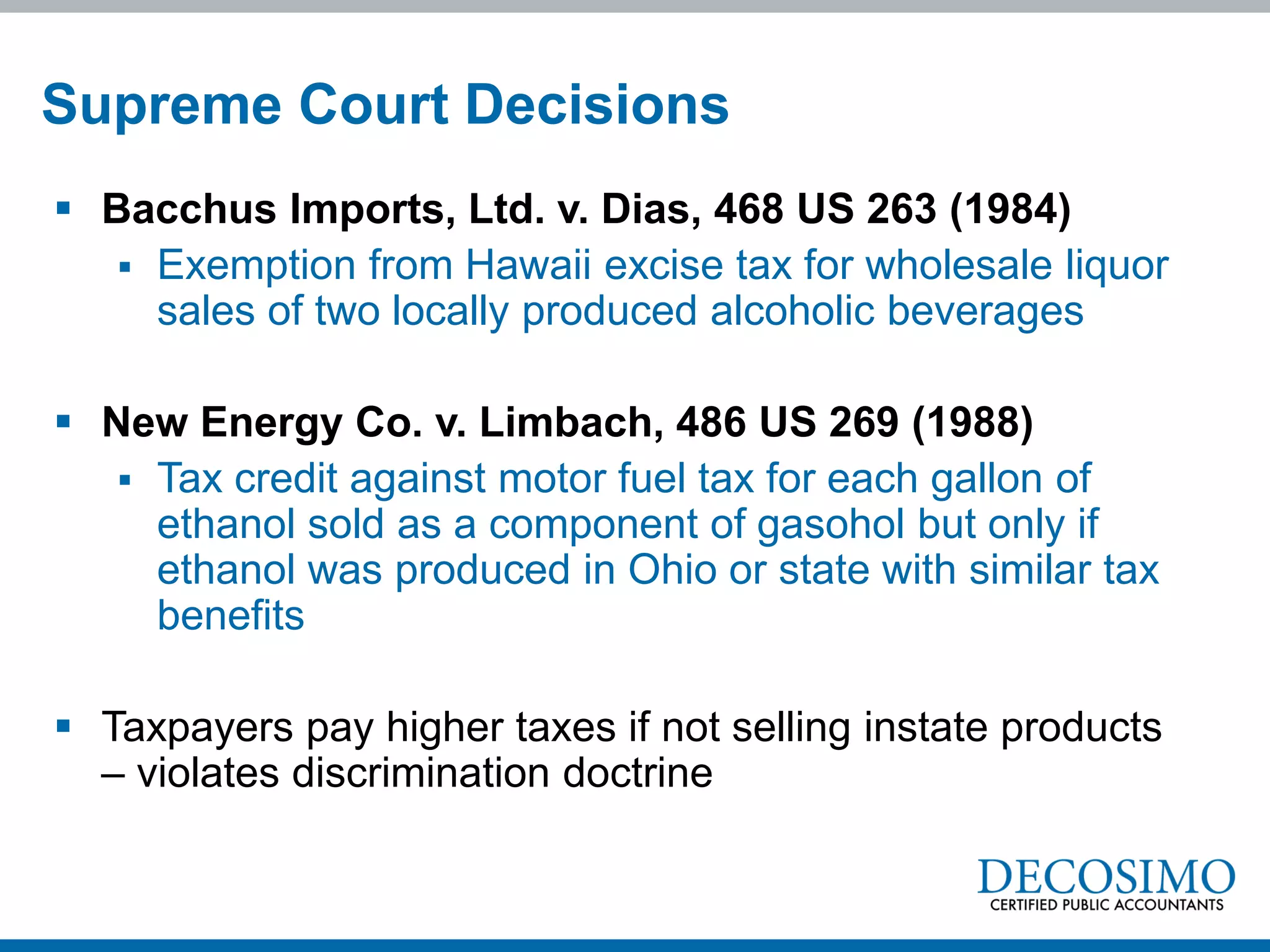

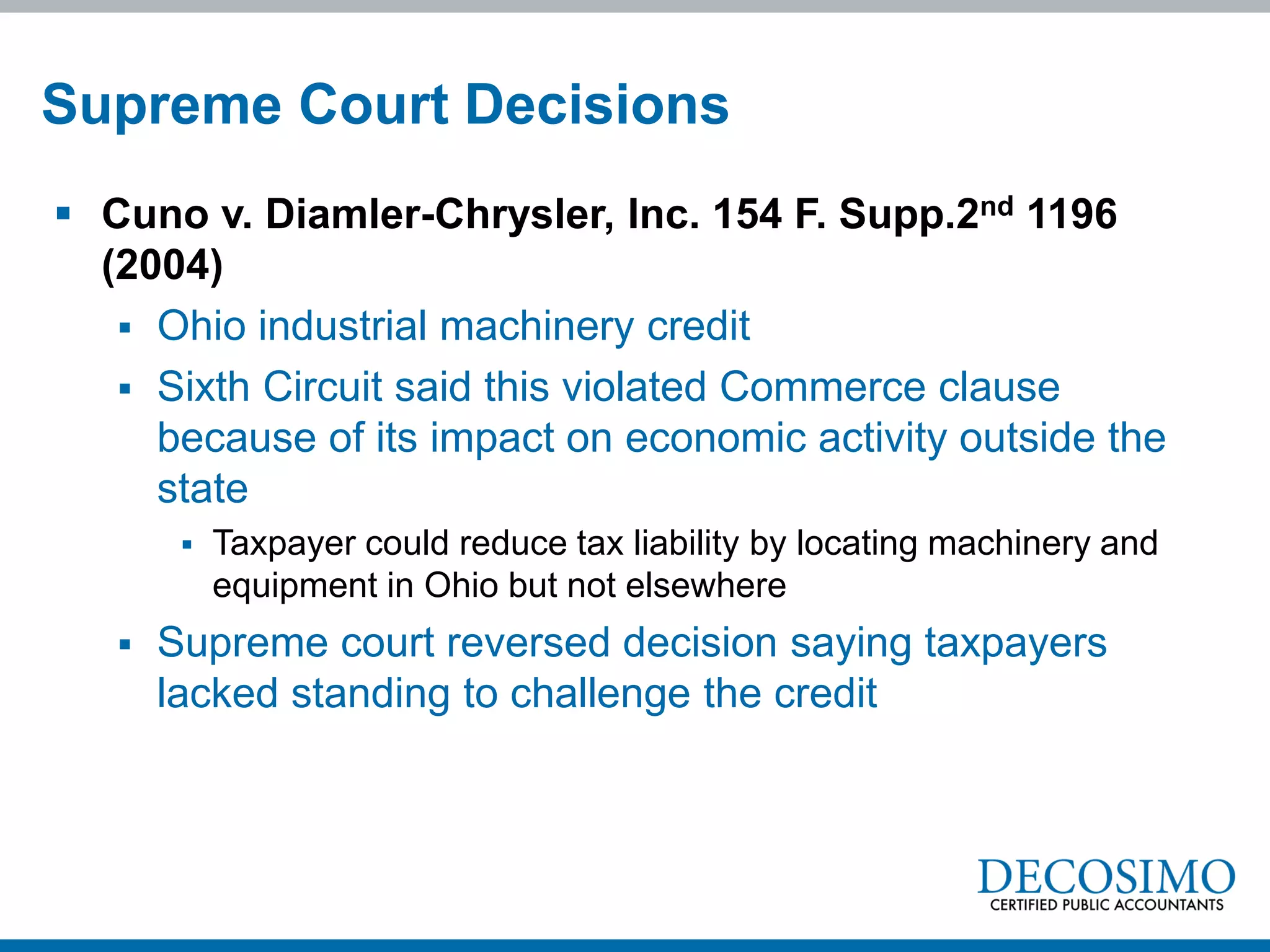

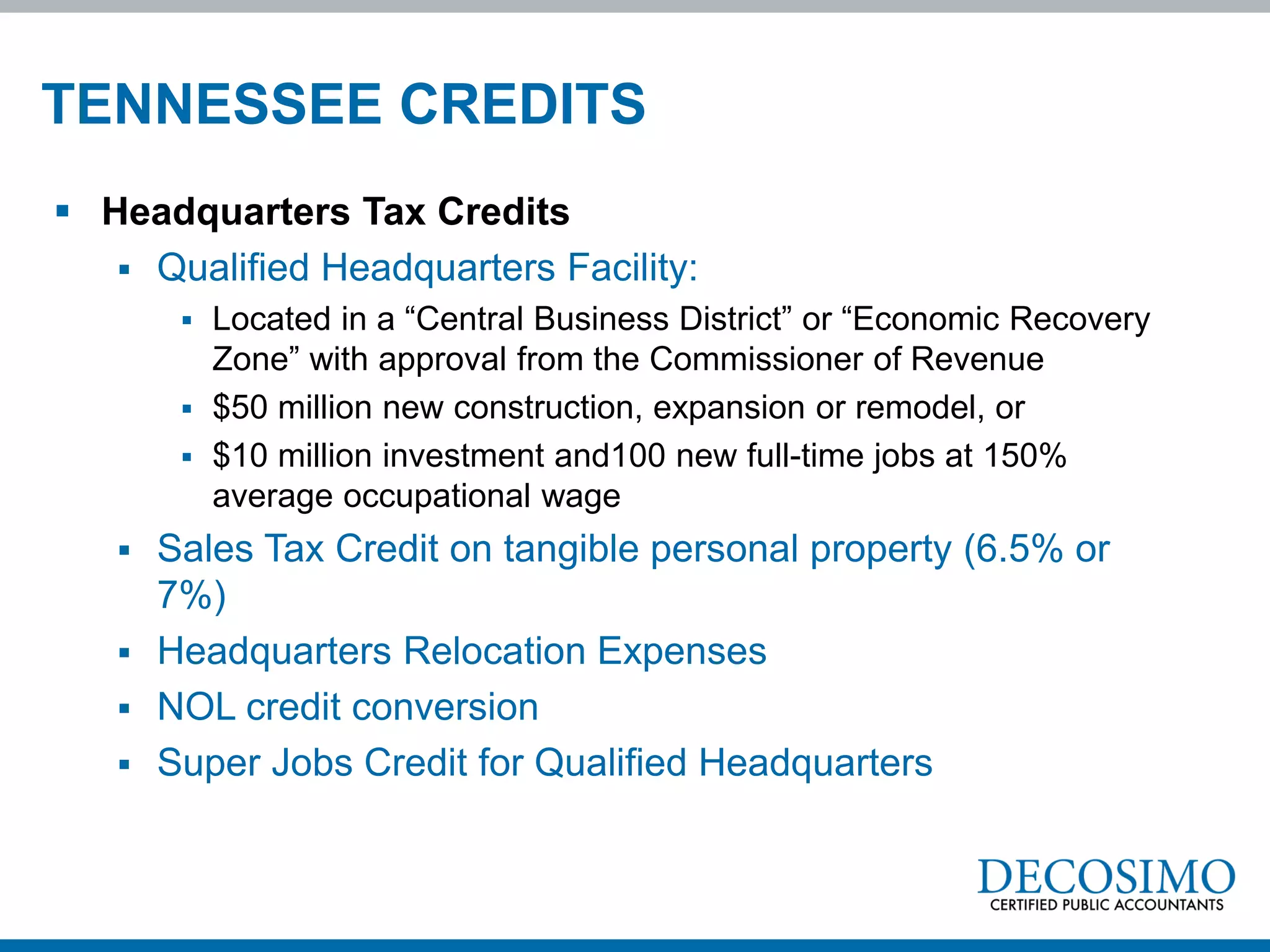

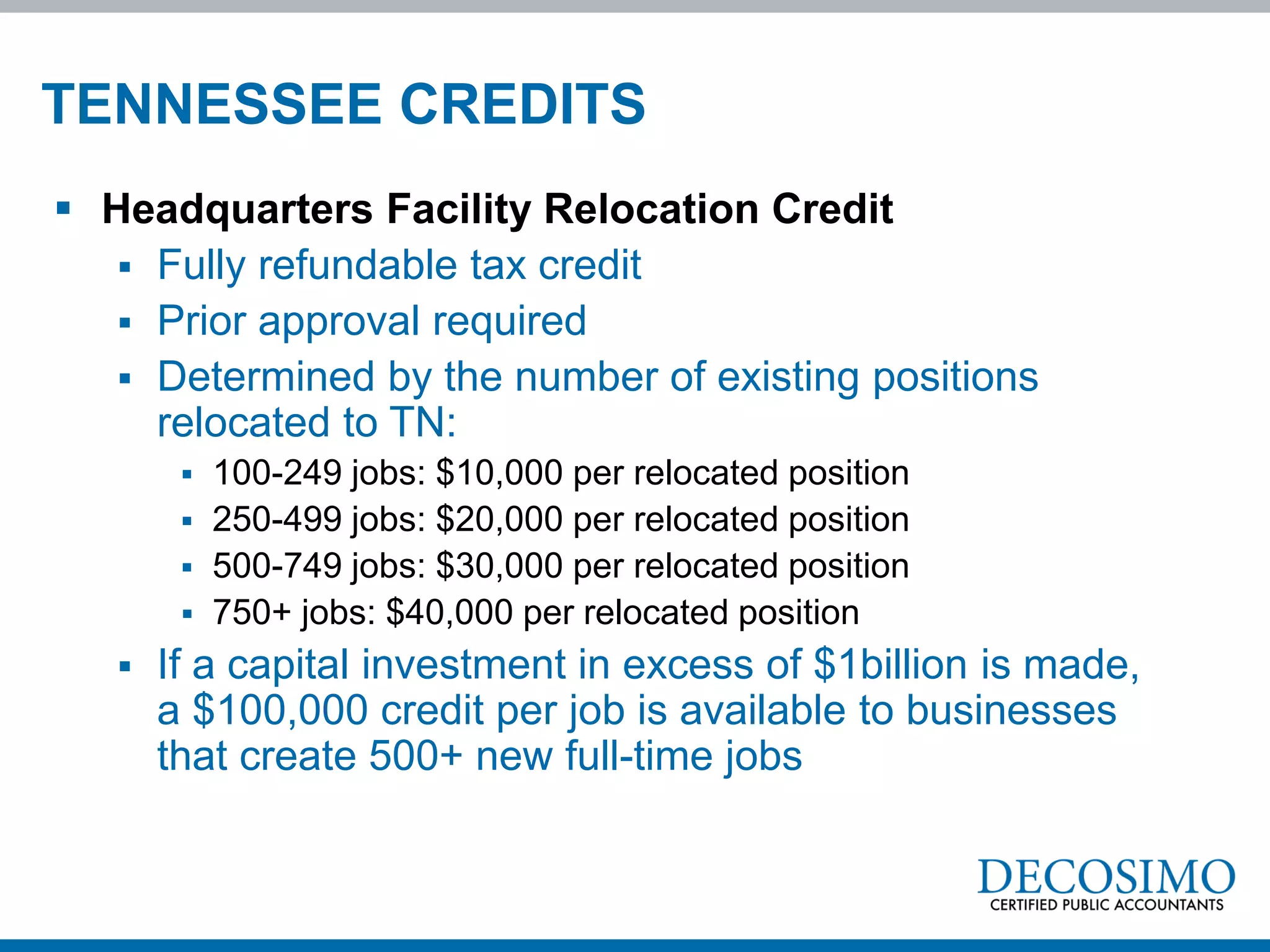

