The document is a guideline on auditing and fiscal laws, detailing various chapters that cover topics such as quality control, audit planning, and internal controls. It also addresses compliance with the Income Tax Act, including specifics on tax audit requirements for various entities. Additionally, it outlines the responsibilities and limitations of auditors, particularly chartered accountants, under Indian law.

![©Taxmann

Published by:

Taxmann Publications (P.) Ltd.

Sales & Marketing:

59/32, New Rohtak Road, New Delhi-110 005 India

Phone: +91-11-45562222

Website : www.taxmann.com

E-mail : sales@taxmann.com

Regd. Office:

21/35, West Punjabi Bagh, New Delhi-110 026 India

Developed by.

Tan Prints (India) Pvt. Ltd.

44 Km. Mile Stone, National Highway, Rohtak Road

Village Rohad, Distt.Jhajjar (Haryana) India

E-mail : sales@tanprints.com

Disclaimer

Every effort has been made to avoid errors or omissions in this publication. In spite of this,

errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice

which shall be taken care ofin the next edition. It is notified that neither the publisher nor the

author or seller will be responsible for any damage or loss ofaction to any one, ofany kind, in

any manner, therefrom. It is suggested that to avoid any doubt the reader should cross-check

all the facts, law and contents of the publication with original Government publication or

notifications.

No part of this book may be reproduced or copied in any form or by any means [graphic,

electronic or mechanical, including photocopying, recording, taping, or information retrieval

systems] or reproduced on any disc, tape, perforated media or other information storage

device, etc., without the written permission ofthe publishers. Breach ofthis condition is liable

for legal action.

All disputes are subject to Delhi jurisdiction only.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-3-2048.jpg)

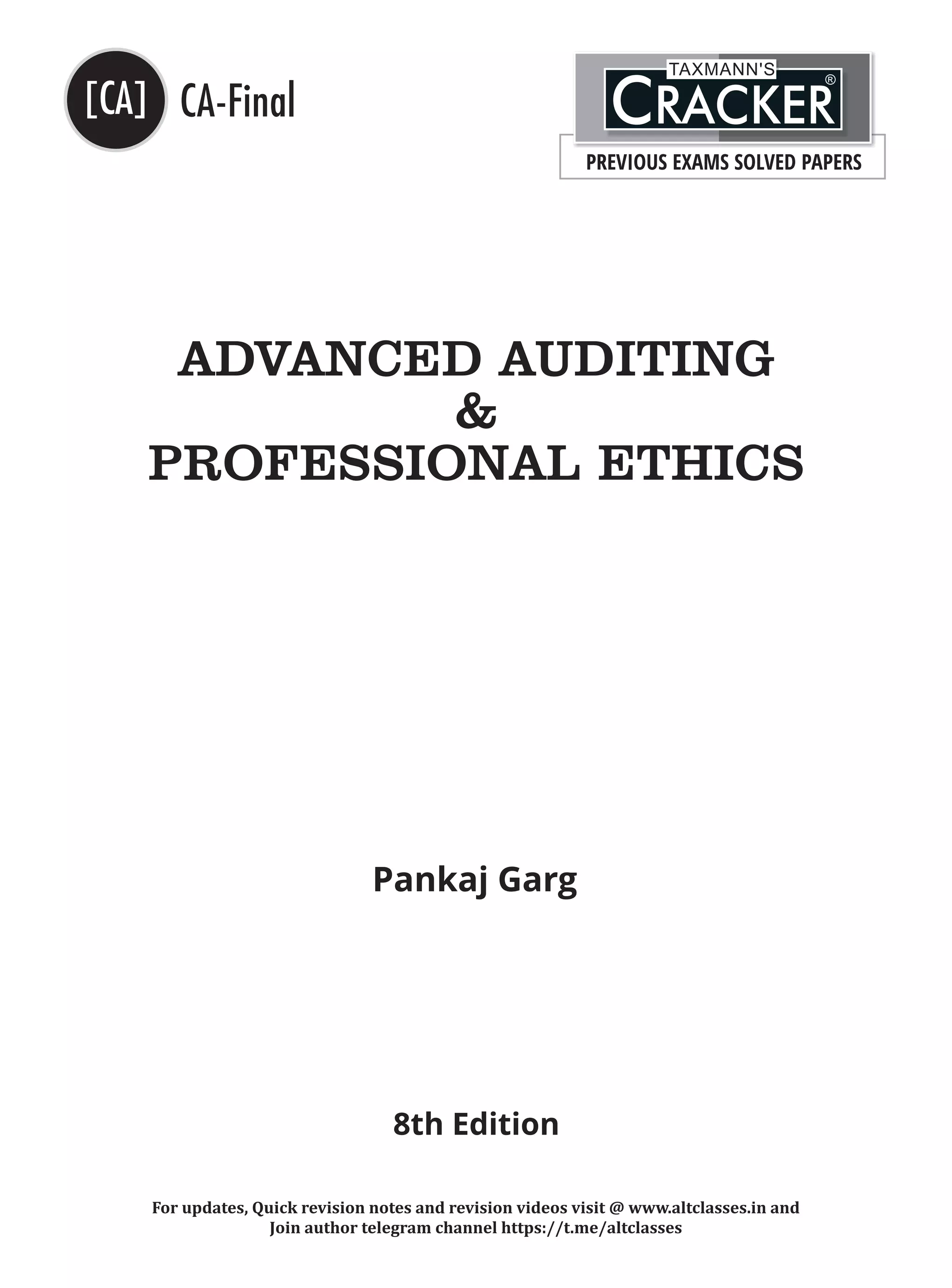

![15.1

Audit under Fiscal Laws

*From May 2019, Marks are given only for subjective questions.

15.1 - Audit of Public Trusts

Q.1 Draft an Audit programme for conducting the audit of a Public Trust registered under section 12A of

the Income Tax Act, 1961. [May 09 (8 Marks)]

Ans.: Audit Programme for conducting audit of a public trust:

1. Preliminary: Obtain the following from the trust:

x A copy of resolution from the trust so as to determine the scope of audit.

x A list of accounting records maintained by the trust.

x A certified true copy of trust deed.

x Trial Balance as at end of accounting period.

x Balance Sheet and Profit & Loss account of the trust authenticated by the trustee.

