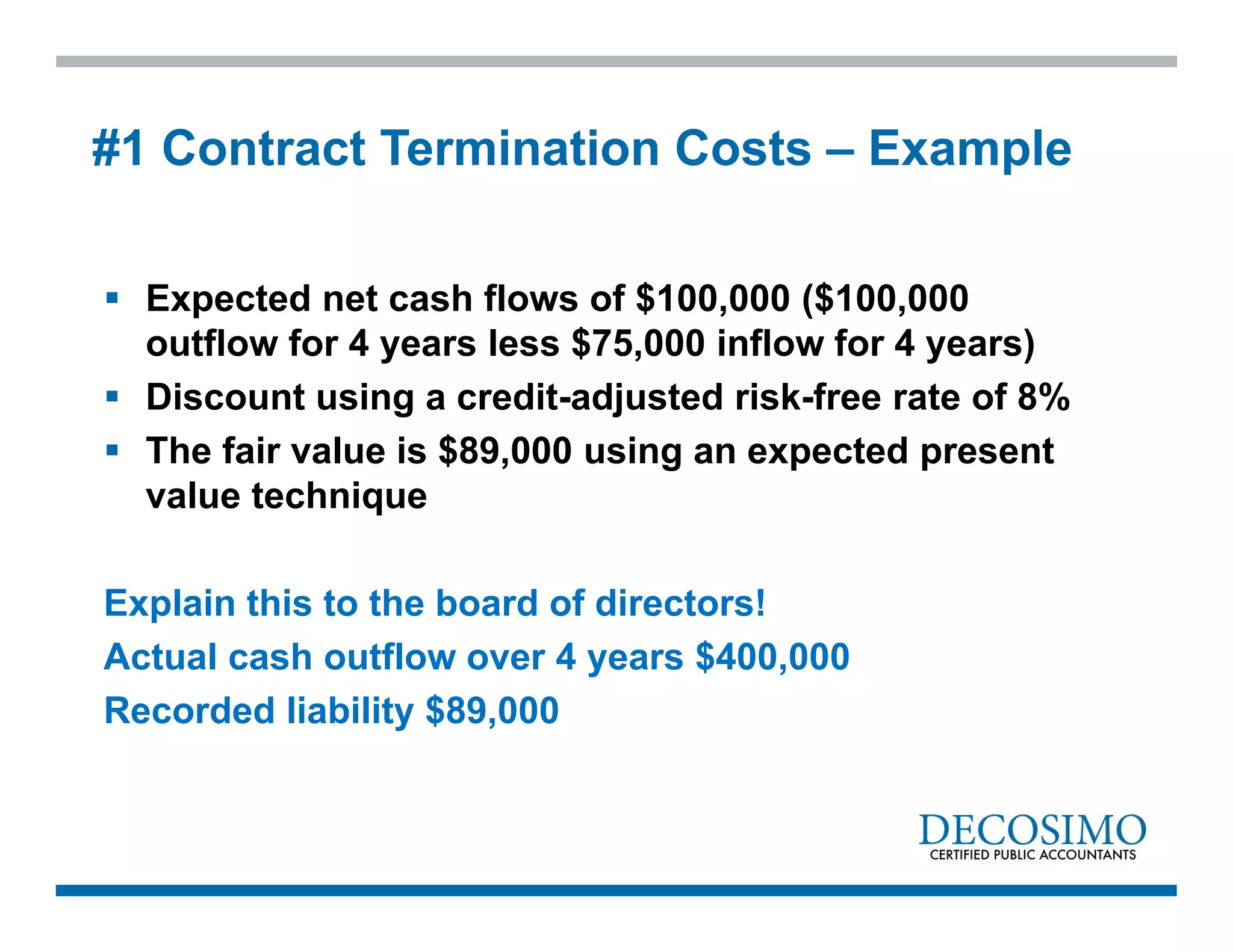

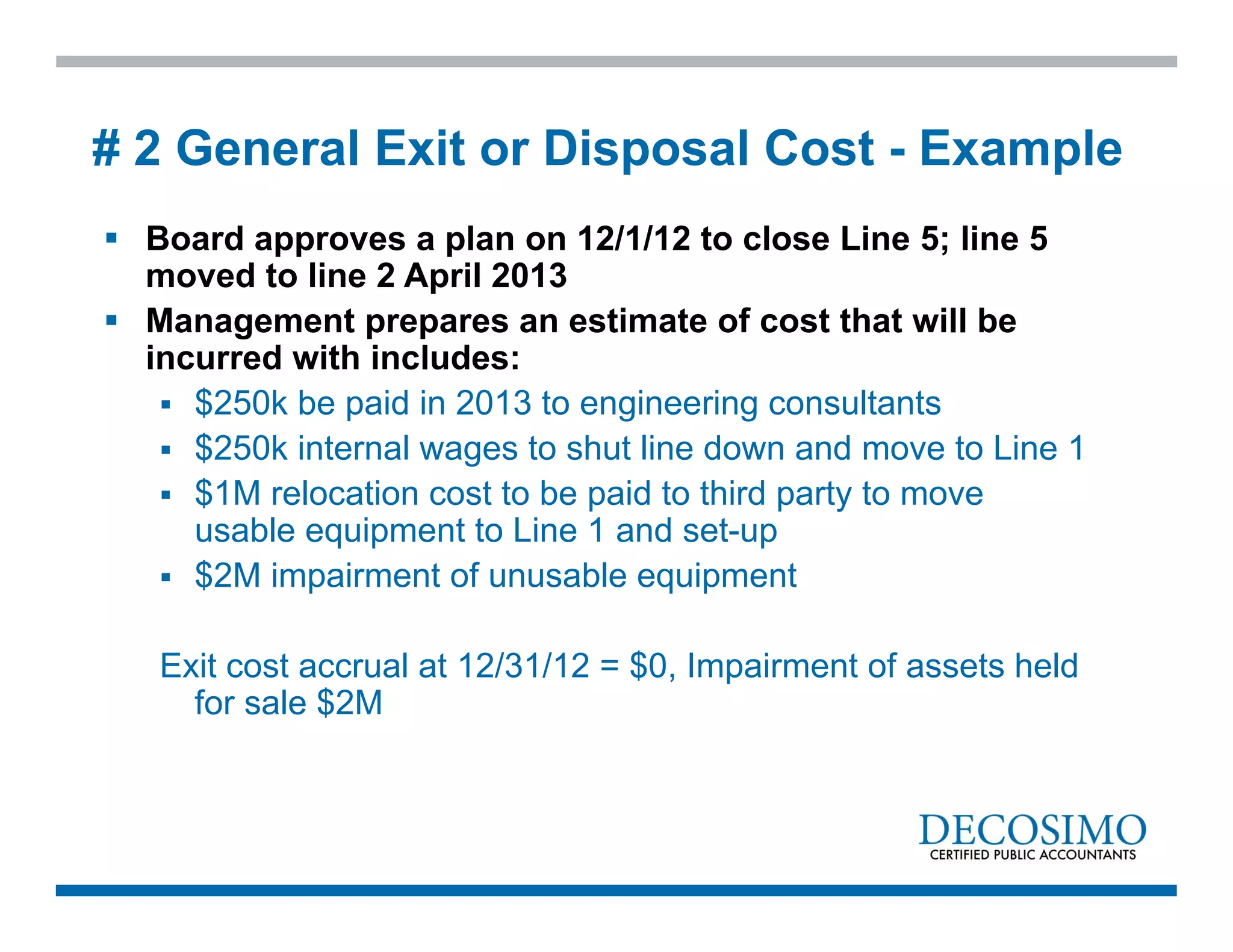

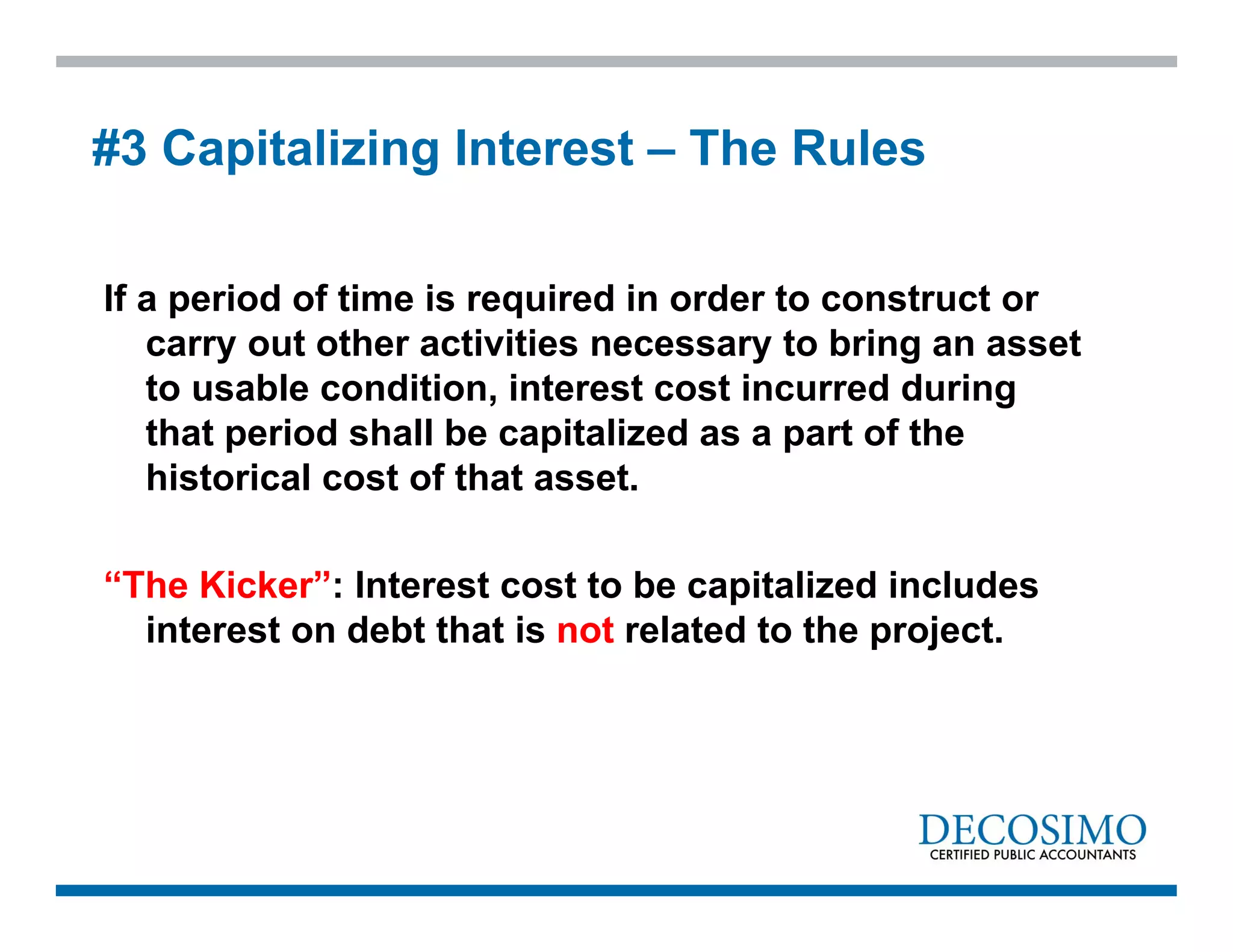

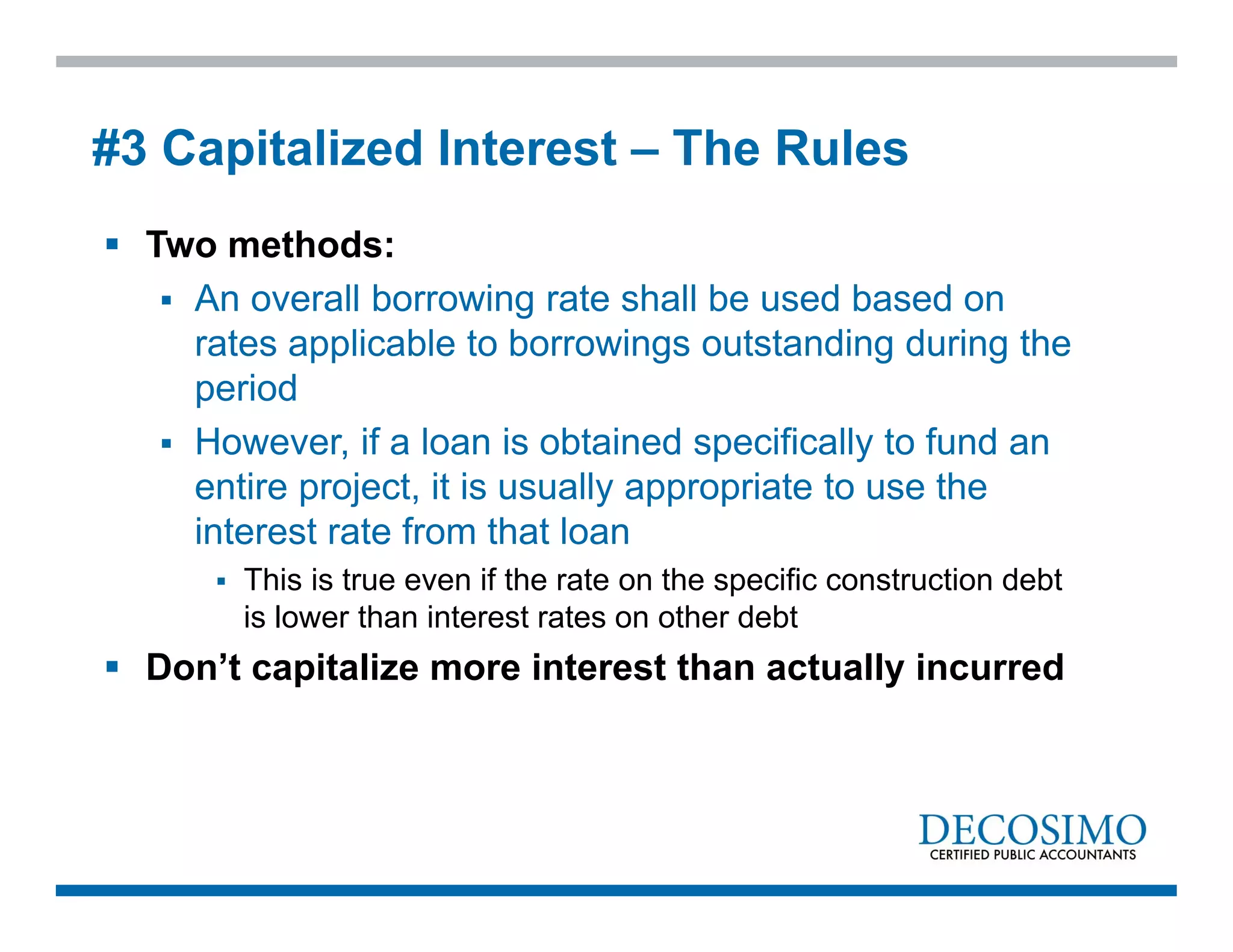

