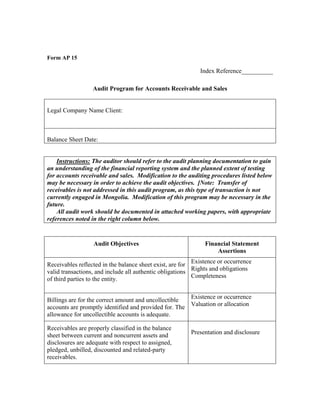

Ap 15 accounts receivable and sales

- 1. Form AP 15 Index Reference__________ Audit Program for Accounts Receivable and Sales Legal Company Name Client: Balance Sheet Date: Instructions: The auditor should refer to the audit planning documentation to gain an understanding of the financial reporting system and the planned extent of testing for accounts receivable and sales. Modification to the auditing procedures listed below may be necessary in order to achieve the audit objectives. [Note: Transfer of receivables is not addressed in this audit program, as this type of transaction is not currently engaged in Mongolia. Modification of this program may be necessary in the future. All audit work should be documented in attached working papers, with appropriate references noted in the right column below. Audit Objectives Financial Statement Assertions Receivables reflected in the balance sheet exist, are for valid transactions, and include all authentic obligations of third parties to the entity. Existence or occurrence Rights and obligations Completeness Billings are for the correct amount and uncollectible accounts are promptly identified and provided for. The allowance for uncollectible accounts is adequate. Existence or occurrence Valuation or allocation Receivables are properly classified in the balance sheet between current and noncurrent assets and disclosures are adequate with respect to assigned, pledged, unbilled, discounted and related-party receivables. Presentation and disclosure

- 2. Performed By Workpaper Reference 1. Perform the following analytical procedures for accounts receivable and investigate any significant fluctuations or deviations from the expected balances: a. Compare the current year’s account balances with the prior year’s account balances for gross receivables; allowance for doubtful accounts; bad debts; and sales returns and allowances. b. Compare monthly sales by product line for the current year with monthly sales for the prior year and the first few months subsequent to year end. c. Compare monthly sales returns and allowances and credit memos for the current year with those of the prior year and the first few months subsequent to year end. d. Compare the aging categories (e.g., 0-30 days; 31-60 days, etc.) of the current year’s accounts receivable with the prior year’s and/or industry data. e. Compute the following ratios for the current year and compare with the prior year’s: (1) Accounts receivable turnover. (2) Days sales in accounts receivable. (3) Ratio of allowance for uncollectible accounts to gross accounts receivable and credit sales. (4) Ratio of write-offs to credit sales. (5) Ratio of sales returns and allowances to credit sales.

- 3. Performed Workpaper By Reference (6) Ratio of customer discounts to credit sales. (7) Ratio of gross profit to credit sales, in total and by major product or division. 2. Prepare or obtain from the client an aged trial balance of trade accounts receivable and perform the following: a. Test the arithmetical accuracy of the aged trial balance and the aging categories therein. b. Reconcile the total balance to the general ledger control account balance. c. Note and investigate any unusual entries. d. Summarize the total of credit balances and make appropriate reclassification entry, if material. e. On a selective basis, trace individual account balances in the aged trial balance to individual subsidiary ledgers and vice versa. f. Determine which accounts receivable should be confirmed (for example, all individually significant items and judgmentally or randomly selected items from the remaining balance). 3. Select customer accounts from the aged trial balance for confirmation procedures and perform the following: a. Arrange for confirmation requests to be signed by the client and mailed directly by the auditor. Maintain control over the confirmation process at all times. b. Trace balances included in individual confirmation requests to subsidiary accounts. c. Mail confirmation requests using envelopes with the auditor’s return address.

- 4. Performed Workpaper By Reference d. If the client requests exemption from confirmation for any accounts selected by the auditor, obtain and document satisfactory explanations, and determine necessity for alternative procedures. e. Obtain new addresses for confirmation requests returned by the post office as undeliverable, and re- send. If the number of confirmation requests returned by the post office is high, determine how the client updates customer information and how statements are delivered to customers with incorrect addresses. f. Send second requests for positive confirmations on which there is no reply and consider registered or certified mail for second requests. 4. Process the confirmation replies and summarize the results of confirmation procedures as follows: a. For positive confirmation requests to which no reply was received and accounts exempted from confirmation at the client’s request, perform alternative procedures for those customers by examining cash receipts subsequent to the confirmation date. If no cash has been received, examine sales invoices and corresponding shipping documents. b. Indicate the total accounts and balances confirmed without exceptions, confirmations reconciled, and non-replies or exempted accounts with alternative procedures performed. 5. For accounts receivable confirmed on a date other than the balance-sheet date, prepare or obtain from the client an analysis of transactions (e.g., cash receipts, sales) between the confirmation date and the balance-sheet date, and perform the following: a. Trace the balance as of the confirmation date to the aged trial balance. b. Trace cash received per the analysis to the cash receipts journal and/or bank statements.

