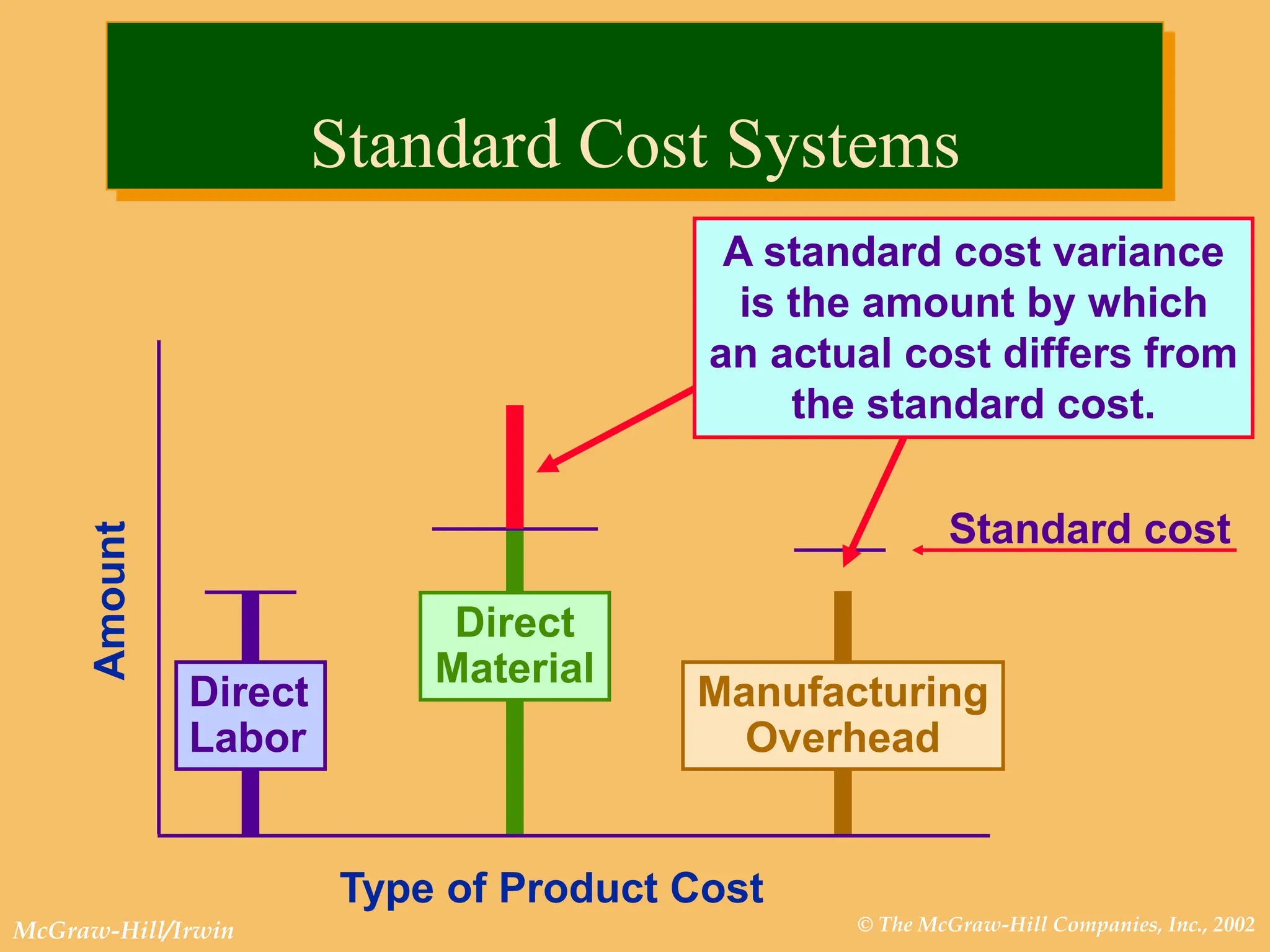

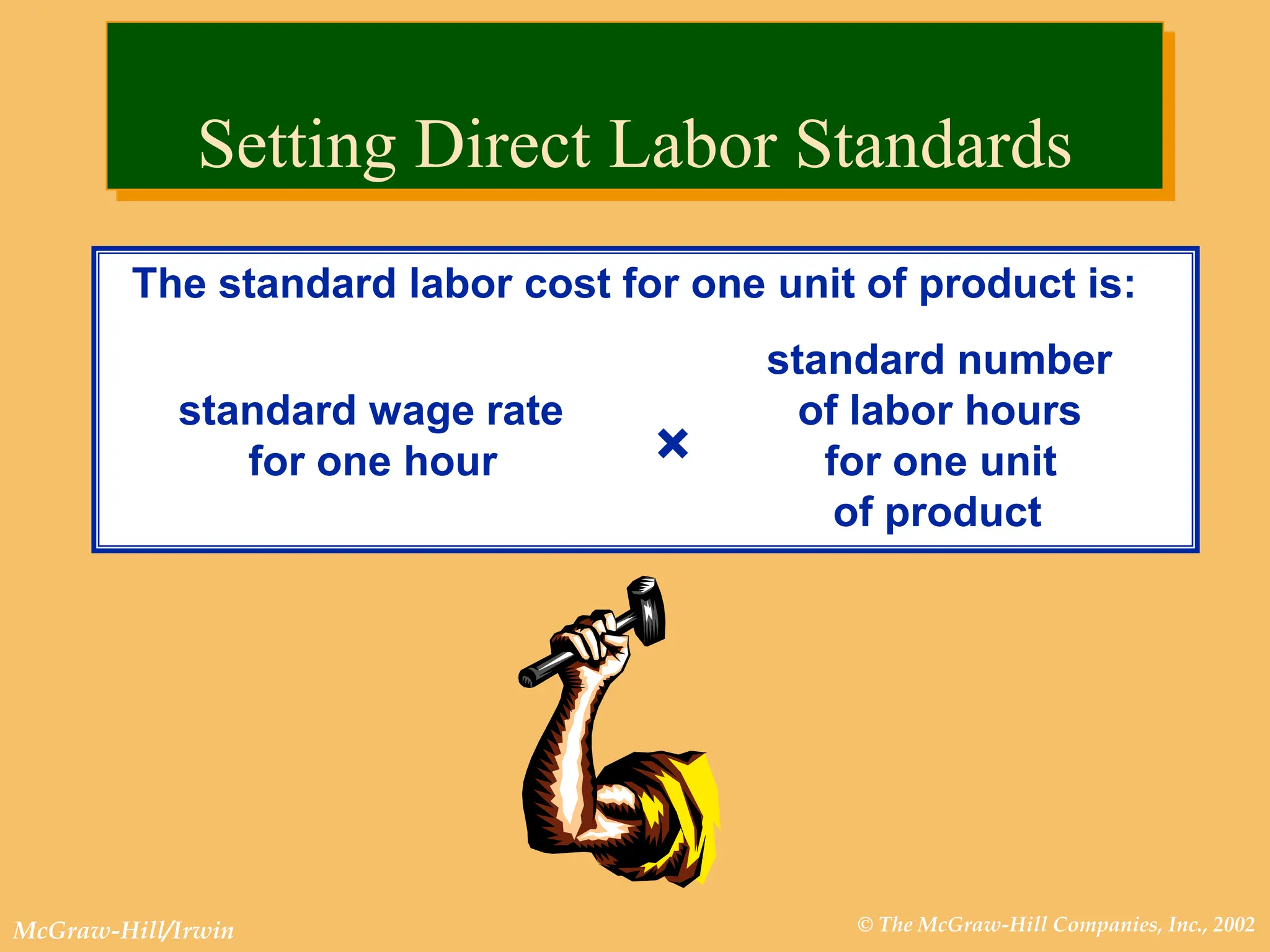

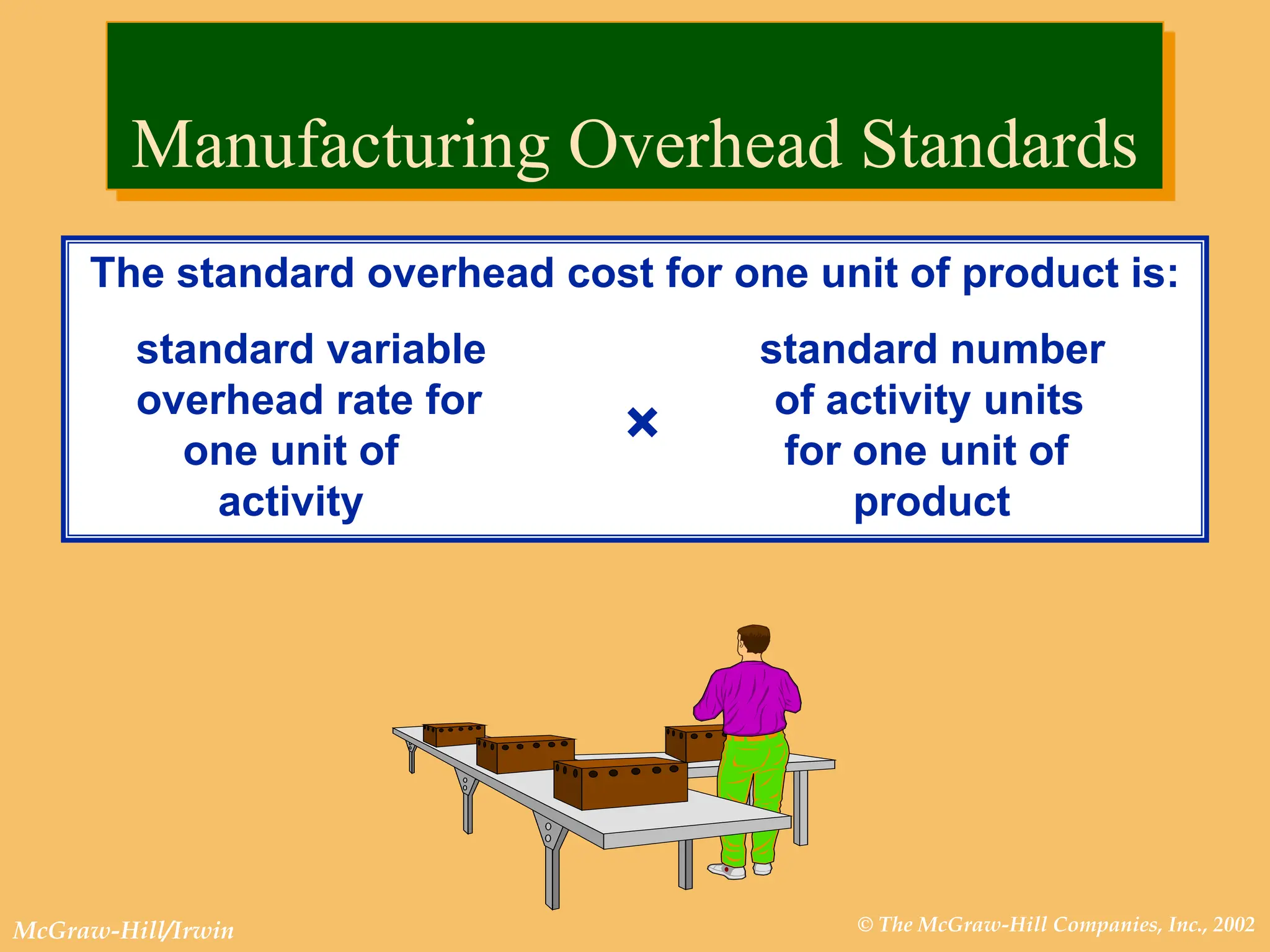

