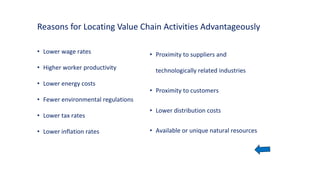

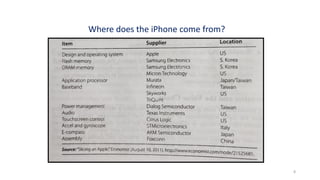

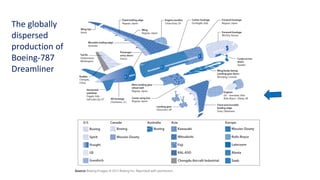

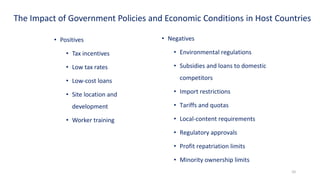

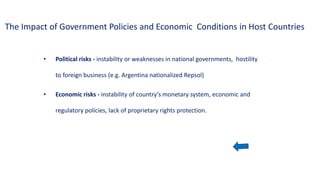

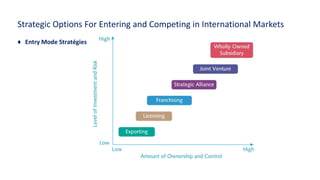

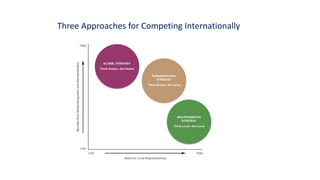

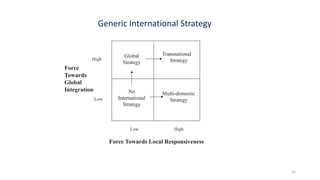

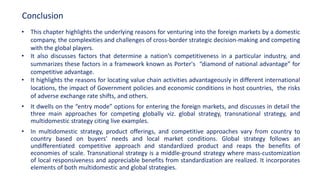

The document discusses international strategies for competing in global markets, highlighting reasons for entering foreign markets, challenges, and government influences. It covers the concept of Porter's national diamond model, entry mode strategies, and different approaches such as global, multidomestic, and transnational strategies. The text emphasizes the complexities of cross-border decision-making and the importance of advantageous value chain location amidst varying economic conditions and buyer preferences.