- 5. Performed Workpaper By Reference c. Trace sales/revenue amounts per the analysis to the sales/revenue journal. d. Determine the reasonableness and propriety of any other reconciling items. e. Trace the ending balance per the analysis to the trial balance as of the balance-sheet date. f. Scan the accounts receivable and sales activity during the period from the interim date to the balance-sheet date and investigate any unusual activity. 6. Determine whether any accounts or notes receivable have been pledged, assigned, or discounted. 7. Determine whether any accounts or notes receivable are owed by employees or related parties and, if so, perform the following: a. Determine the nature and purpose of the transaction that resulted in the receivable balance. b. Determine whether transactions were properly executed and approved by an official of the company or the board of directors. c. Consider obtaining positive confirmation requests of such balances. d. Evaluate the collectibility of the balances outstanding. 8. For notes and accounts receivable with maturities greater than one year, perform the following: a. Evaluate if the principal and interest payments will be collected in accordance with their contractual terms. b. If either interest or principal payments will not be collected in accordance with their contractual terms, determine whether an allowance for credit loss has been computed.

- 6. Performed Workpaper By Reference 9. Test the adequacy of the allowance for uncollectible accounts, as follows: a. Review subsequent cash collections of account balances. b. Review accounts written off during the period. c. Determine if write-offs have been properly authorized and examine related supporting documentation. d. Ask the client if there are any collection problems with accounts receivable currently classified as current assets. If so, consider whether such accounts should be reclassified to noncurrent assets. Determine the client’s plans for collection and the probability that these efforts will be successful. e. Perform and review ratio analyses for relationships such as (1) accounts receivable turnover, (2) allowance for uncollectible accounts to accounts receivable, (3) allowance for uncollectible accounts to sales, and (4) accounts written off to sales. f. Review post-balance-sheet transactions related to receivables, particularly for discounts taken, credits allowed, and accounts written off, and determine whether any adjustments should be made as of the balance-sheet date. 10. Perform the following sales cutoff procedures and ascertain that receivables are recorded in the proper accounting period: a. From the population of shipping documents, trace the last few shipments of the year to the sales journal and determine that they were properly included in accounts receivable as of the balance-sheet date. b. From the population of shipping documents, trace the first few shipments subsequent to year-end to the sales journal and determine that they were properly excluded from accounts receivable as of the balance-

- 7. Performed Workpaper By Reference sheet date. c. Using the sales journal, trace the last few sales entries of the year from the sales journal to the shipping documents and determine that they were properly included in accounts receivable as of the balance-sheet date. d. Using the sales journal, trace the first few sales entries subsequent to year-end from the sales journal to the shipping documents and determine that they were properly excluded from accounts receivable as of the balance-sheet date. 11. If the auditor is concerned about the risk of fraud, audit procedures such as the following should be considered in addition to the ones listed above: a. Expand the number of accounts receivable confirmations and pursue all non-replies and discrepancies. b. Confirm amounts written off that appear unusual, such as write-offs of balances due from continuing customers. c. Compare sales price to list price. d. Ascertain that shipped merchandise actually arrived at the customer’s location and that the merchandise was not shipped to a warehouse or location controlled by the client. e. Ascertain that shipping documents and invoices are pre-numbered sequentially and accounted for. f. Examine original documents for sales invoices and shipping documents and be alert for possible alterations. g. Telephone customers directly and confirm items such as: unusual payment terms, sales returns, credit memos, side agreements, merchandise receipt date, or other concerns.

- 8. Performed Workpaper By Reference h. Review customer complaints and look for unusual trends. j. Look for evidence of salespeople trying to meet or exceed sales goals in order to achieve quotas or increase their commissions or bonuses. k. Agree daily cash receipts detail to the bank statements and investigate unusual lags. 12. If disclosures about fair value are required, or the entity chooses to provide voluntary fair value information, perform the following: a. Obtain information about the fair values of accounts receivable and notes receivable and determine that the valuation principles are being consistently applied under IAS. b. Determine that the fair value amounts are supported by the underlying documentation. c. Determine that the method of estimation and significant assumptions used are properly disclosed. Based on the procedures performed and the results obtained, it is my opinion that the objectives listed in this audit program have been achieved. Performed by Date Reviewed and approved by Date Conclusions: Comments: