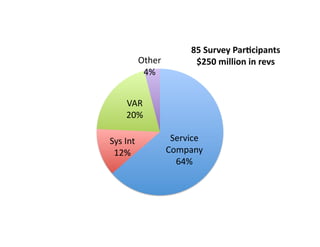

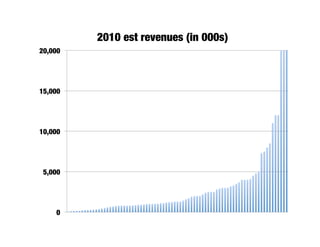

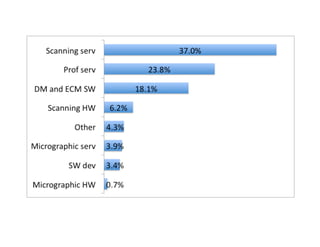

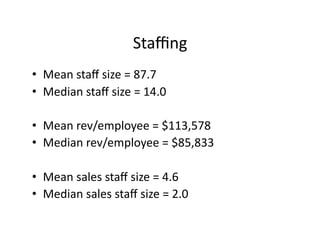

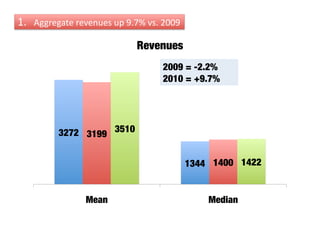

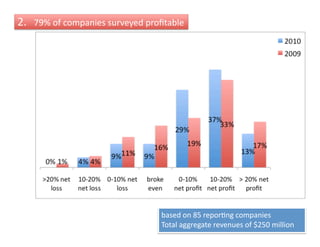

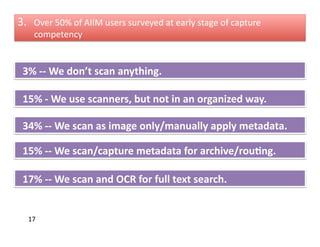

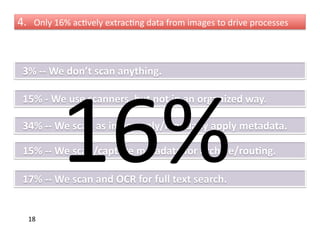

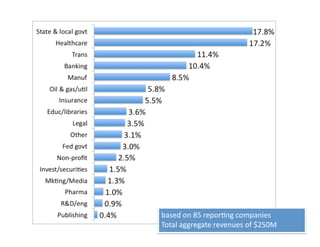

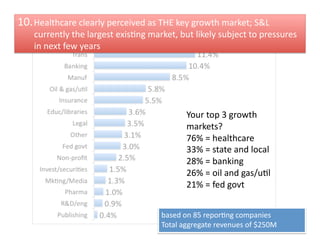

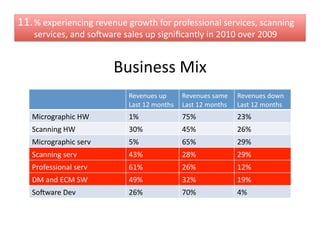

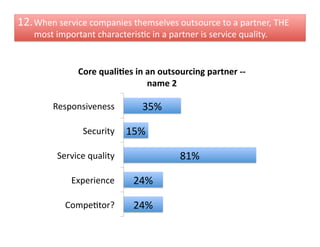

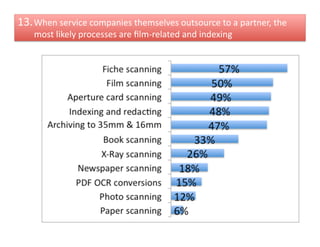

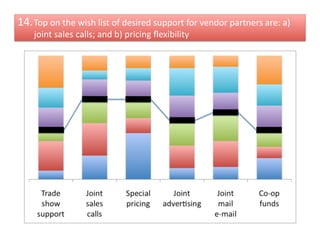

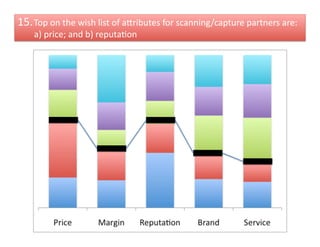

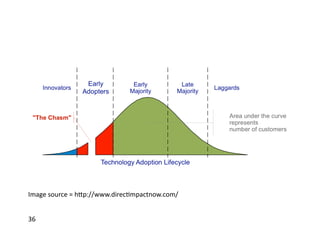

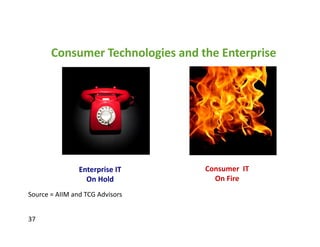

The document analyzes the state of the document management service providers industry in 2010, highlighting a 9.7% revenue increase from 2009 and that 79% of surveyed companies reported profitability. It discusses the evolution of capture competency among AIIM users, with over 50% at an early stage and only 16% actively extracting data from images to drive processes. Key industry drivers include healthcare as a growth market and a focus on service quality when outsourcing.