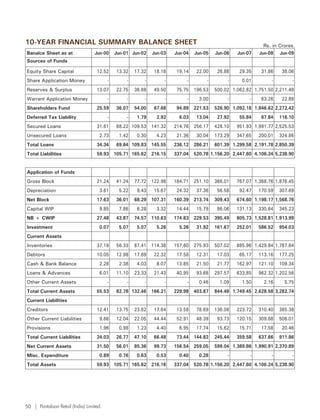

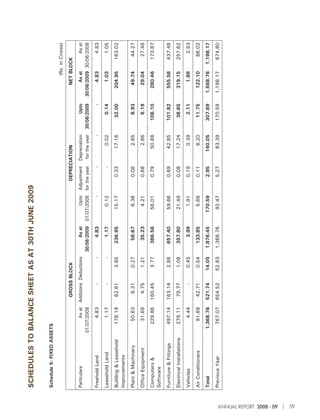

The document appears to be an annual report from 2008-2009 that includes various financial ratios and key parameters for a company from 2005 to 2009. It includes ratios related to costs, profitability, balance sheet items, and per share data. It also includes tables showing growth in total income, earnings per share, profit after tax, and debt-equity ratio from 2005 to 2009.