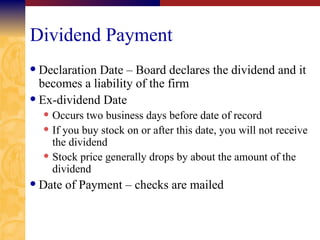

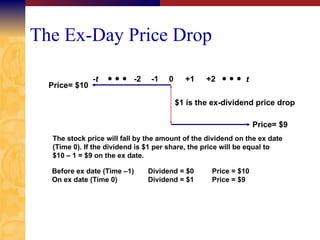

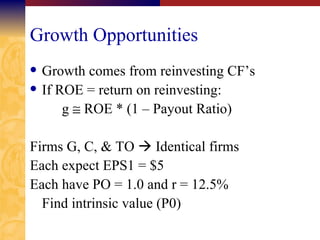

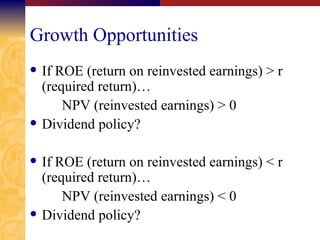

Dividends can be paid as regular cash dividends, special cash dividends, or liquidating dividends. The dividend declaration date is when the dividend is declared as a liability, the ex-dividend date is two business days before the date of record, and the date of payment is when checks are mailed. Dividend policy matters because the value of stock is based on expected future dividends, but retaining earnings can boost future growth. Firms must balance paying dividends now versus using retained earnings to reinvest and grow. Stock repurchases are an alternative to dividends that allow investors to choose whether to take the cash or remain invested and face capital gains taxes instead of ordinary income taxes.