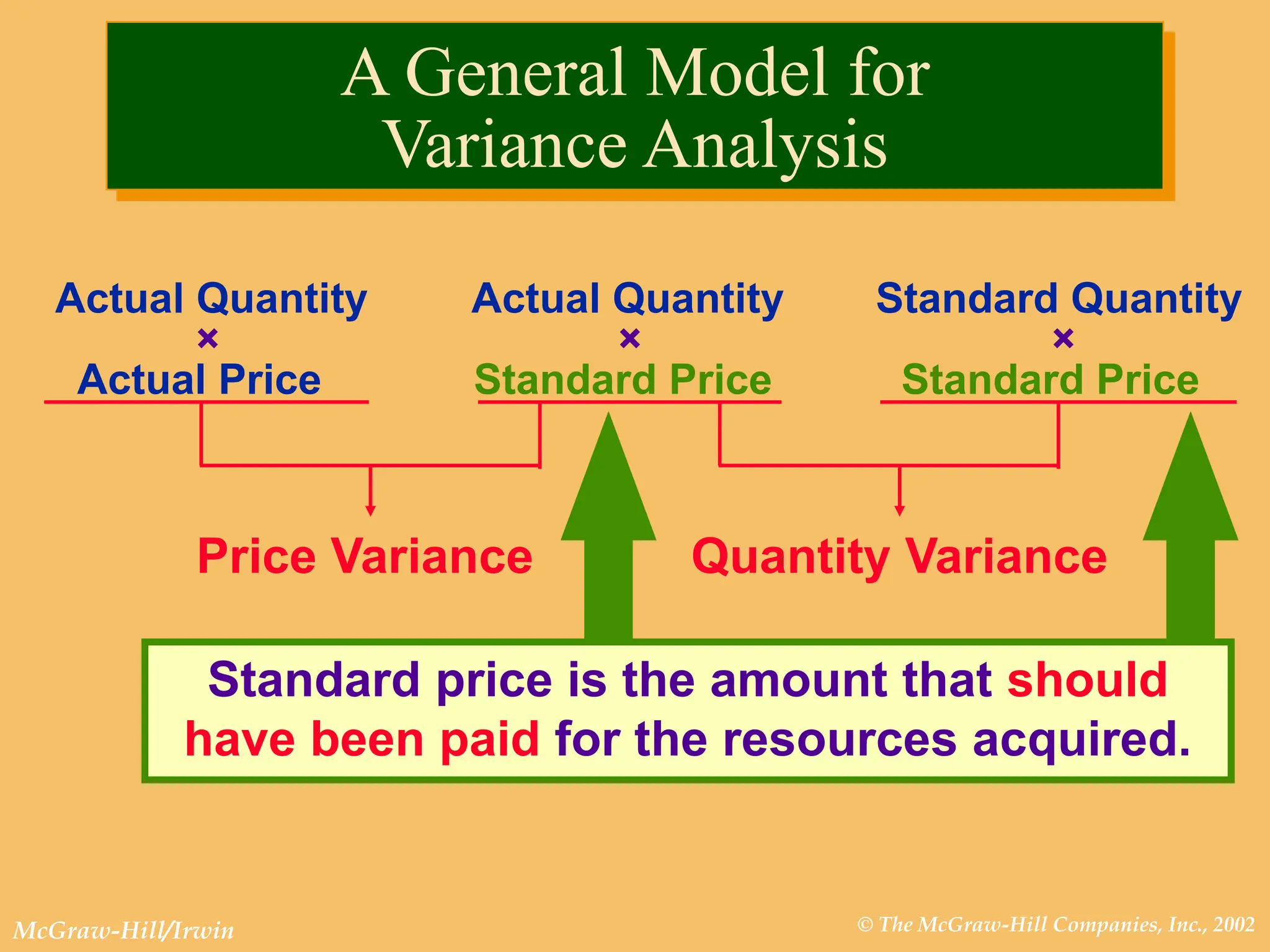

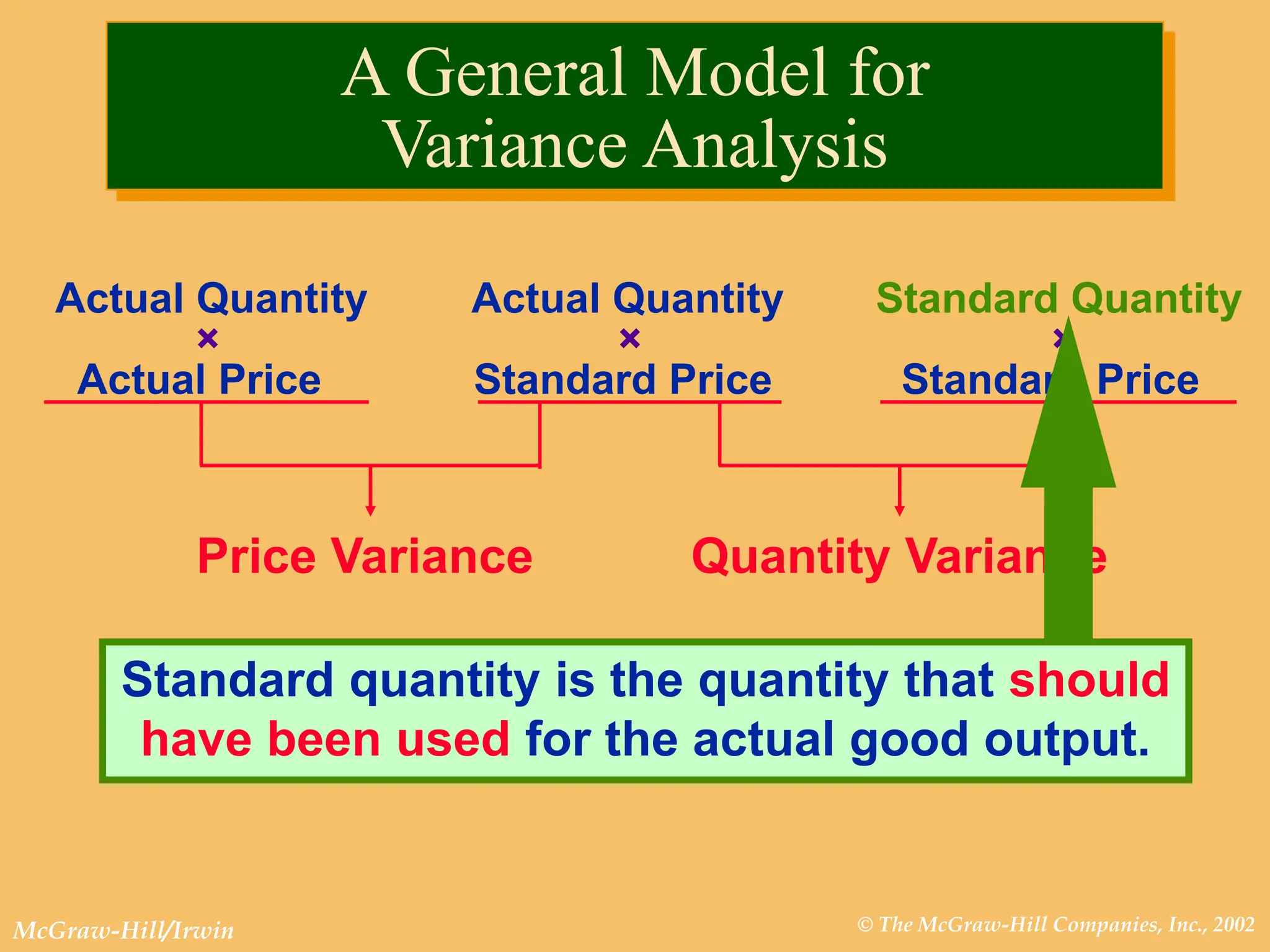

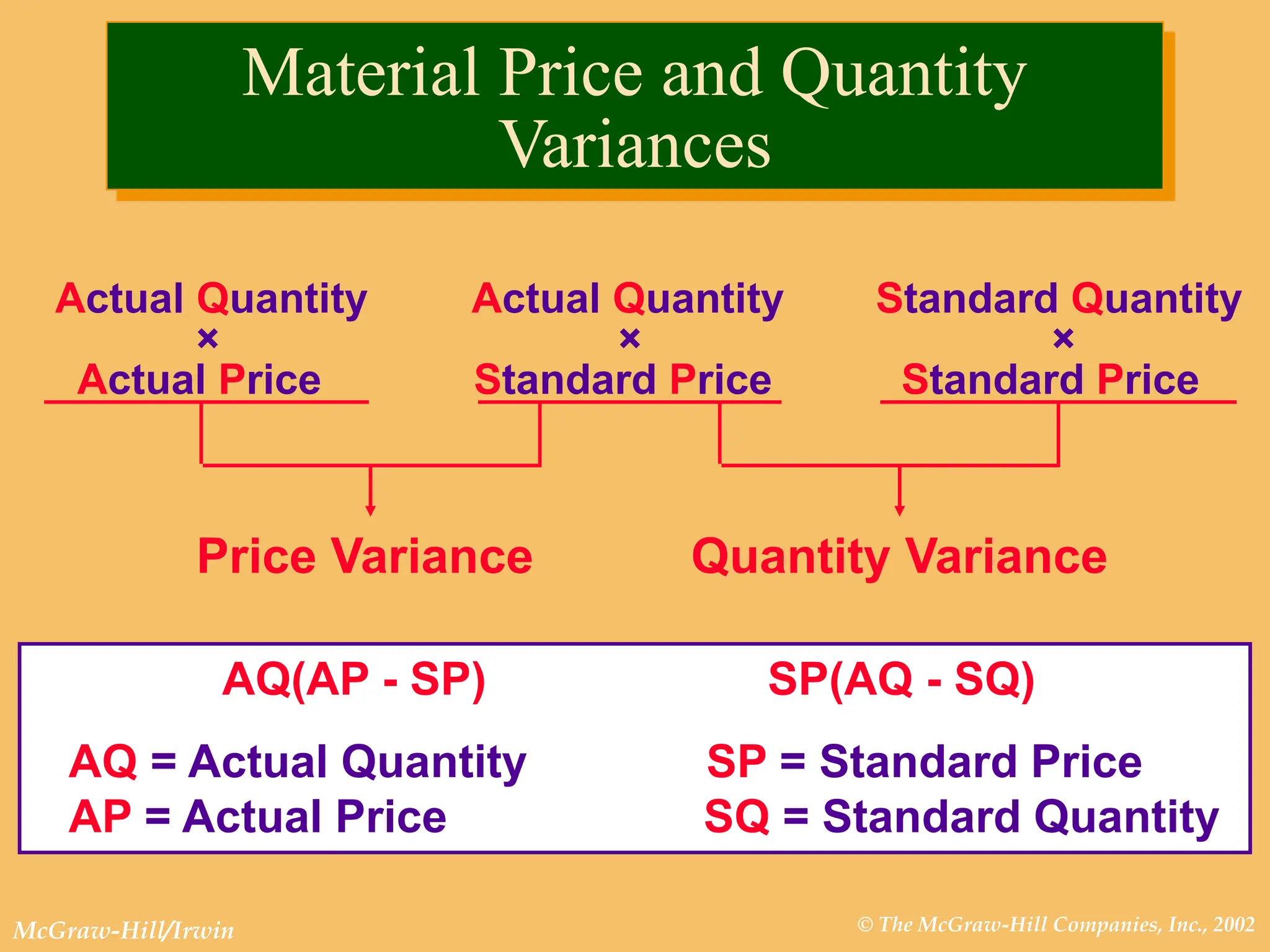

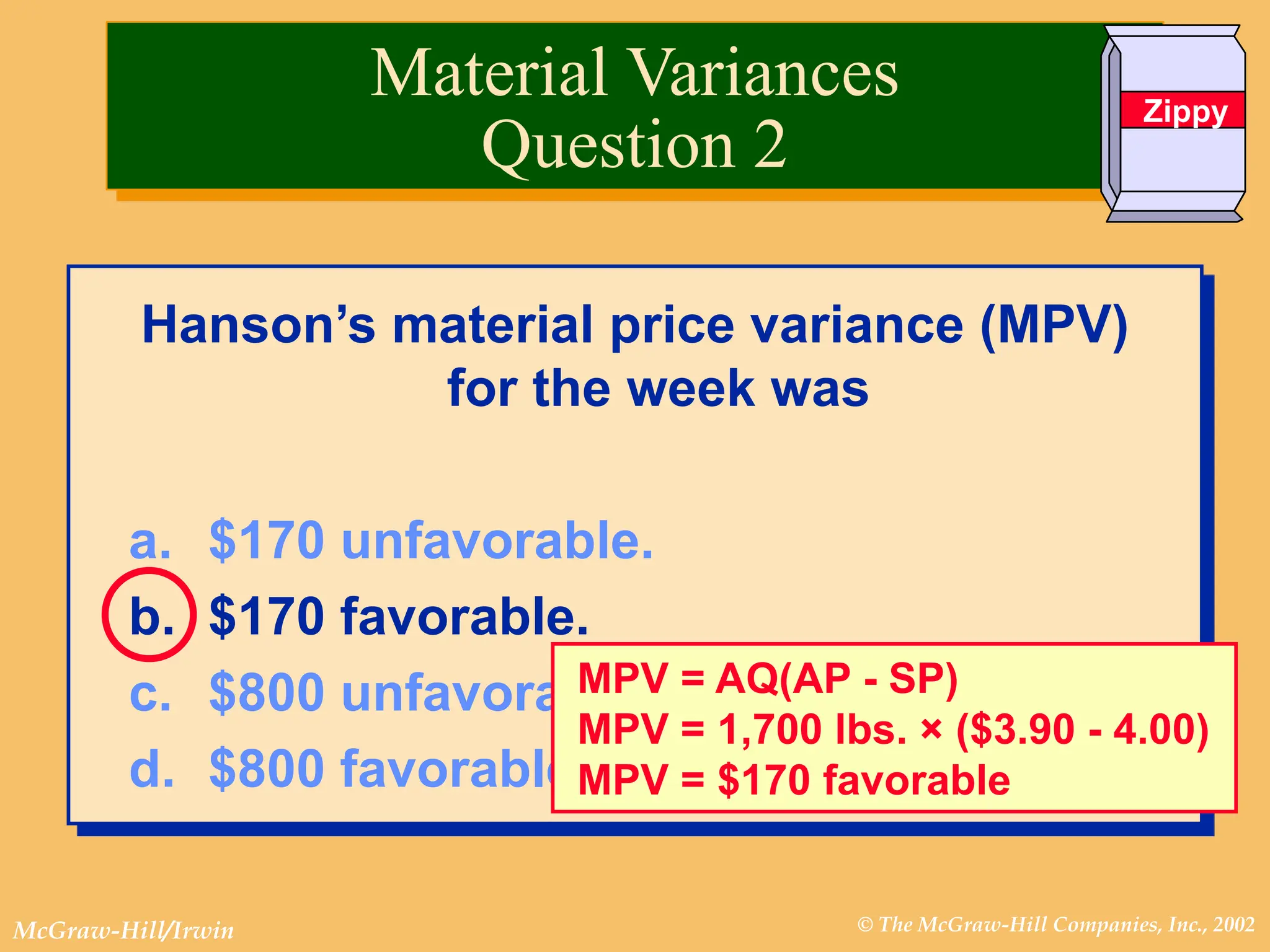

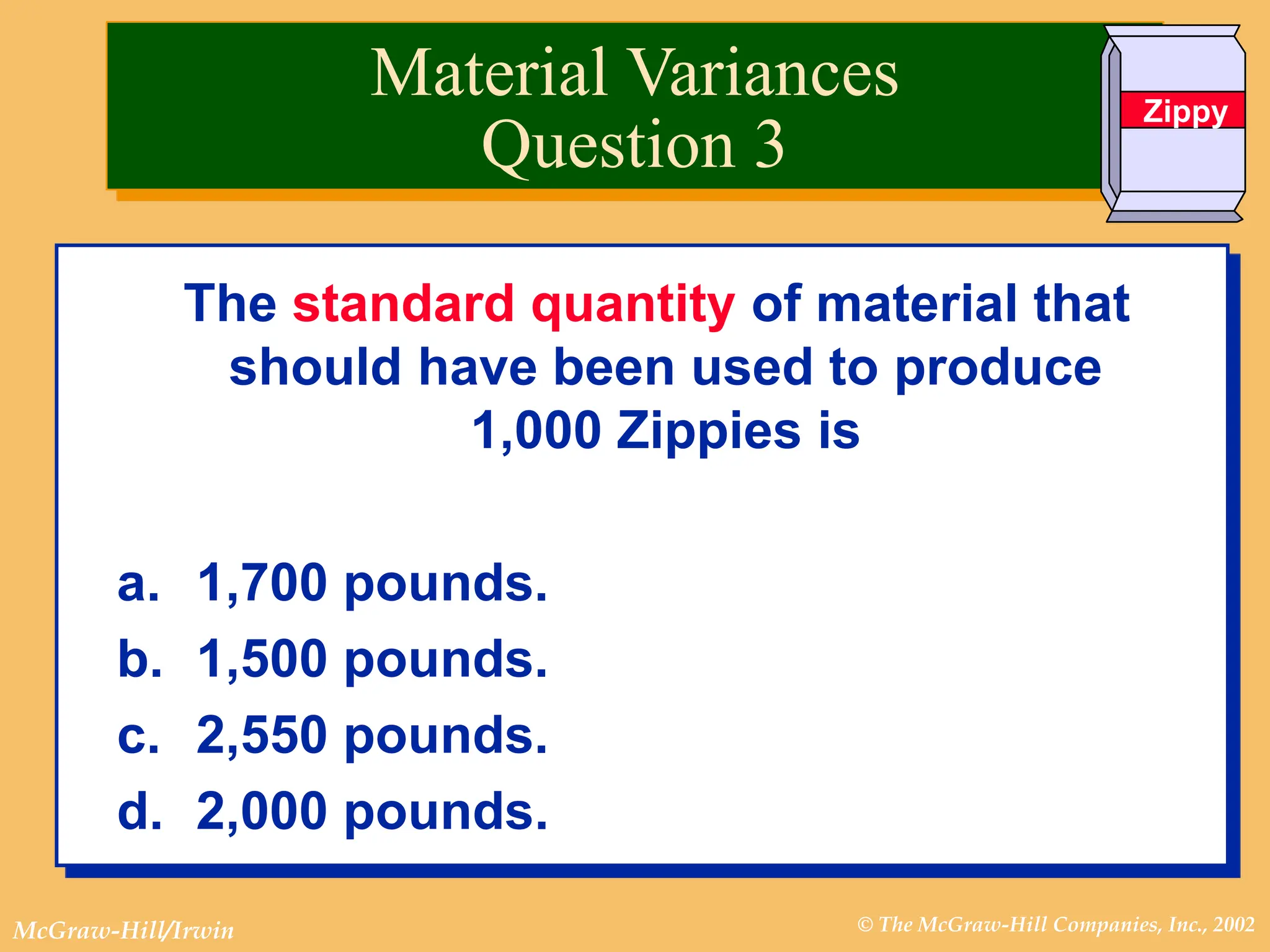

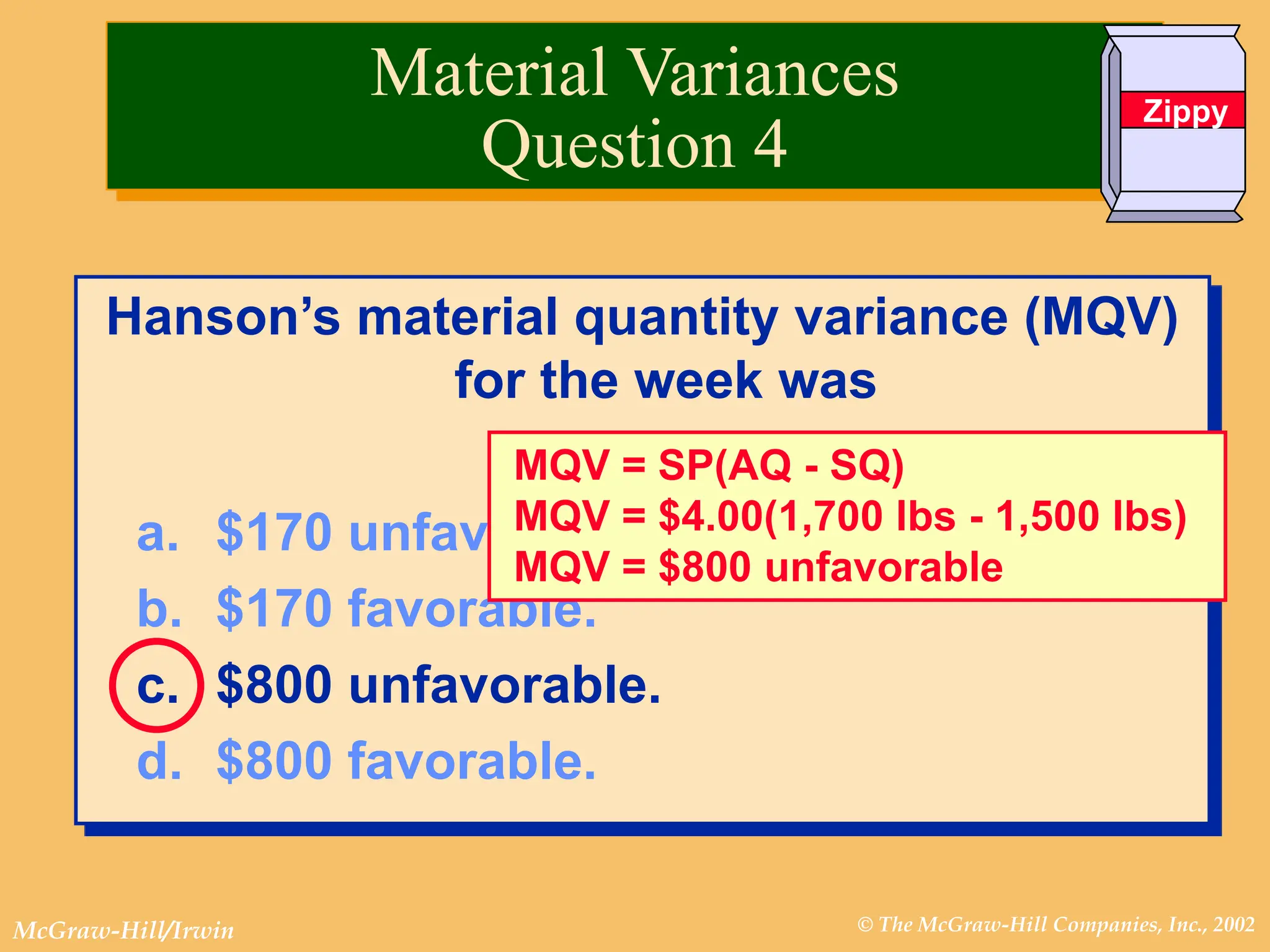

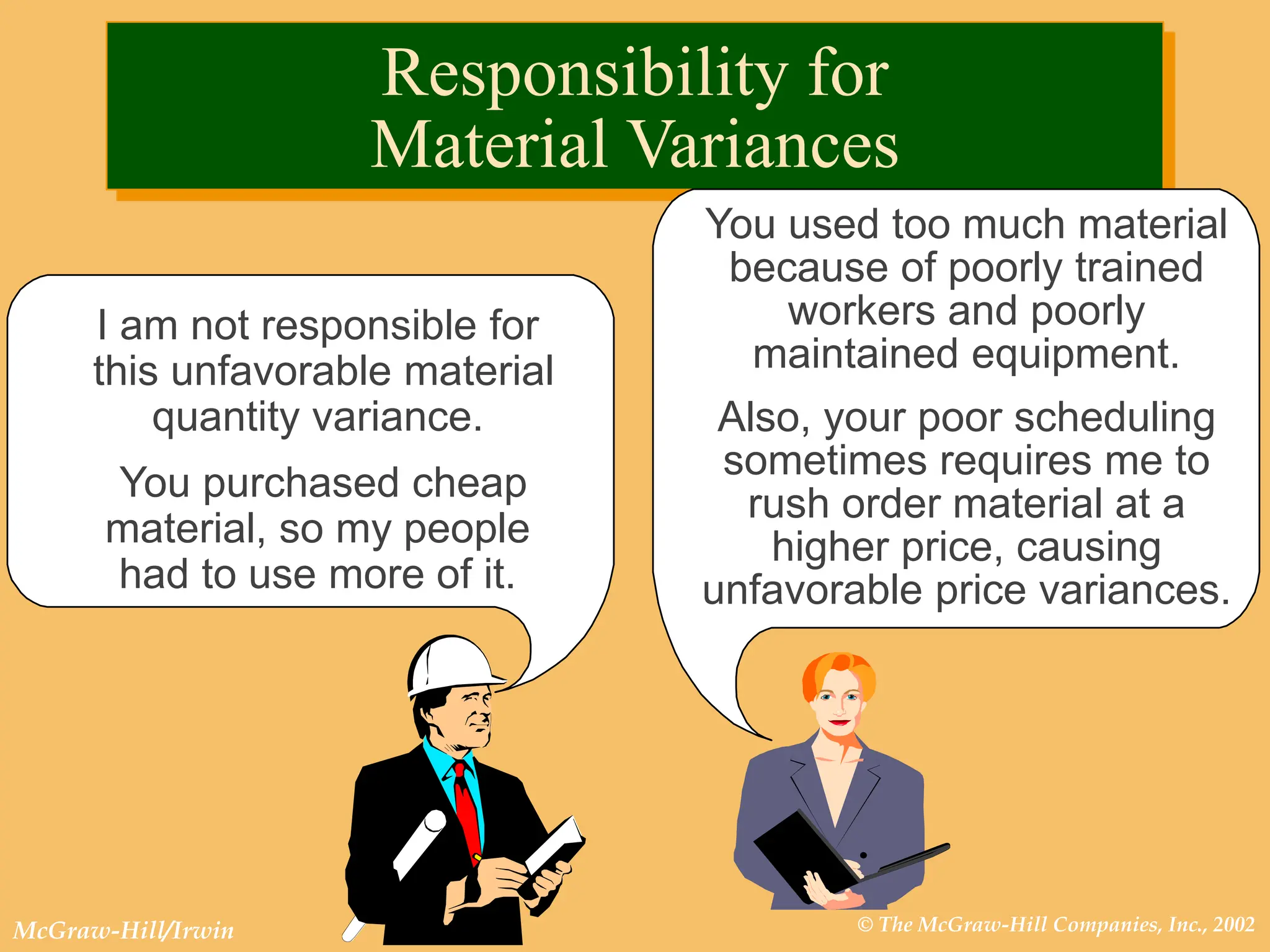

