This document discusses financial statement analysis and the information that a financial expert may request when analyzing statements. It provides:

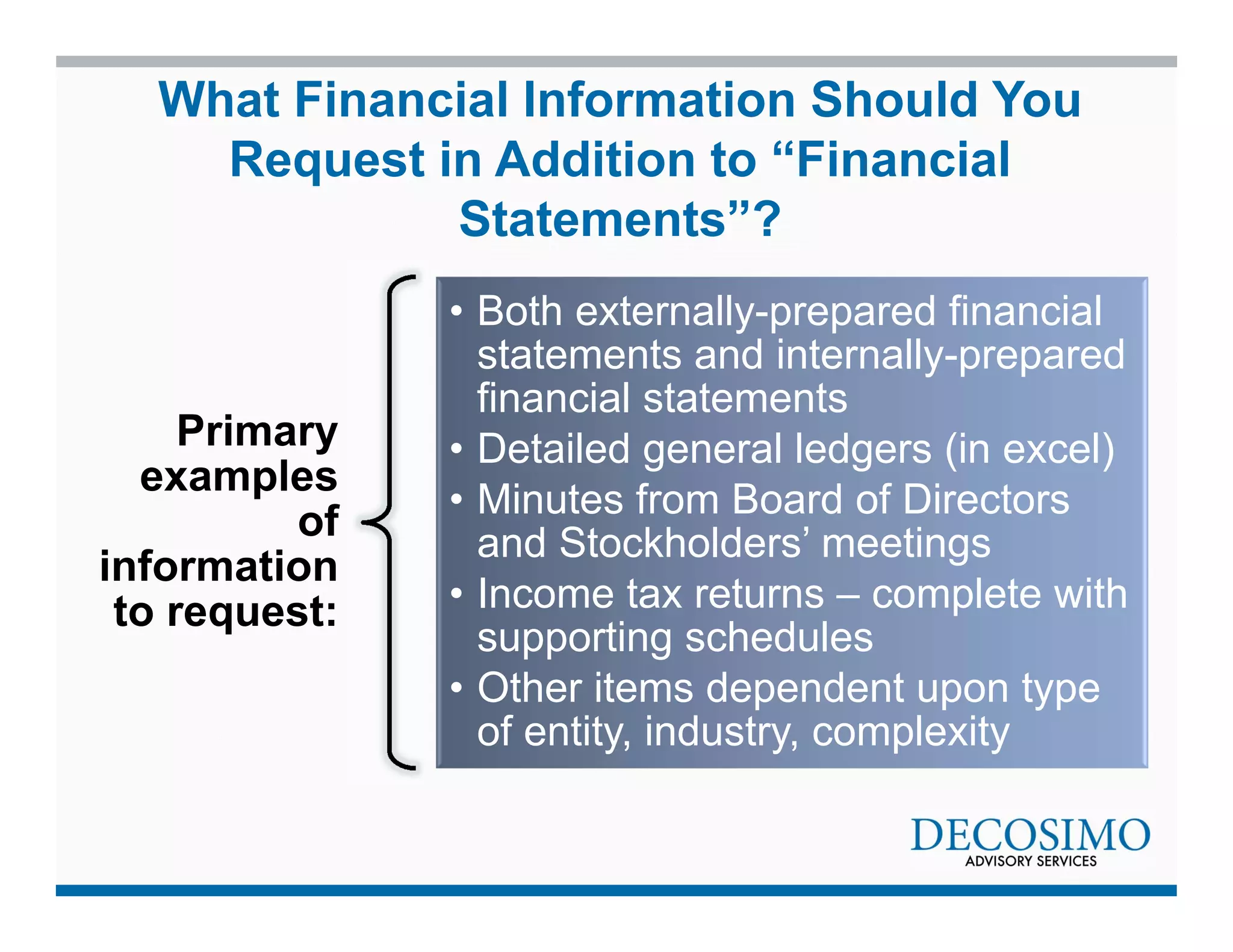

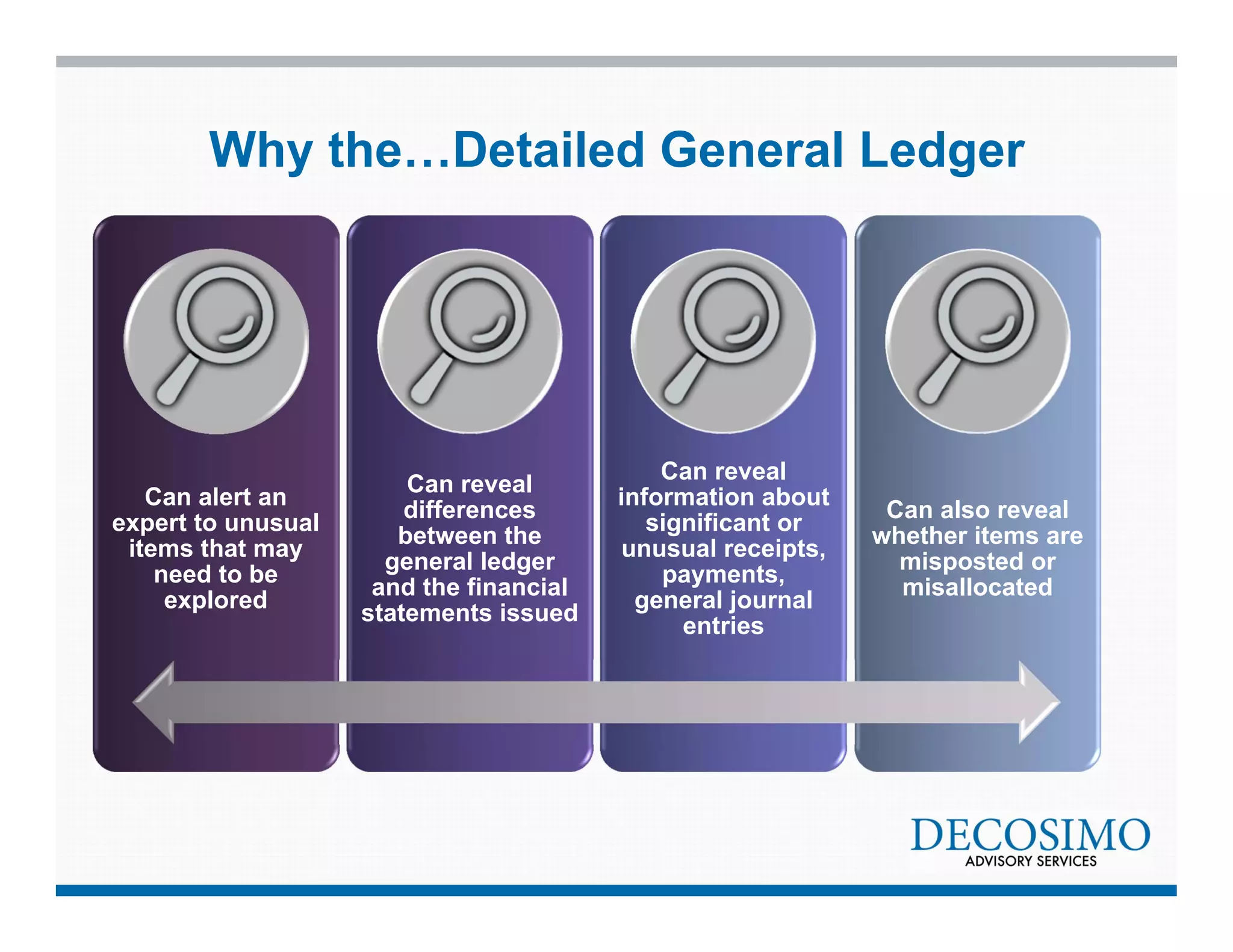

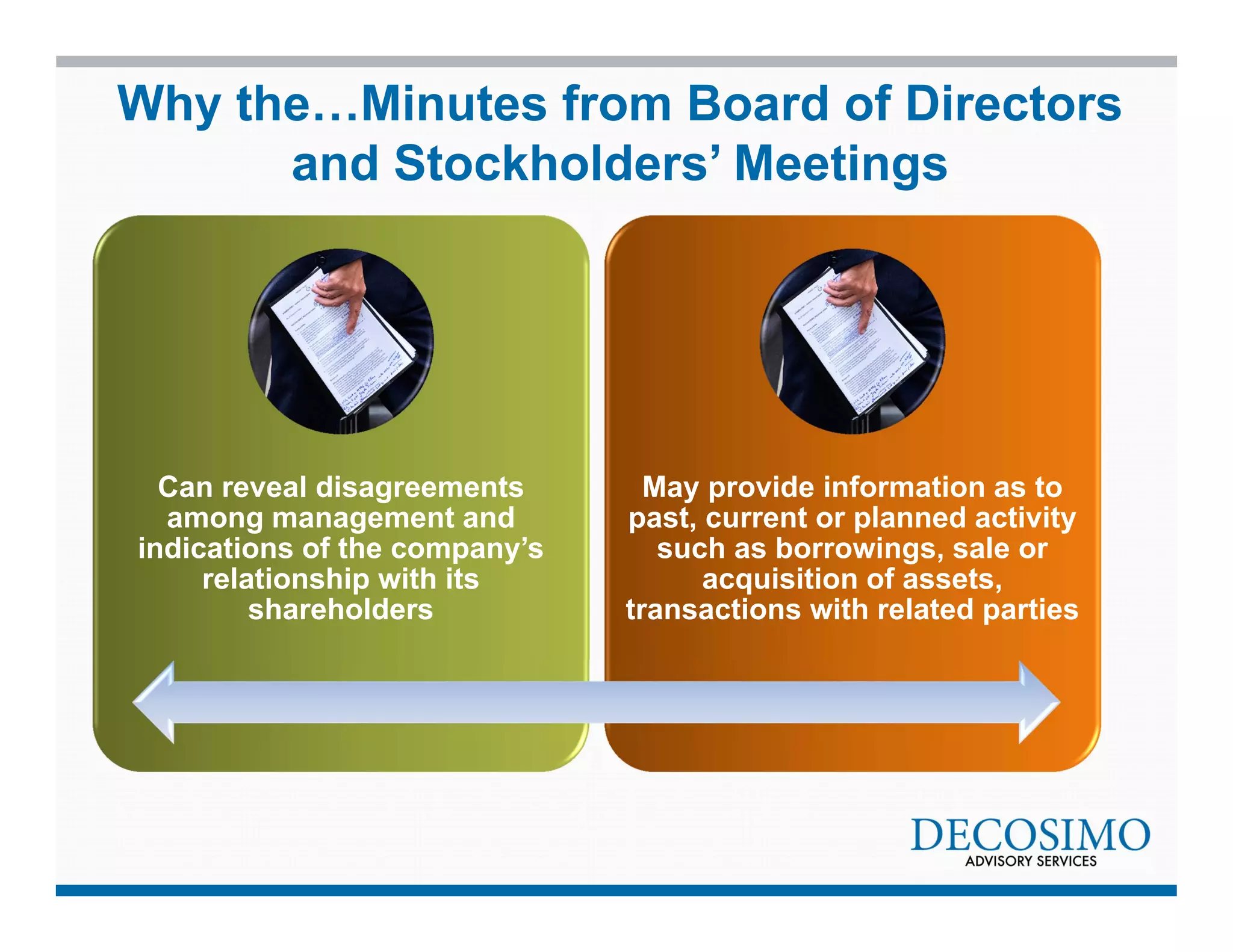

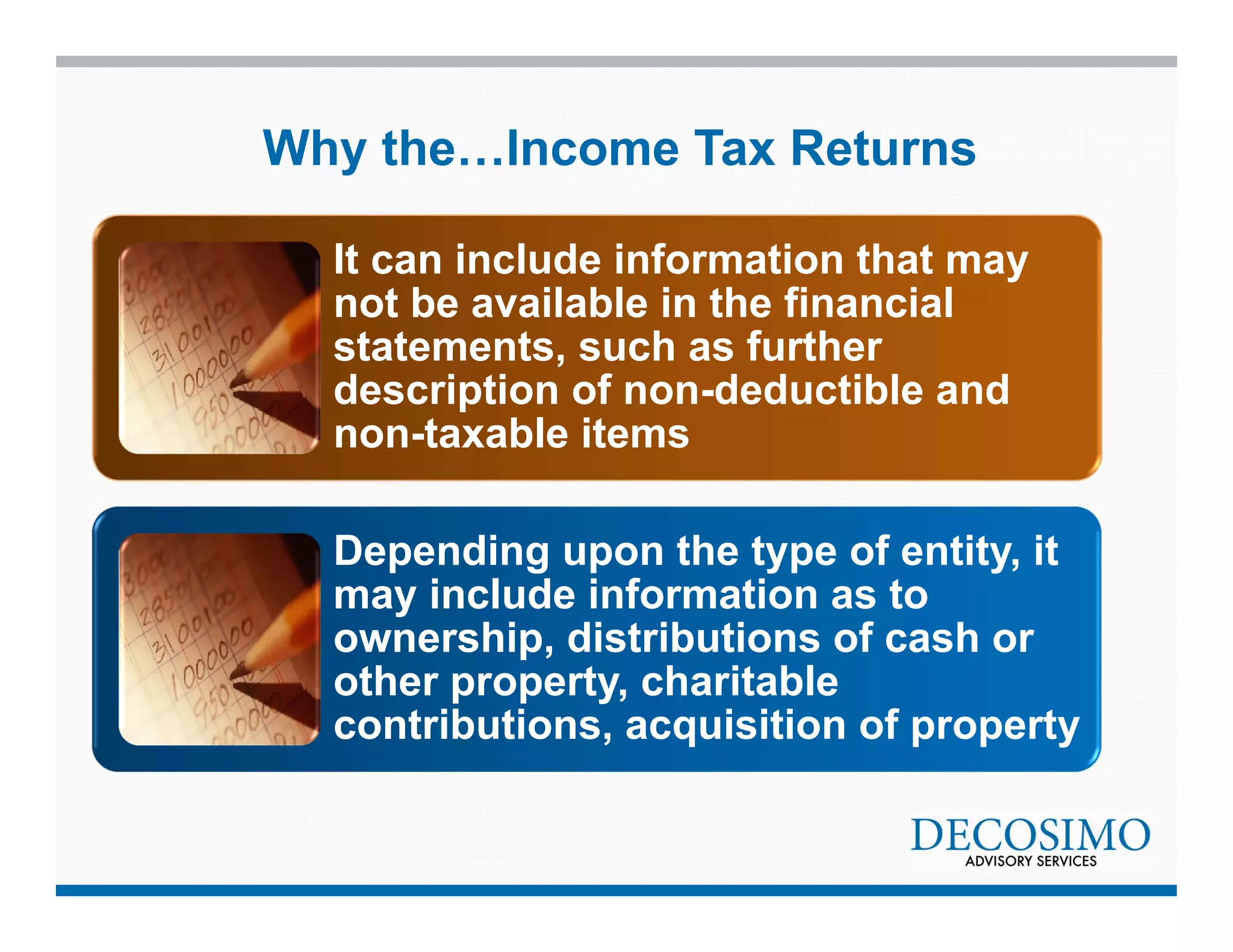