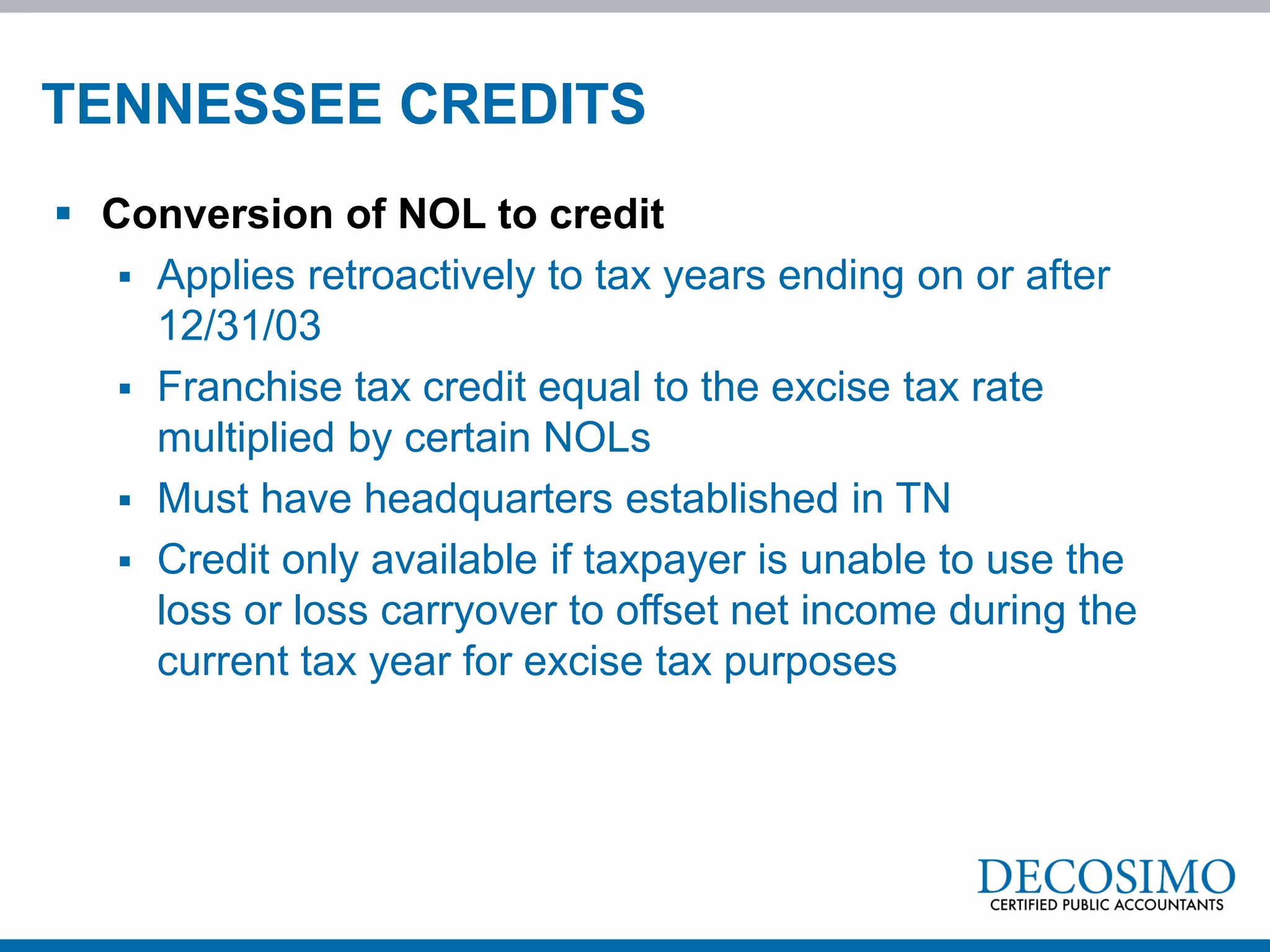

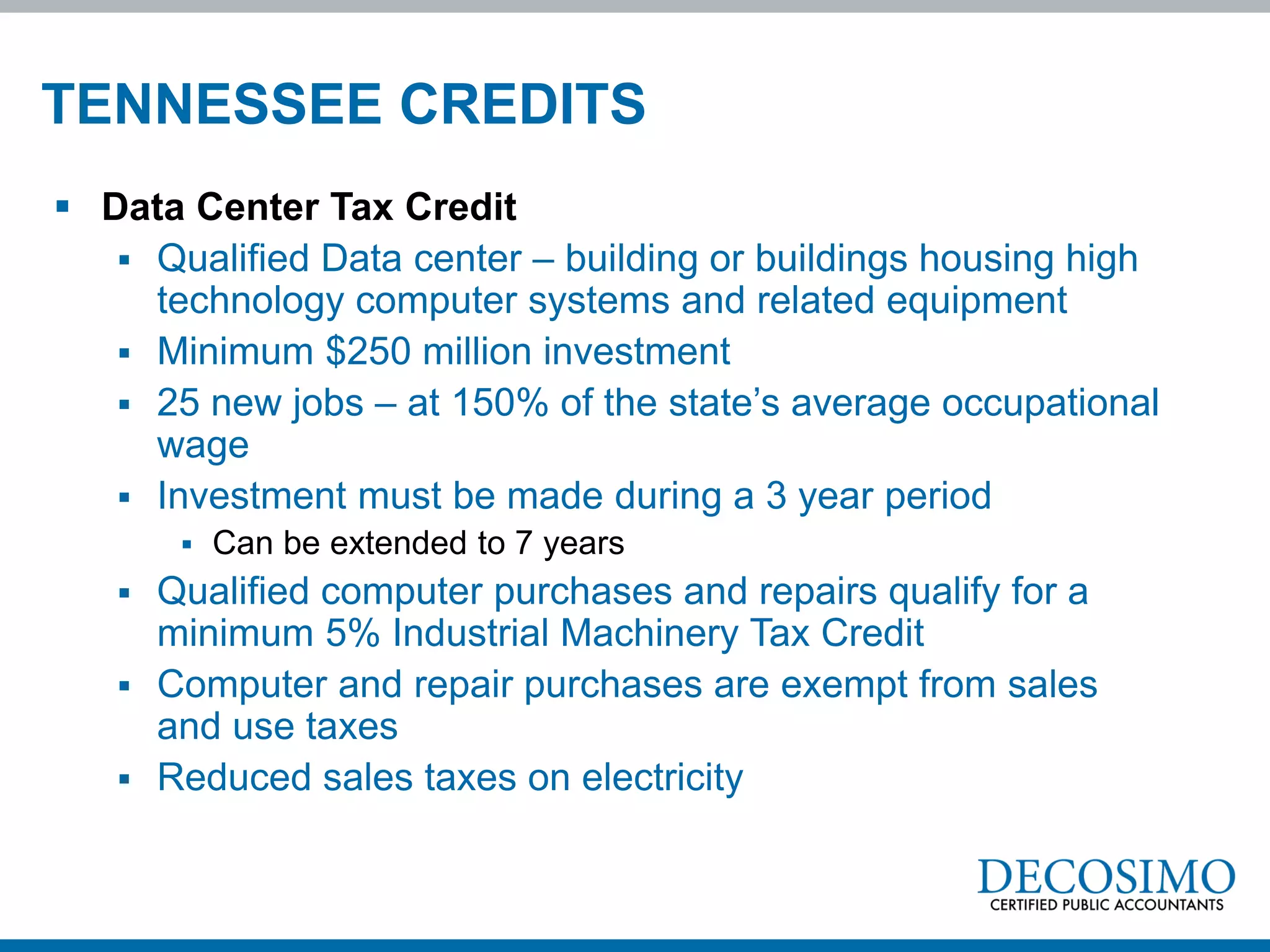

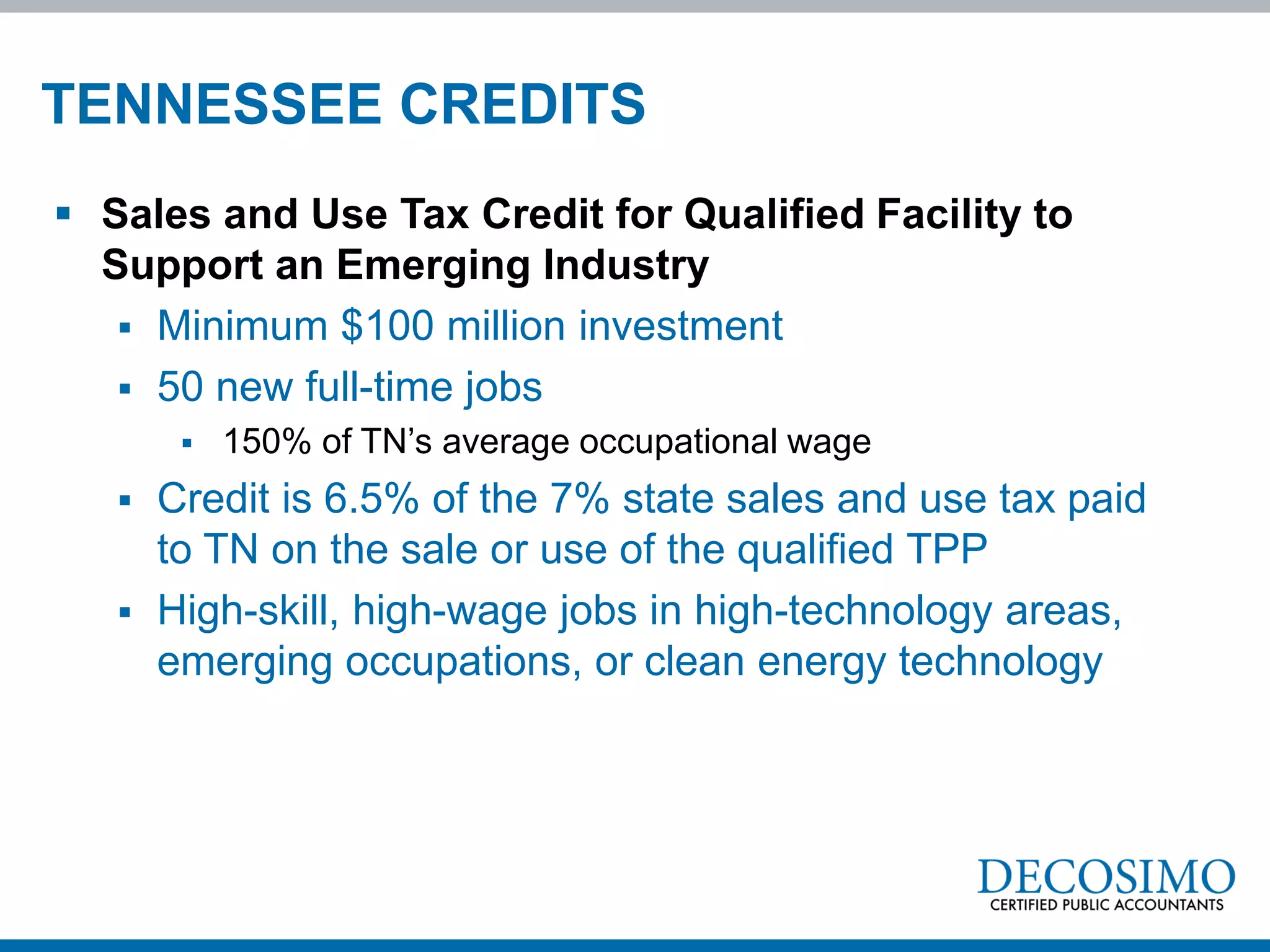

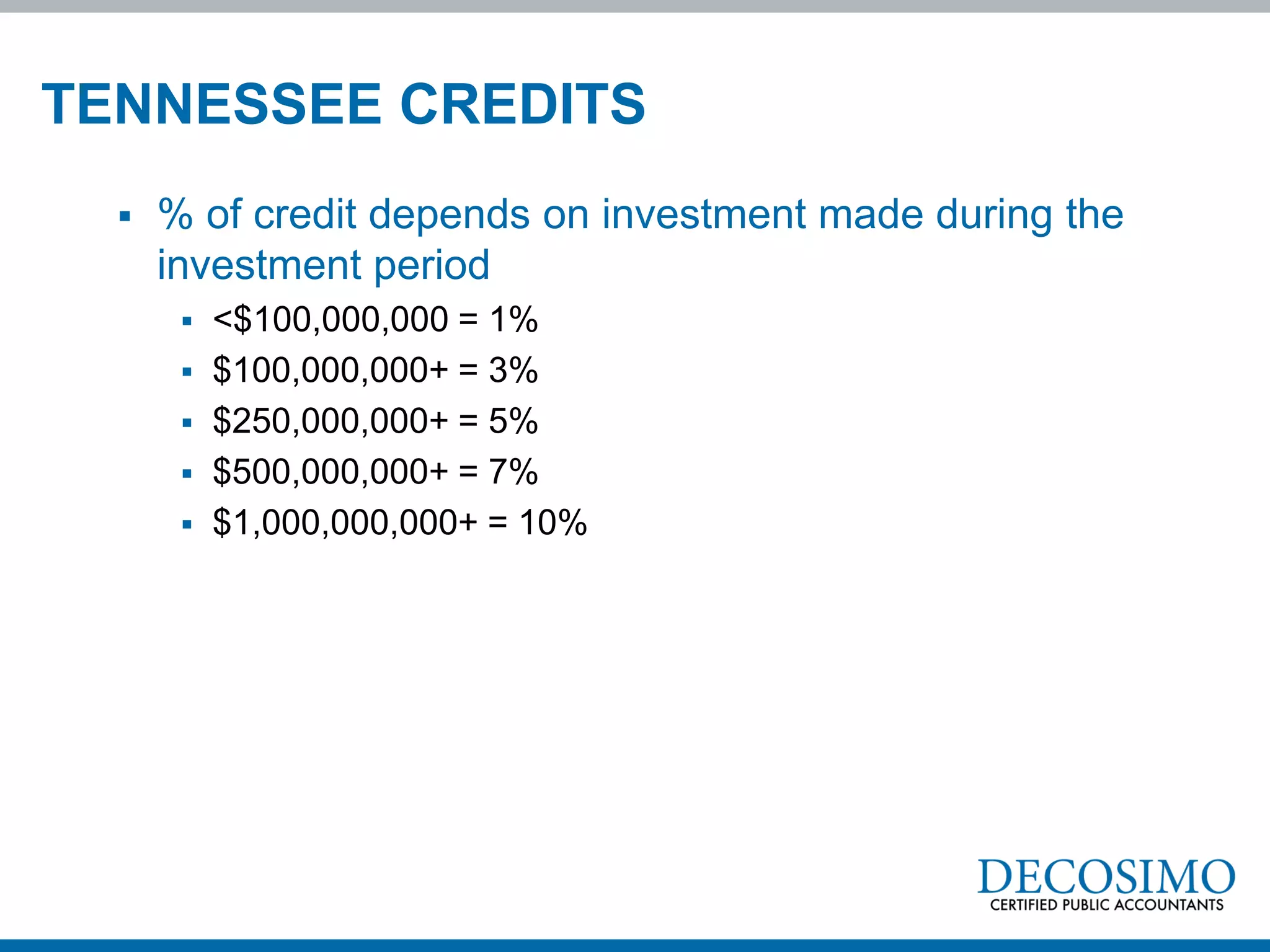