2. Compliance and Substantive Checking

(i) Examine the system of accounting and internal control.

(ii) Vouch the transactions of the trust so as to ensure the following:

(a) transaction falls within the ambit of the trust;

(b) transaction is properly authorized by the trustees or other delegated authority;

(c) Proper accounting of all incomes and expenses on the basis of the system of accounting

followed by the trust;

(d) Amount applied towards the object of the trust are covered by the objects of trust as

specified in the trust deed.

(iii) Check whether the financial statements agrees with the trial balance.

May-18 Nov-18 May-19 Nov-19 Nov-20 Jan-21 May-21 -

Series1 5 5 4 4 0 8

0

1

2

3

4

5

6

7

8

9

Marks

"Marks Distribution of Past Exams* (New Syllabus)"

15](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-6-2048.jpg)

![Audit under Fiscal Laws Chapter 15

15.2

3. Issuing Audit Report

x Audit Report shall be furnished in Form No. 10B.

x Annexure to Form 10B requires certain information to be provided by the auditor, which need

to be obtained from the trustees.

15.2 - Tax Audit u/s 44AB

Q.2 A Co-operative Society having receipts above ₹ 100 lakhs get its accounts audited by a person eligible

to do audit under Co-operative Societies Act, 1912, who is not a C.A. State with reasons whether such

audit report can be furnished as tax audit report u/s 44AB of the Income Tax Act, 1961?

[Nov. 09 (3 Marks)]

Or

A Co-operative society having receipts over ₹ 2 crores have appointed Mr. D as the statutory auditor –

Mr. D is eligible to do the same under the state Co-operative Societies Act. Mr. D is not a chartered

accountant. Mr. D is also appointed to conduct the tax audit of the society u/s 44AB of the Income Tax

Act, 1961. Comment. [Nov. 17 (4 Marks)]

Ans.: Tax Audit Report in case of Co-operative society:

x Proviso to Sec. 44AB of Income Tax Act, 1961 lays down that where the accounts of an assessee are

required to be audited by or under any other law, it shall be sufficient compliance with the

provisions of this section, if such person get the accounts of such organisation audited under such

other law before the specified date and furnishes by that date, the report of the audit as required

under such other law and a further report by an Accountant in the form prescribed under this

section.

x The term “accountant” as defined under section 288 under the Income Tax Act, 1961 means a

chartered accountant within the meaning of the Chartered Accountants Act, 1949, who holds a

valid certificate of practice.

x Accordingly, the person who is not a Chartered Accountant as mentioned in the question, though is

eligible to act as auditor of Cooperative Society under the Cooperative Societies Act, 1912, but is

not eligible to carry out tax audit under Section 44AB of the Income Tax Act, 1961.

Conclusion: Audit report by a person other than Chartered Accountant cannot be furnished as tax audit

report under Section 44AB of the Income-tax Act, 1961.

Q.3 Mr. X deals in a commodity and purchase and sales of that commodity is ultimately settled otherwise

than by the actual delivery. During the financial year 2020-21 he purchased the commodity worth ₹

95 Lacs and sold the same commodity for ₹ 104 Lacs and the contract was settled otherwise than by

the actual delivery. X seeks your advice whether he is liable for tax audit u/s 44AB of the Income Tax

Act.

Ans.: Liability for Tax Audit in case of Speculative Transactions:

x Mr. X deals in commodity as a speculator. A speculative transaction means a transaction in which a

contract for the purchase or sale of any commodity, including stocks and shares, is periodically or

ultimately settled otherwise than by the actual delivery.

“ICAI Examiner Comments”

Even though many examinees have given correct conclusion, few examinees failed to refer Sec. 288(2)

of the Income-tax Act, 1961 and its explanation while some of them mistakenly related with

Professional misconduct under CA Act, 1949.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-7-2048.jpg)

![Audit under Fiscal Laws Chapter 15

15.4

Q.5 Mr. A engaged in business as a sole proprietor presented the following information to you for the FY

2020-21. Turnover made during the year ₹ 124 lacs. Goods returned in respect of sales made during

FY 2019-20 is ₹ 20 lacs not included in the above. Cash discount allowed to his customers ₹ 1 lac for

prompt payment. Special rebate allowed to customer in the nature of trade discount ₹ 5 lacs. Kindly

advise him whether he has to get his accounts audited u/s 44AB of the Income Tax Act, 1961.

[Nov. 13 (4 Marks)]

Ans.: Computation of Turnover for the purpose of determining requirement of Tax Audit:

As per section 44AB of the Income Tax Act, 1961, audit is required in case of every person carrying on

business, if his total sales, turnover or gross receipts in business exceed ₹ 1 crore and in case of every

person carrying on a profession, if his gross receipts from profession exceed ₹ 50 lakhs in any previous

year.

As per Guidance Note on Tax Audit issued by the ICAI, the following points merit consideration for the

purpose of computing turnover:

(i) Discount allowed in the sales being in the nature of trade discount will be deducted from the

turnover.

(ii) Cash discount otherwise than that allowed in a cash memo/sales invoice is in the nature of a

financing charge and hence should not be deducted from the turnover.

(iii) Special rebate allowed to a customer can be deducted from the sales if it is in the nature of trade

discount.

(iv) Price of goods returned should be deducted from the turnover even if the returns are from the

sales made in the earlier year/s.

Accordingly, the turnover of Mr. A may be computed as under:

Recorded turnover during the year ₹ 1,24,00,000

Less: Trade discount (5,00,000)

Sales Return (20,00,000)

Effective turnover ₹ 99,00,000

Conclusion: As the effective turnover of Mr. A is less than ₹ 1 Crore, the provisions related to tax audit

are not applicable to Mr. A.

Q.6 Comment with respect to computation of total sales, turnover or gross receipts in business exceeding

the prescribed limit under section 44AB of Income Tax Act, 1961.