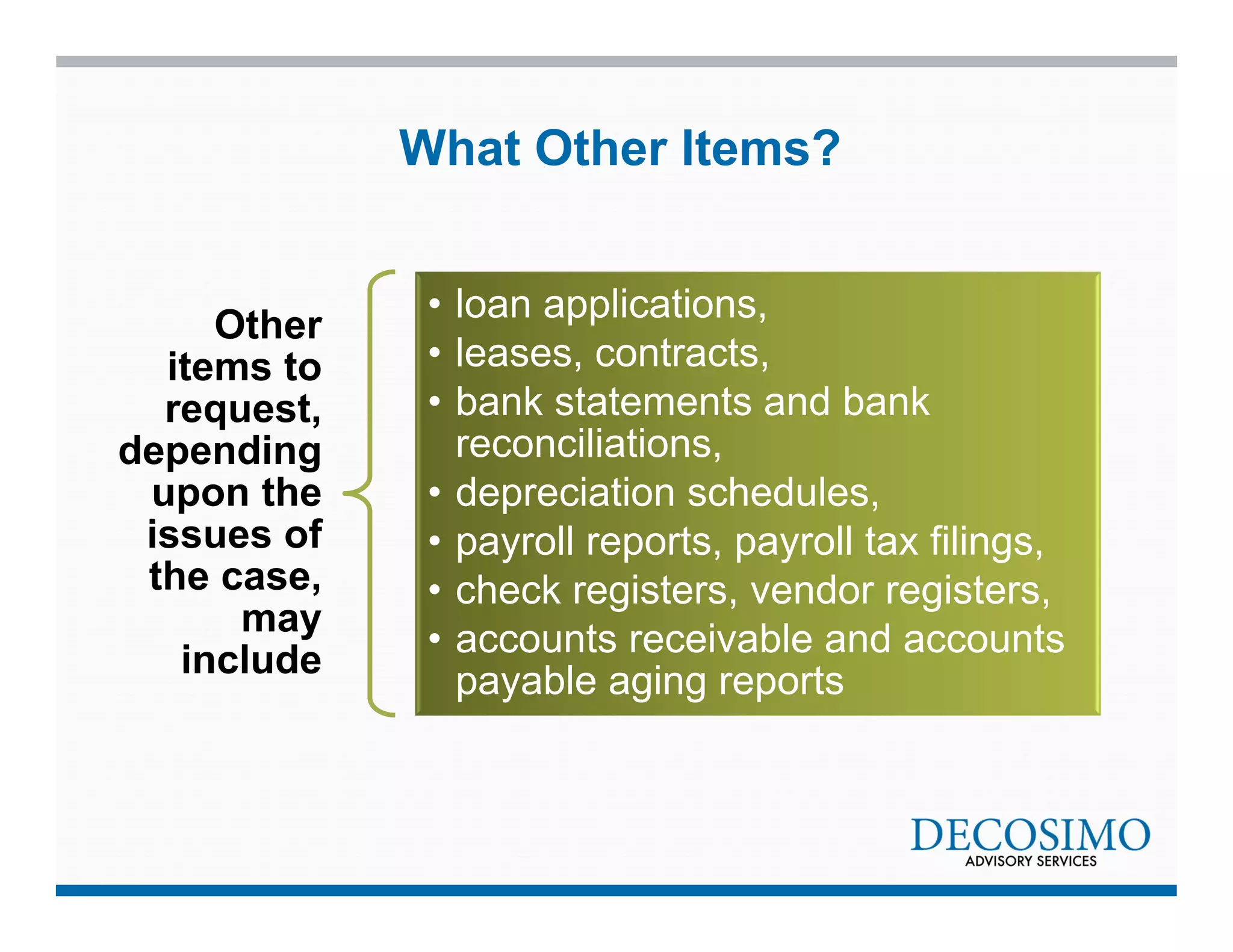

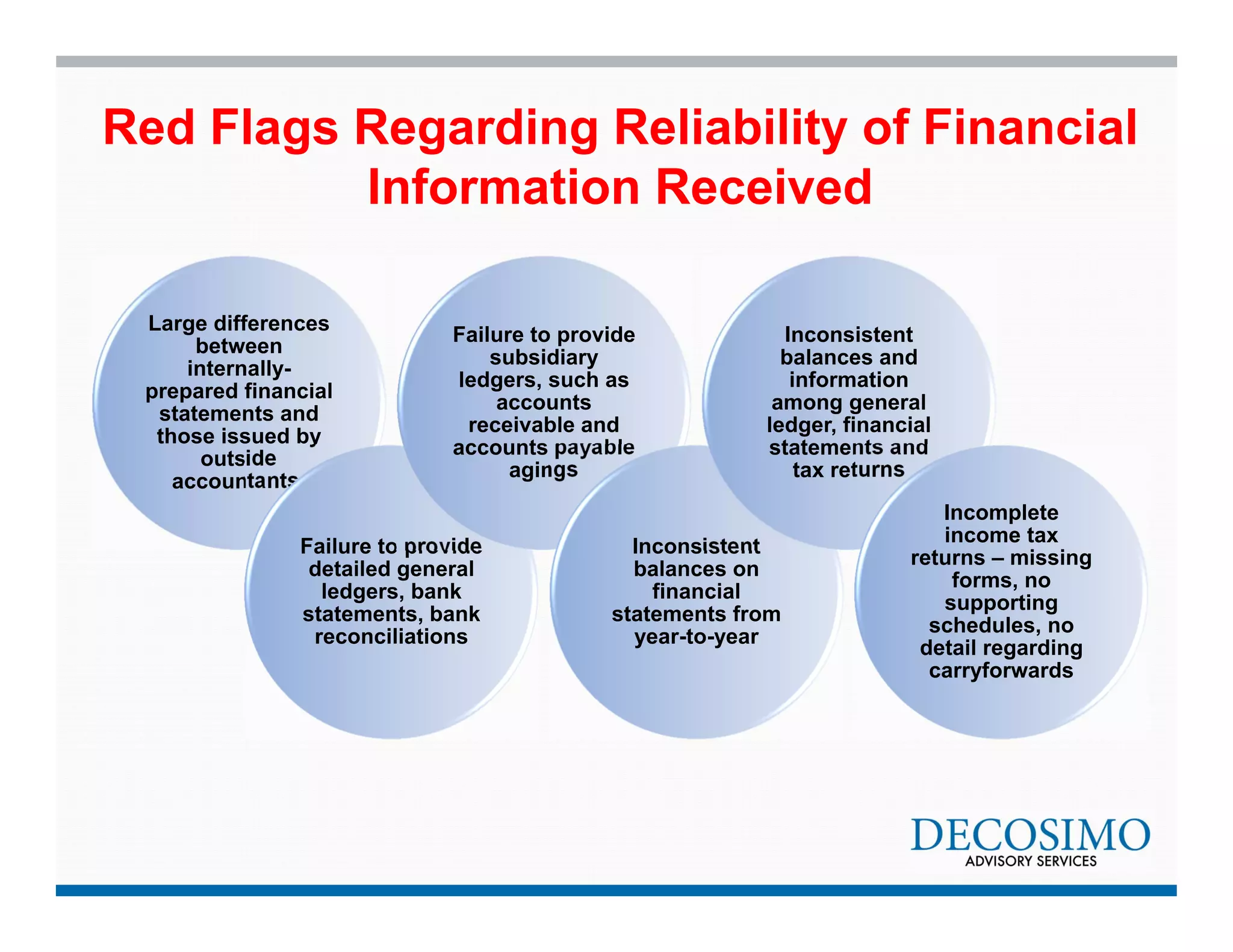

- A list of additional documents and information that should be requested beyond basic financial statements, such as detailed general ledgers, tax returns, board minutes, and accounts receivable/payable reports.