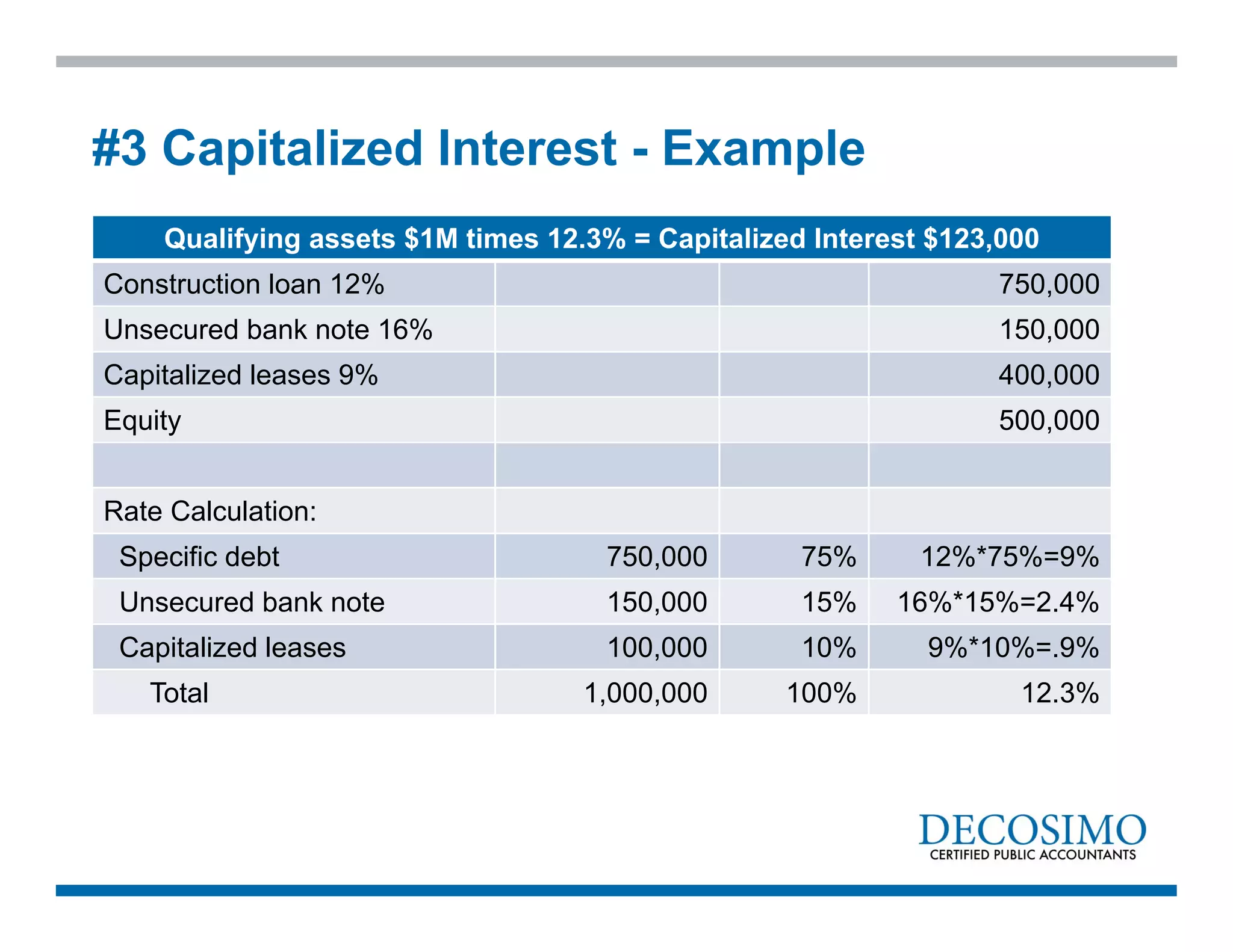

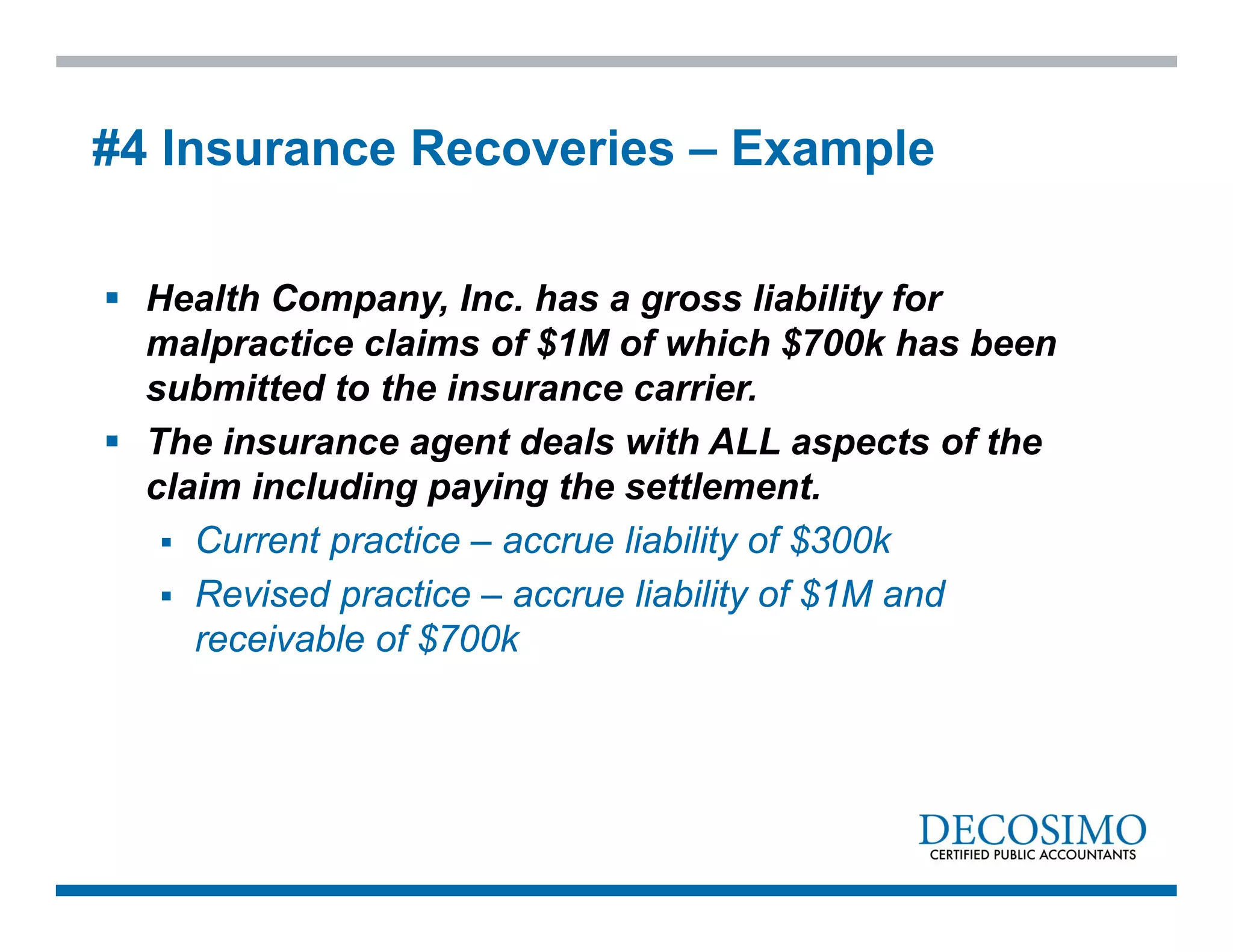

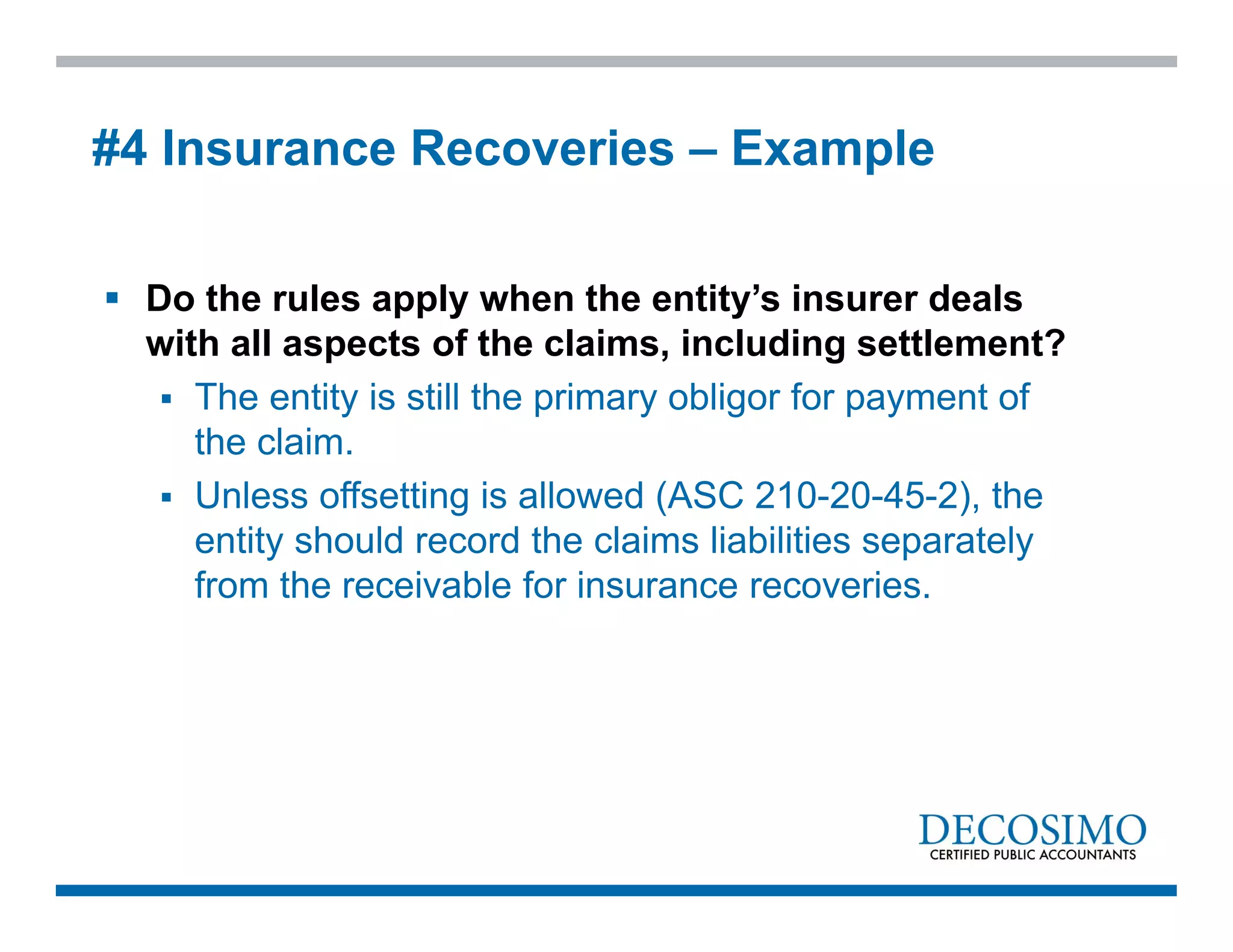