(i) Discount allowed in the sales invoice

(ii) Cash discount

(iii) Price of goods returned related to earlier year

(iv) Sale proceeds of fixed assets. [May 15 (4 Marks)]

Ans.: Computation of Total Sales:

(i) Discount allowed in the sales invoice: Deducted from turnover as it reduces the sale price.

(ii) Cash discount: Not to be deducted being in the nature of financing charge.

(iii) Price of goods returned related to earlier year: Deducted from turnover.

(iv) Sale proceeds of fixed assets: Will not form part of turnover as these are not held for resale.

Q.7 Write short note on: Circumstances in which Chartered Accountant in practice or firm of Chartered

Accountants cannot conduct tax audit u/s 44AB of the Income Tax Act, 1961 of the concern.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-9-2048.jpg)

![Chapter 15 Audit under Fiscal Laws

15.5

Ans.: Circumstances in which CA in Practice cannot conduct tax audit:

As per Explanation to Sec. 288, the following persons cannot conduct tax audit:

x In case of a company, the person who is not eligible for appointment as an auditor of as per

provisions of Sec. 141(3) the Companies Act, 2013 cannot conduct tax audit.

x In case of assessee other than company, following persons cannot conduct tax audit:

1. the assessee himself or in case of the firm or AOP or HUF, any partner of the firm, or member

of the AOP or the HUF;

2. in case of the assessee, being a trust or institution, any person referred to in Sec. 13(3);

3. the person who is competent to verify the return in accordance with the provisions of section

140;

4. any relative of any of the persons referred above;

5. an officer or employee of the assessee;

6. an individual who is a partner, or who is in the employment, of an officer or employee of the

assessee;

7. an individual who, or his relative or partner

(a) is holding any security of, or interest in, the assessee: Provided that the relative may

hold security or interest in the assessee of the face value not exceeding ₹ 1,00,000;

(b) is indebted to the assessee: Provided that the relative may be indebted to the assessee

for an amount not exceeding ₹ 1,00,000;

(c) has given a guarantee or provided any security in connection with the indebtedness of

any third person to the assessee: Provided that the relative may give guarantee or

provide any security in connection with the indebtedness of any third person to the

assessee for an amount not exceeding ₹ 1,00,000;

8. a person who, whether directly or indirectly, has business relationship with the assessee of

such nature as may be prescribed;

9. a person who has been convicted by a court of an offence involving fraud and a period of ten

years has not elapsed from the date of such conviction.

Q.8 M/s. SB & Co. has been appointed as tax auditor under section 44AB of Income Tax Act, 1961 by

Woodcraft Interior Consultants, a professional partnership firm, having turnover ₹1.25 Crores. M/s

RS & Co. are the statutory auditors of the firm but they are unable to give their report on the financial

statements of the firm. M/s. SB & Co., have, however, completed their tax audit and want to issue

their reports. Comment. [May 17 (4 Marks)]

Ans.: Tax Audit Report in case of Partnership firm assessee:

x Proviso to Sec. 44AB of Income Tax Act, 1961 lays down that where the accounts of an assessee are

required to be audited by or under any other law, it shall be sufficient compliance with the

provisions of this section, if such person get the accounts of such organisation audited under such

other law before the specified date and furnishes by that date, the report of the audit as required

under such other law and a further report by an Accountant in the form prescribed under this

section.

x There is no statutory requirement of audit of a firm under the provisions of Partnership Act, 1932.

So, appointment of two auditors one as tax auditor and another as statutory auditor does not

appears to be correct.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-10-2048.jpg)

![Audit under Fiscal Laws Chapter 15

15.6

x It is also provided under Section 44AB that the tax auditor should report whether in his opinion the

particulars in respect of Form 3CD are true and correct. The audit report is in the form of 3CA if

accounts are being examined under the requirements of provisions of any other Act, otherwise

report should be in Form 3CB.

x In the present case, assessee is a partnership firm and appoints separate persons as tax auditor and

statutory auditor. Statutory auditor is not able to give their report on financial statements of firm.

Conclusion: Form No. 3CA requires the tax auditor to enclose a copy of the audit report conducted by

the statutory auditor. Where the report of the statutory auditor is not available for whatever reasons, it

will be possible for the tax auditor to give his report in Form No. 3CB and to certify the relevant

particulars in Form No. 3CD.

Note: There is no requirement of statutory audit under Partnership Act, 1932. Hence while

answering the question, this fact also needs to be stated.

Q.9 Mr. PK is conducting the Tax audit u/s 44AB of the Income Tax Act, 1961 of MG Ltd. for the year

ended 31st March, 2021. There is a difference of opinion between Mr. PK and the Management in

respect of certain information to be furnished in Form No. 3CD. As a tax auditor, Mr. PK has to report

whether the statement of particulars in Form 3CD are true and correct and the same is to be annexed

to the report in Form No. 3CA. Advise on the matters to be considered by Mr. PK while furnishing the

particulars in Form No. 3CD. [Nov. 19 – New Syllabus (4 Marks)]

Ans.: Form 3CD - Considerations for auditor while furnishing particulars in Form 3CD:

While furnishing the particulars in Form No. 3CD it would be advisable for the tax auditor to consider

the following:

1. If a particular item of income/expenditure is covered in more than one of the specified clauses,

care should be taken to make a suitable cross reference to such items at the appropriate places.

2. If there is any difference in the opinion of the tax auditor and that of the assessee in respect of any

information furnished in Form No. 3CD, the tax auditor should state both the view points and also

the relevant information in order to enable the tax authority to take a decision in the matter.

3. If any particular clause in Form No. 3CD is not applicable, he should state that the same is not

applicable.

4. In computing the allowance or disallowance, he should keep in view the law applicable in the

relevant year, even though the form of audit report may not have been amended to bring it in

conformity with the amended law.

5. In case the prescribed particulars are given in part to the tax auditor or relevant form is

incomplete and the assessee does not give the information against all or any of the clauses, the

auditor should not withhold the entire audit report. In such a case, he can qualify his report on

matters in respect of which information is not furnished to him.

6. The information in Form No. 3CD should be based on the books of account, records, documents,

information and explanations made available to the tax auditor for his examination.