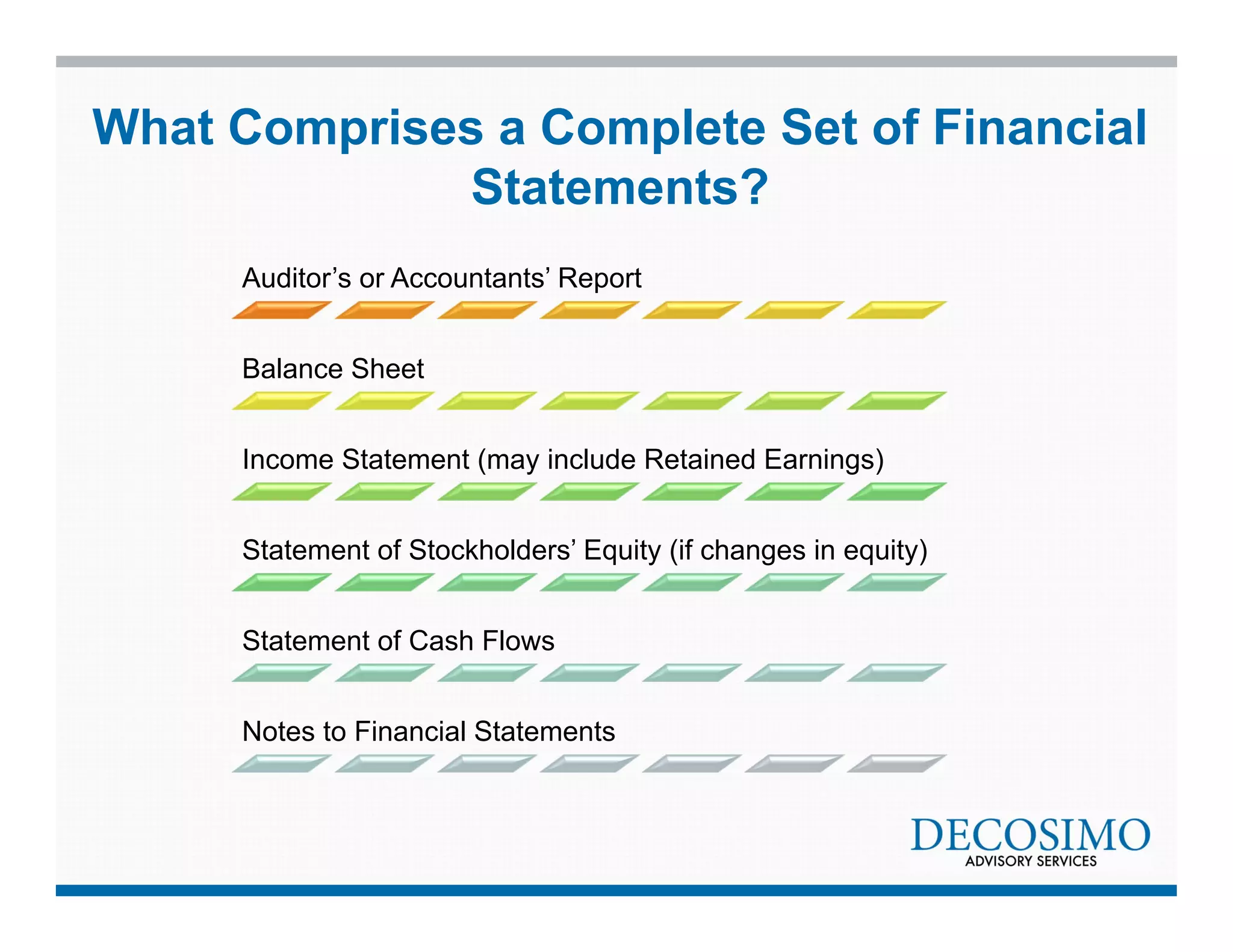

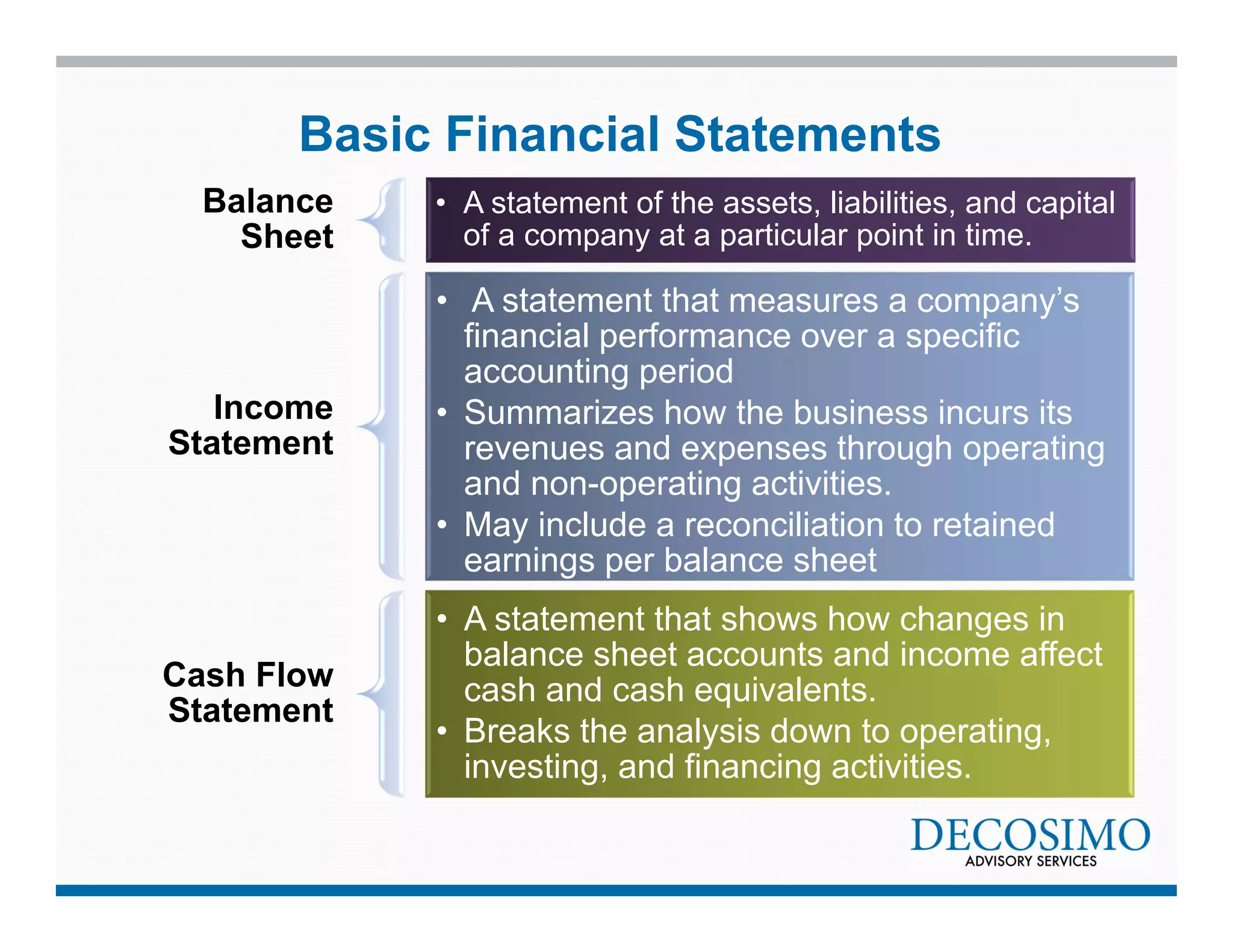

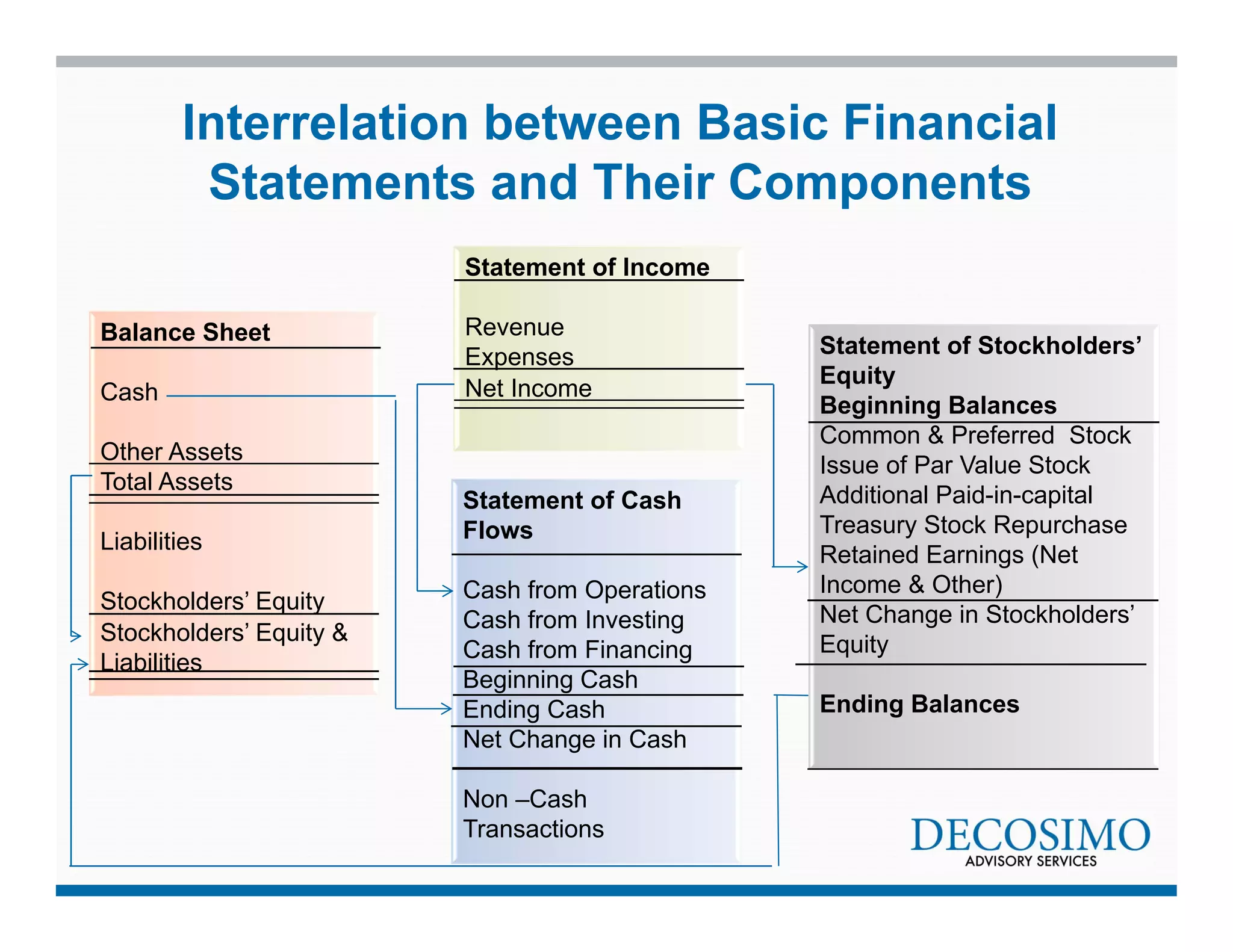

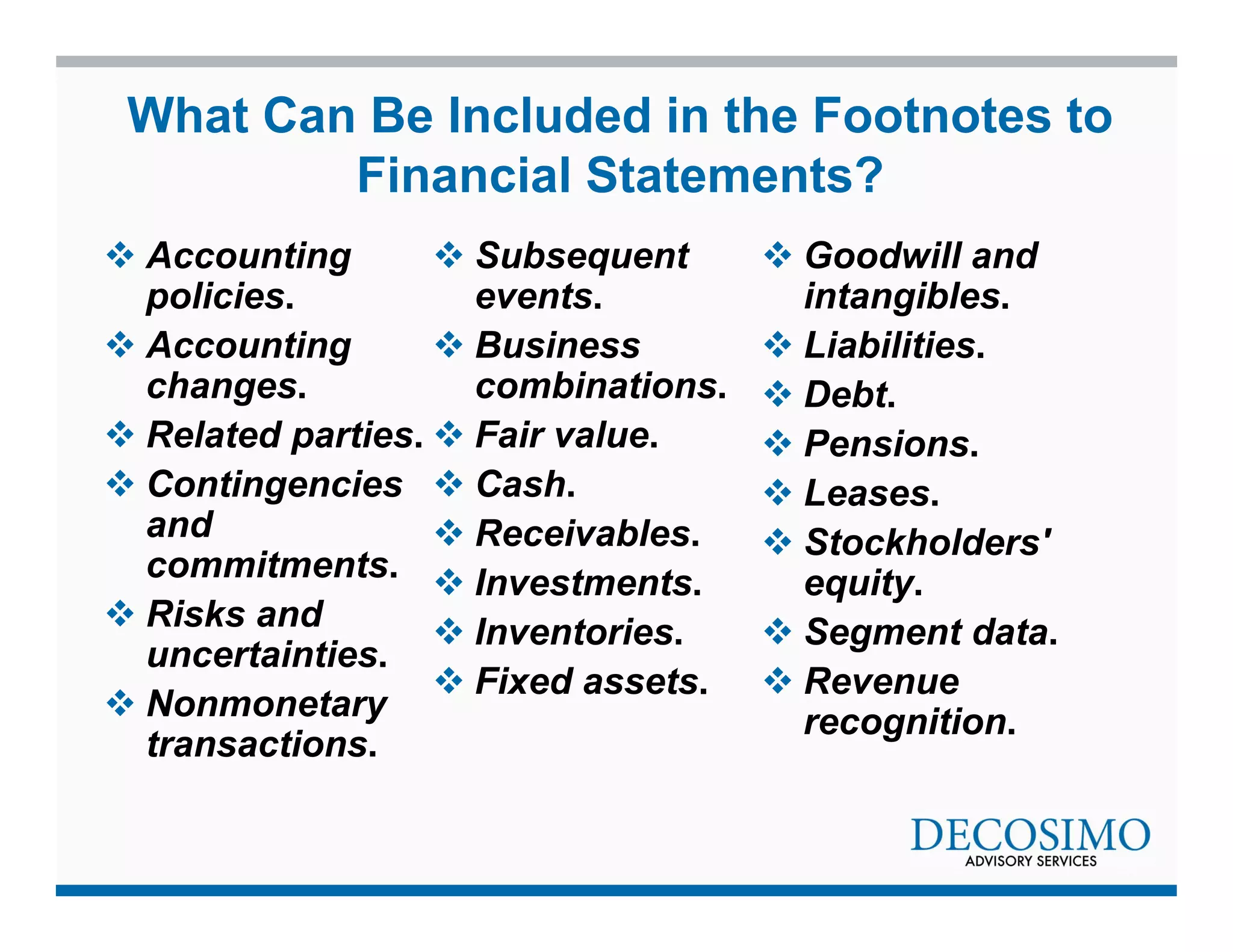

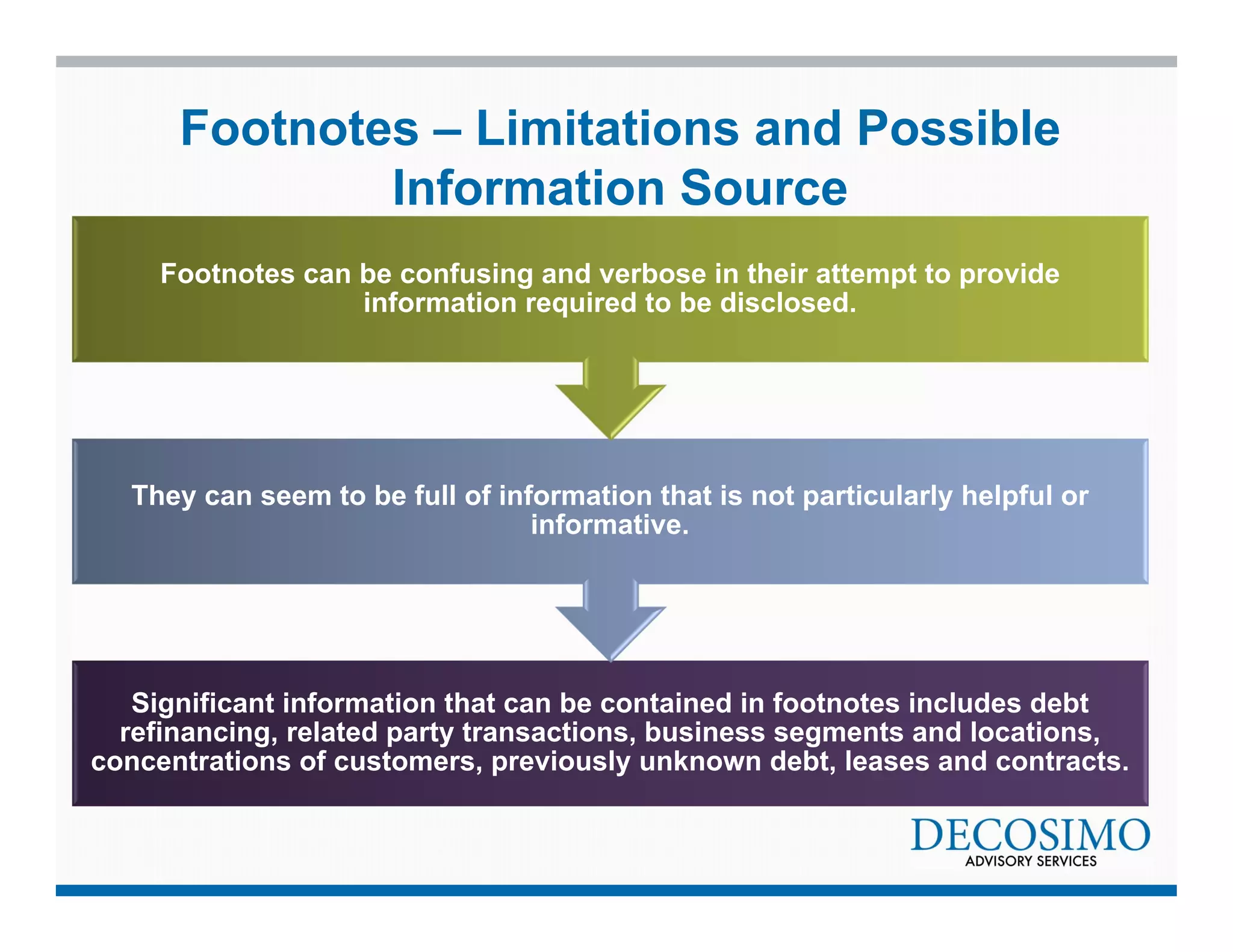