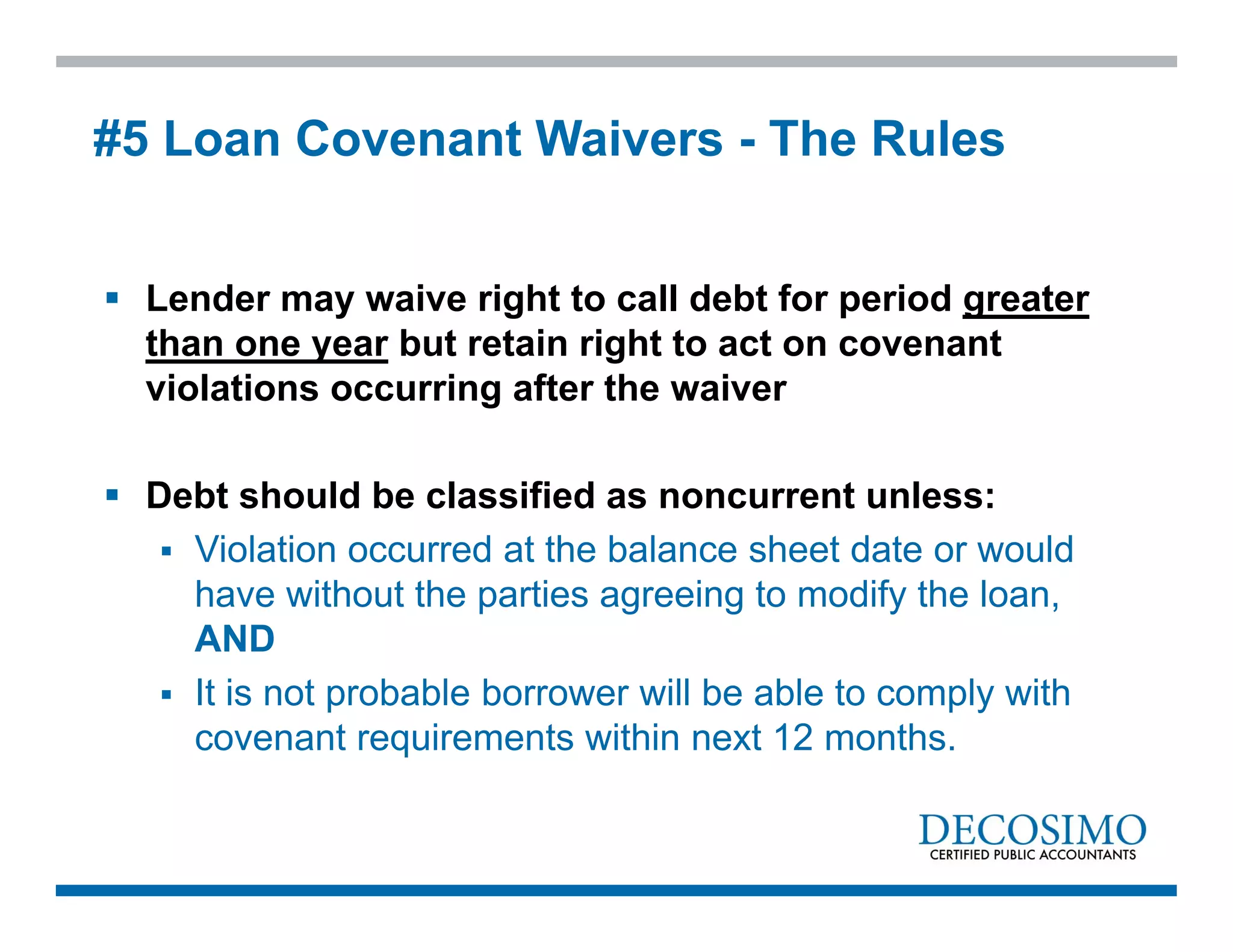

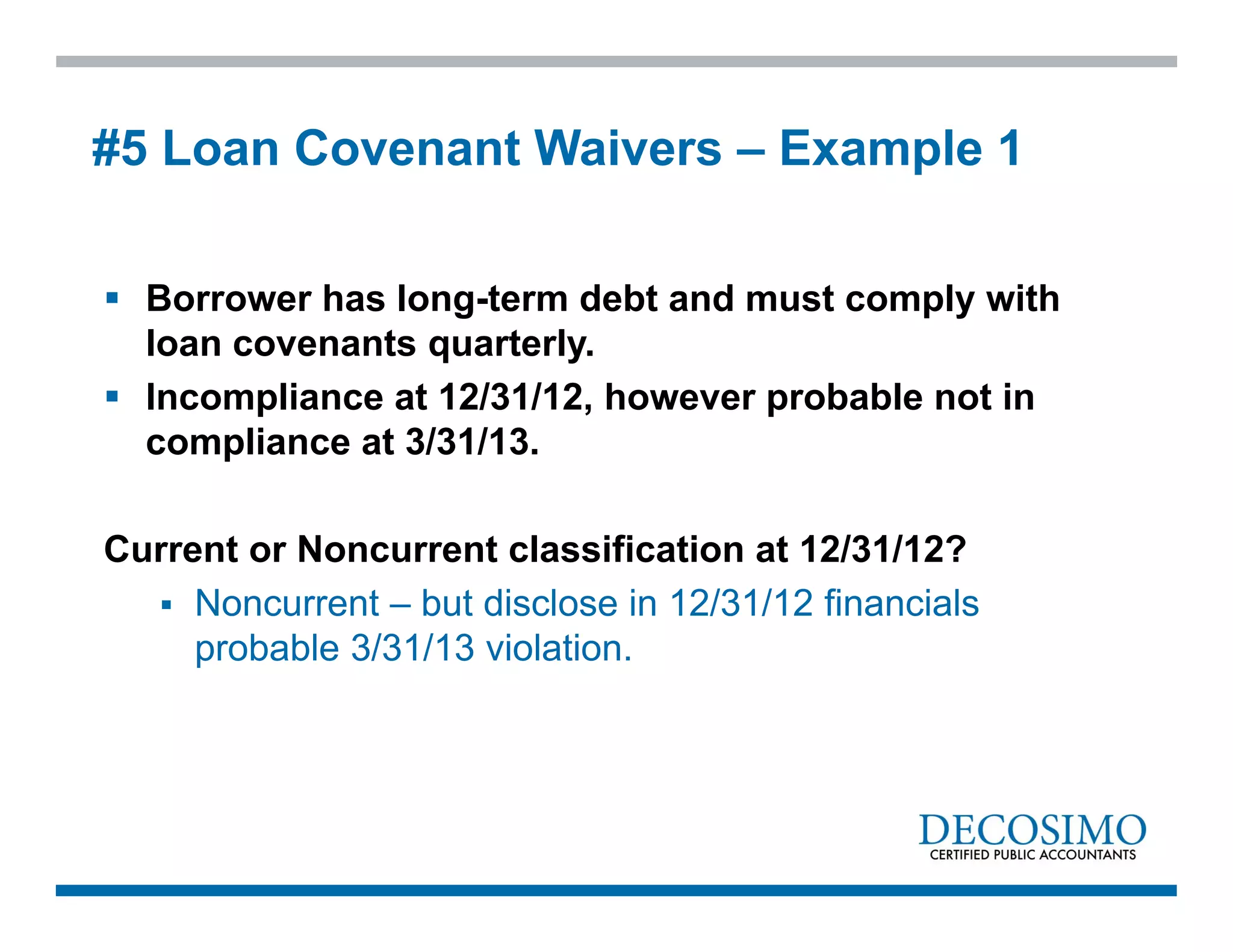

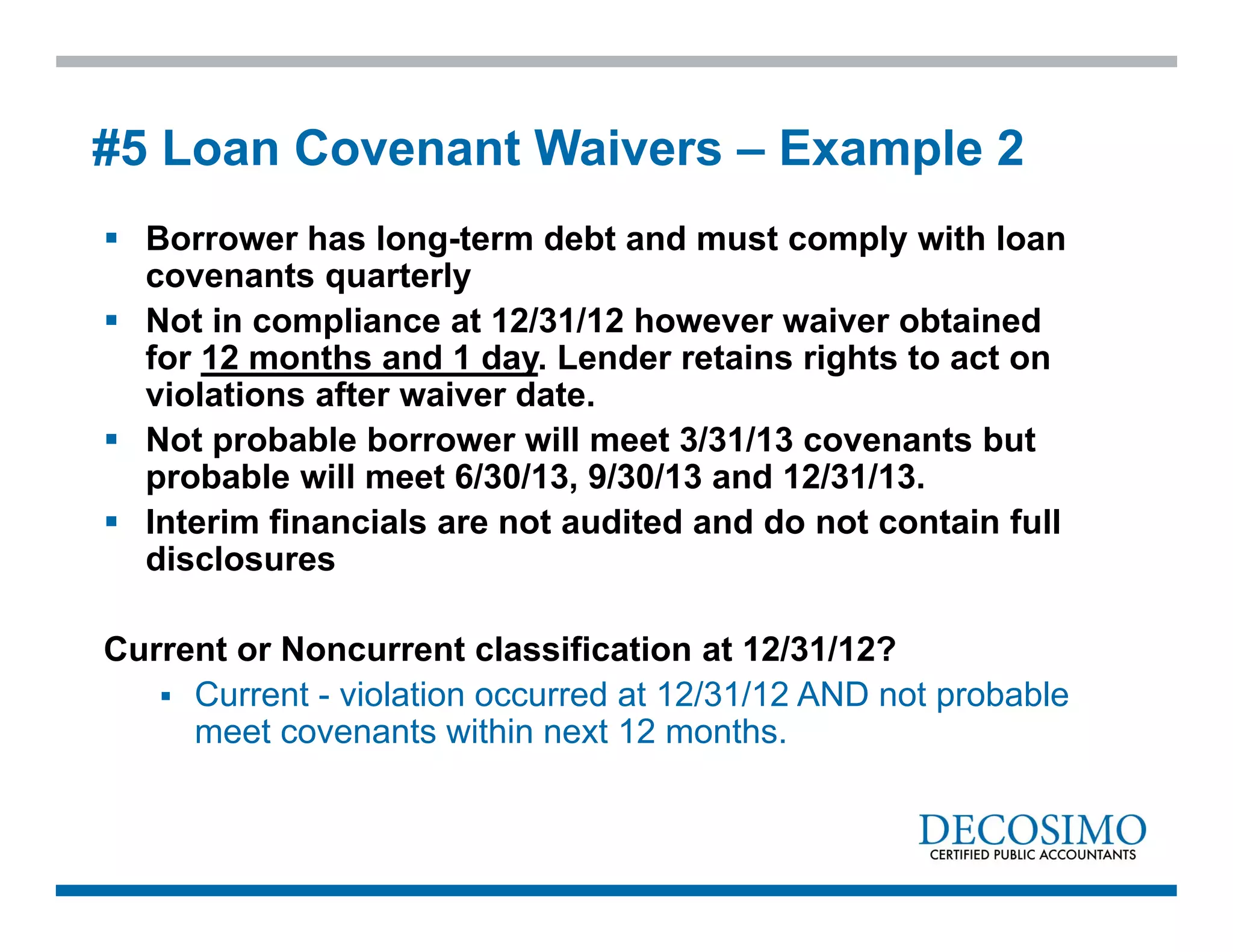

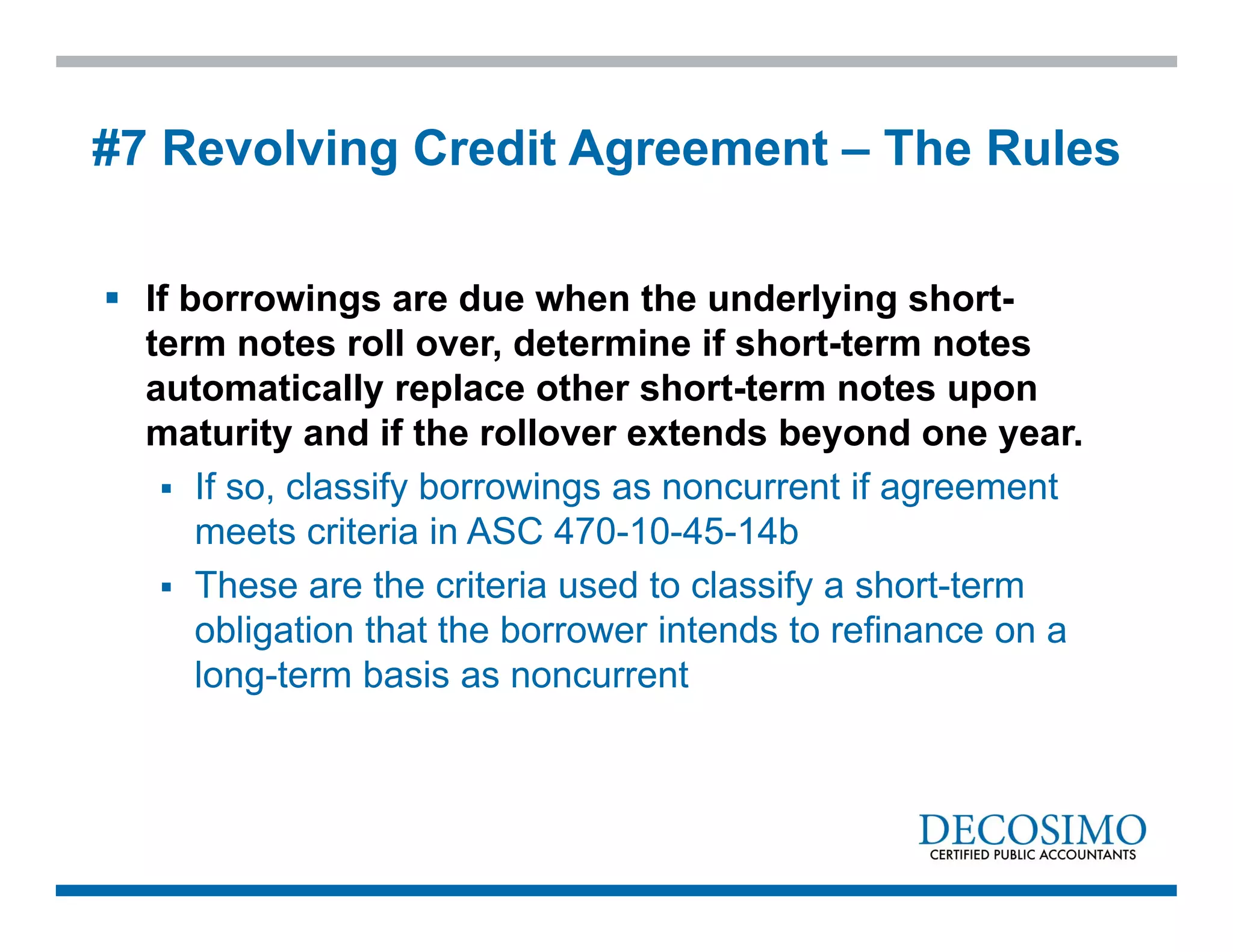

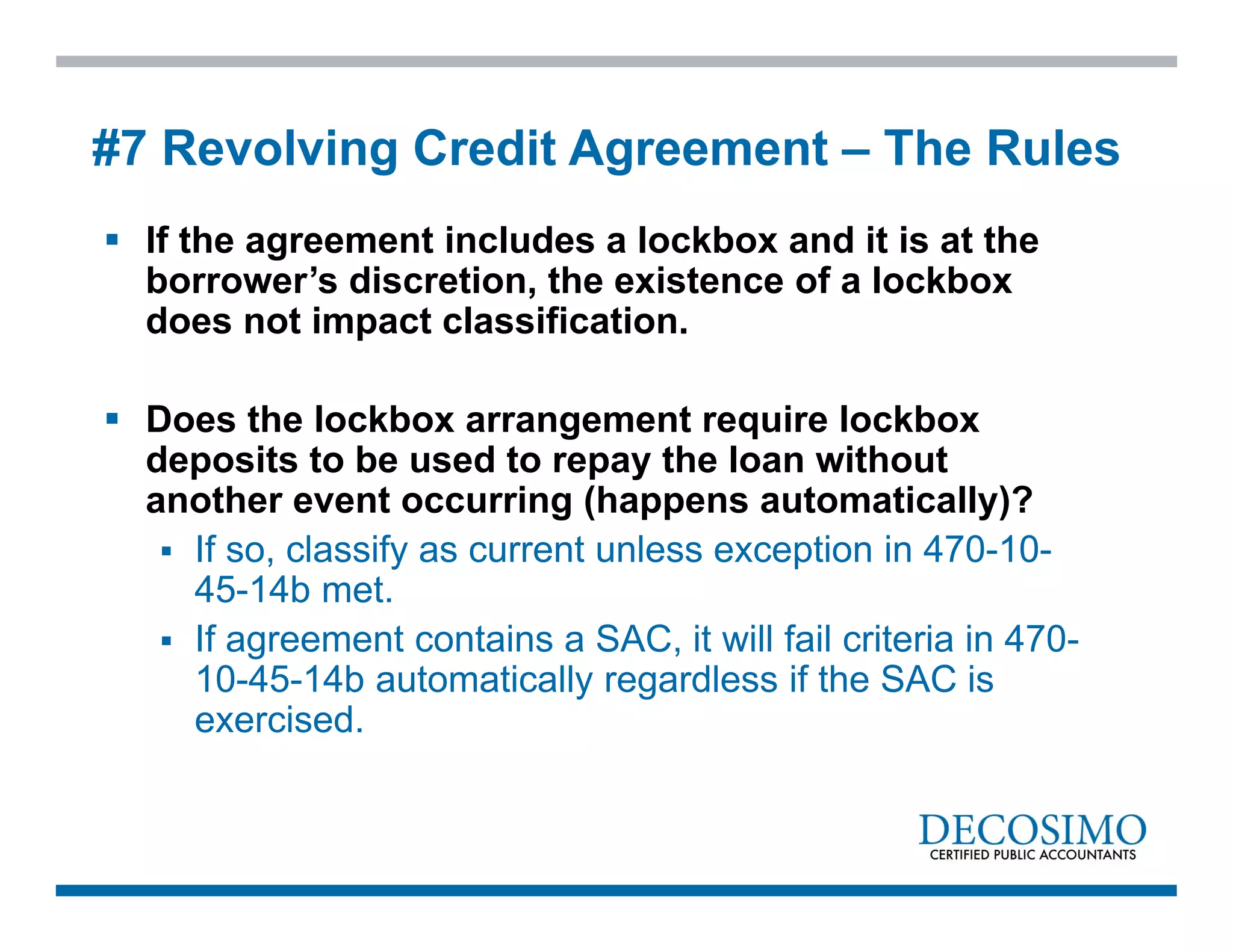

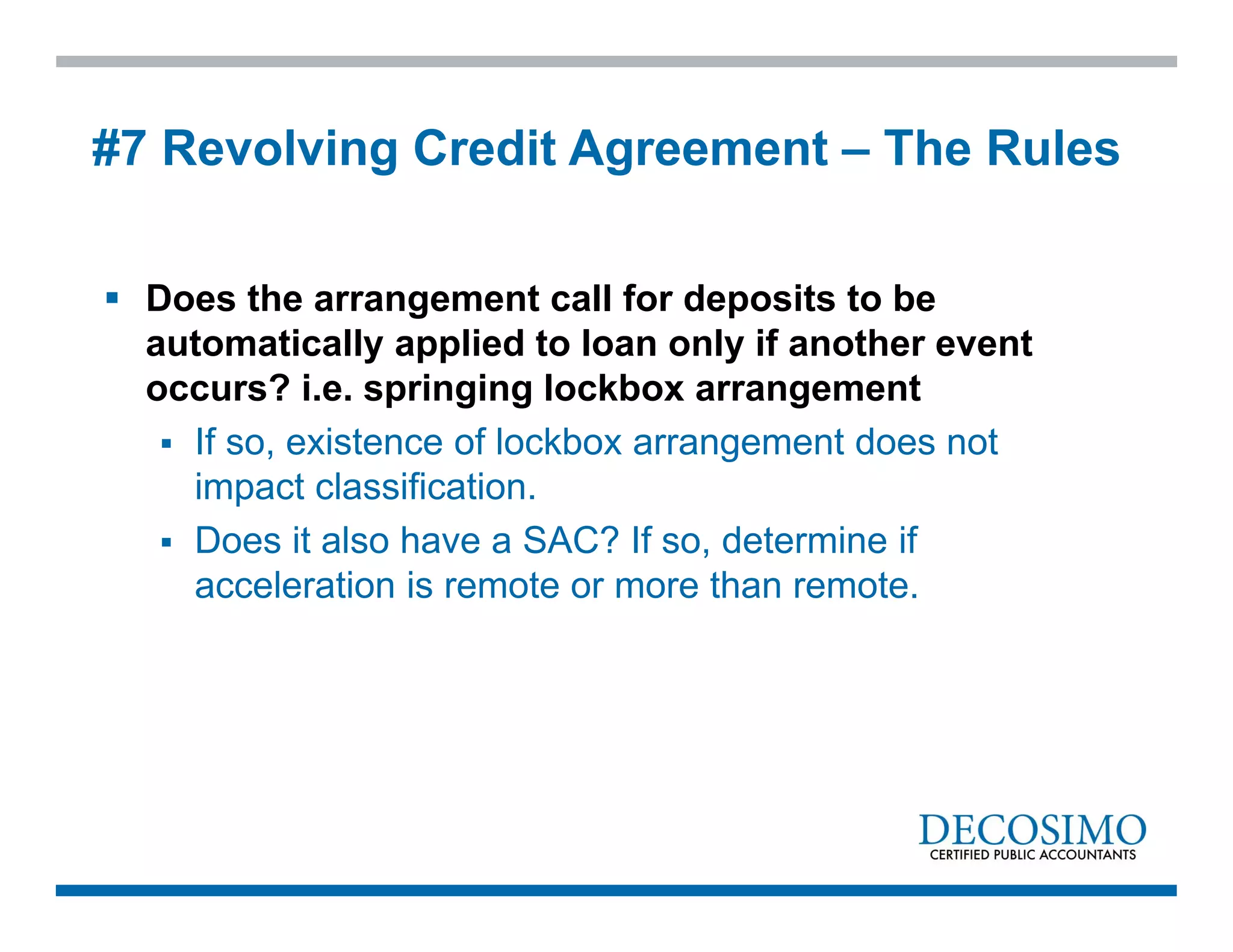

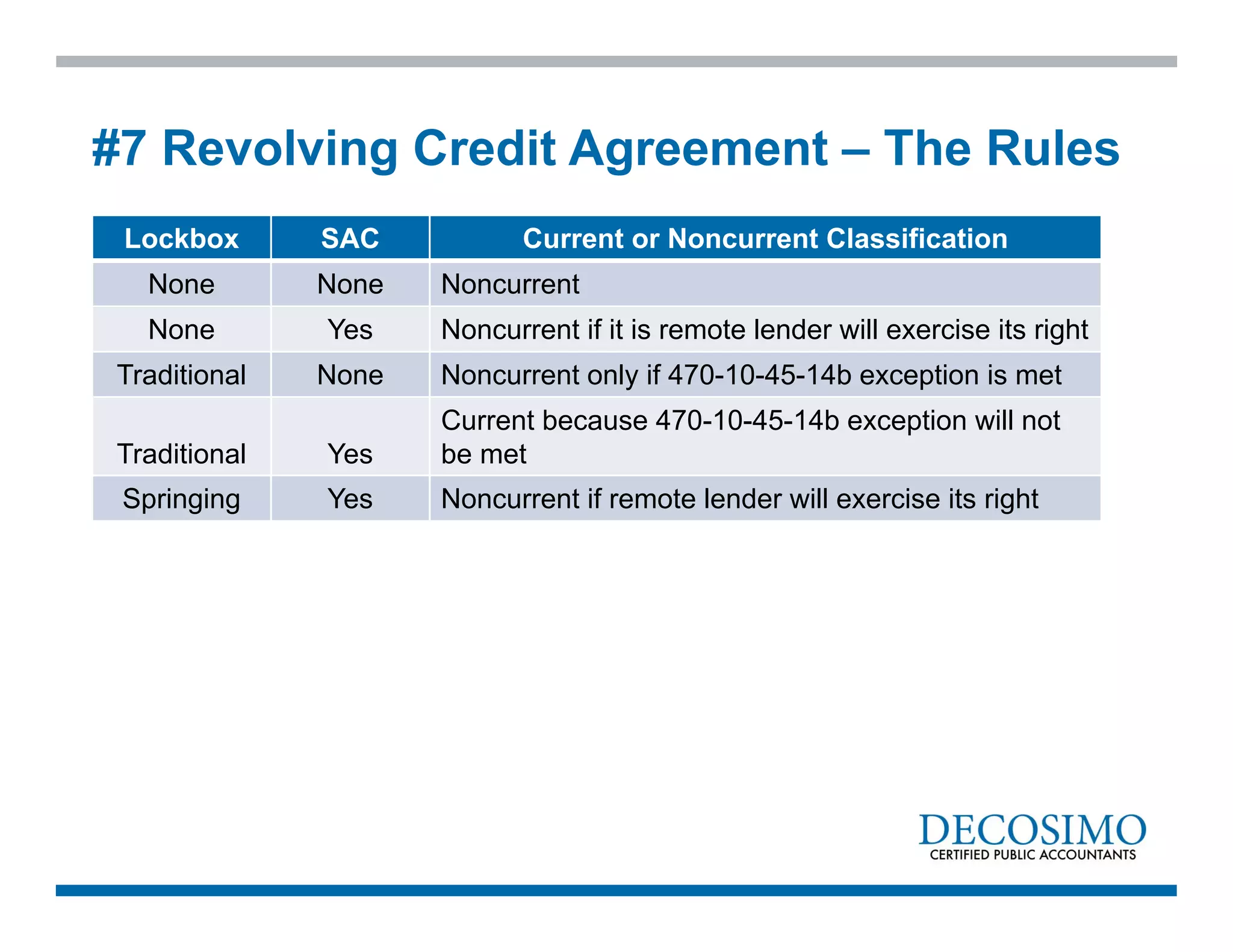