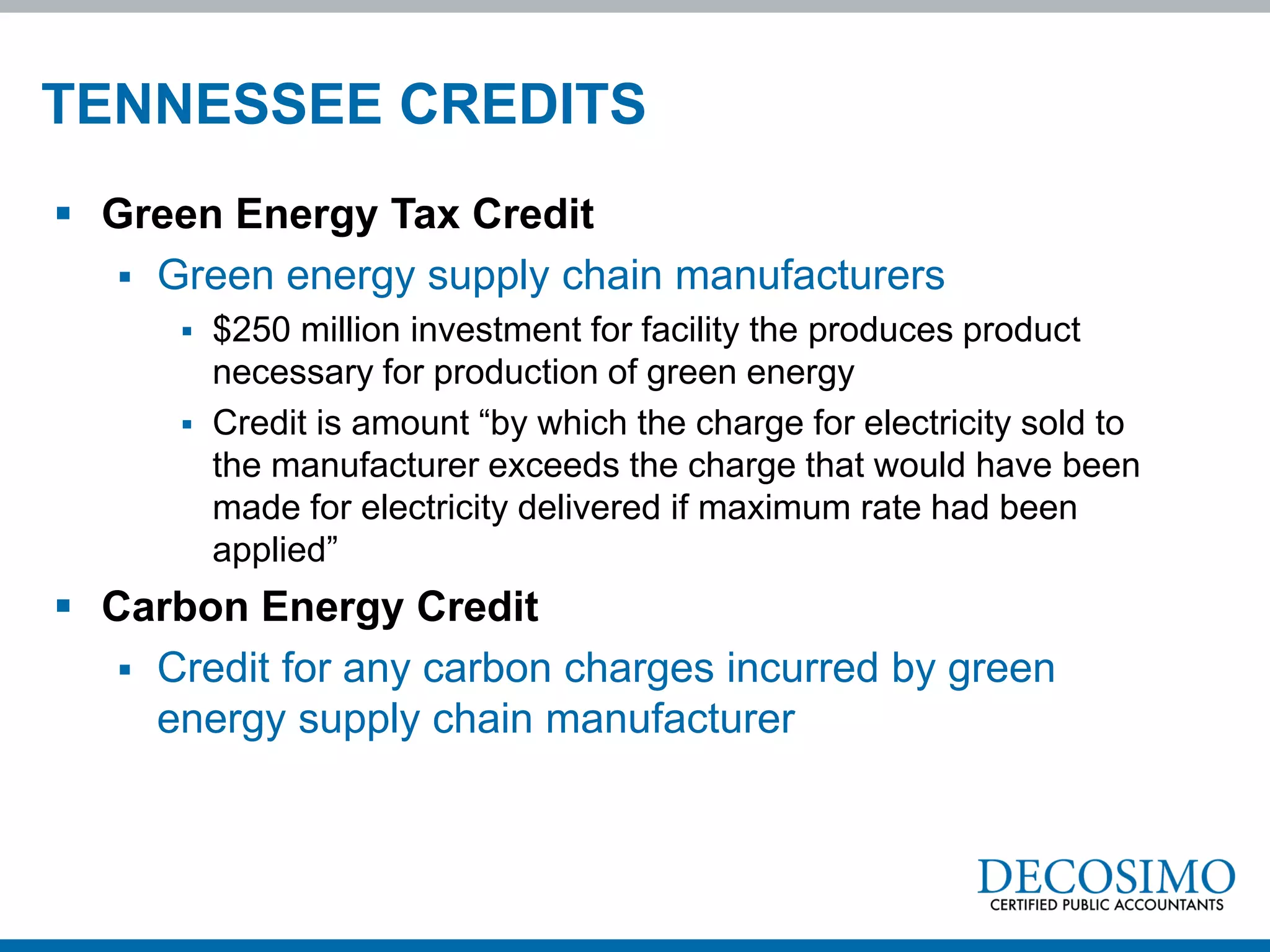

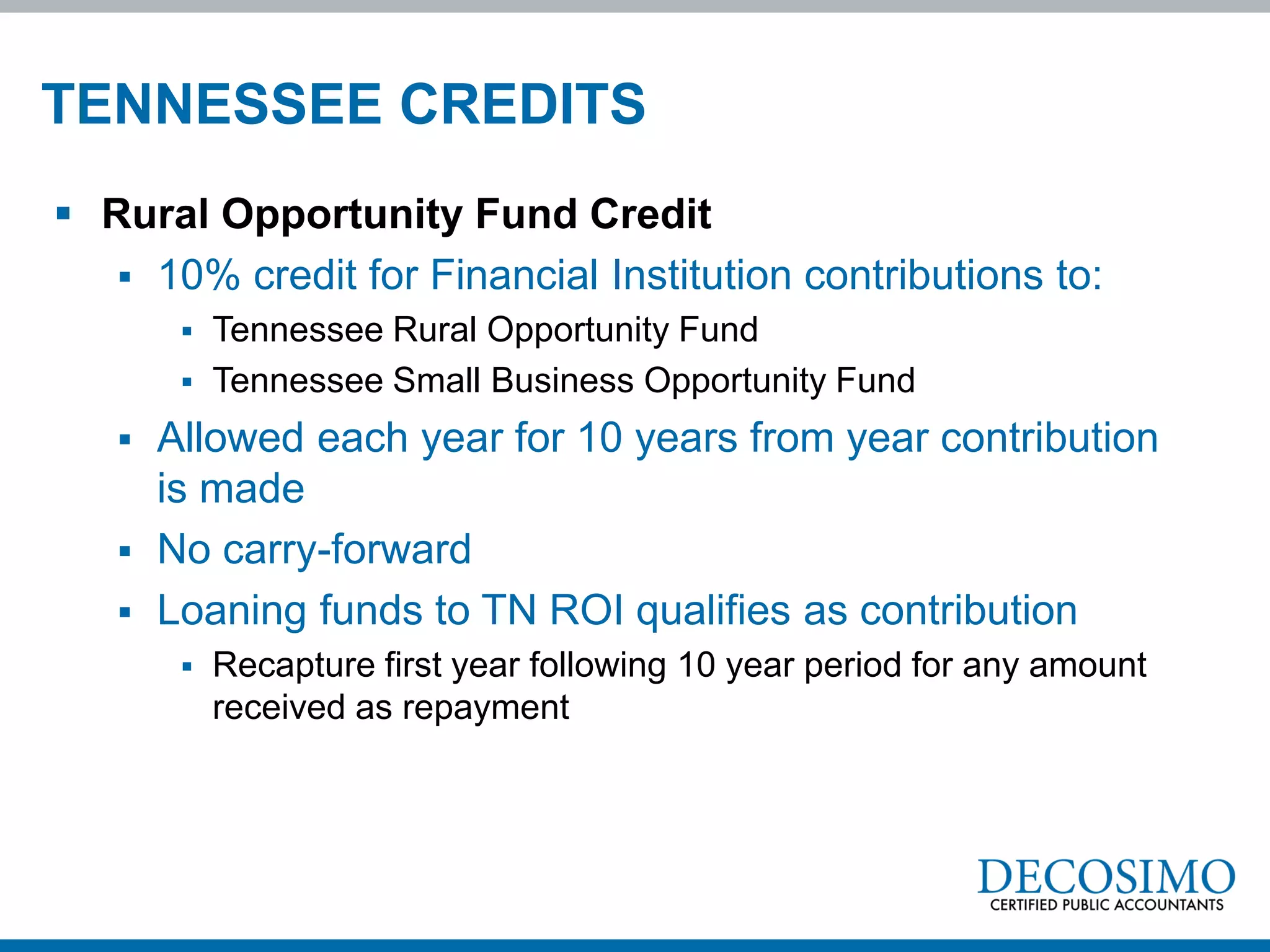

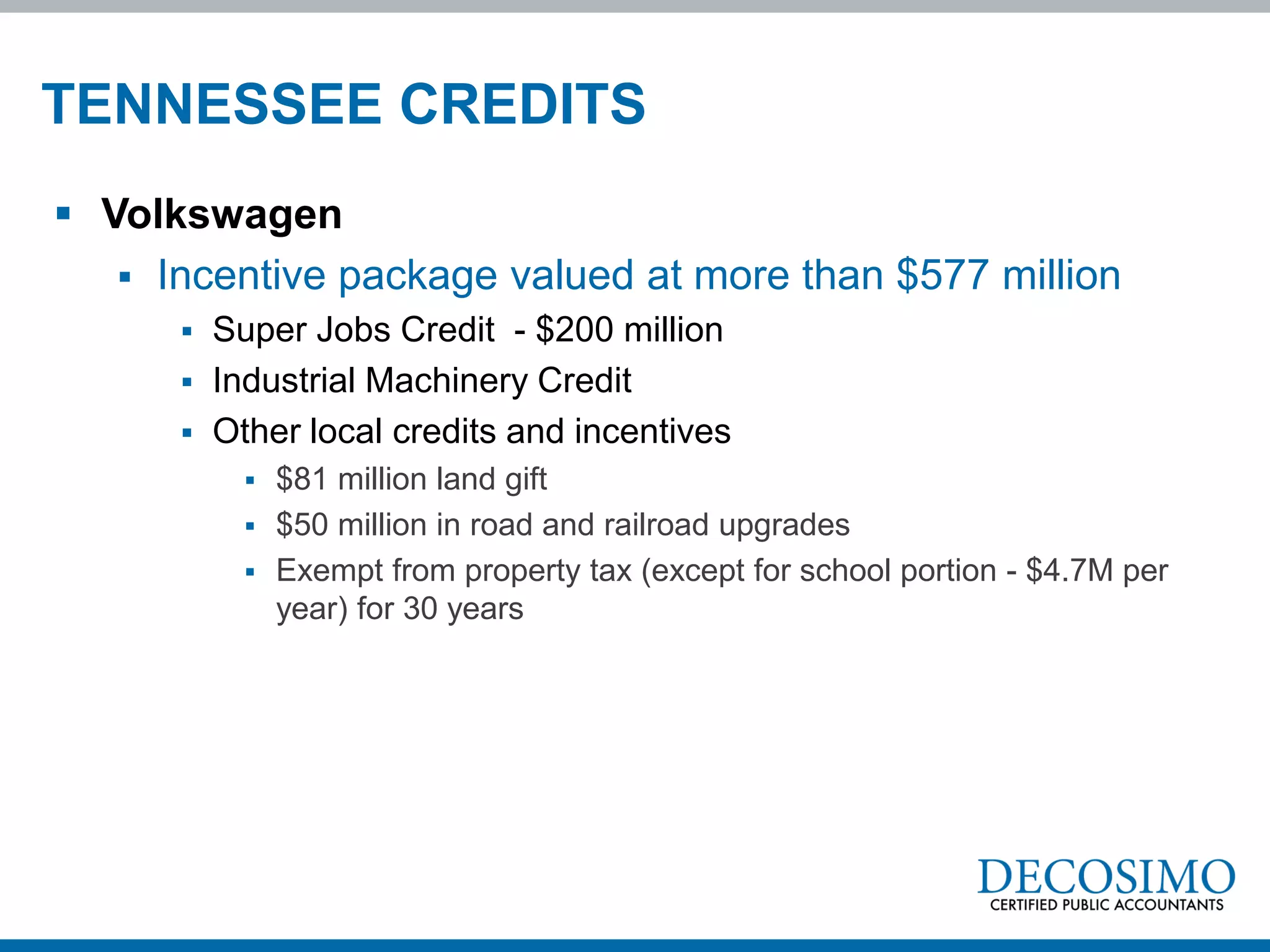

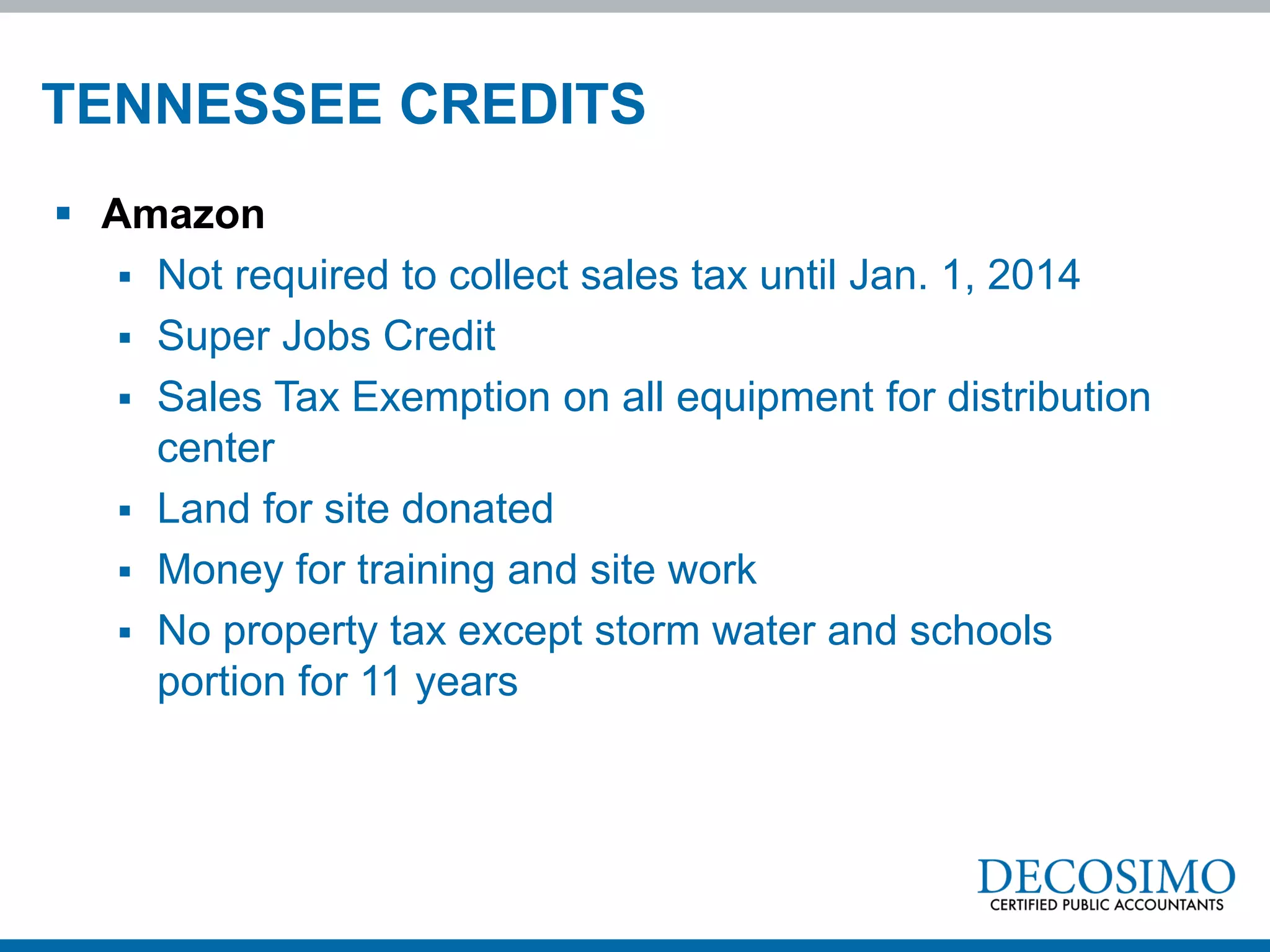

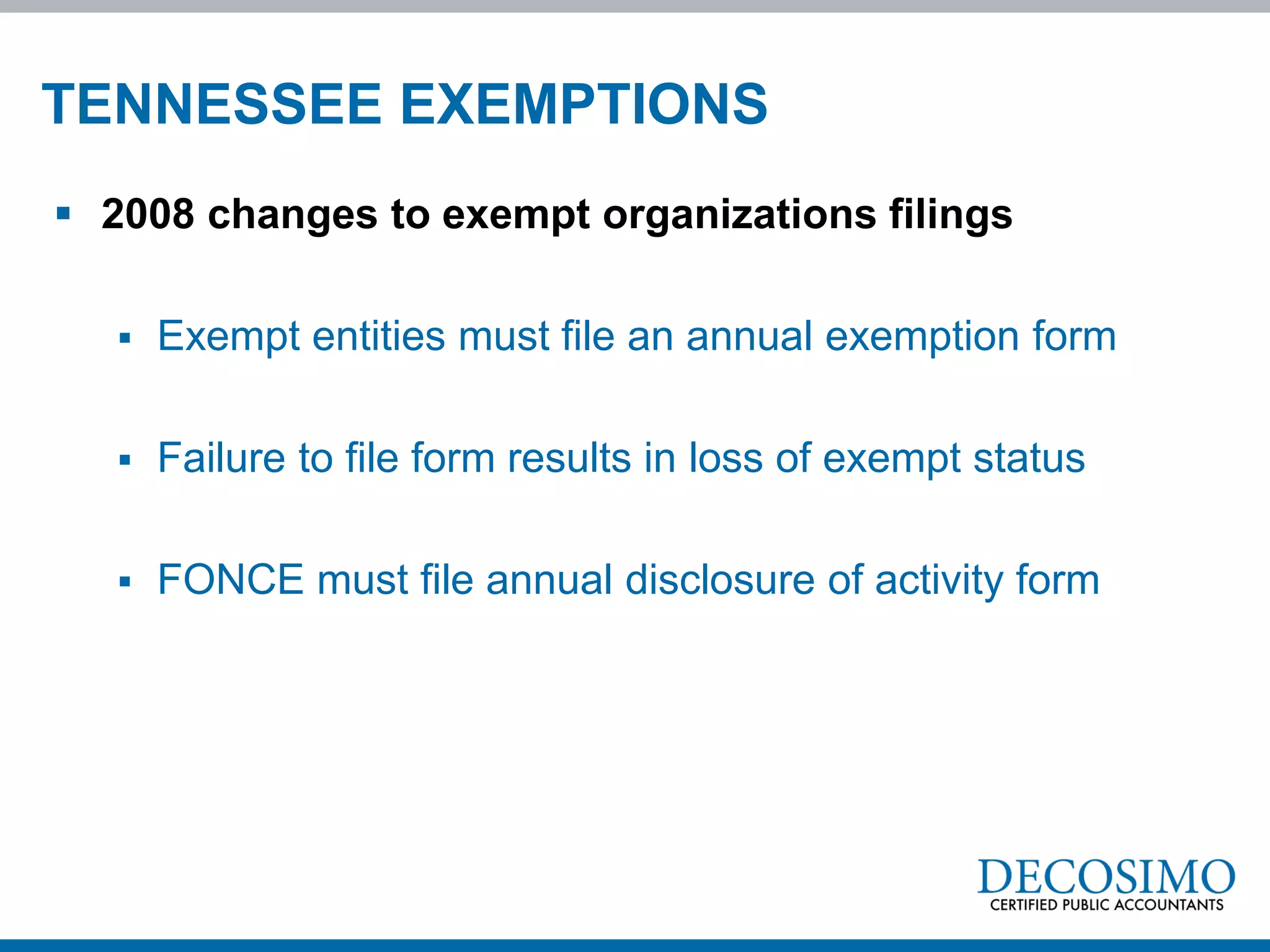