7. In case the auditor relies on a judicial pronouncement, he may mention the fact as his

observations in Form No. 3CA or Form No. 3CB, as the case may be.

“ICAI Examiner Comments”

Majority of candidates failed to discuss the circumstances in which Form 3CA and Form 3CB are

furnished by a Tax auditor. Some candidates wrongly discussed the relationship between the

statutory auditor and tax auditor and concluded wrongly that Tax auditor has to wait till statutory

audit is completed. It seems that Candidates failed to understand the requirement of the question.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-11-2048.jpg)

![Chapter 15 Audit under Fiscal Laws

15.7

Q.10 Mr. Abhinandan engaged in business as a sole proprietor presented the following information to you

for the FY 2020-21. Turnover expected to be made during the year ₹ 524 lacs. Goods returned in

respect of sales made during FY 2019-20 is ₹ 20 lacs not included in the above. Cash discount allowed

to his customers ₹ 1 lac for prompt payment. Special rebate allowed to customer in the nature of

trade discount ₹ 5 lacs. Further, the aggregate of all amounts received including amount received for

sales, turnover or gross receipts during the previous year, in cash, does not exceed five per cent of

the said amount and aggregate of all payments made including amount incurred for expenditure, in

cash, during the previous year does not exceed five per cent of the said payment. Kindly advise him

whether he has to get his accounts audited u/s 44AB of the Income Tax Act, 1961. [MTP – March 21]

Ans.: Turnover limit for the purpose of Tax Audit:

The following points merit consideration as stated in the Guidance note on Tax Audit issued by the

Institute of Chartered Accountants of India-

(i) Price of goods returned should be deducted from the figure of turnover even if the return are

from the sales made in the earlier years.

(ii) Cash discount otherwise than that allowed in a cash memo/sales invoice is in the nature of a

financing charge and is not related to turnover. The same should not be deducted from the

figure of turnover.

(iii) Special rebate allowed to a customer can be deducted from the sales if it is in the nature of trade

discount.

Applying the above stated points to the given problem,

1. Total Turnover 524 Lac

2. Less – Goods Returned 20 Lac

Special rebate allowed to customer in the nature of trade discount

would be deducted

5 Lac

Balance 499 Lac

Since the aggregate of all amounts received including amount received for sales, turnover or gross

receipts during the previous year, in cash, does not exceed 5% of the said amount and aggregate of all

payments made including amount incurred for expenditure, in cash, during the previous year does not

exceed 5% of the said payment, limit for tax audit is ₹ 5 crore.

Conclusion: Abhinandan would not be required to get his accounts audited u/s 44AB of the Income

Tax Act, 1961 as ₹ 499 lac is below prescribed tax audit limit i.e. ₹ 5 crore.

15.3 - Methods of Accounting & ICDSs (Sec. 145)

Q.11 As the tax auditor of a non-corporate entity u/s 44AB of the Income Tax Act, 1961, how would you

ensure compliance of section 145 of the Income Tax Act, 1961? [May 09 (8 Marks)]

Ans.: Compliance of Section 145:

x Sec. 145(1) of Income Tax Act, 1961 requires that the income chargeable under the head ‘PGBP’

or ‘Other sources’ shall, be computed in accordance with either cash or mercantile system of

accounting regularly employed by the assessee.

x Sec. 145(2) provides that the C.G. may notify in the Official Gazette from time to time Income

Computation and Disclosure Standards to be followed by any class of assessee or in respect of

any class of income.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-12-2048.jpg)