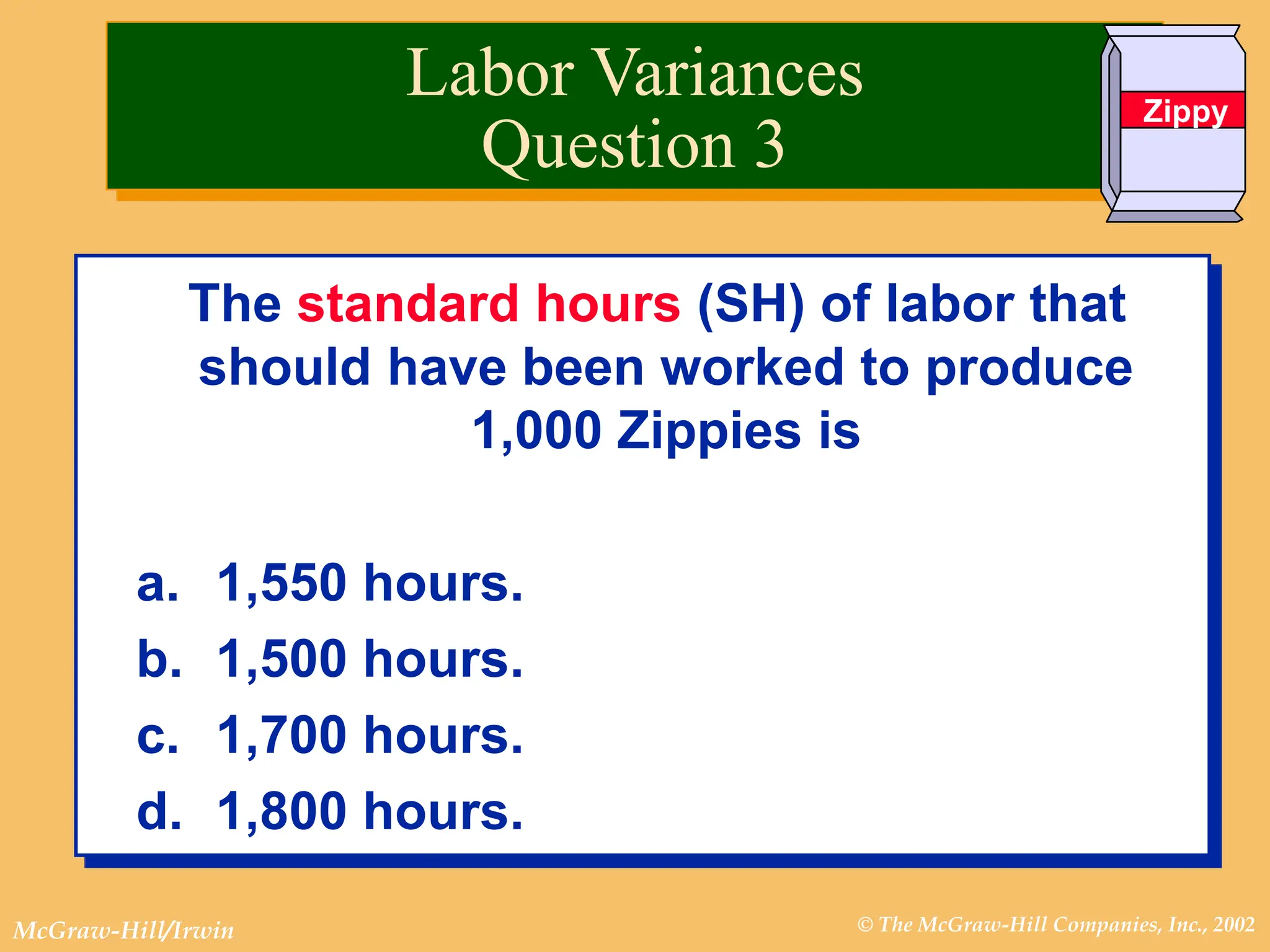

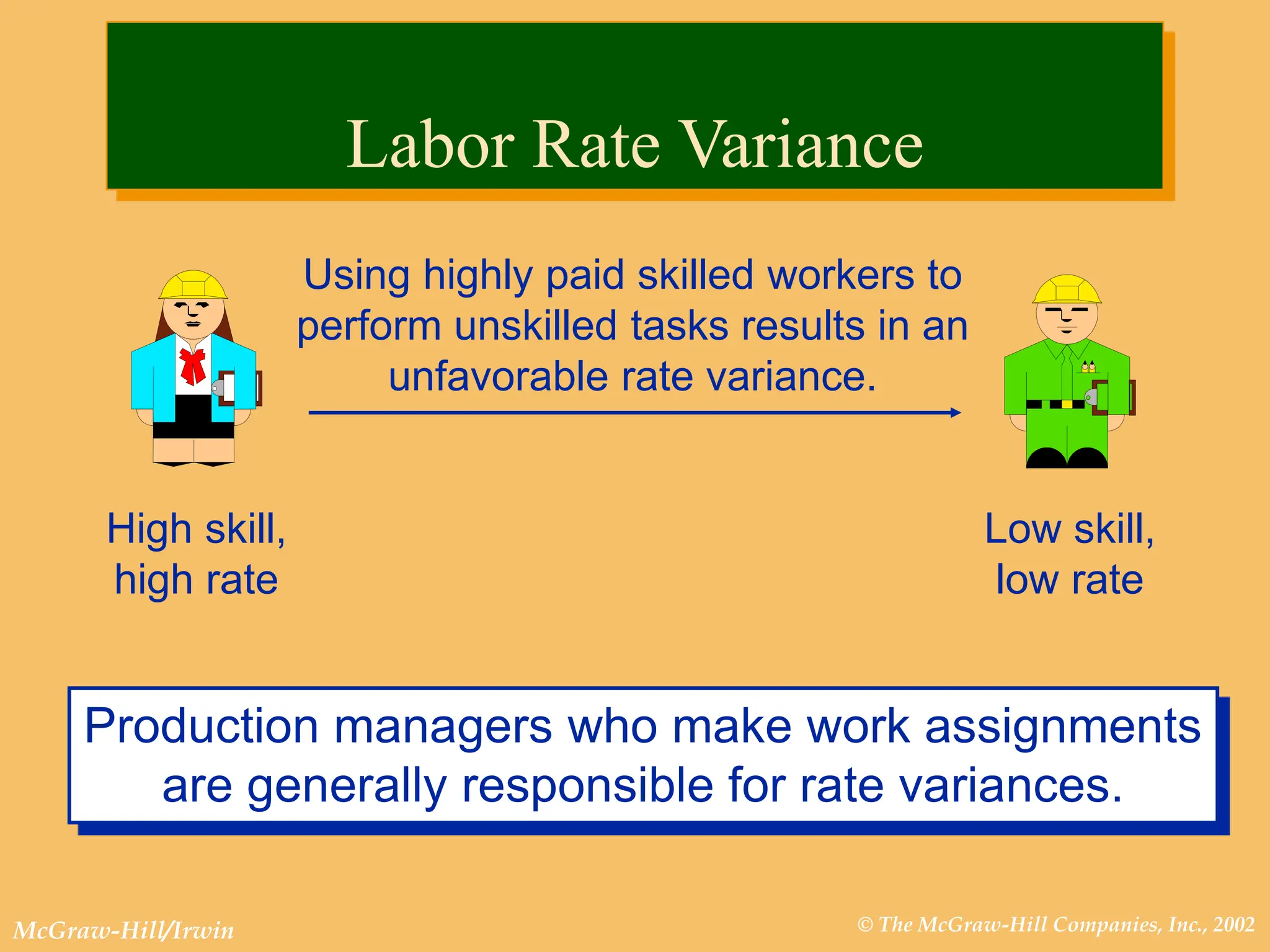

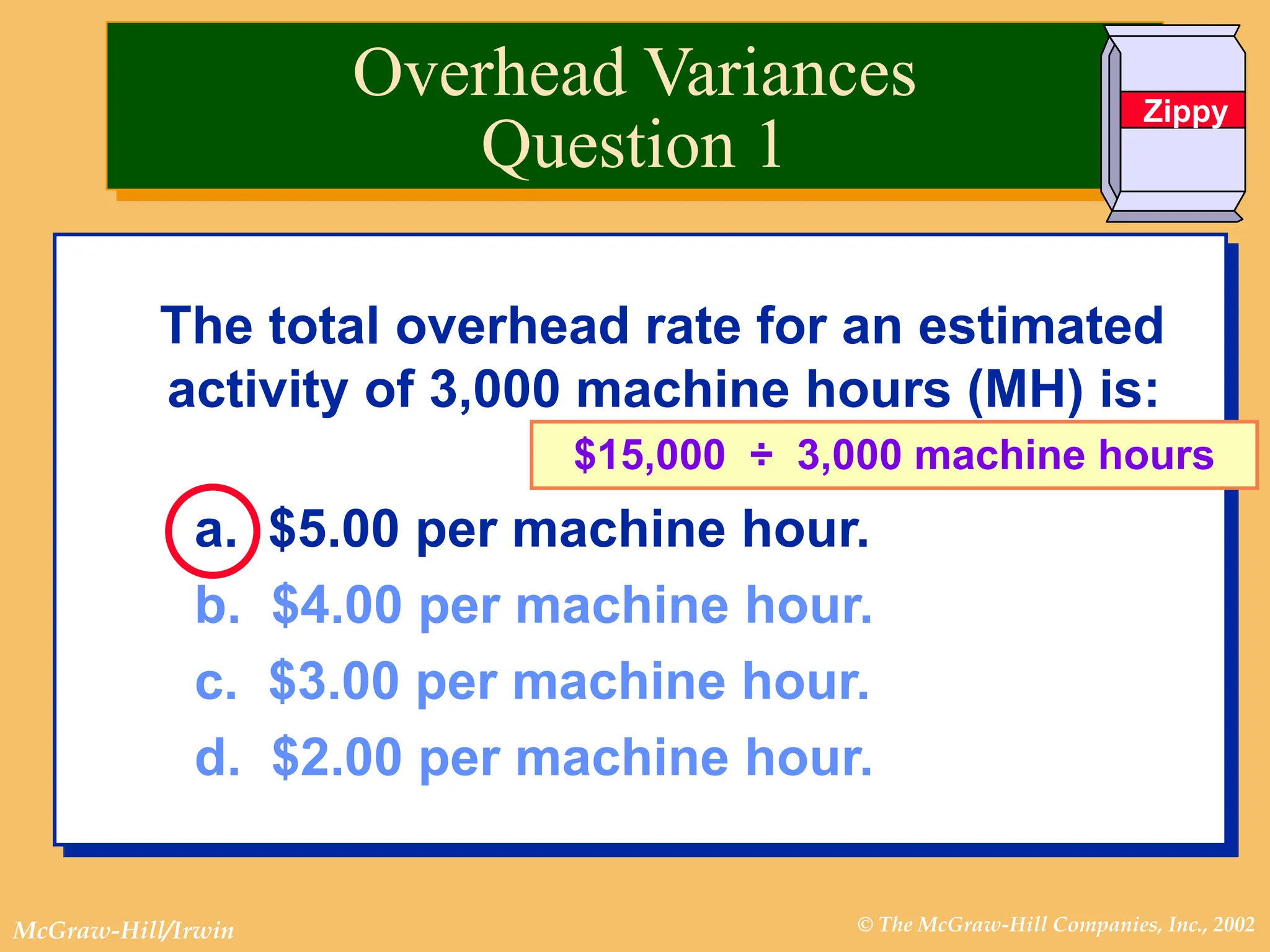

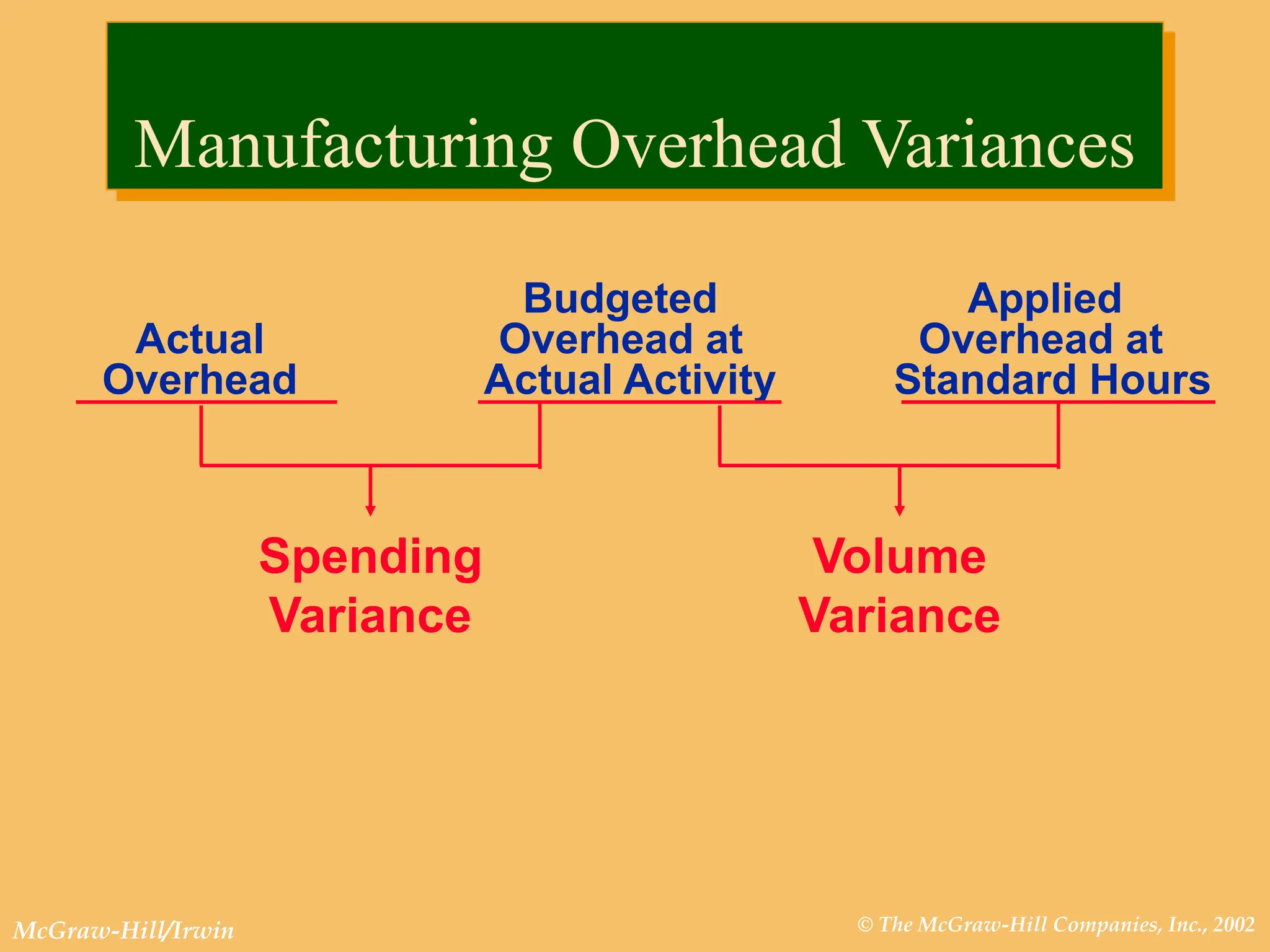

