1. The document discusses various types of audits including cost audit, tax audit, and management audit. It outlines the objectives and processes involved in each type.

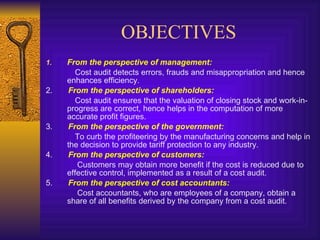

2. A cost audit ensures accurate profit figures by verifying stock valuation and work-in-progress. A tax audit ensures proper maintenance and presentation of accounts for tax authorities.

3. A management audit appraises managerial performance, plans, controls, and functions to evaluate if objectives are met effectively and efficiently. It provides recommendations to improve organizational processes.