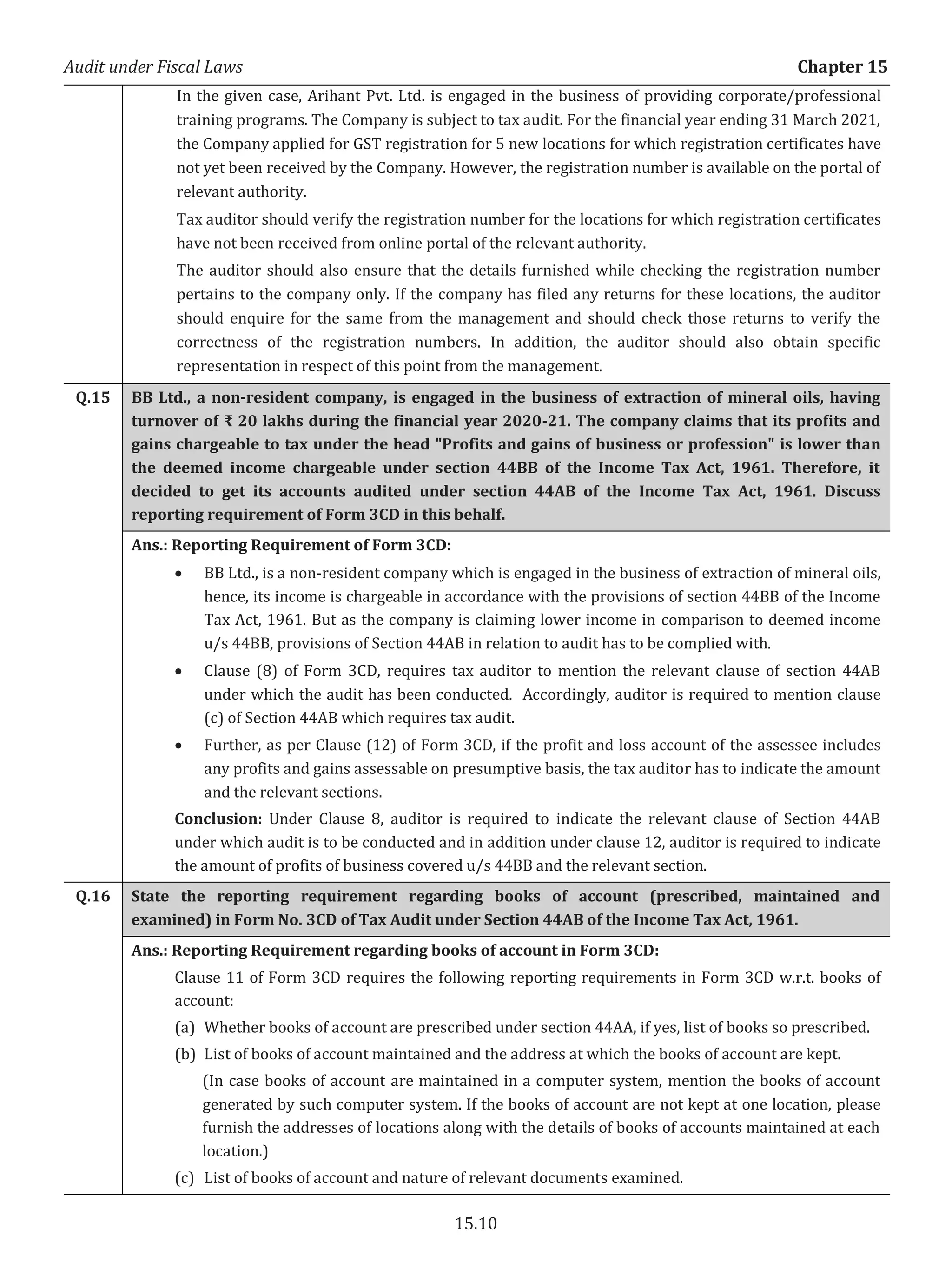

![Chapter 15 Audit under Fiscal Laws

15.9

collected GST of ₹ 7 lakhs but utilized for personal use. The department issued a show cause notice

to him why the tax collected by him in not deposited to the Government account. He appeared

before the department and stated his inability to pay the sum due to financial crisis. The

proceedings are still pending. Mr. X requests you not to disclose his GST registration details while

filling particulars to be furnished in From No. 3CD. As a tax auditor how would you deal with this?

[May 16 (4 Marks)]

Ans.: Reporting Requirement of Form 3CD:

x Clause (4) of Form 3CD, requires tax auditor to mention the registration number or any other

identification number, if any, allotted, in case the assessee is liable to pay indirect taxes like

excise duty, service tax, sales tax, GST, customs duty, GST etc. Auditor is required to furnish the

details of registration numbers as provided to him by the assessee.

x The reporting is however, to be done in the manner or format specified by the e-filing utility in

this context. The information may be obtained and maintained in the following format:

S.

No.

Relevant Indirect Tax

Law which requires

registration

Place of Business/profession/

service unit for which registration

is in place/ or has been applied for

Registration/

Identification

number

x In the present case Mr. X has defaulted in payment of GST for the previous year. Consequently,

the department issued a show cause notice for such non-payment of tax. The arguments are still

going on between the department and assessee. He also restrained his tax auditor from

disclosing GST registration details in tax audit report.

Conclusion: Instruction of Mr. X is not acceptable as clause 4 of Form 3CD requires tax auditor to

furnish the details of registration number or other identification number of assessee, if assessee is

required to pay indirect taxes like excise duty, service tax, GST etc.

Q.14 Arihant Pvt. Ltd. is engaged in the business of providing corporate/professional training programs.

It has an annual turnover of ₹ 74 crore. The Company is subject to tax audit for which the work has

been started by the tax auditor. For the financial year ending 31 March 2021, the Company applied

for GST registration for 5 new locations for which registration certificates have not yet been

received by the Company. However, the registration number is available on the portal of relevant

authority which can be verified by checking the details of the Company. In this case what should be

the audit procedures to verify this registration number? [RTP – May 21]

Ans.: Reporting of Registration Number under Indirect Taxes in Form 3CD:

Clause 4 of Form No. 3CD requires the tax auditor to ensure whether the assessee is liable to pay

indirect tax like excise duty, service tax, sales tax, GST tax, custom duty, etc. If yes, the registration

number or GST number or any other identification number allotted for the same need to be

furnished.

Therefore, the auditor is primarily required to furnish the details of registration numbers as

provided to him by the assessee. The reporting is required to be done in the manner or format

specified by the e-filing utility in this context.

“ICAI Examiner Comments”

Most of the candidates failed to visualize the requirement of the question and answered about

reporting requirement due to non-payment of GST under clause 41 instead of GST registration

number under clause 4.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-14-2048.jpg)

![Chapter 15 Audit under Fiscal Laws

15.11

Q.17 Write a short note on: Method of Accounting in Form No. 3CD of Tax Audit.

Ans.: Method of Accounting in Form No. 3CD:

Clause 13 of Form 3CD requires the following reporting requirements w.r.t. Methods of accounting:

(a) Method of accounting employed in the previous year

(b) Whether there had been any change in the method of accounting employed vis-a-vis the method

employed in the immediately preceding previous year.

(c) If answer to (b) above is in the affirmative, give details of such change, and the effect thereof on

the profit or loss.

Serial number Particulars Increase in profit (₹) Decrease in profit (₹)

(d) Details of deviation, if any, in the method of accounting employed in the previous year from

accounting standards prescribed under section 145 and the effect thereof on the profit or loss.

Q.18 A leading manufacturing concern valued its inventory following a method not in line with the

provisions of Income Computation and Disclosure Standard (ICDS)- 2 ‘Valuation of Inventories’.

In such a situation, discuss the relevant clause of Form No. 3CD under which the tax auditor is

required to report?