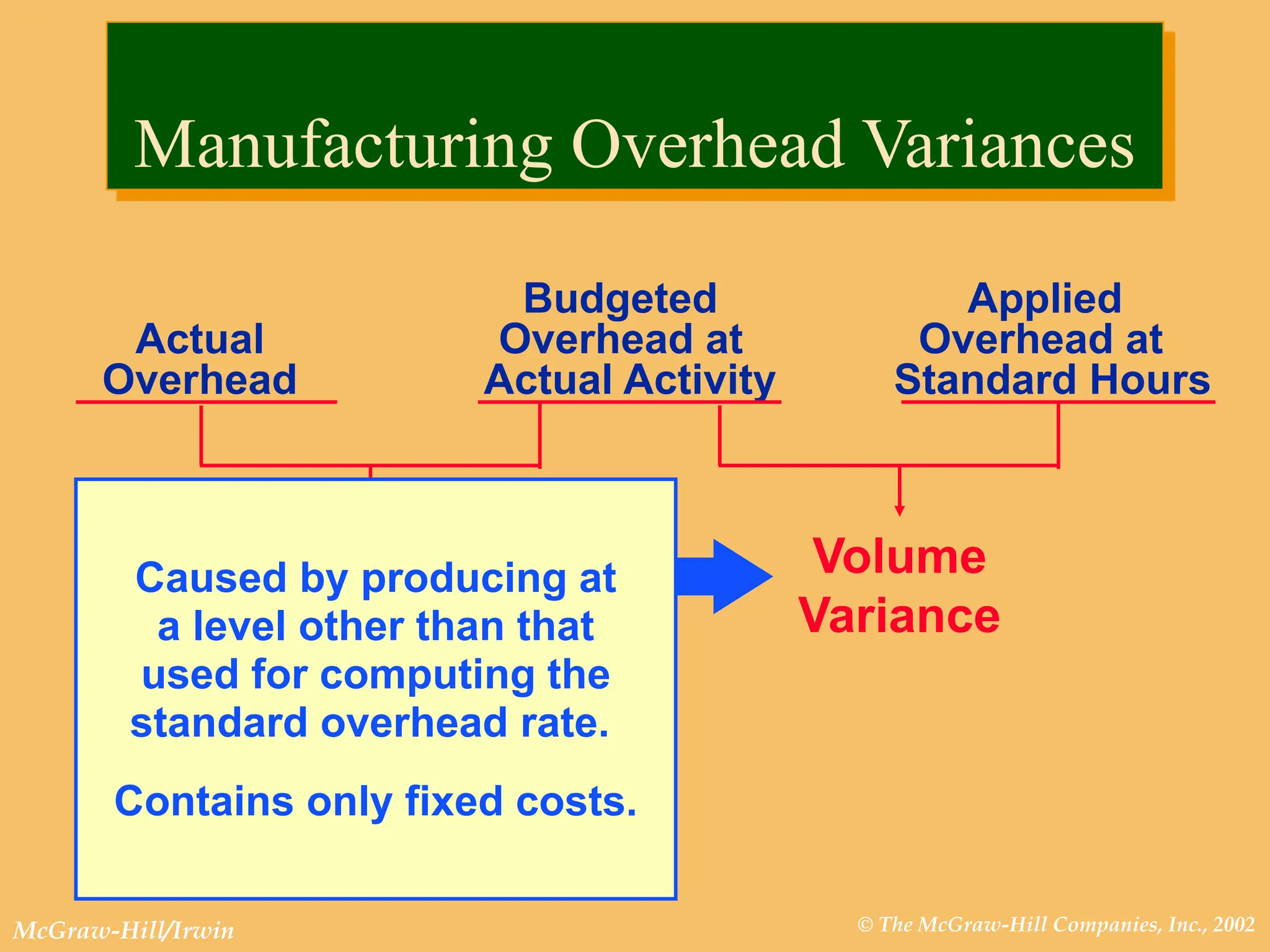

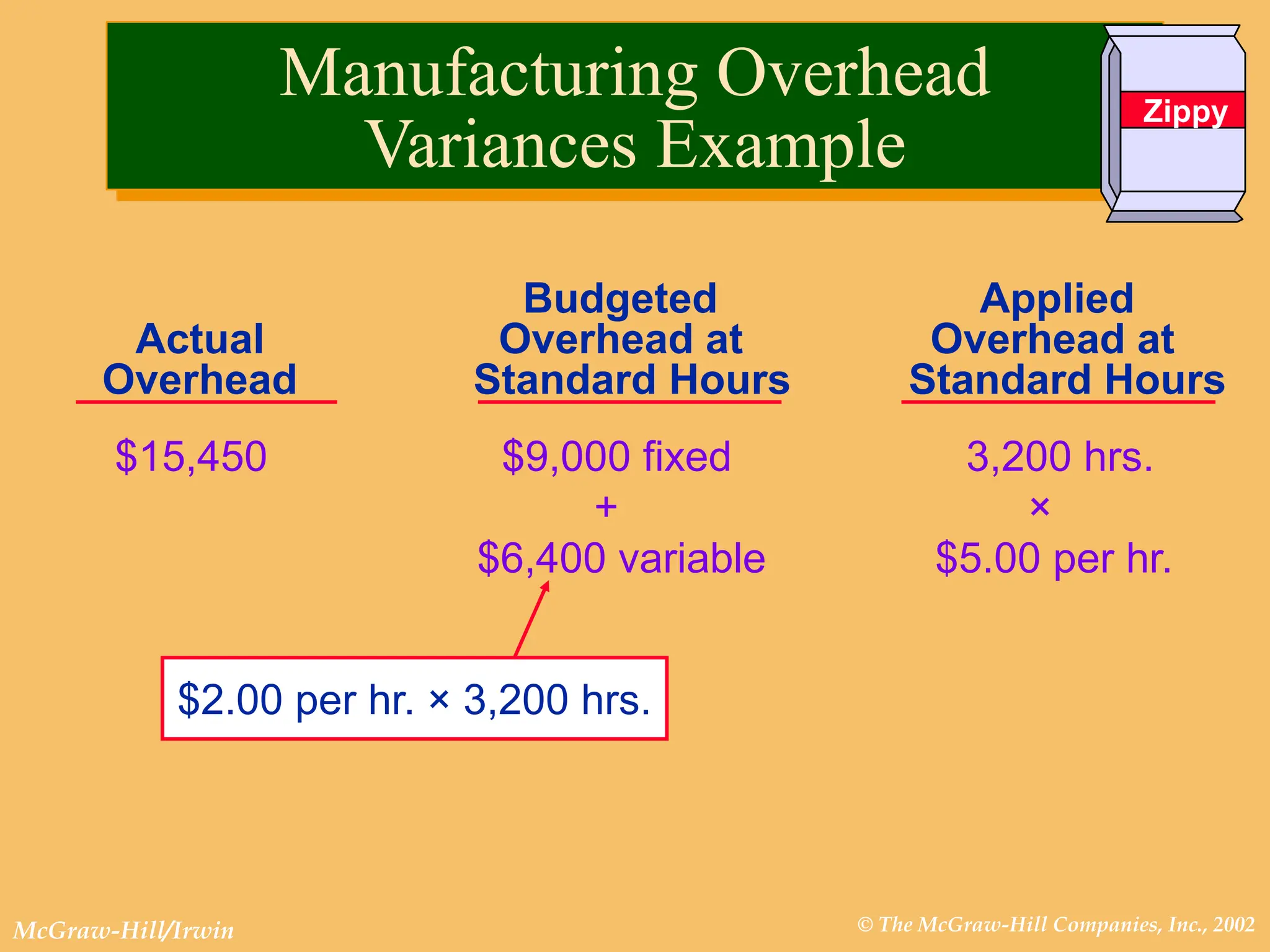

The document discusses standard cost systems used for measuring performance in manufacturing, focusing on components like direct materials, direct labor, and manufacturing overhead. It explains the calculation of standard cost variances, including price and quantity variances, and how these metrics guide managerial decisions and corrective actions. Additionally, it explores the establishment of normal versus ideal standards and the relationship between standards and budgets.