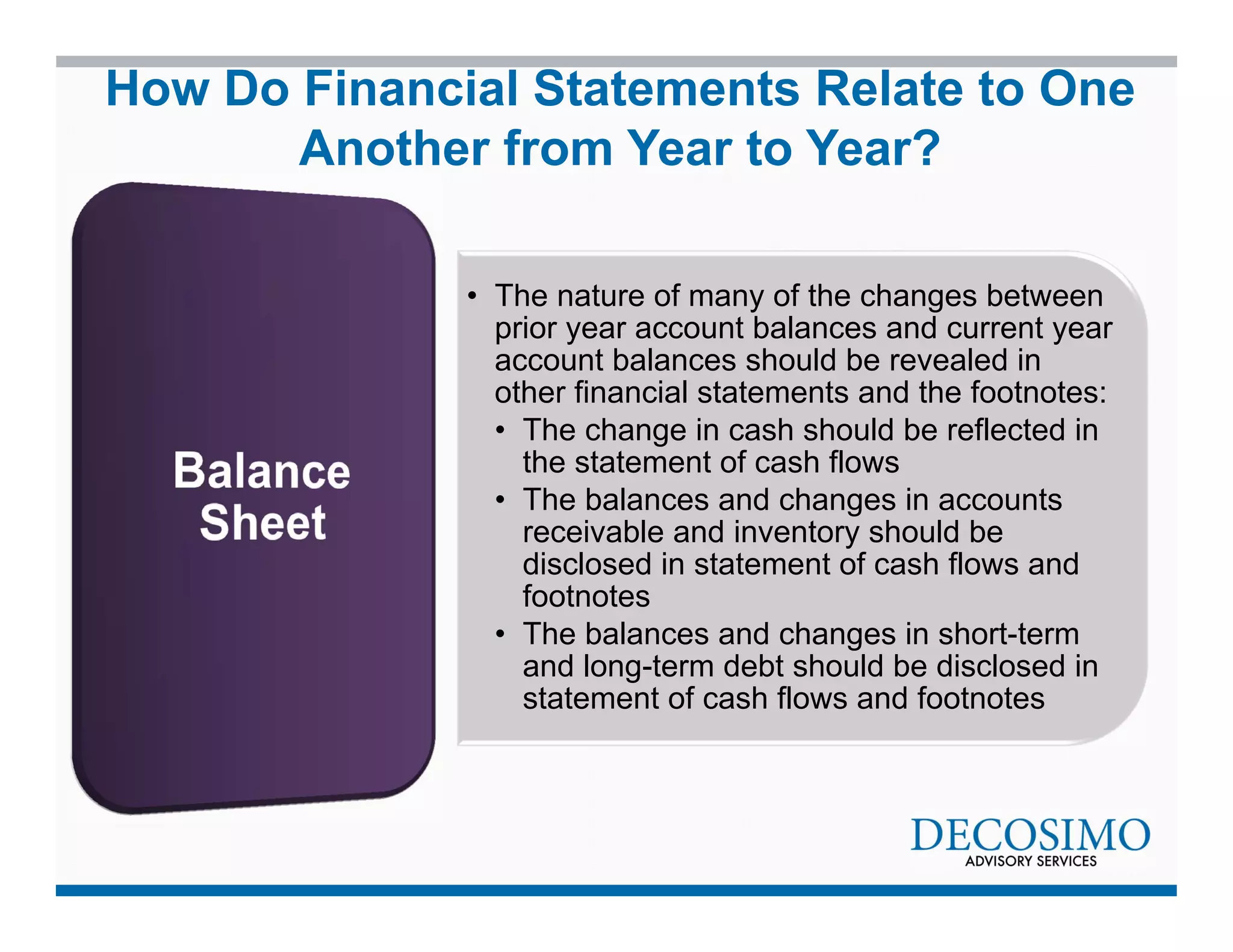

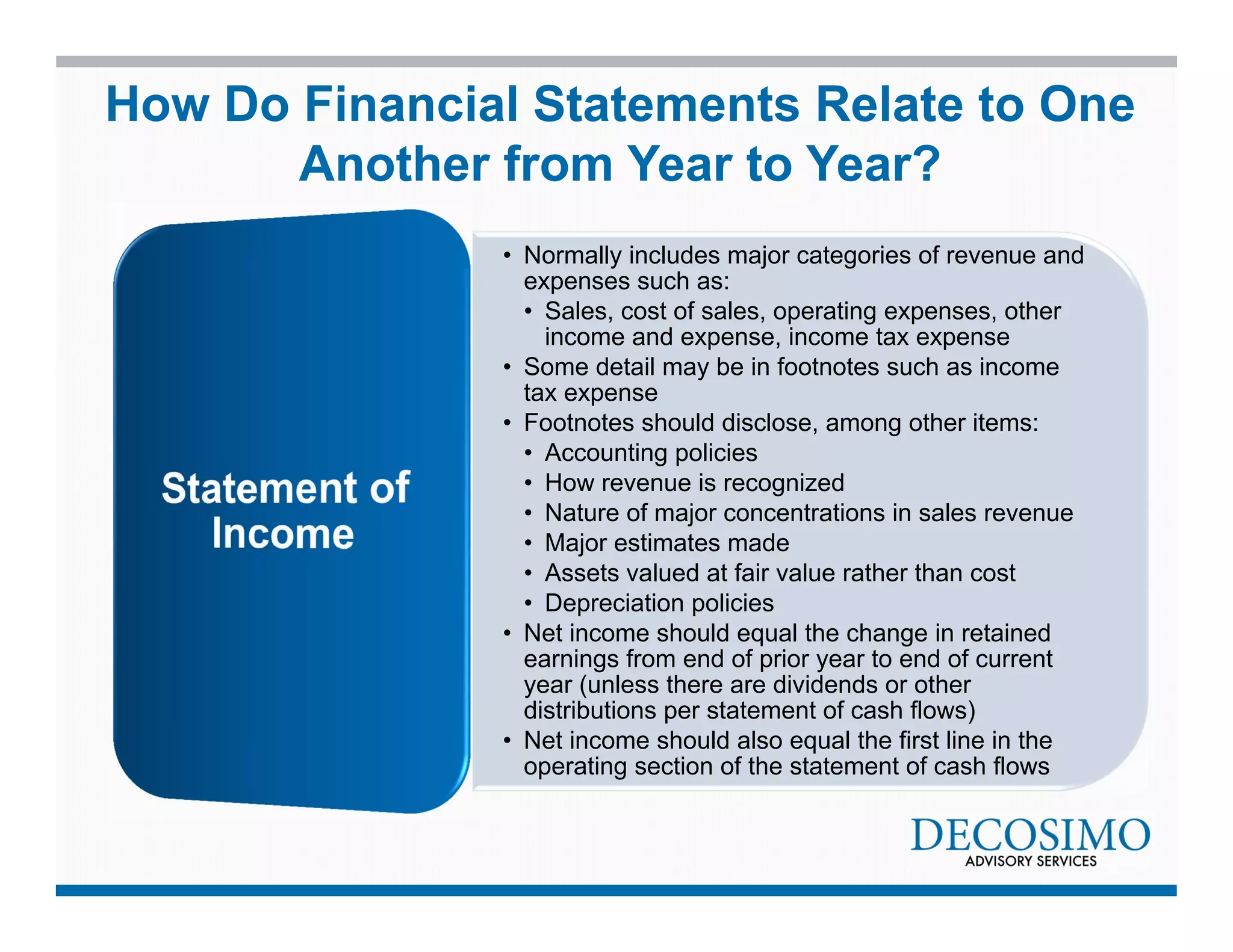

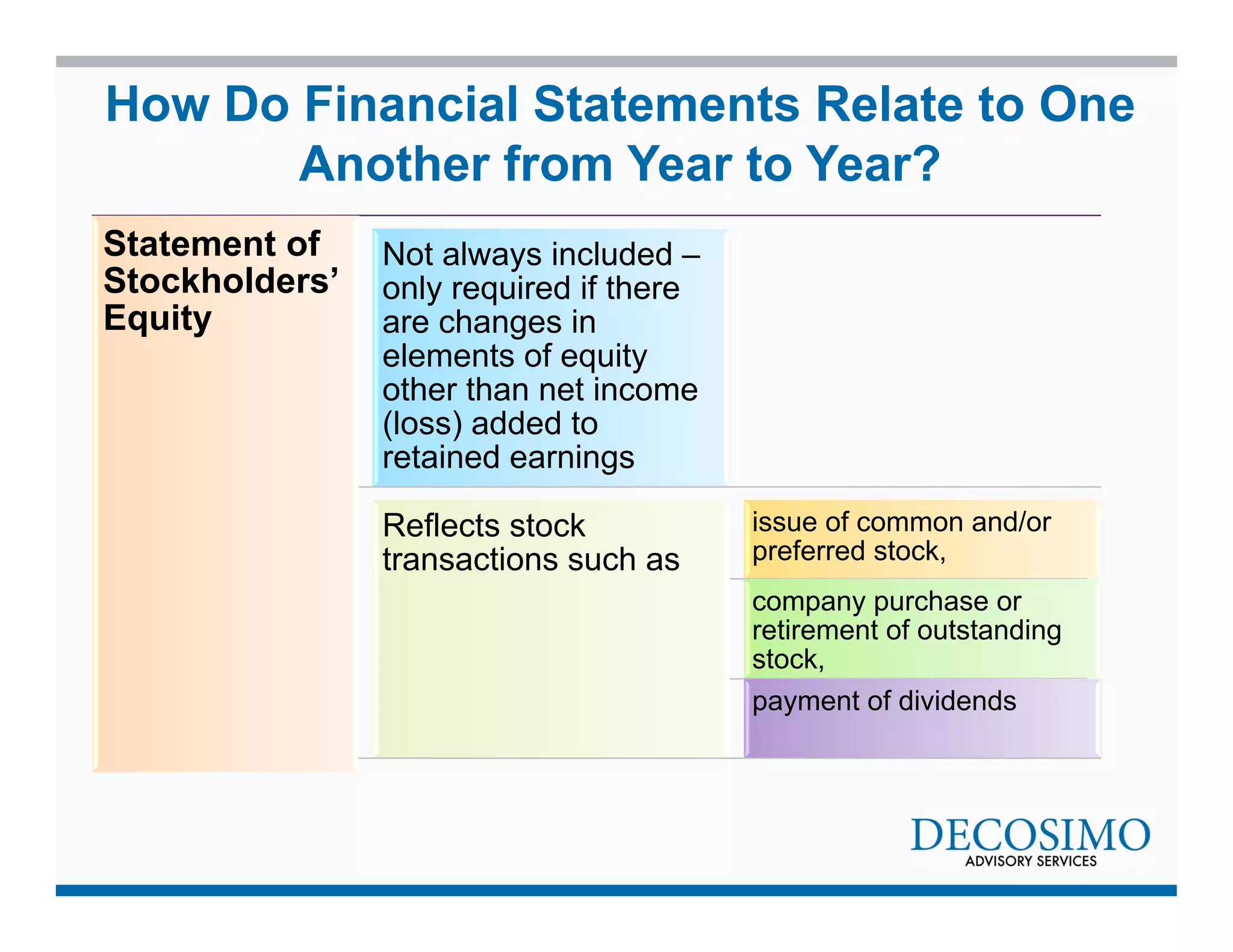

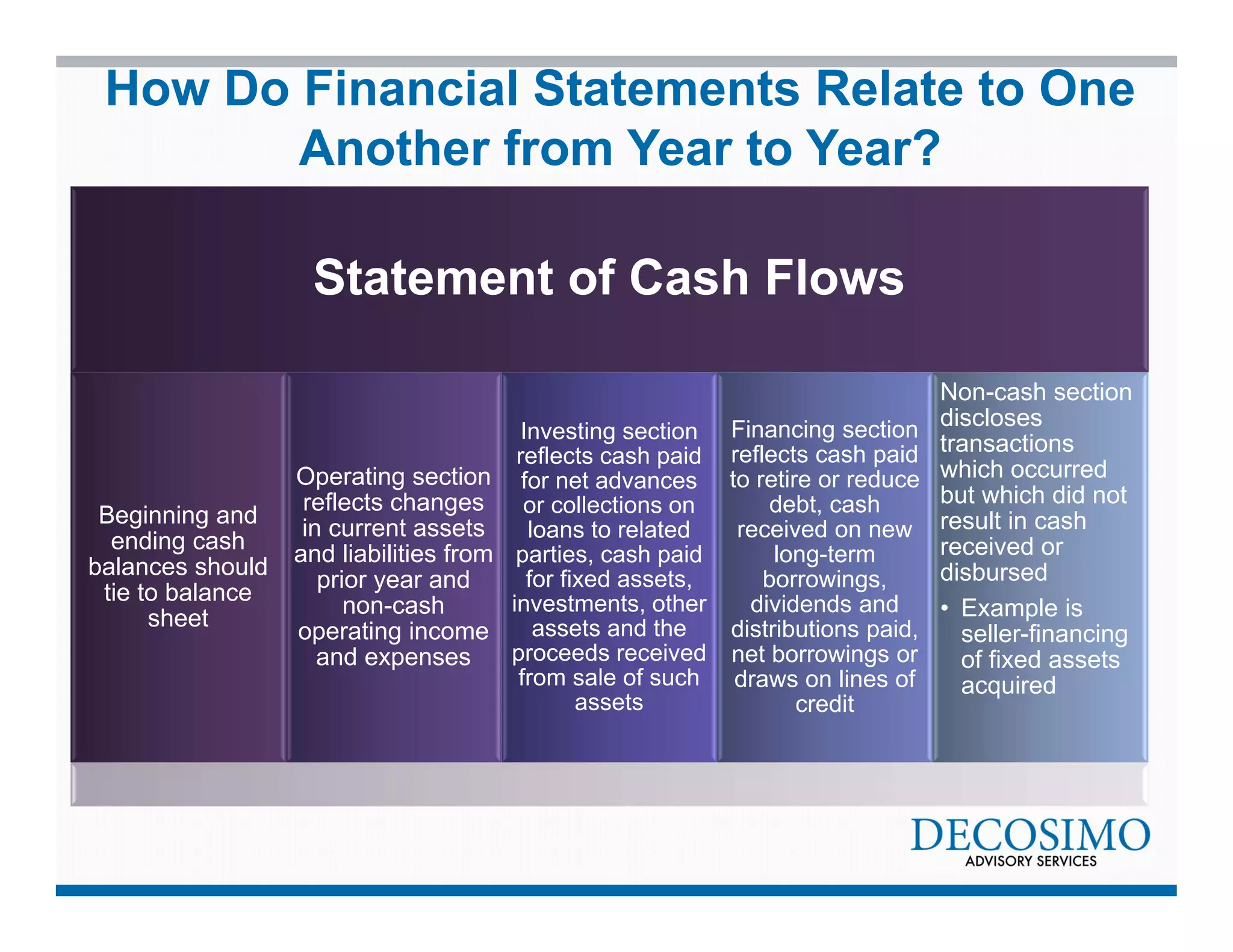

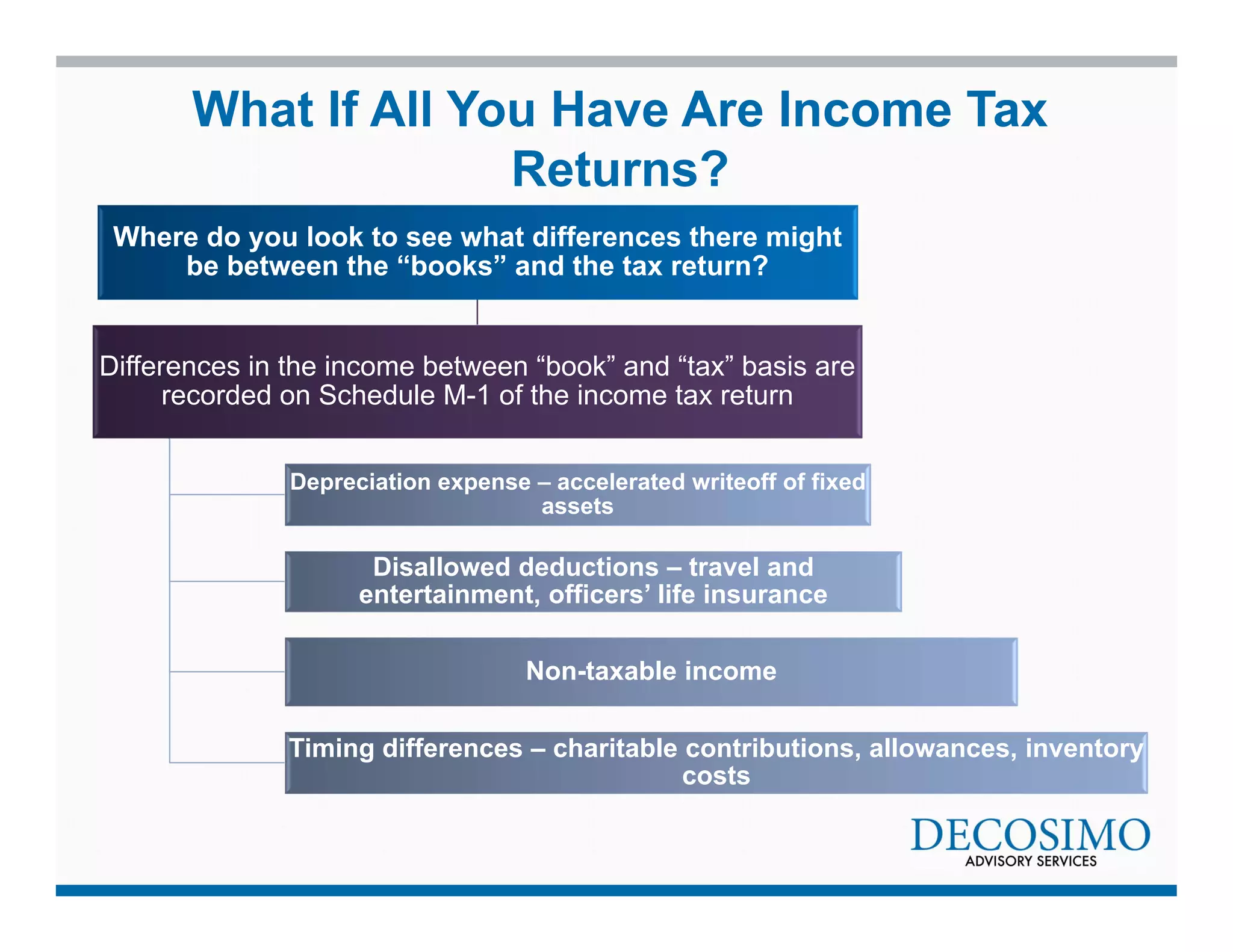

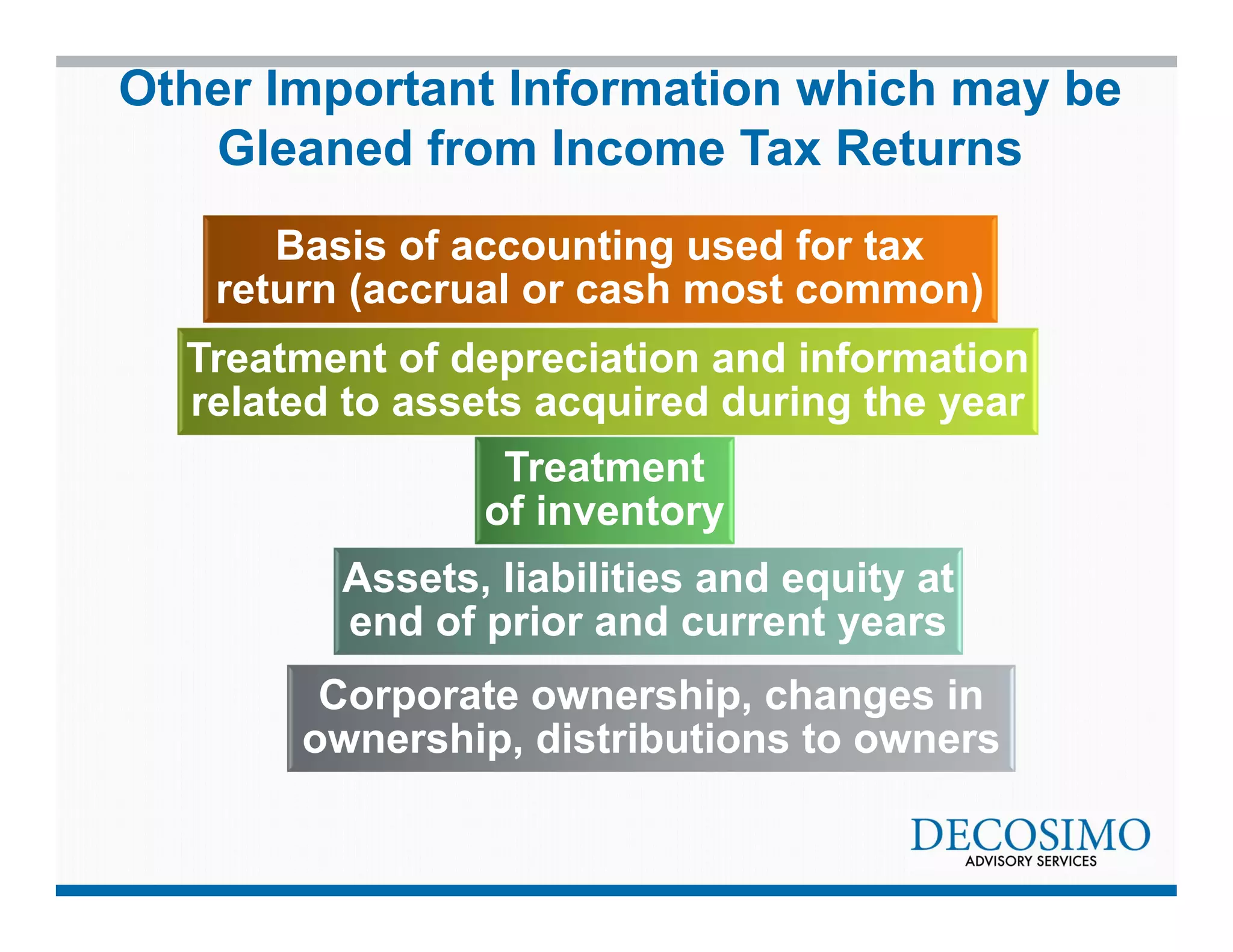

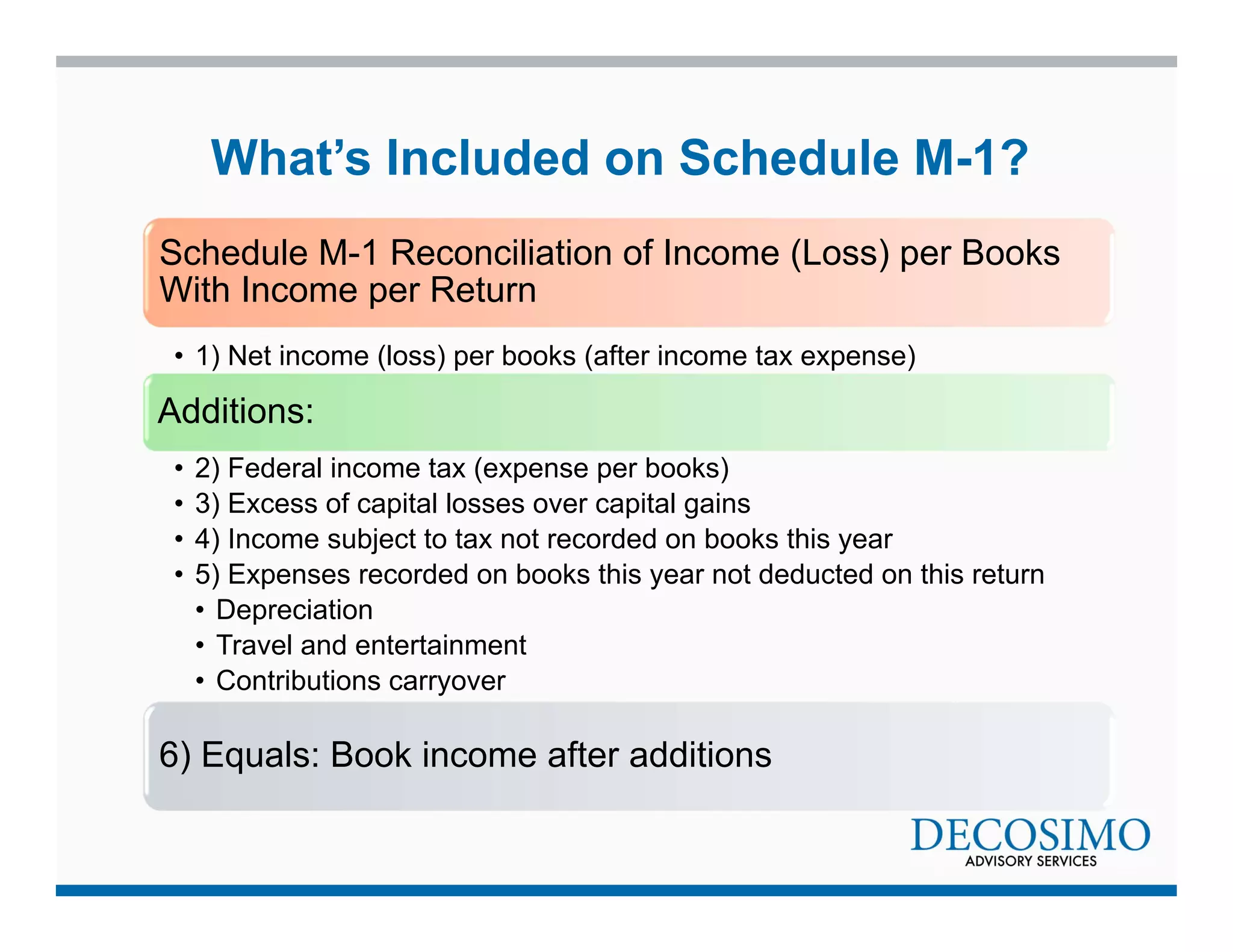

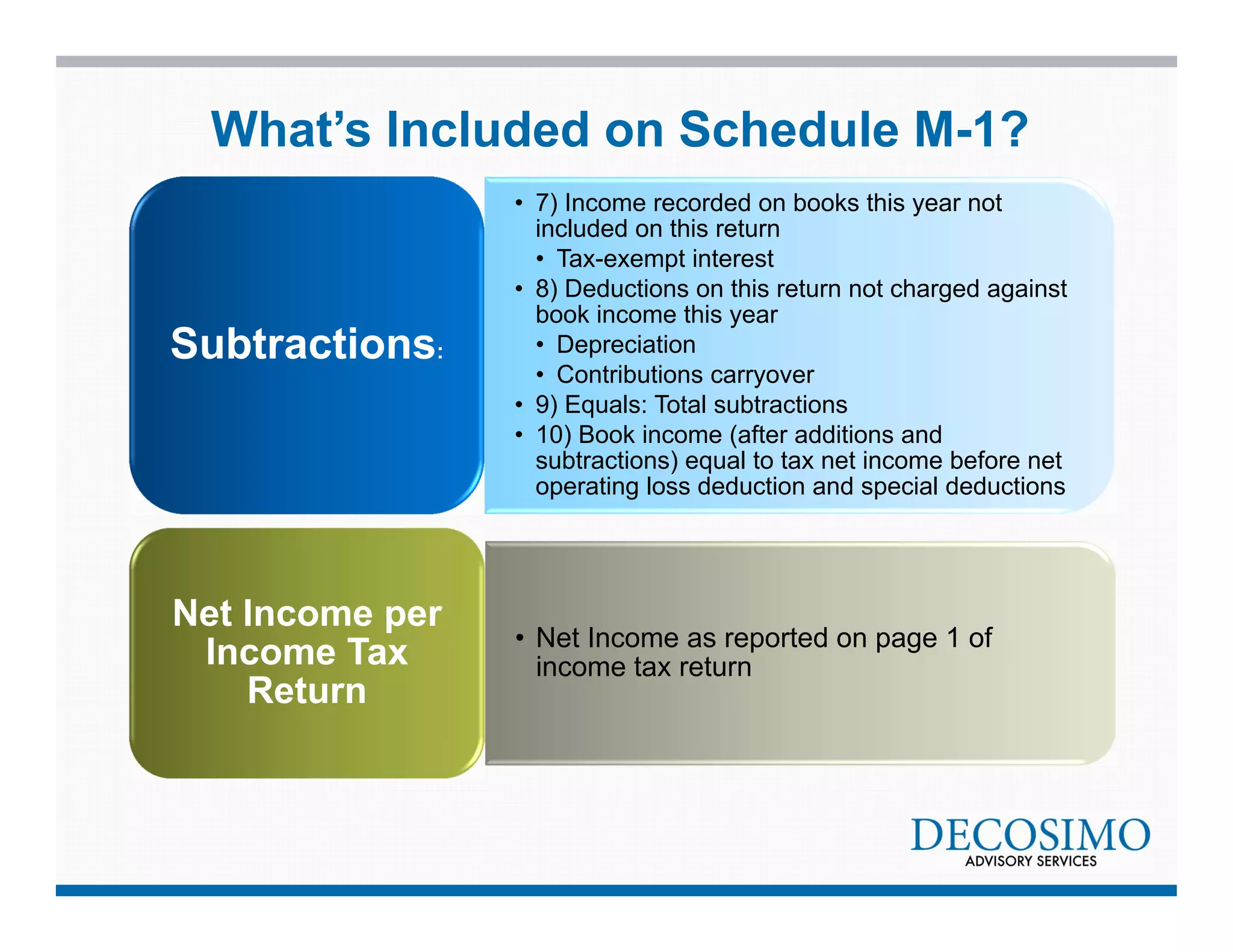

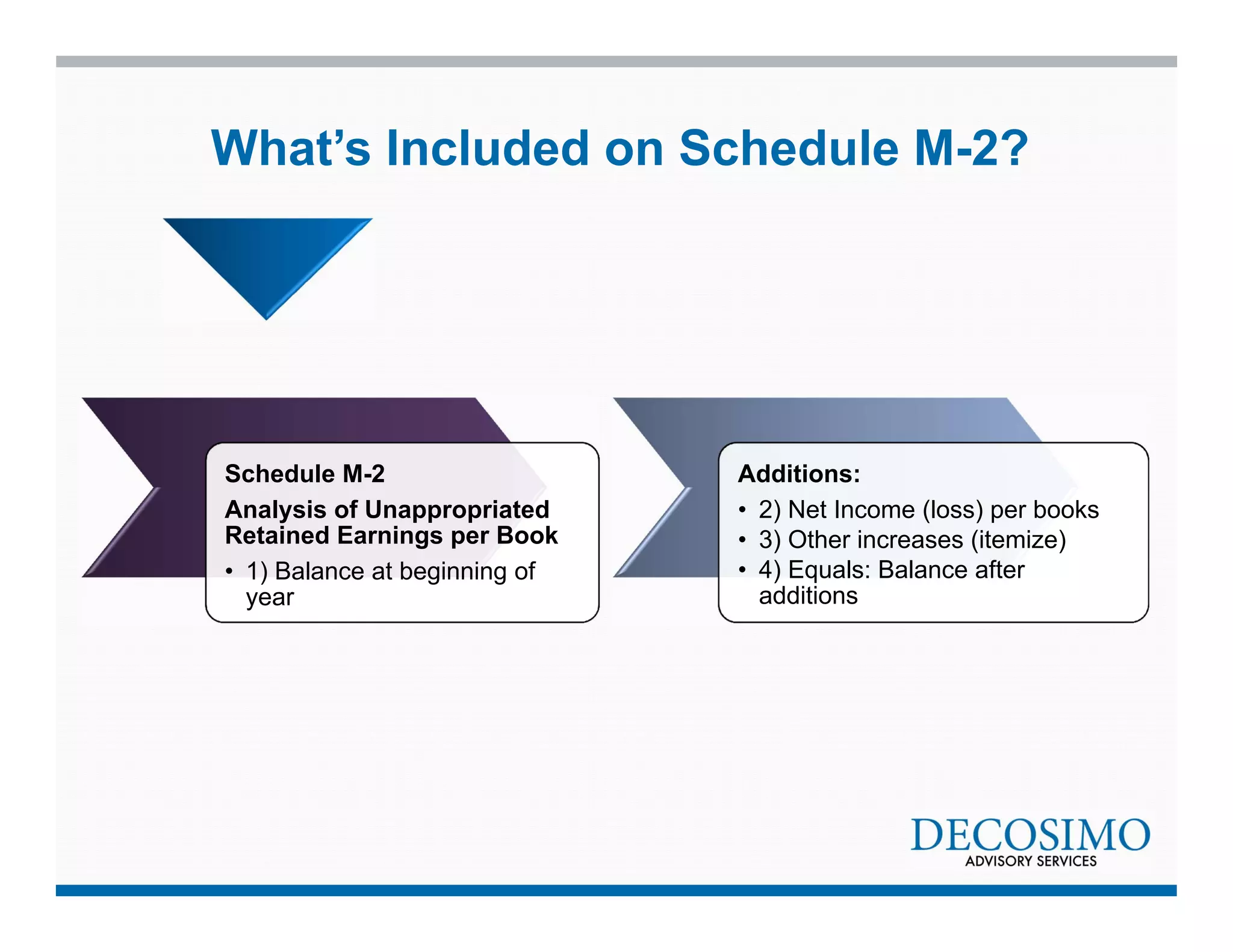