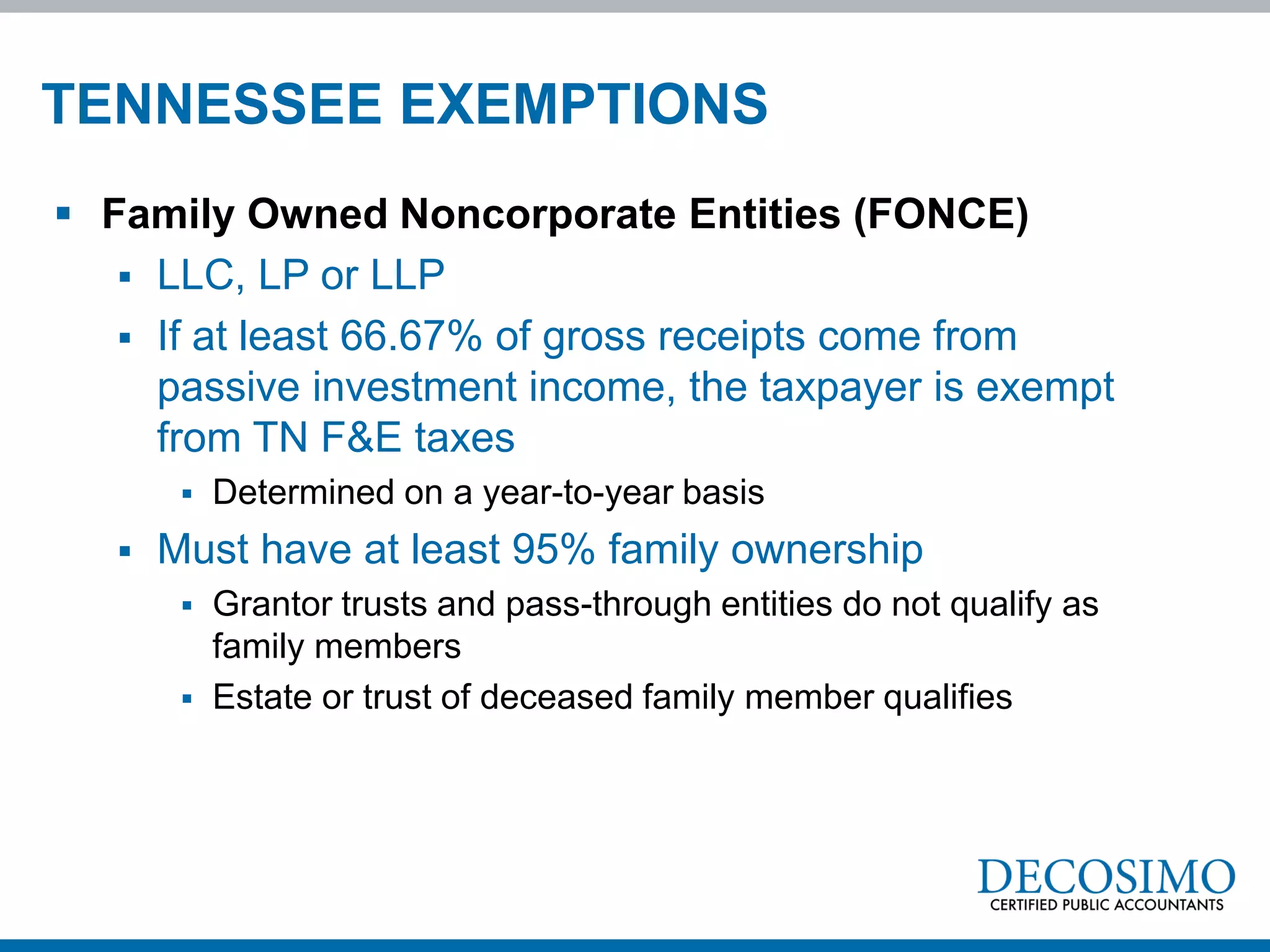

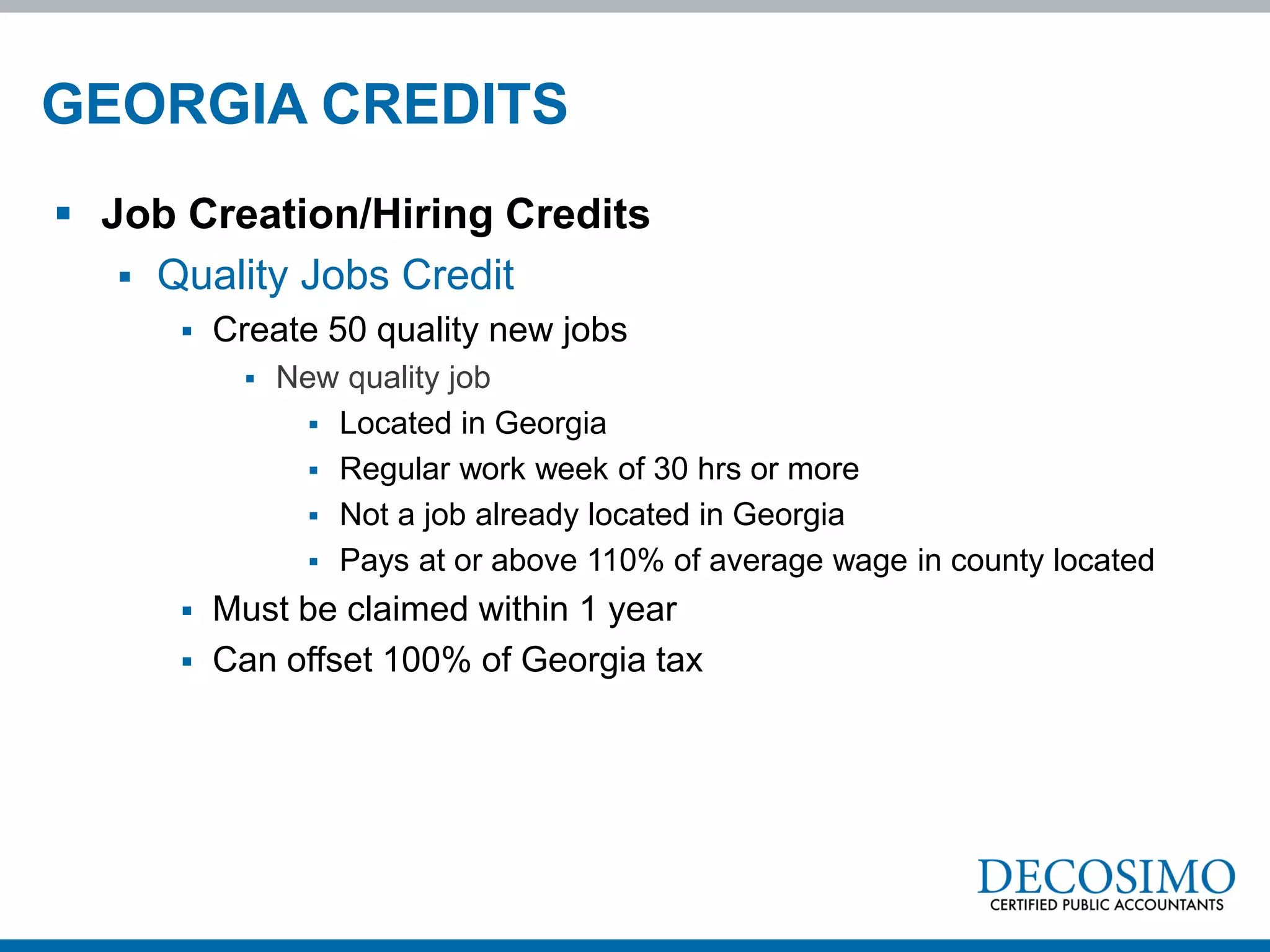

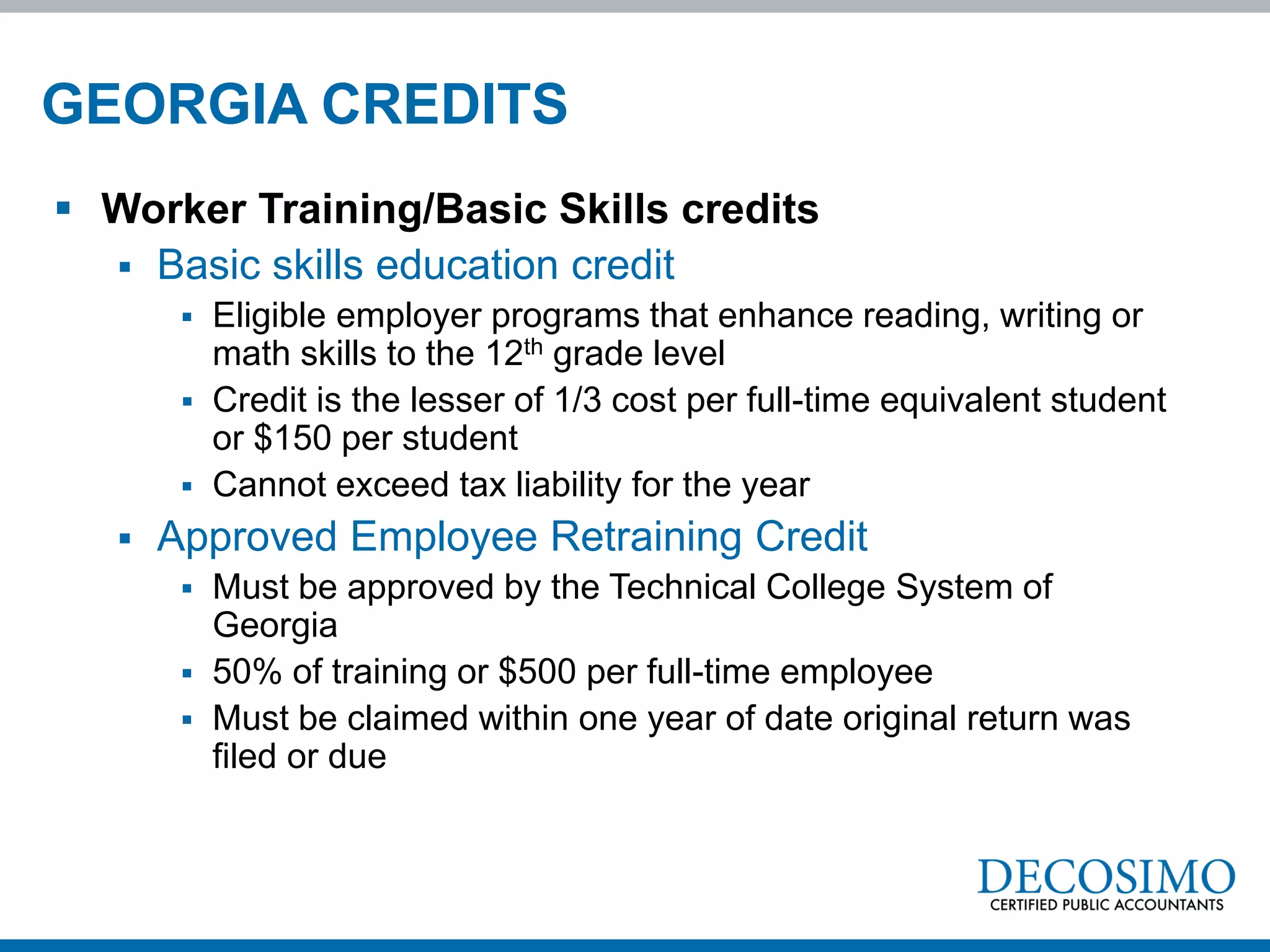

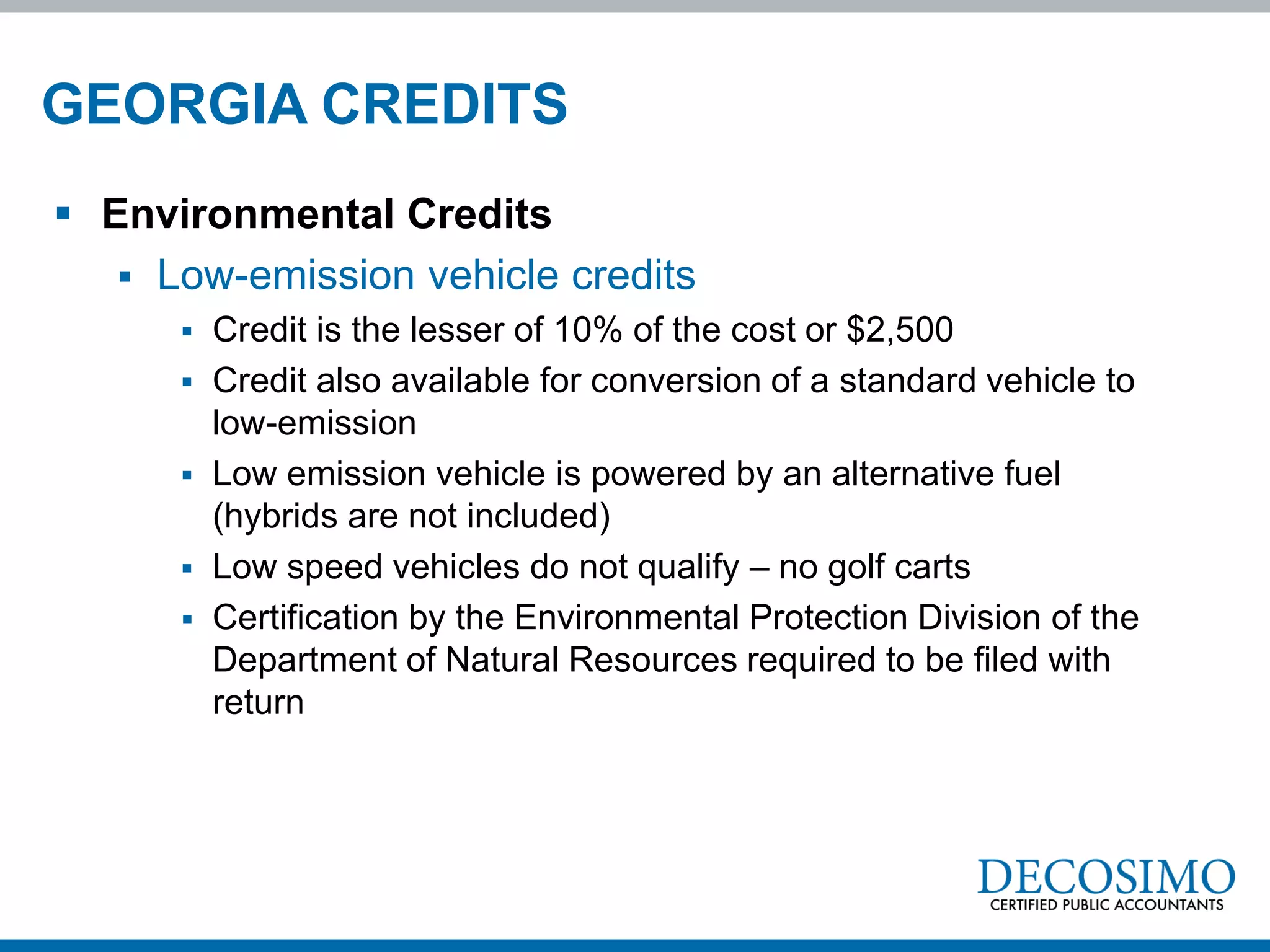

