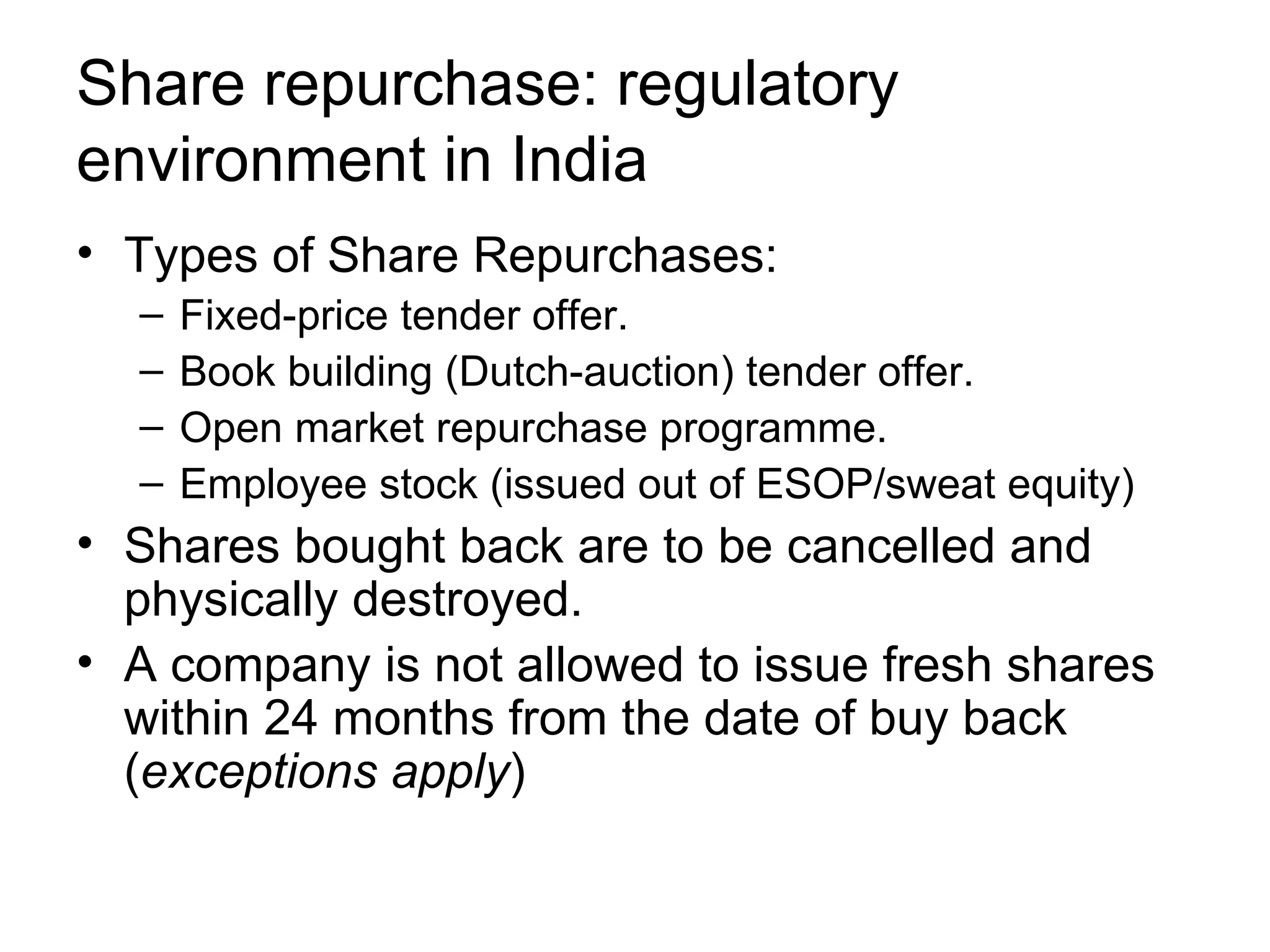

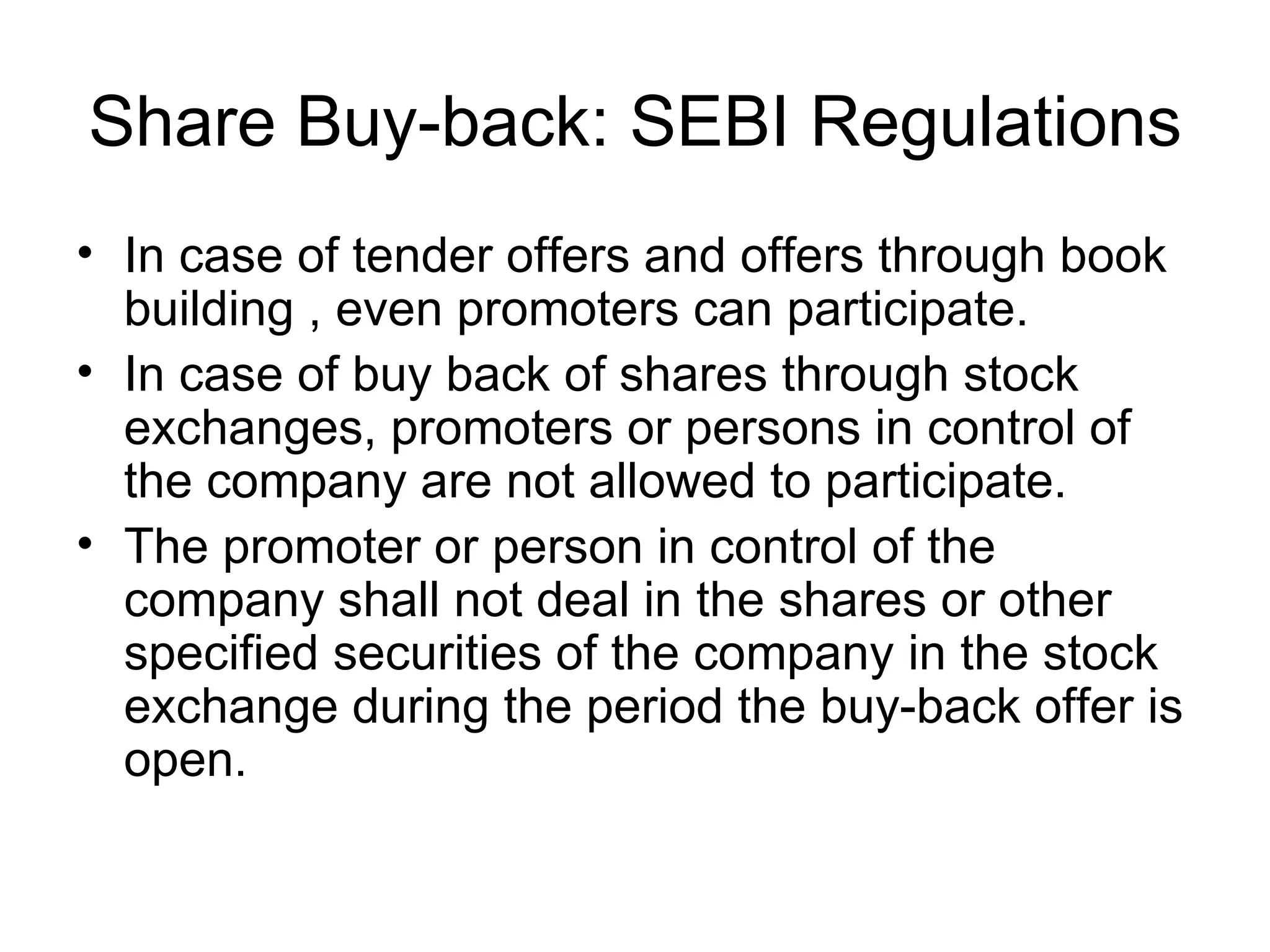

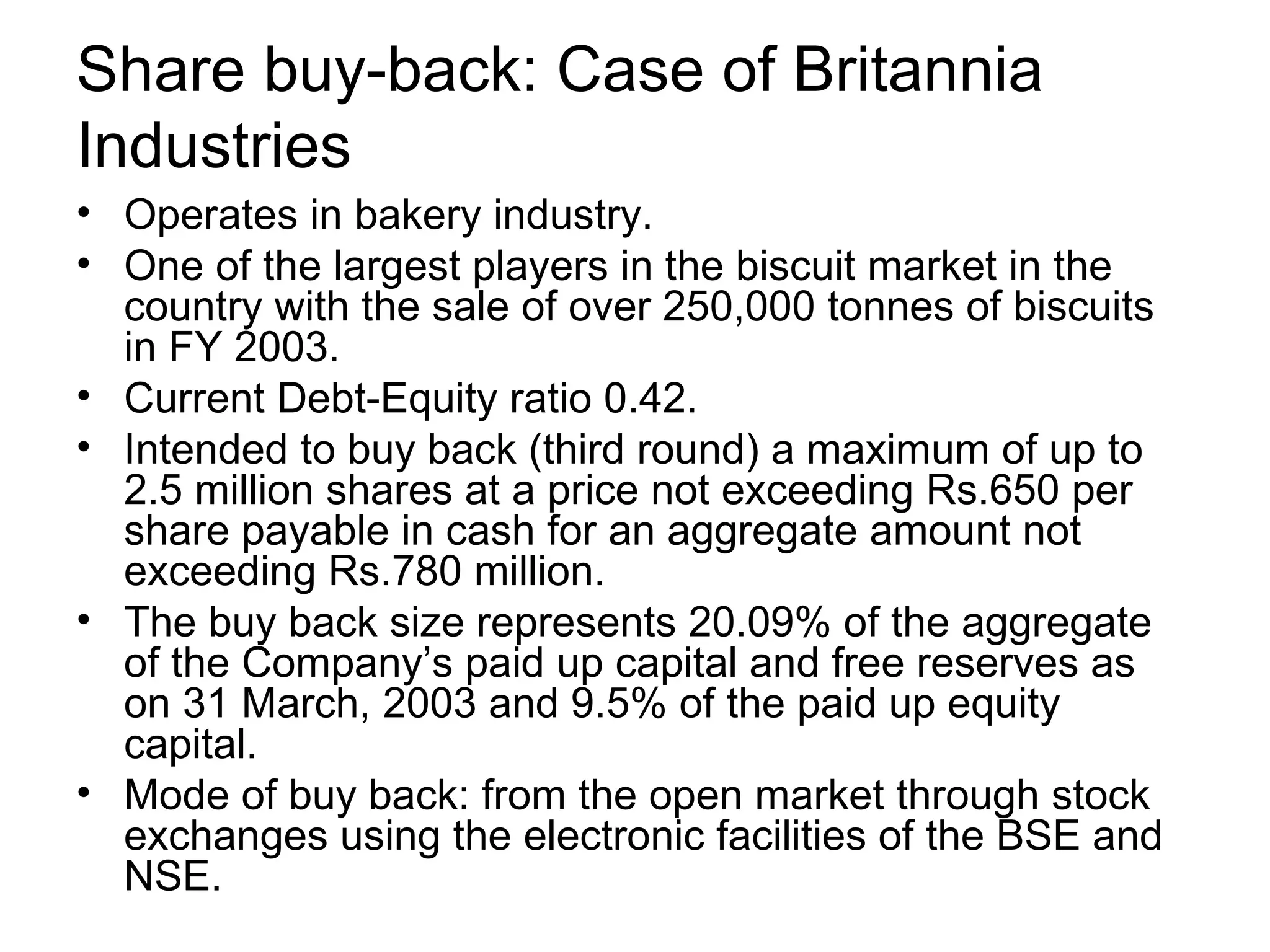