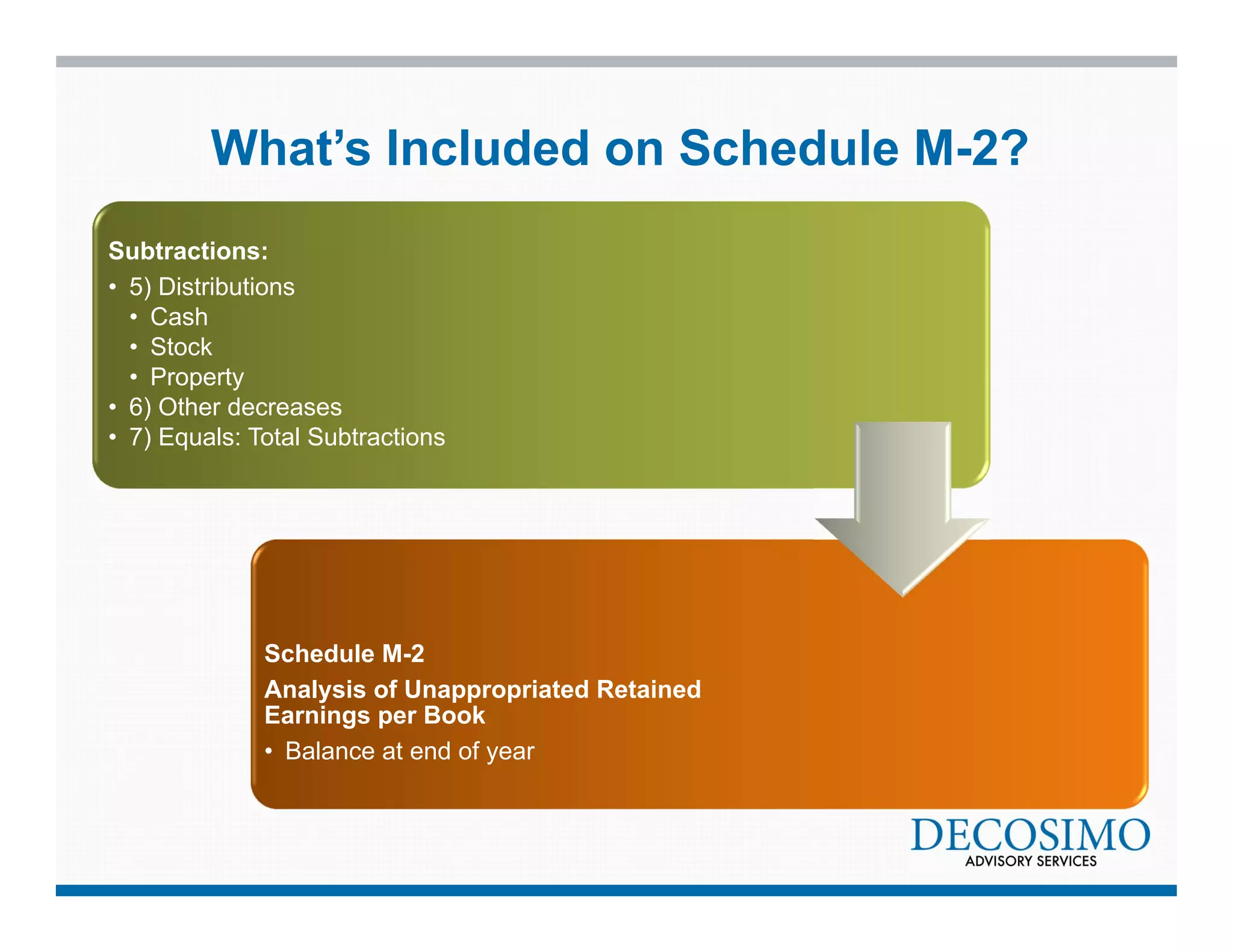

- An overview of the different types of financial statements (balance sheet, income statement, cash flow statement), their purpose, and how they relate to each other.