Or

ABC Ltd., is consistently following accounting standards as required u/s 133 of the Companies Act,

2013. During your tax audit u/s 44AB of the Income-tax Act, 1961, the board of directors informed

you that profits of the company is properly arrived at and the ASs applicable to it have been

followed consistently and as such, there need not be any adjustments to be made as per ICDS

notified u/s 145 of Income Tax Act, 1961. Based on the requirement of Law in this regard, examine

the validity of the stand of management in this regard. [May 18–New Syllabus (5 Marks)]

Ans.: Reporting for Adjustment to be made to the Profits or Loss for complying with ICDSs:

x Central Government has, in exercise of the powers conferred u/s 145(2) of Income-tax Act, 1961,

notified 10 income computation and disclosure standards (ICDSs) to be followed by all assessees

(other than an individual or a HUF who is not required to get his accounts of one previous year

audited in accordance with the provisions of section 44AB), following the mercantile system of

accounting, for the purposes of computation of income chargeable to income-tax under the head

“Profit and gains of business or profession” or “Income from other sources”.

x Clause 13(d) of Form No. 3CD of the tax audit report requires the tax auditor to state whether

any adjustment is required to be made to the profits or loss for complying with the provisions of

income computation and disclosure standards notified under section 145(2) of the Income Tax

Act, 1961.

x Further, the tax auditor is also required to report under Clause 13(e), if answer to Clause 13(d)

above is in the affirmative i.e. the auditor is required to give details of such adjustments as

follows:

Increase in

Profit (₹)

Decrease in

Profit (₹)

Net Effect

(₹)

ICDS I Accounting Policies

ICDS II Valuation of Inventories](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-16-2048.jpg)

![Audit under Fiscal Laws Chapter 15

15.12

ICDS III Construction Contracts

ICDS IV Revenue Recognition

ICDS V Tangible Fixed Assets

ICDS VI Changes in Foreign Exchange Rates

ICDS VII Governments Grants

ICDS VIII Securities

ICDS IX Borrowing Costs

ICDS X Provisions, Contingent Liabilities &

Contingent Assets

Total

Conclusion: Contention of the management that they are following Accounting Standards and

need not to make any adjustments as per ICDS, is not correct. Thus, ABC Ltd. is required to adjust

the profits in compliance with ICDS.

Q.19 A leading jewellery merchant used to value his inventory at cost on LIFO basis. However, for the

current year, in view of requirements of AS-2, he changed over to FIFO method of valuation. The

difference in value of stock amounted to ₹ 55 lakhs which is higher than that under the previous

method. In such a situation, what are the reporting responsibilities of a Tax Audit u/s 44AB of

Income Tax Act, 1961.

Ans.: Reporting of Changes in Valuation of Inventory:

x As per the provisions of Income Tax Act, 1961, if the change in method of valuation is bona fide,

and is regularly and consistently adopted in the subsequent years as well, such change would be

permitted to be made for tax purposes.

x In the instant case, the change in the valuation of stock is pursuant to mandatory requirements of

the AS-2 ‘Valuation of Inventories’ and therefore should be viewed as bona fide change and

allowed.

x Clause 14 of Form 3CD also requires in this regard reporting over the following:

1. Method of valuation of closing stock employed in the previous year.

2. In case of deviation from the method of valuation prescribed under section 145A, and the

effect thereof on the profit or loss.

x In reference to Section 145A, auditor is not required to report change in the method of valuation

of purchases, sales and inventories which is regularly employed by the assessee. Auditor is

required to adjust the valuation for any tax, duty, cess or fee actually paid or incurred by the

assessee, if the same had not already been adjusted.

Q.20 T Ltd. previous year ended on 31st March 2021. During that period, it made a claim for refund of

customs duty which was admitted as due by the customs authorities during April 2021. T Ltd.

neither credited the claim in the profit and loss account nor reported the same in clause 16(b) of

Form 3CD for the reason that this has been admitted as due by the authorities only in the next

financial year. Further T Ltd had changed the method of determination of cost formula for the

purpose of stock valuation from FIFO basis to Weighted Average Cost basis, but that was also not

reflected in clause 13(b) of Form 3CD which requires reporting on change in accounting method

employed. Comment. [May 12 (6 Marks)]](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-17-2048.jpg)

![Chapter 15 Audit under Fiscal Laws

15.13

Ans.: Reporting requirement of Claim of Custom Duty Refund and change in Accounting policy:

x As per Clause 16(b) of form 3CD, the details of custom duty refund, if admitted as due but not

reported in Profit and Loss account, are to be stated. But the claim which have been admitted as

due after the relevant previous year need not be reported.

x Hence non-reporting of claim of refund of custom duty in Form 3CD is in order.

x Clause 13(b) of Form 3CD required reporting in case of change in method of accounting

employed. But in the present case there is a change in accounting policy. Change in Accounting

policy cannot be treated as change in method of accounting, hence does not require any

reporting under clause 13(b) in Form 3CD.

x Hence non-reporting of method of valuation in Form 3CD is in order.

Q.21 While conducting the tax audit of A & Co. you observed that it made an escalation claim to one of its

customers but which was not accounted as income. What is your reporting responsibility?

[May 11 (4 Marks)]

Ans.: Clause 16(c) of Form 3CD:

x A tax auditor has to report under clause 16(c) of Form 3CD on any escalation claim accepted

during the previous year and not credited to the profit and loss account under clause 16(c) of

Form 3CD.

x The escalation claim accepted during the year would normally mean “accepted during the

relevant previous year.” If such amount is not credited to Profit and Loss Account the fact should

be reported. The system of accounting followed in respect of this particular item may also be

brought out in appropriate cases. If the assessee is following cash basis of accounting with

reference to this item, it should be clearly brought out since acceptance of claims during the

relevant previous year without actual receipt has no significance in cases where cash method of

accounting is followed.

x Escalation claims should normally arise pursuant to a contract (including contracts entered into

in earlier years), if so permitted by the contract. Only those claims to which the other party has

signified unconditional acceptance could constitute accepted claims. Mere making claims by the

assessee or claims under negotiations cannot constitute accepted claims. After ascertaining the

relevant factors as outlined above, a decision whether to report or not, can be taken.

Q.22 While writing the audit program for tax audit in respect of A Ltd you wish to include possible

instances of capital receipt if not credited to Profit & Loss Account which needs to be reported

under clause 16(e) of Form 3CD. Please elucidate possible instance. [May 13 (4 Marks)]

or

What can be the possible instance of capital receipt which, if not credited to the profit and loss

account, needs to be reported in form 3CD? [Nov. 15 (4 Marks)]

Or

In the course of your tax audit assignment u/s 44AB of the Income Tax Act, 1961 of Dream Bank Ltd.