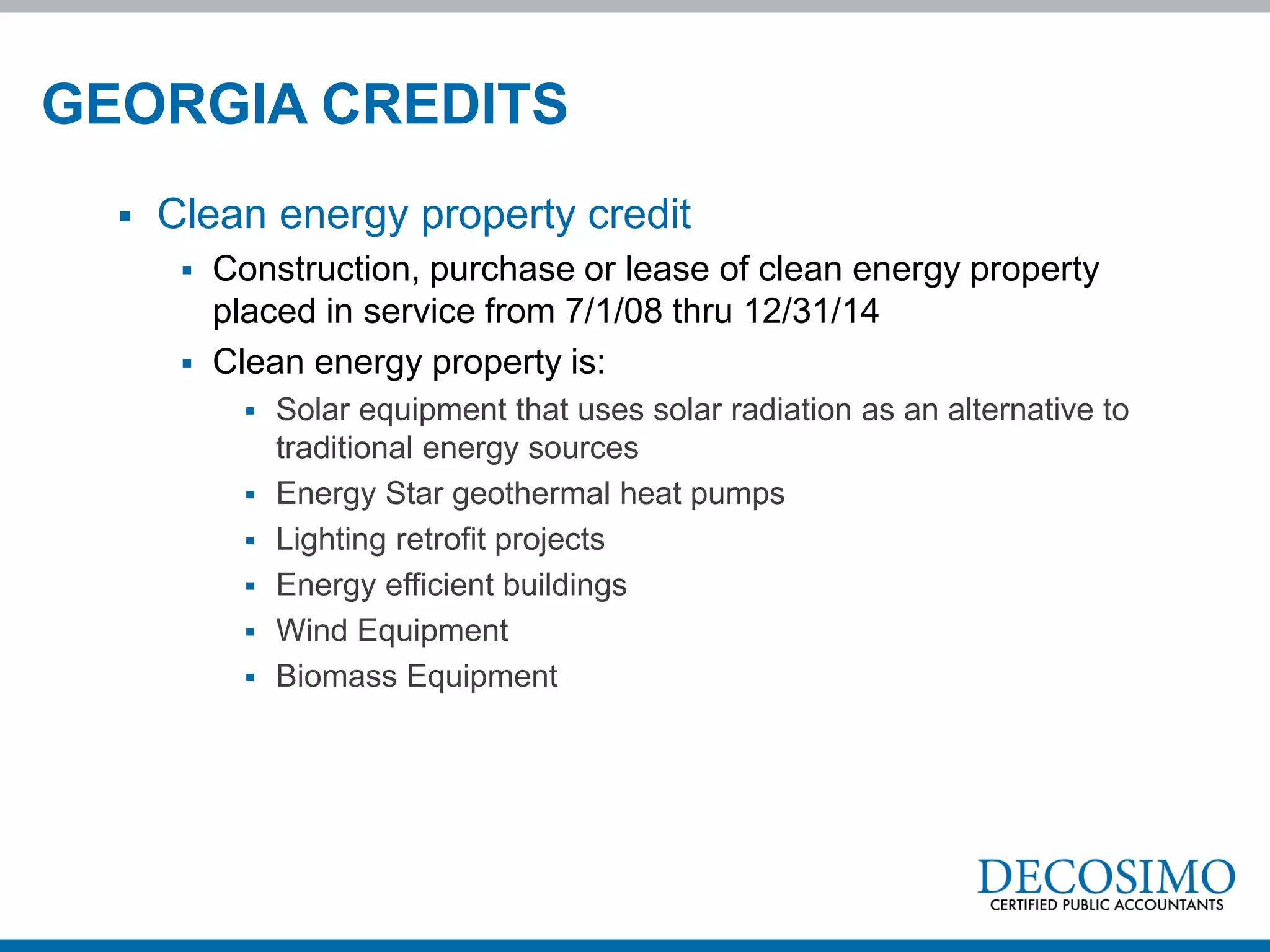

The document outlines various tax credits and incentives available at federal, state, and local levels, focusing on their importance in attracting capital investment, generating jobs, and addressing environmental and social concerns. It highlights the complexities businesses face in identifying and utilizing these credits, noting that a significant percentage of companies are not fully exploiting available programs. Specific examples are provided for Tennessee and Georgia, detailing the criteria and benefits associated with different types of tax incentives, including job creation, investment in facilities, and environmental sustainability.