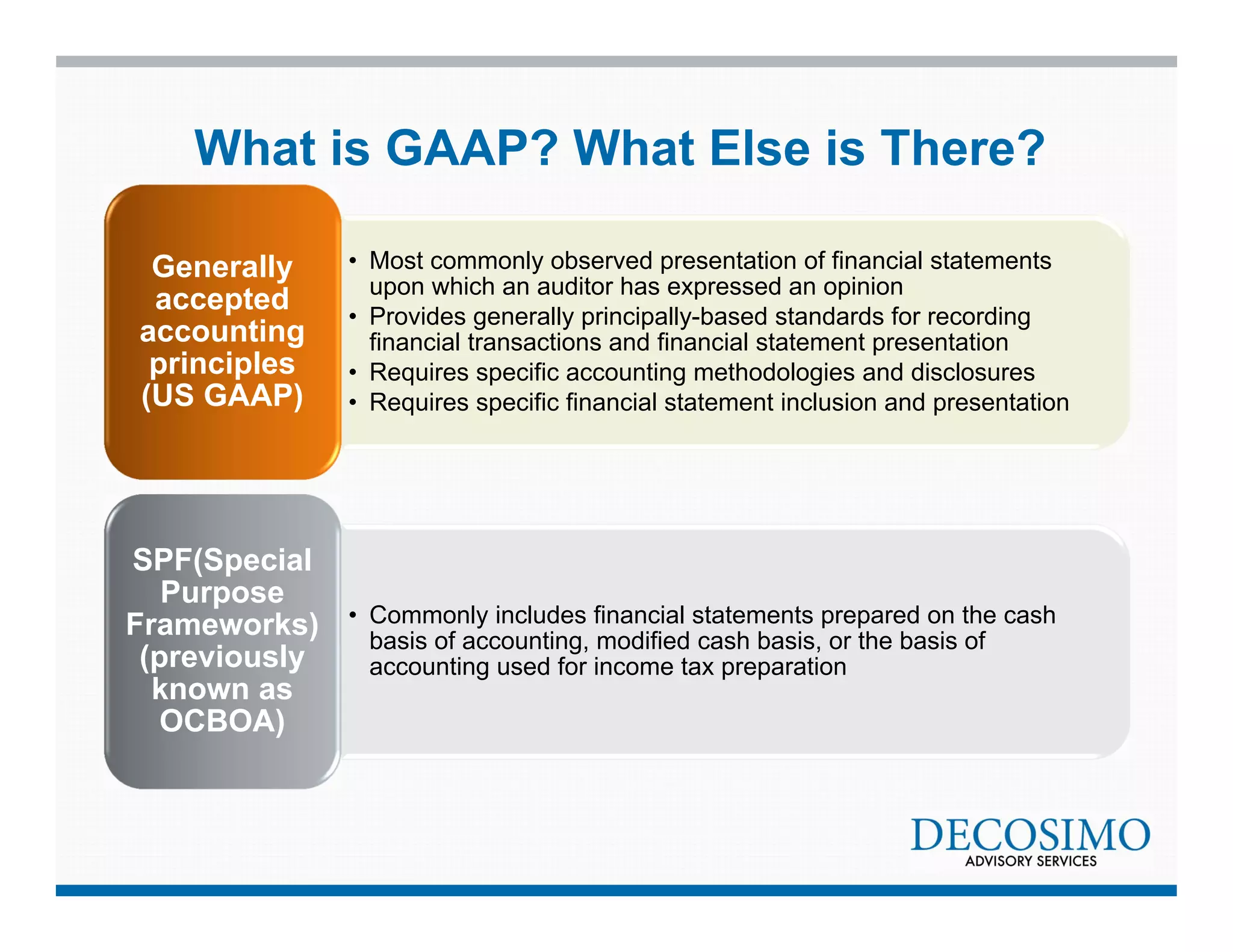

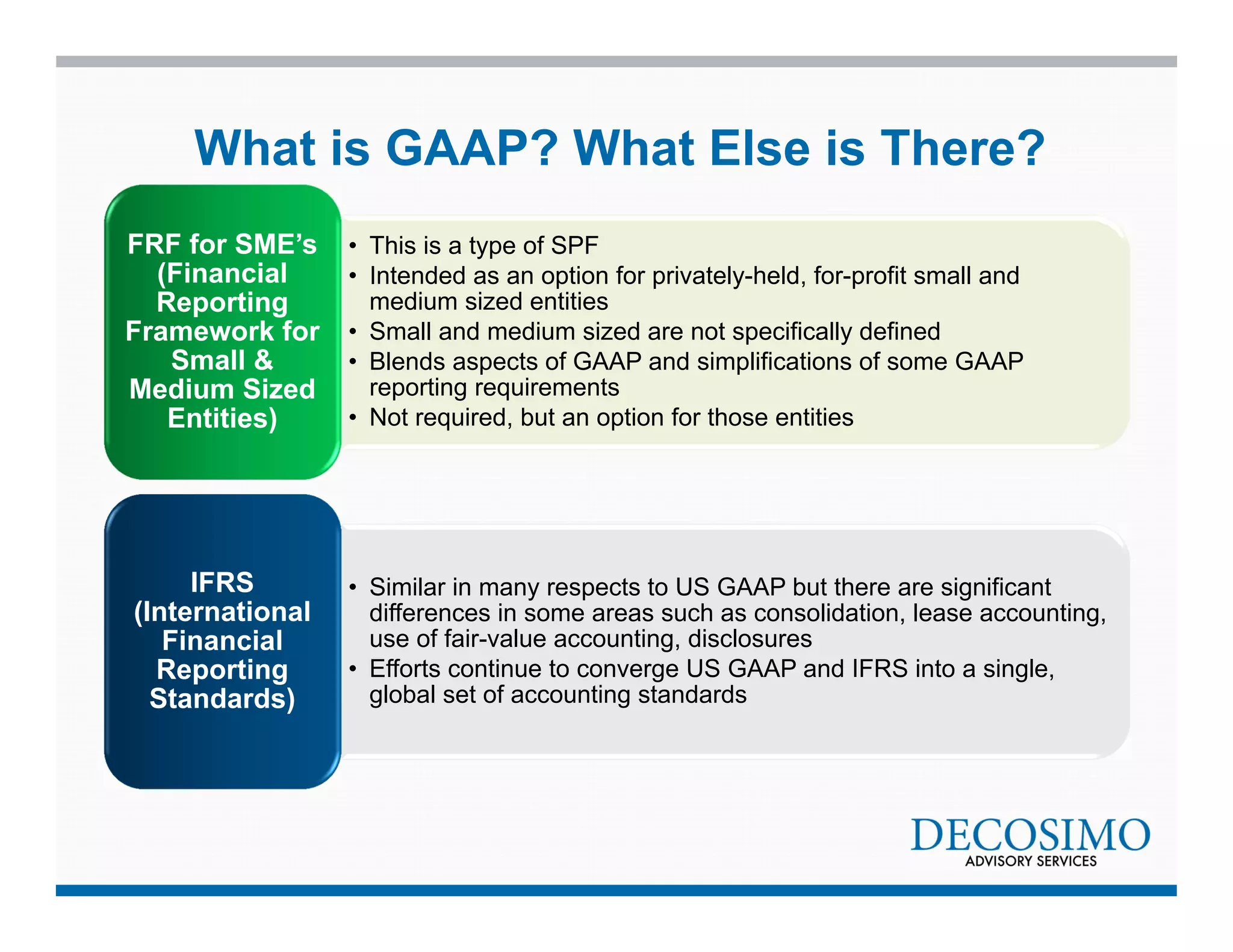

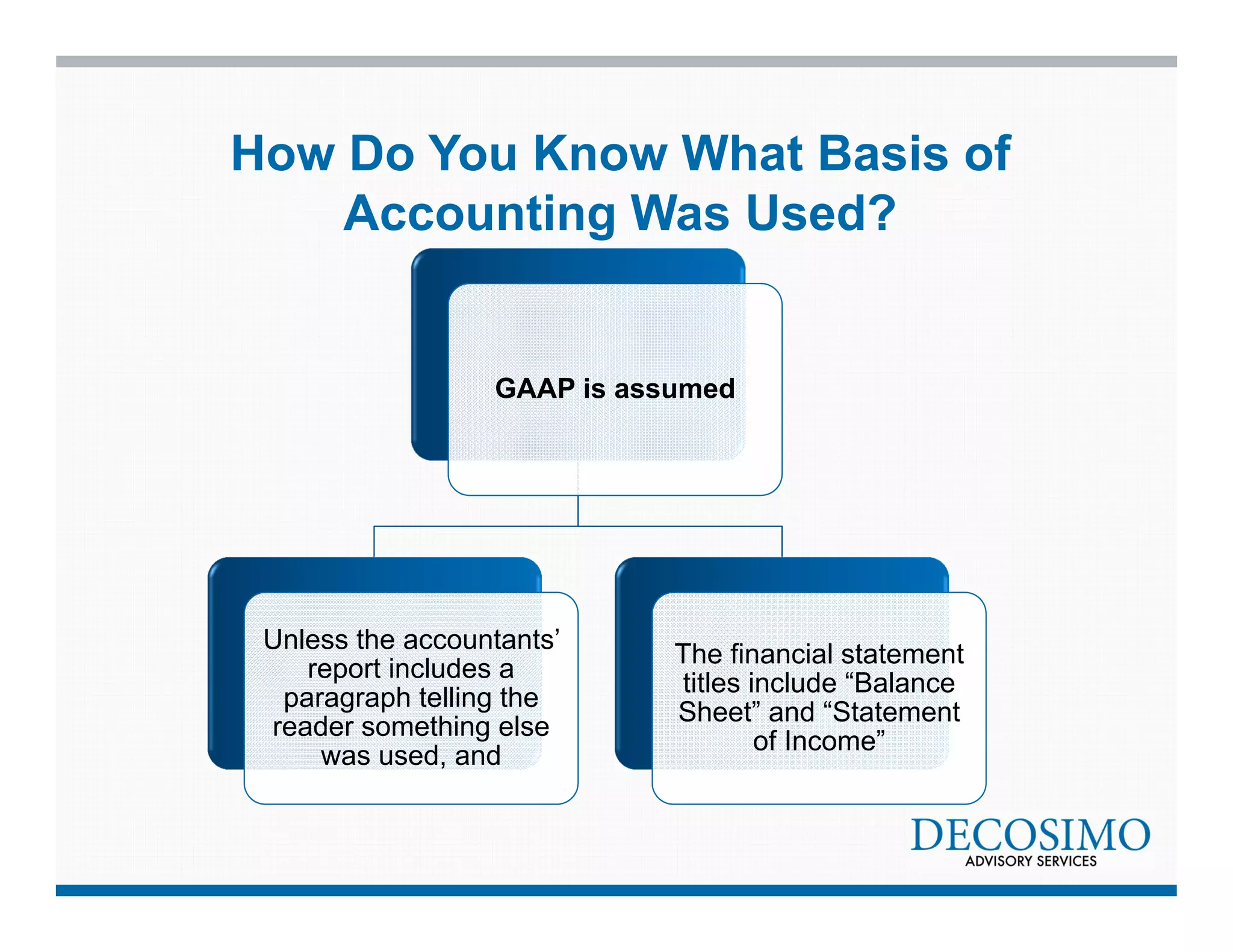

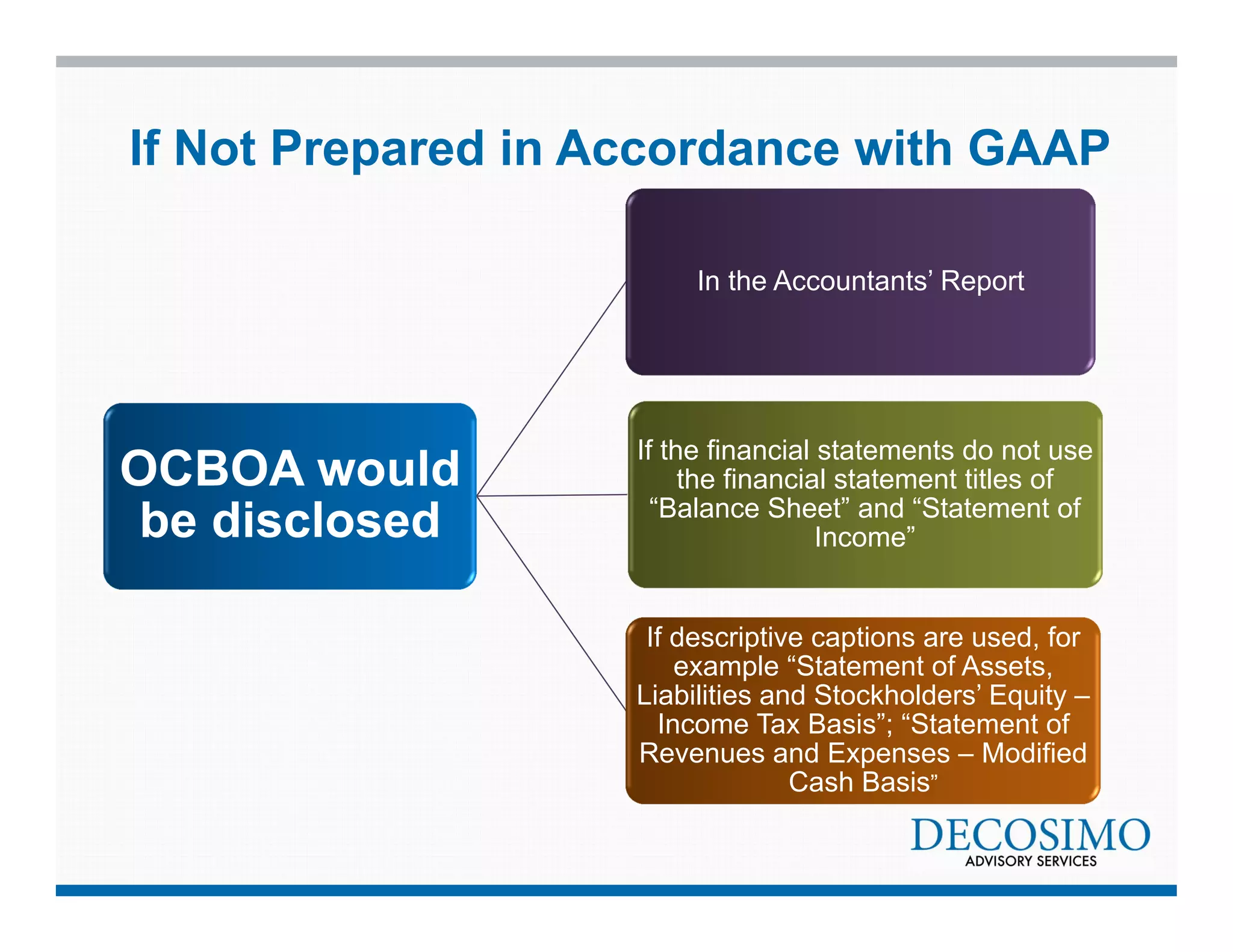

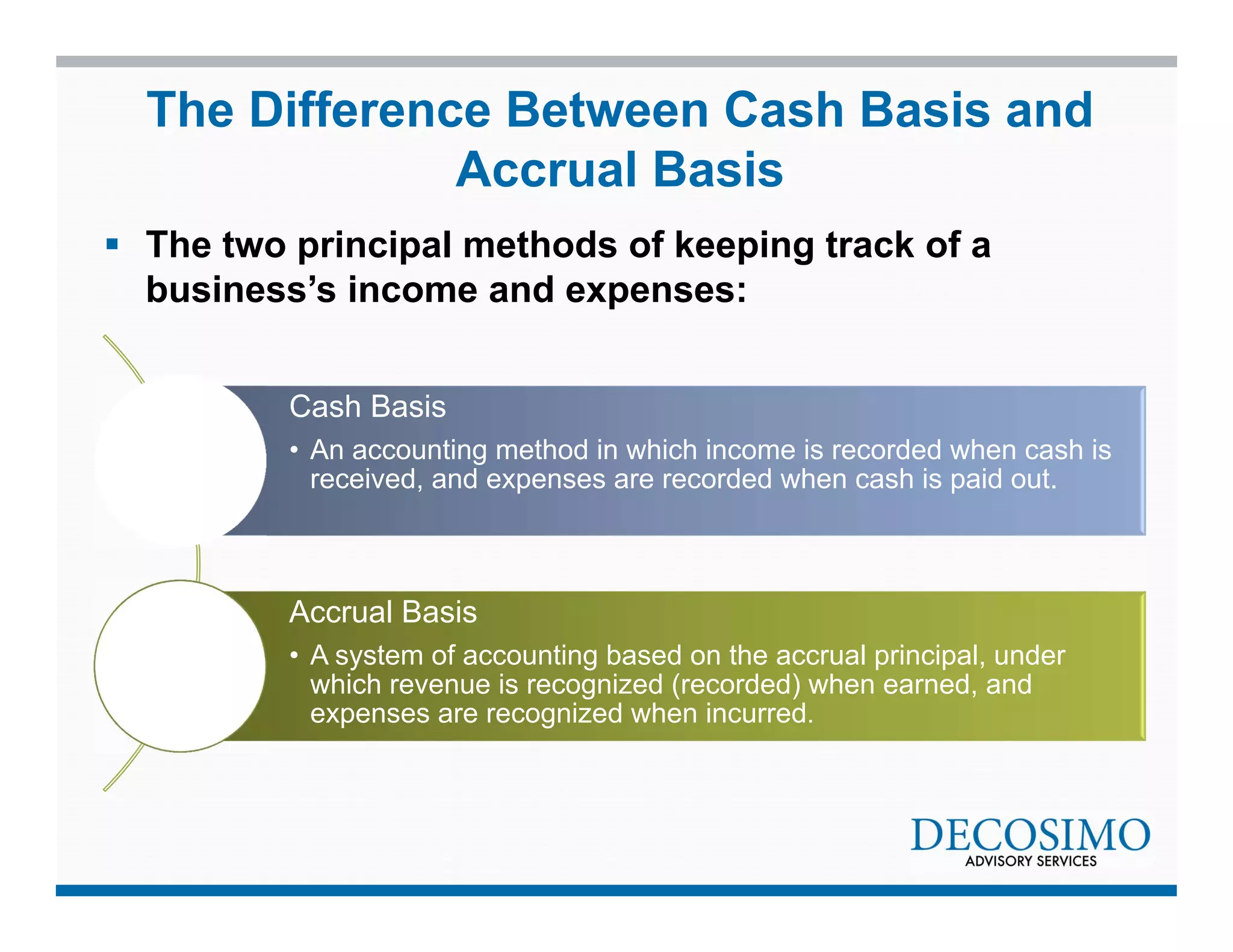

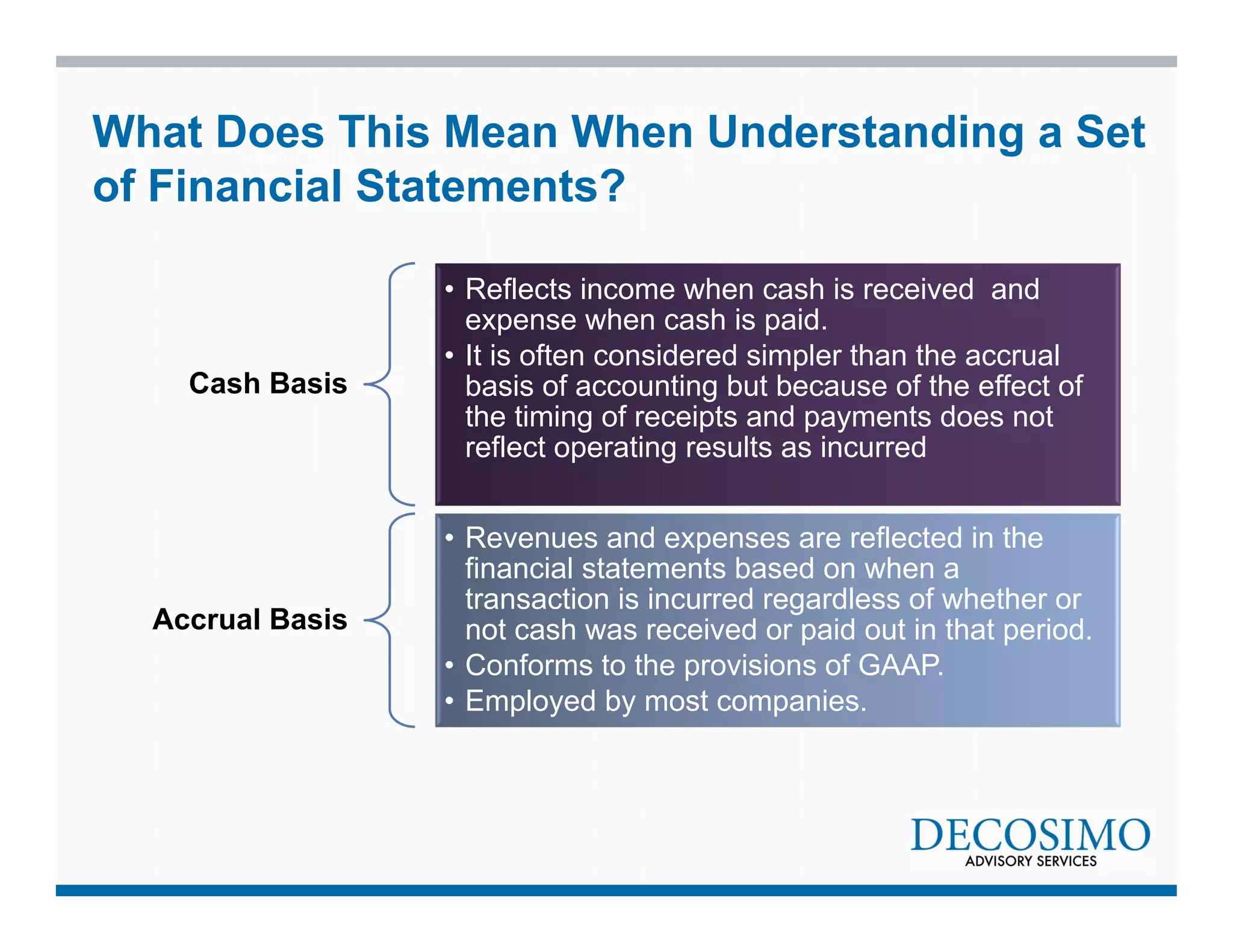

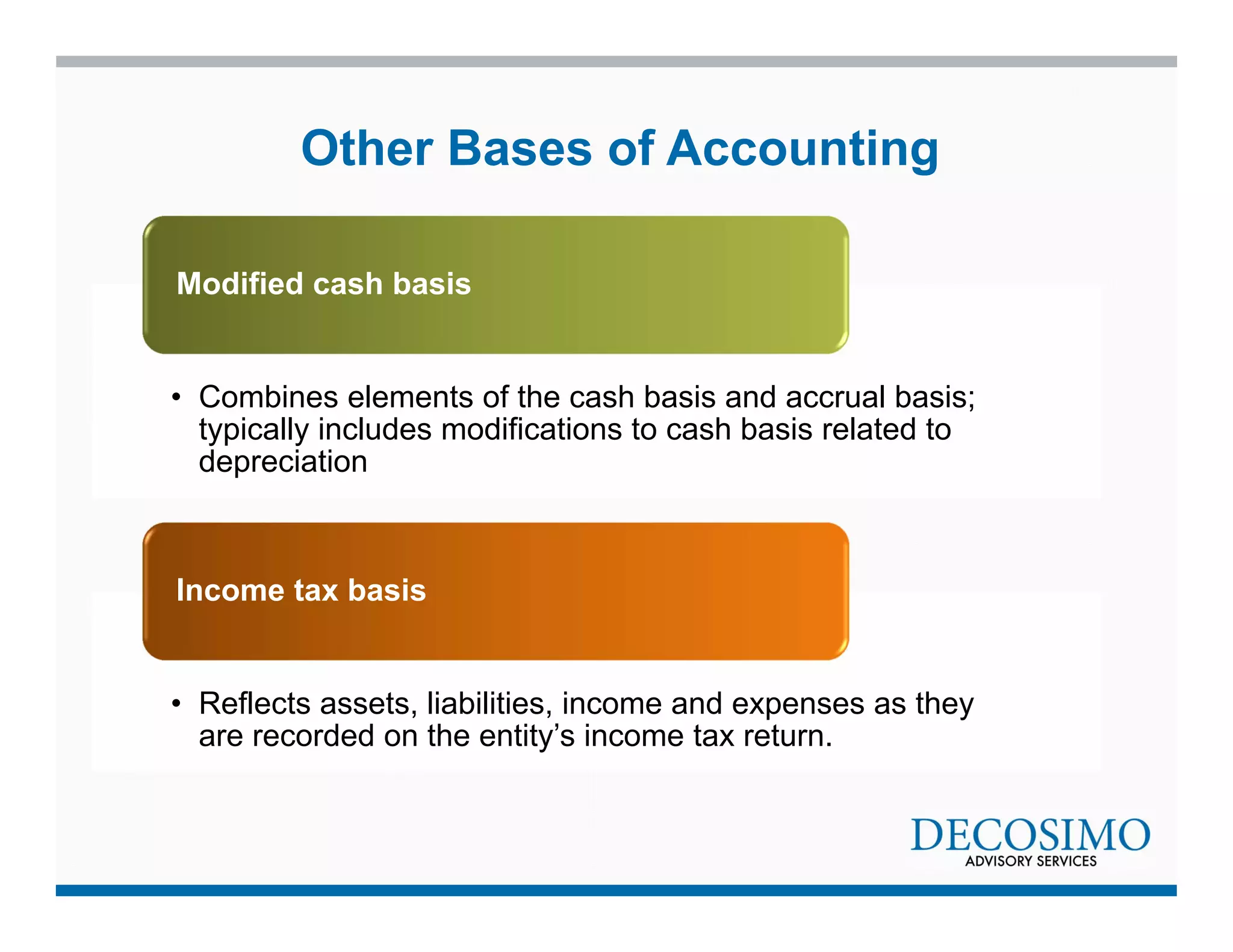

