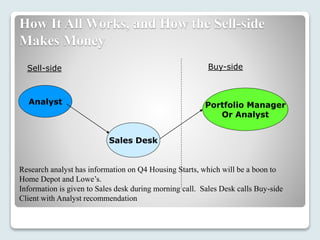

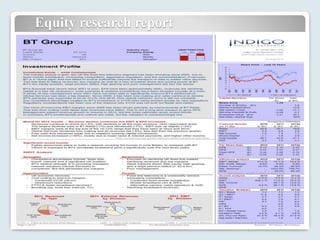

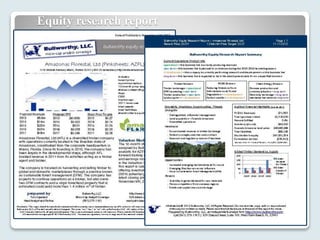

The document discusses equity research, which is the analysis of companies and stocks to inform investment decisions. It describes the equity research process, which involves economic, industry, company, and financial statement analysis as well as financial modeling and report writing. Equity research is used for investment evaluation, in the mutual fund industry, for mergers and acquisitions deals, in financial publications, and by charitable endowments. The skills required for equity research include financial analysis, business knowledge, presentation/writing capabilities, and judgment.