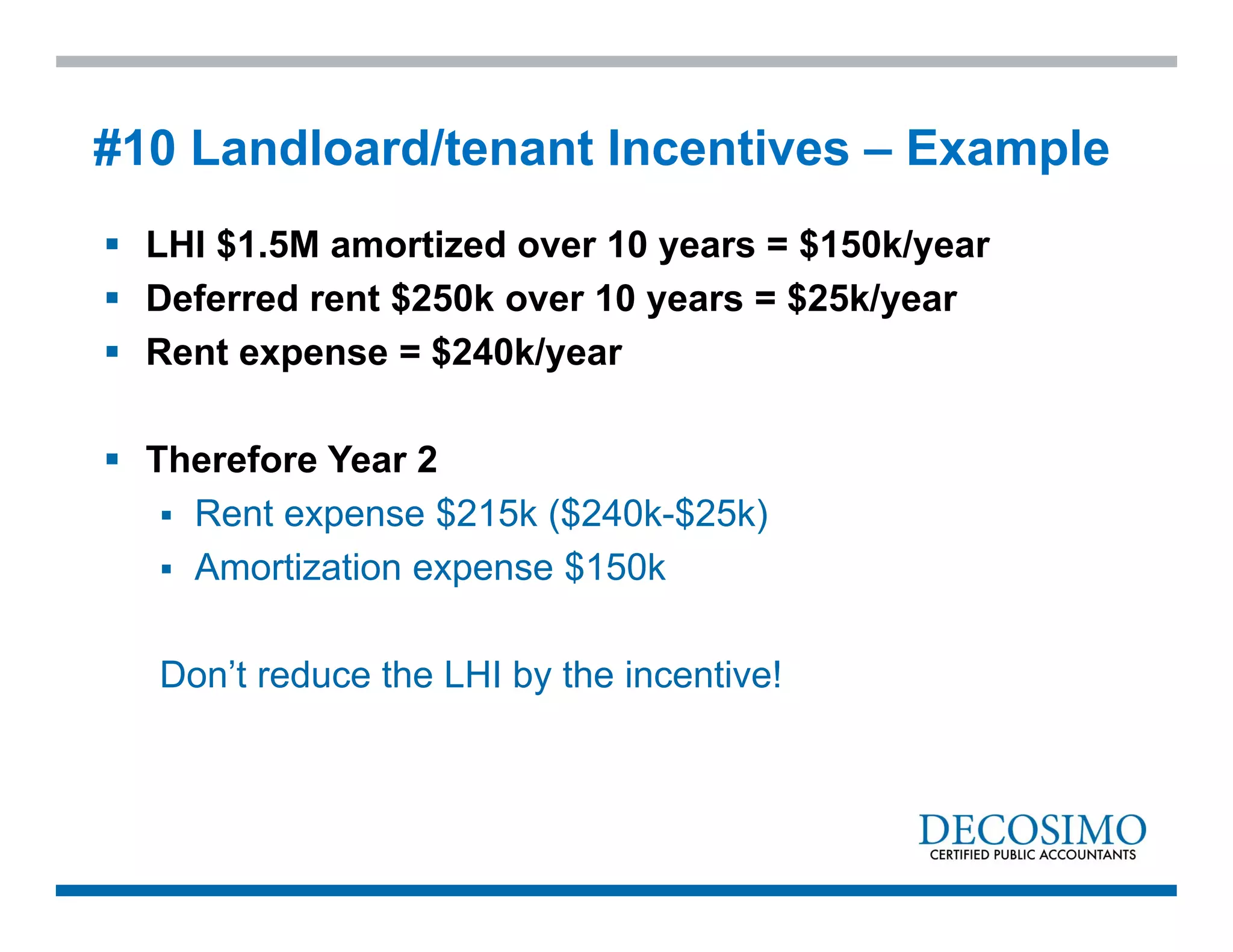

The document discusses various accounting rules and guidelines as interpreted by the FASB, focusing on topics such as contract termination costs, capitalizing interest, and the classification of debt. It provides examples to demonstrate the complexity of applying these rules in practice, particularly emphasizing scenarios like leasehold improvements and exit or disposal costs. The content aims to clarify the recognition and measurement of liabilities under different circumstances, highlighting key considerations and potential pitfalls for accounting professionals.