- A discussion of the different bases of accounting (GAAP, tax basis, cash basis) and how to identify which was used in a set of statements.

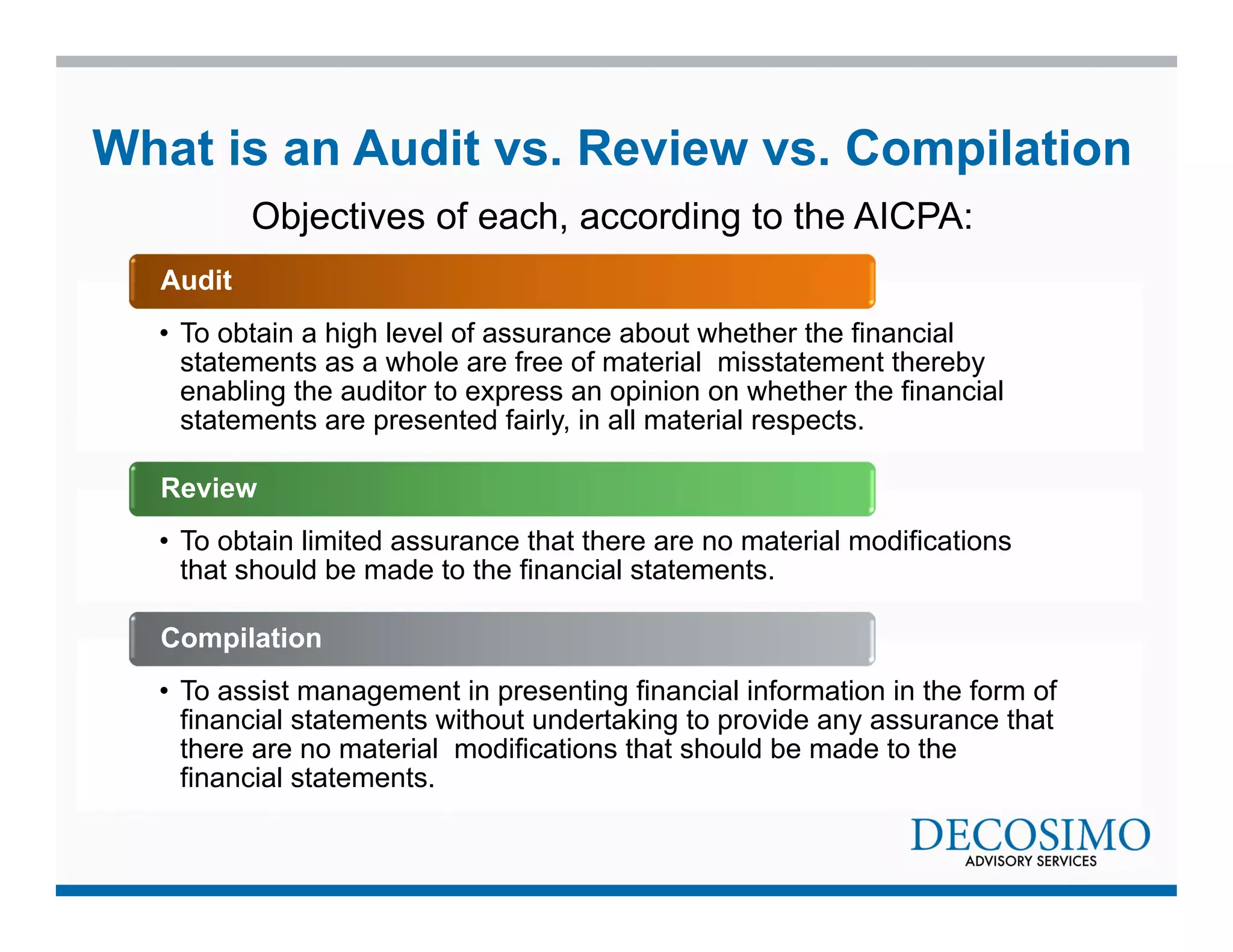

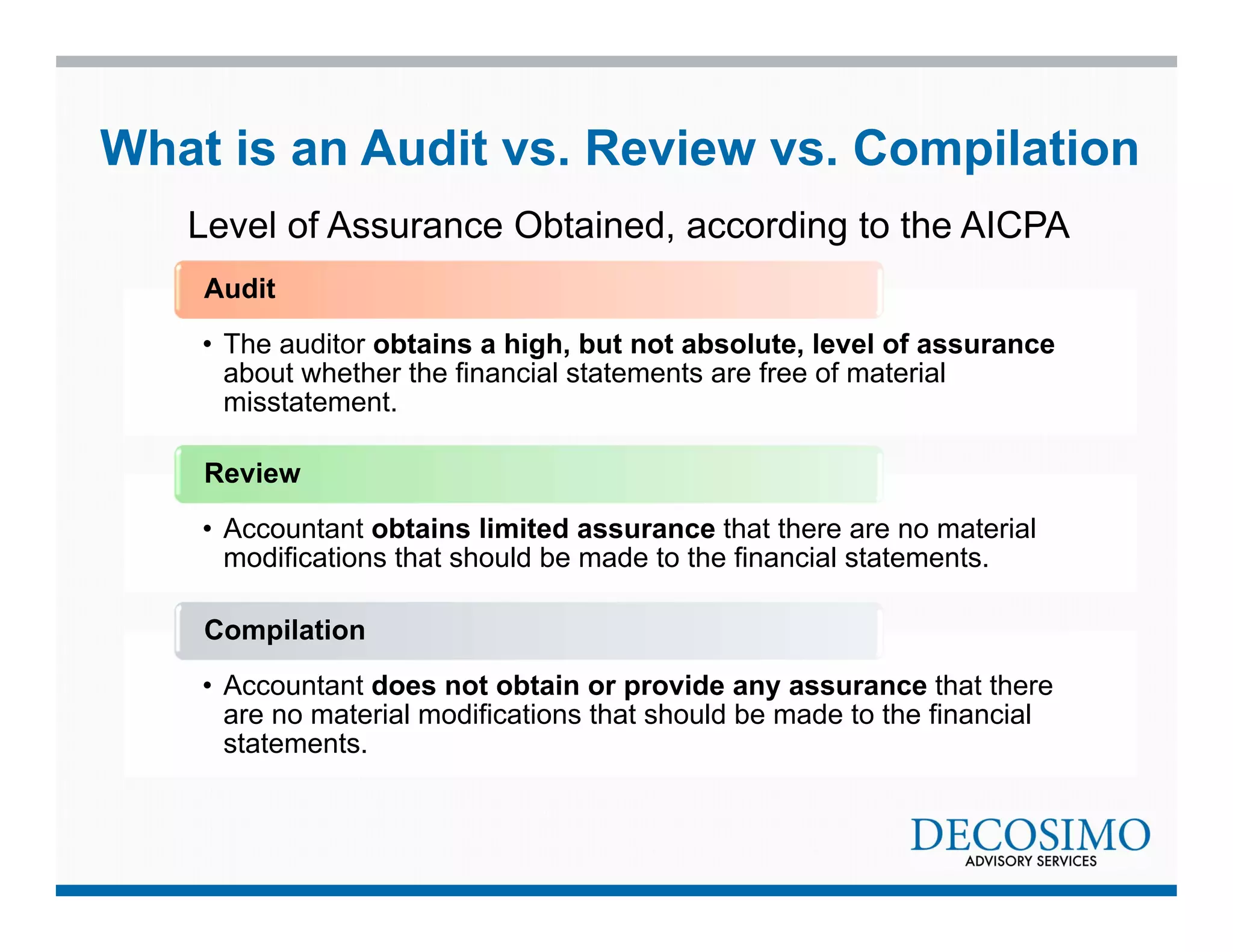

- Descriptions of the levels of assurance provided by audits,