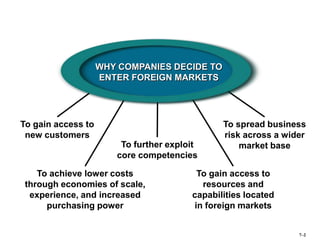

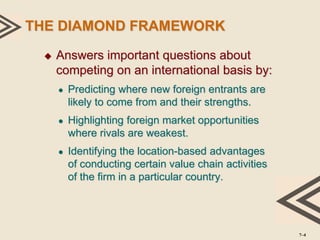

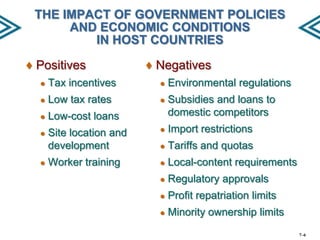

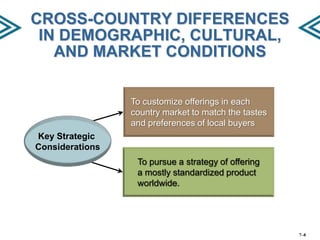

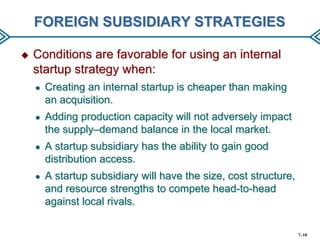

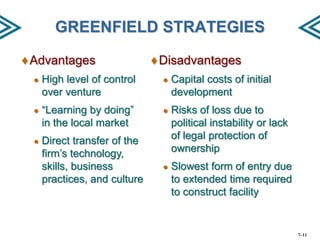

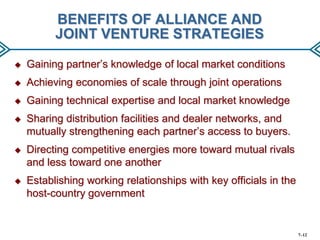

This document summarizes strategies for competing internationally. It discusses reasons why companies enter foreign markets, including gaining new customers and resources. Competing globally makes strategy more complex due to differences in government policies, currencies, and customer tastes across countries. The document outlines strategic approaches for entering international markets such as exporting, licensing, franchising, foreign subsidiaries, and alliances. It also discusses how to build competitive advantage abroad through location, sharing resources, and coordination across borders.