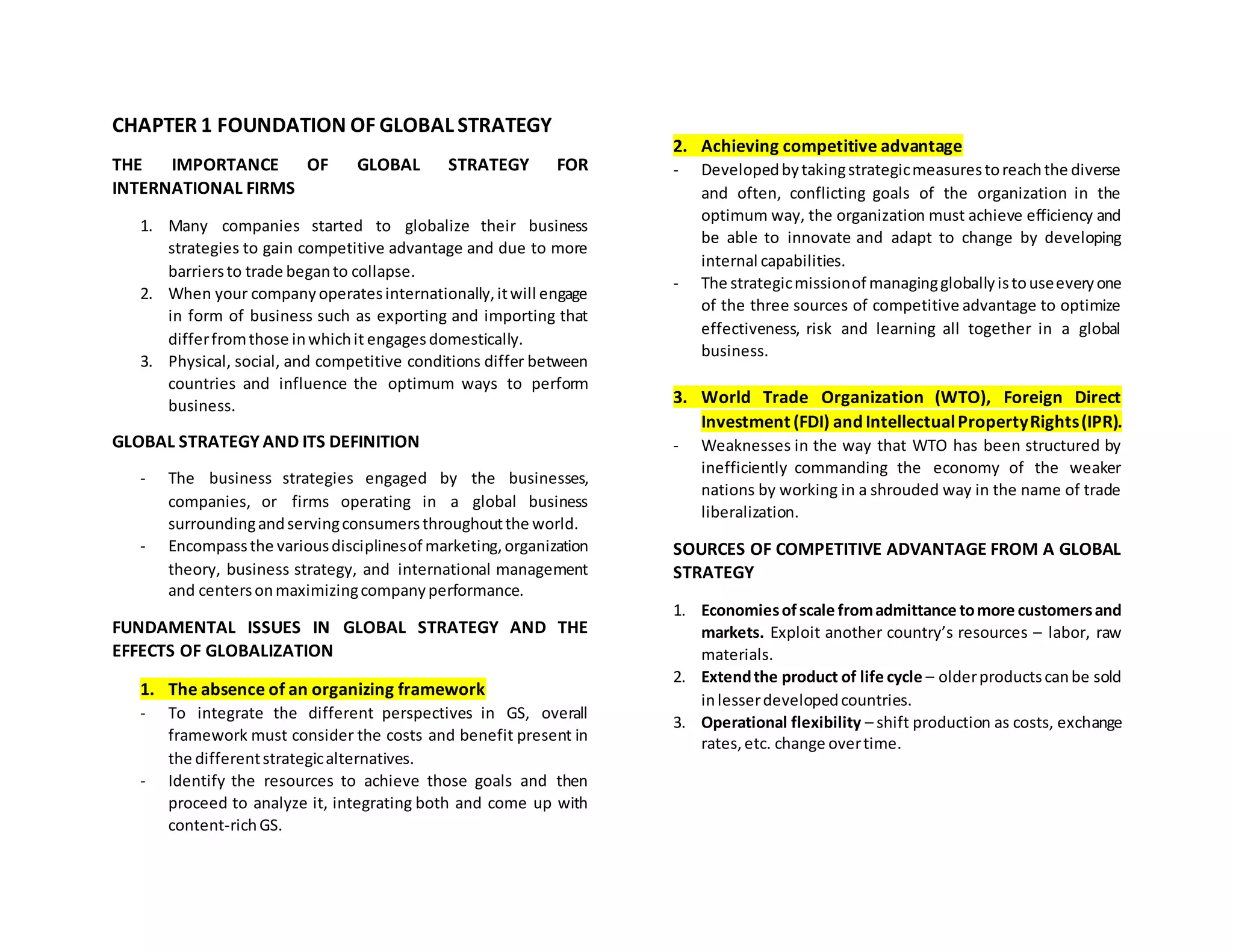

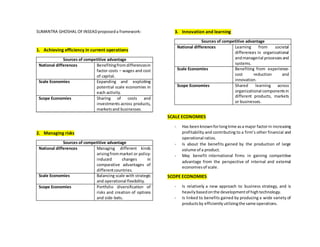

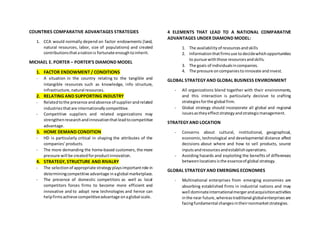

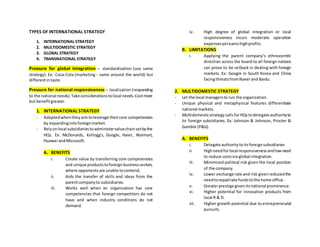

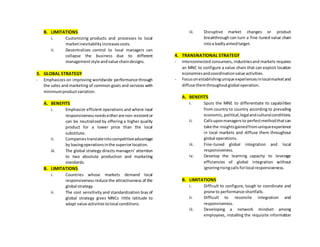

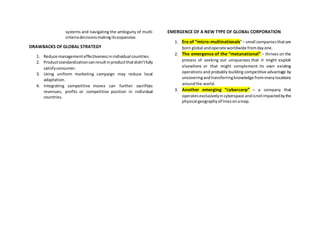

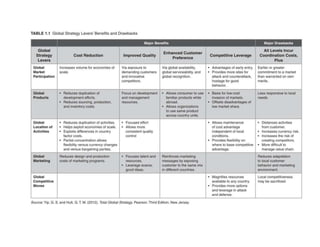

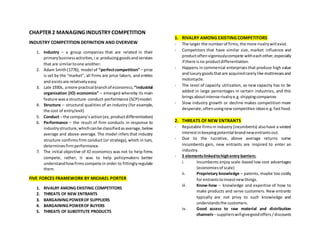

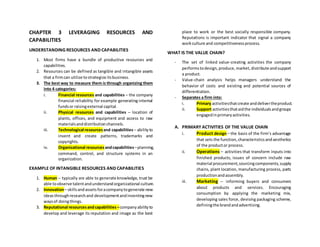

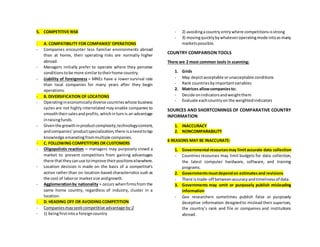

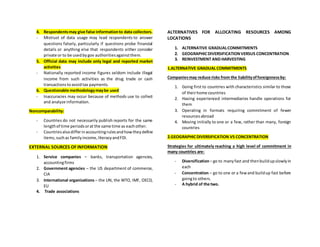

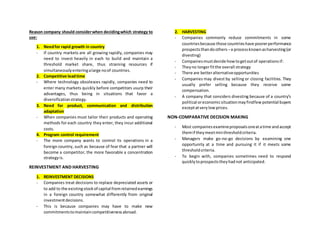

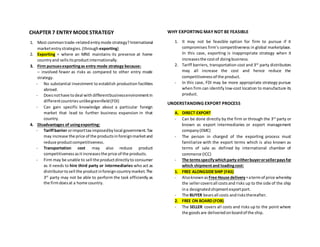

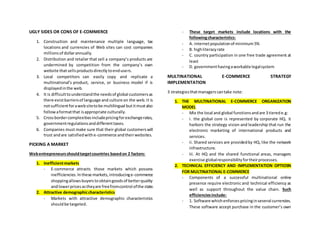

The document discusses global strategy and international business. It defines global strategy as business strategies that serve consumers throughout the world by maximizing company performance across marketing, organization theory, business strategy, and international management. Effective global strategies consider differences between countries to gain competitive advantages from factors like labor costs, market sizes, and flexibility. They also manage risks and promote innovation and learning across international operations.