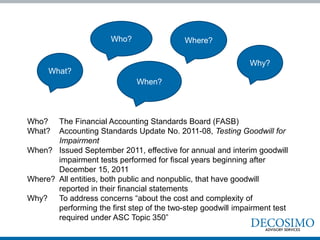

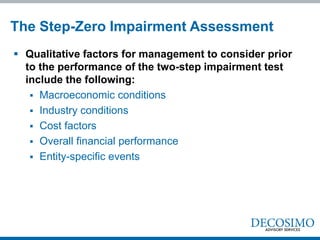

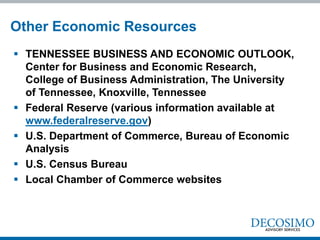

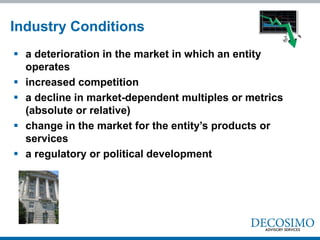

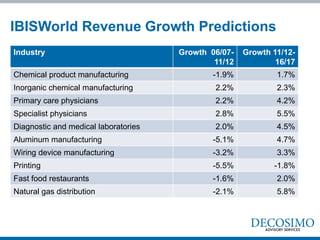

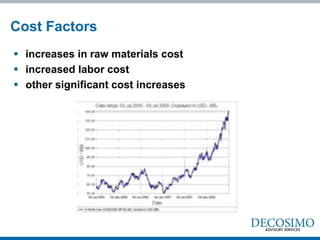

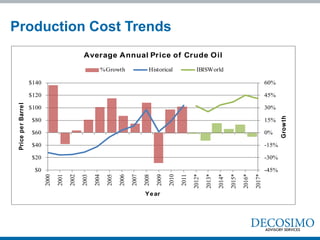

The document discusses the FASB's new qualitative assessment option for assessing goodwill impairment that became effective in late 2011. It allows companies to first qualitatively assess factors such as macroeconomic conditions, industry trends, costs, financial performance, and entity-specific events to determine if it is more likely than not that the fair value of a reporting unit is less than its carrying amount before performing the two-step goodwill impairment test. The document provides examples of qualitative factors to consider and economic resources for researching trends to inform the assessment. It emphasizes properly documenting the assessment and notes that Decosimo advisors can assist with researching industry data and transaction multiples to aid the analysis.