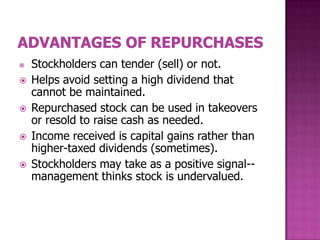

The document discusses stock repurchases and their benefits. It notes that stock repurchases can be used to provide an internal investment opportunity, modify a firm's capital structure, and increase earnings per share which should raise the stock price. Repurchases can also benefit investors for tax purposes by being taxed as capital gains rather than ordinary income like dividends. However, dividends may still be preferred by investors for being more dependable and if the stock price is too high.