You have instructed your assistant to find out receipt of capital nature which might not have been

credited to Profit & Loss Account and needs to be reported in Para 16(e) of 3CD. Your audit

assistant seeks your guidance in reporting the same. Specify any four illustrative examples of such

receipt. [May 19 – New Syllabus (4 Marks)]

Ans.: Instances of Capital receipt:

(a) Capital subsidy received in the form of Government grants, which are in the nature of promoters’](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-18-2048.jpg)

![Chapter 15 Audit under Fiscal Laws

15.15

Q.24 A is proprietor of a firm M/s ABC & Co. The firm has a turnover of ₹ 500 lakhs during the financial

year ended 31.03.2021. The firm sold land and building during the year for a consideration of ₹ 15

lakhs, whose value for stamp duty purposes was ₹ 16 lakhs. As the Tax Auditor of the said firm, is

the above to be reported? If yes, how will you report the same? [Nov. 19 – Old Syllabus (4 Marks)]

Ans.: Reporting of Sale of property at a price lower than value adopted for the purpose of stamp

duty:

x Clause 17 of Form 3CD requires tax auditor to furnish certain information if land or building or

both is transferred during the previous year for a consideration less than value adopted by any

authority of a State Government as under:

Details of Property Consideration Received or

Accrued

Value adopted or assesses or

assessable

x For this purpose, auditor should obtain a list of all properties transferred by the assessee during

the previous year and furnish the amount of consideration received or accrued, as disclosed in

the books of account of the assessee.

x For reporting the value adopted or assessed or assessable, the auditor should obtain from the

assessee a copy of the registered sale deed. In case the property is not registered, the auditor

may verify relevant documents from relevant authorities or obtain third party expert like lawyer,

solicitor representation to satisfy the compliance of section 43CA / section 50C of the Act.

Conclusion: ABC Ltd. has sold the house property to Mr. X at a price lower than value adopted for

stamp duty purpose, tax auditor is required to report on the same under Clause 17 of Form 3CD.

Note: Suggested answer of ICAI also requires reporting under Clause 29B. Reporting under

clause 29B is required when the assessee receives any property. But in this case the assessee, i.e.

firm ABC and Co. sold its property, hence no reporting required under Clause 29B.

Q.25 As an auditor of a partnership firm under section 44AB of the Income Tax Act, 1961, how would you

report on the following: Capital Expenditure incurred for scientific research assets.

[Nov. 12 (2 Marks)]

Ans.: Reporting of Capital Expenditure incurred on Scientific Research Assets in form 3CD:

Clause 19 of Form 3CD requires the auditor to report the following:

(i) Amount debited to profit and loss account.

(ii) Amounts admissible as per the provisions of the Income Tax Act, 1961 and also fulfils the

conditions, if any specified under the relevant provisions of Income Tax Act, 1961 or Income

Tax Rules, 1962 or any other guidelines, circular, etc., issued in this behalf.

Q.26 As a tax auditor how would you deal and report the following: An assessee has incurred payments

to clubs. [Nov. 11 (2 Marks)]

Or

As an auditor of a partnership firm under section 44AB of the Income Tax Act, 1961, how would you

report on the following: Expenditure incurred at Clubs. [Nov. 12 (2 Marks)]

Ans.: Reporting of Payment to Club in Form 3CD:

x Clause 21(a) of Form 3CD requires the tax auditor is required to furnish the details of amounts

debited to the profit and loss account, being in the nature of capital, personal, advertisement

expenditure etc.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-20-2048.jpg)

![Audit under Fiscal Laws Chapter 15

15.16

x Such reporting requires the tax auditor to report on the

(a) Expenditure incurred at clubs being entrance fees and subscriptions; and

(b) Expenditure incurred at clubs being cost for club services and facilities used.

x The payments made may be in respect of directors and other employees in case of companies,

and for partners or proprietors in other cases

x The fact whether such expenses are incurred in the course of business or whether they are of

personal nature should be ascertained.

Q.27 M/s PQRS & Associates is appointed for conducting tax audit as per Income Tax Act, 1961 of QW

Ltd., a cotton textile company. The Company had incurred ₹ 6 lac towards advertisement

expenditure on a brochure/ pamphlet published by a political party in Pune. Advise the auditor

whether such expenditure should be included in the tax audit report or not. [RTP-Nov. 20]

Ans.: Expenses on Advertisement in the Media of a Political Party:

x Clause 21(a) of Form 3CD requires the tax auditor to furnish the details of amounts debited to

the Profit and Loss Account, being in the nature of advertisement expenditure in any souvenir,

brochure, tract, pamphlet or the like published by a political party in his tax audit report.

x In the given situation, M/s PQRS & Associates is appointed for conducting tax audit as per

Income Tax Act, 1961 of QW Ltd., a cotton textile company. The Company had incurred ₹ 6 lac

towards advertisement expenditure on a brochure/ pamphlet published by a political party.

Conclusion: Advertisement expenditure of ₹ 6 lac on brochure/pamphlet published by a political

party shall be reported in the tax audit report as per Clause 21(a) of Form 3CD.

Q.28 ABC Ltd., engaged in the manufacturing of goods carriage, appointed you as the tax auditor for the

financial year 2020-21. How would you deal with the following matters in your tax audit report:

(i) Payments of 6 invoices of ₹ 5,000 each made in cash to Mr. X, engaged in leasing of goods

carriages on 4th July, 2020.

(ii) Payments of 2 invoices of ₹ 18,000 each made in cash to Mr. Y, engaged in leasing of goods

carriages on 5th July, 2020 and 6th July, 2020 respectively.

(iii) Payment of ₹ 40,000 made in cash to Mr. Z, engaged in leasing of goods carriages on 7th July,

2020 against an invoice for expenses booked in 2019-20.

