Embed presentation

Downloaded 19 times

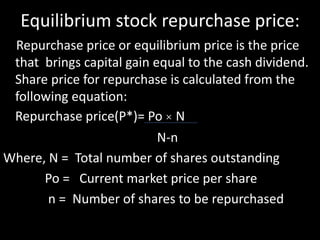

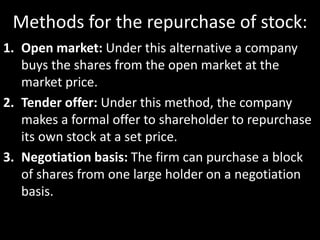

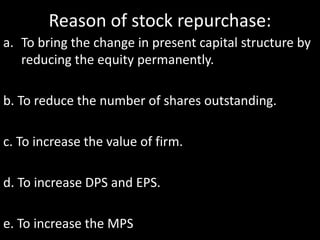

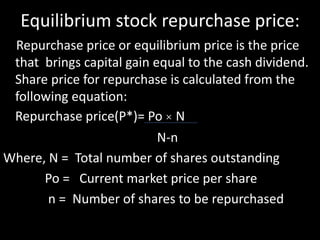

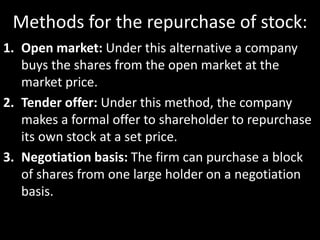

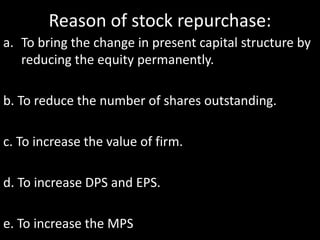

Stock repurchase is when a firm buys back its own outstanding shares to reduce the number in circulation. It can be used as an alternative to cash dividends to return funds to shareholders. The repurchase price is calculated based on the total number of shares, current market price, and number to be repurchased to equal the capital gain from dividends. Methods for repurchasing include the open market, tender offers, or negotiated block purchases. Reasons for stock repurchase include changing capital structure, increasing share value and earnings per share, and boosting stock price.