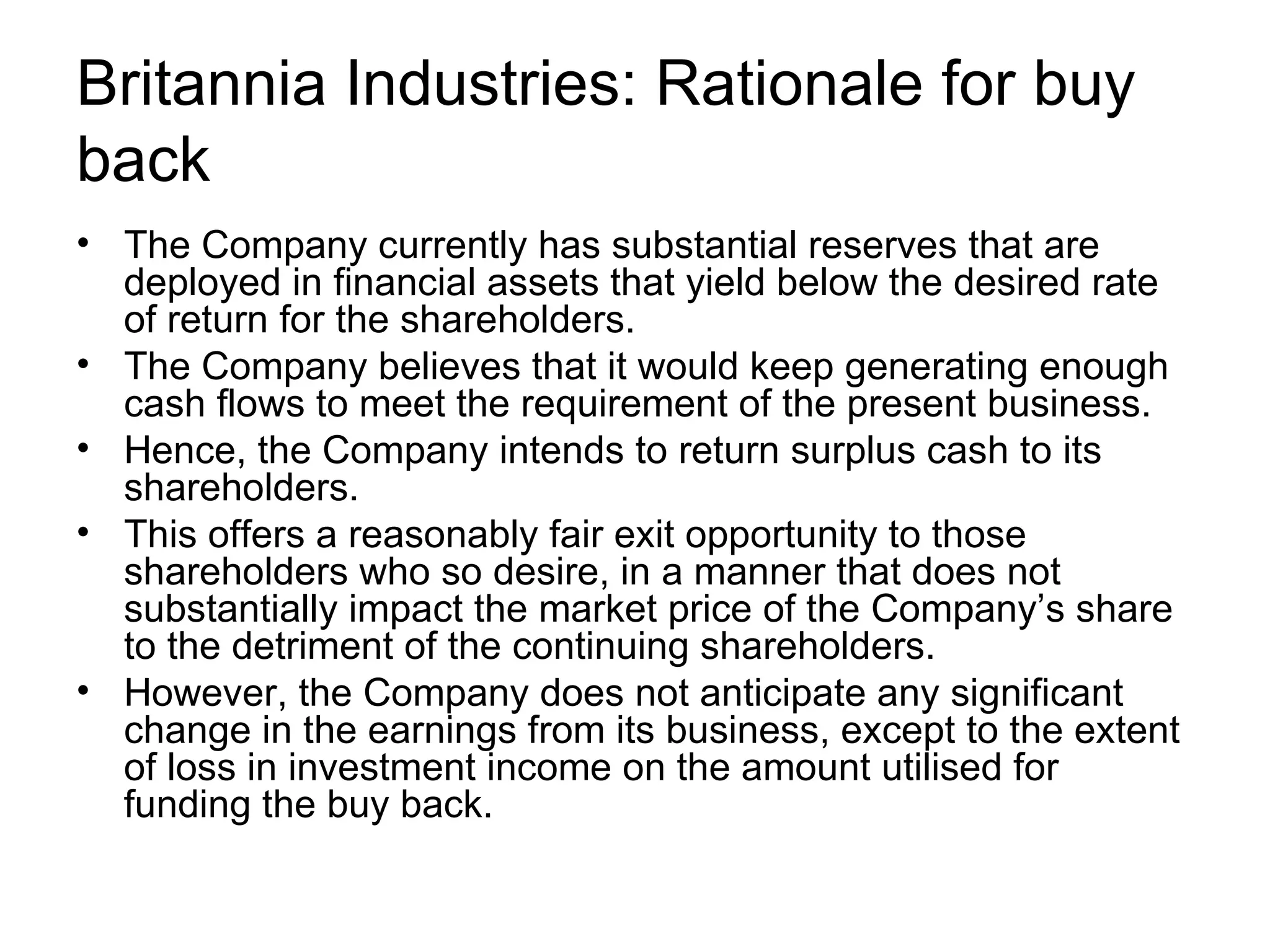

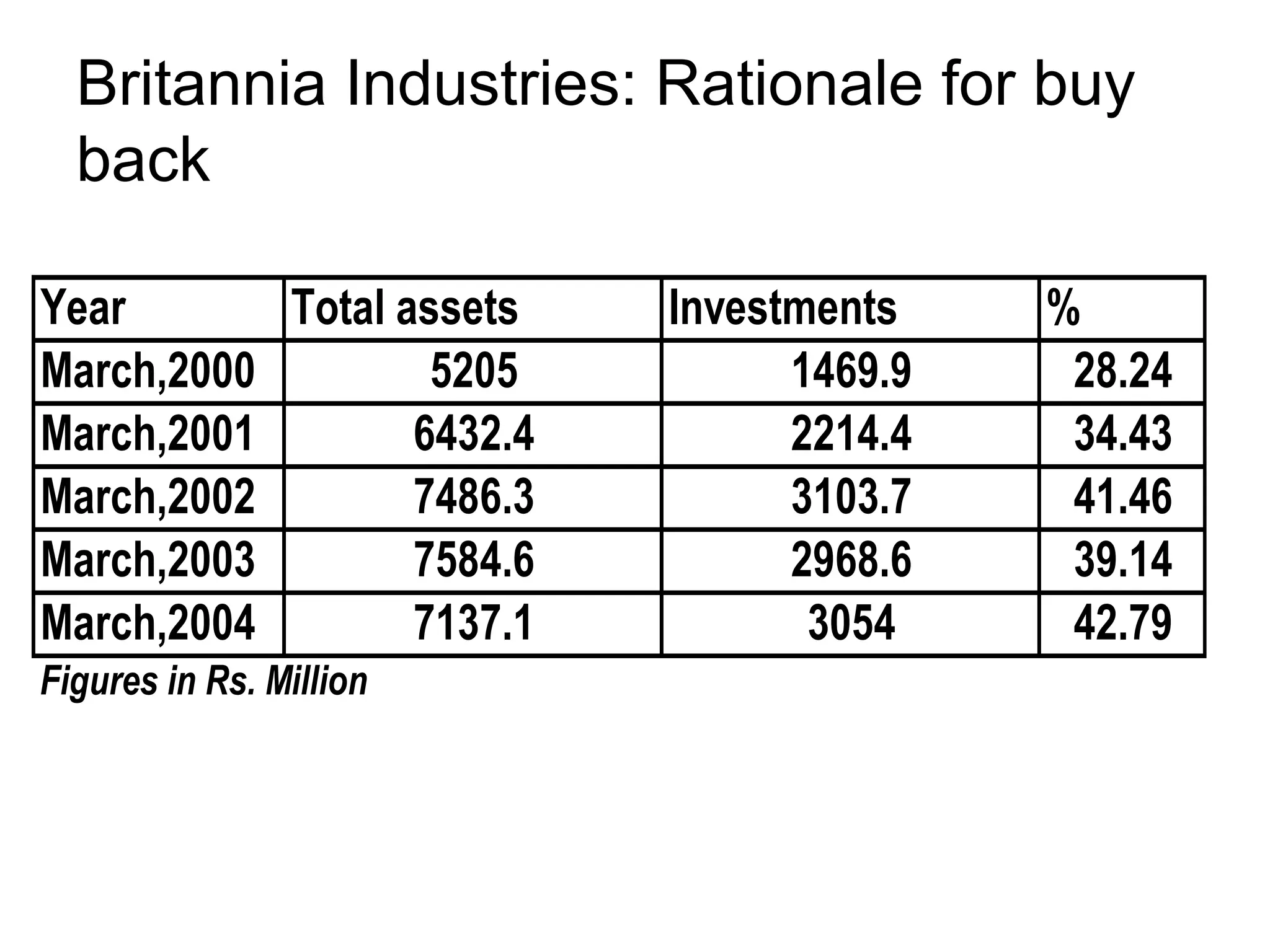

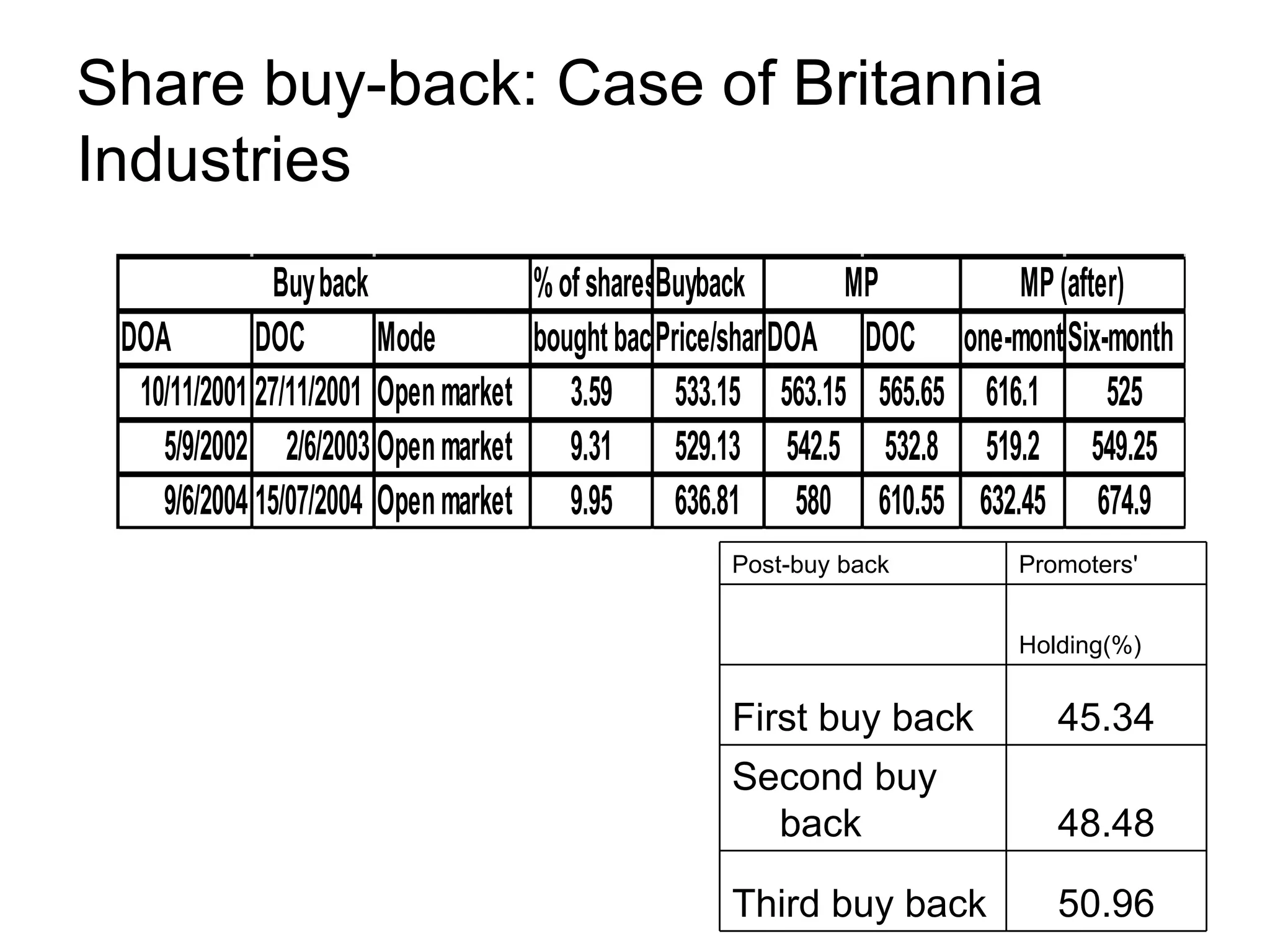

There are several factors that influence a firm's choice between paying dividends or repurchasing shares. Some key reasons for share repurchases include signaling undervaluation to the market, adjusting capital structure, and addressing agency costs through distributing excess cash flows. Regulations in India allow share repurchases of up to 25% of paid-up capital from free reserves, with debt-equity ratios after buybacks not exceeding 2:1. Case studies of share repurchase programs at Britannia Industries and Reliance Energy are presented.