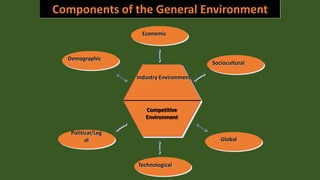

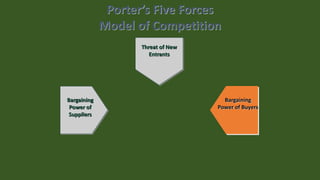

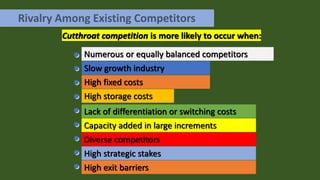

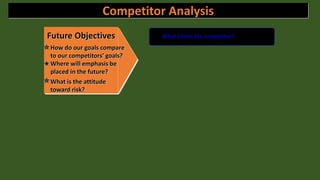

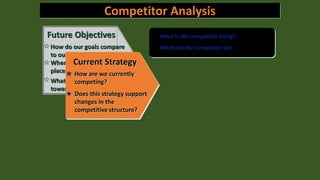

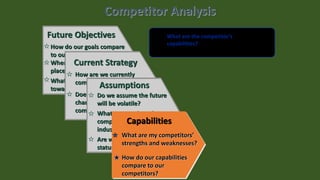

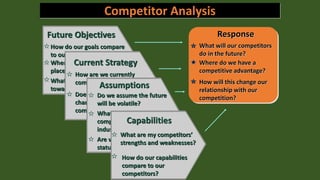

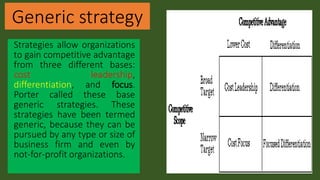

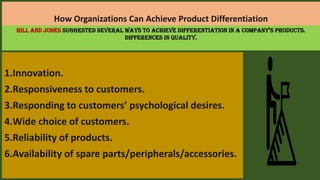

This document discusses various business level strategies including Michael Porter's competitive strategies of cost leadership, differentiation, and focus. It defines each strategy and provides examples of how organizations can achieve them. Cost leadership involves reducing production costs below competitors through economies of scale, technology, and raw materials. Differentiation strategy makes a product unique through innovation, quality, reliability, and customization. Focus strategy targets a niche market segment through specialized products and marketing. The document also discusses Porter's five forces model of competition and how to analyze competitors and the external environment through SWOT and PESTLE analyses.