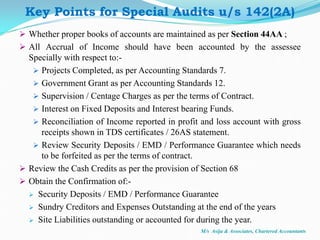

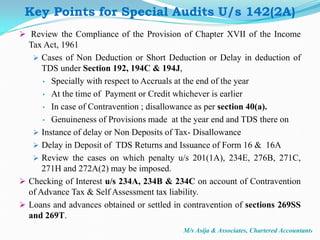

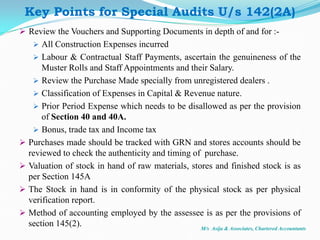

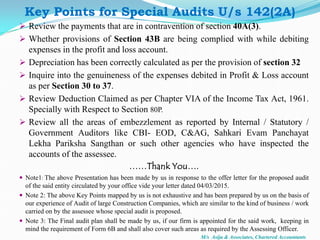

The document outlines key points for a special audit of a company under section 142(2A) of the Indian Income Tax Act of 1961. It lists several areas the audit should review, including proper maintenance of books of accounts, accounting for all income accruals, compliance with tax deduction and deposit provisions, expenses and deductions claimed, and checks for embezzlement. The special audit aims to inspect the company's financial records and transactions in depth to ensure compliance with relevant taxation laws and accounting standards.