Ans.: Reporting of Payments Exceeding ₹ 35,000 in Cash:

x Clauses 21(d)(A) and 21(d)(B) of Form 3CD, requires tax auditor to scrutinize on the basis of the

examination of books of account and other relevant documents/evidence, whether the

expenditure covered under sections 40A(3) and 40A(3A) respectively read with rule 6DD were

made by account payee cheque drawn on a bank or account payee bank draft. If not, the same has

to be reported under abovementioned clauses.

x As per section 40A(3) of the Income Tax Act, 1961, an expenditure is disallowed if the assessee

incurs any expenses in respect of which payment or aggregate of payments made to a person in a

day, otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds

₹ 10,000. However, in case of payment made for plying, hiring or leasing of goods carriage, limit

is ₹ 35,000 instead of ₹ 10,000.

x As per section 40A(3A) of the Income Tax Act, 1961, where an allowance has been made in the

assessment for any year in respect of any liability incurred by the assessee for any expenditure

and subsequently during any previous year the assessee makes payment in respect thereof,

otherwise than by an account payee cheque drawn on a bank or account payee bank draft, the

payment so made shall be deemed to be the profits and gains of business or profession and](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-21-2048.jpg)

![Chapter 15 Audit under Fiscal Laws

15.17

accordingly chargeable to income-tax as income of the subsequent year if the payments made to

a person in a day, exceeds ₹ 10,000 (₹ 35,000 in case of plying, hiring or leasing of goods

carriages).

x Based on the abovementioned provisions, following conclusion may be drawn:

(i) Payments of 6 invoices of ₹ 5,000 each aggregating ₹ 30,000 made in cash on 4th July,

2020 need not be reported as the aggregate of payments do not exceed ₹ 35,000.

(ii) Payments of 2 invoices of ₹ 18,000 each made in cash on 5th July, 2020 and 6th July, 2020

respectively aggregating ₹ 36,000 need not be reported as the payment do not exceed ₹

35,000 in a day.

(iii) Payment of ₹ 40,000 made in cash against an invoice for expenses booked in 2019-20 is

likely to be deemed to be the profits and gains of business or profession under section

40A(3A) of the Income Tax Act, 1961. Thus, the details of such amount need to be

furnished under clause 21(d)(B) of Form 3CD.

Q.29 Mr. R, the Tax Auditor finds that some payments inadmissible under Section 40A(3) were made, and

advised the client to report the same in form 3CD. The client contends that cash payments were

made since the other parties insisted upon the same and did not have Bank Accounts. Comment.

[Nov. 10 (5 Marks)]

Ans.: Reporting for Cash payments above ₹ 10,000:

x Clause 21(d) of Form 3CD requires tax auditor to report on disallowance under section 40A(3).

Disallowance u/s 40A(3) of the Income Tax Act, 1961 is attracted if the assessee incurs any

expenses in respect of which payment or aggregate of payments made to a person in a day,

otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds ₹

10,000.

x However, there are certain cases as specified in Rule 6DD, in which, disallowance under section

40A(3) would not be attracted. Cash payment made on insistence of other parties on the

contention that they do not have bank accounts is not covered under the list of exceptions

provided under Rule 6DD.

x In the present case, tax auditor is required to scrutinize on the basis of the examination of books

of account and other relevant documents/evidence, whether the expenditure covered under

section 40A(3) read with rule 6DD were made by account payee cheque drawn on a bank or

account payee bank draft. If not, the same has to be reported under abovementioned clause.

Conclusion:Payments made by the XYZ Ltd. are inadmissible u/s 40A(3) of the Income Tax Act, 1961

and hence, needs to be reported under clause 21(d) of Form 3CD.

Q.30 XYZ Ltd. pays ₹ 90,000 for its 10 employees to a Hotel as boarding and lodging expenses of such

employees for a conference. The Company pays the amount in cash to the Hotel. The Hotel gives 10

bills each amounting to ₹ 9,000. The Company contends that each bill is within the limit, so there is

no violation of the provisions of the Income Tax Act, 1961. As the tax auditor, how would you deal

with the matter in your tax audit report for the Assessment Year 2021-22? [Nov. 14 (4 Marks)]

Ans.: Reporting for Cash payments above ₹ 10,000:

x Clause 21(d) of Form 3CD requires tax auditor to report on disallowance under section 40A(3).

Disallowance u/s 40A(3) of the Income Tax Act, 1961 is attracted if the assessee incurs any

expenses in respect of which payment or aggregate of payments made to a person in a day,

otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds ₹

10,000.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-22-2048.jpg)

![Audit under Fiscal Laws Chapter 15

15.18

x In the given case, the tax auditor found that a hotel issued 6 bills to XYZ Ltd. Each amounting to ₹

9,000 for boarding & lodging expenses of 6 employees. XYZ Ltd. in aggregate has paid ₹ 90,000 to

the hotel in cash. Consequently, no expenditure shall be allowed for deduction as per the

provisions of section 40A(3).

x Contention of the company that each bill is within the limit is not tenable since aggregate of

payments need to be considered.

Conclusion: Payments made by the XYZ Ltd. are inadmissible u/s 40A(3) of the Income Tax Act,

1961 and hence, needs to be reported under clause 21(d) of Form 3CD.

Q.31 Answer the following: As the tax auditor of a Company, how would you report on payments

exceeding ₹ 10,000 made in cash to a supplier against an invoice for expenses booked in an earlier

year?

Ans.: Reporting of payments exceeding ₹ 10,000 in cash:

x Reporting is required under clause 21(d) of Form 3CD for the payments exceeding ₹ 10,000

made in cash against an invoice for expenses booked in an earlier year.

x Section 40A(3A) disallowed an expense payment exceeding ₹ 10,000 made in cash against an

invoice booked in an earlier year.

x Claude 21(d) of Form 3CD requires furnishing of the amount inadmissible u/s 40A(3) read with

rule 6DD along with computation.

x The entire amount paid, is likely to be disallowed u/s 40A(3A) of the Income Tax Act, 1961.

Q.32 You are the Tax auditor of BL & Co., a partnership firm engaged in the business of plying of Goods

Carriages for the financial year 2020-21 having a turnover of ₹ 20 crores. How would you deal and

report on the following:

(i) Payment of ₹ 50,000 in cash to Mr. R on 10th September, 2020 towards settlement of invoice for

expenses accounted in financial year 2019-20.

(ii) Payments of 3 invoices of ₹ 15,000 each made in cash to Mr. Y on 8th, 9th, 10th, July, 2020

respectively. [Nov. 18-Old Syllabus (4 Marks)]

Ans.: Reporting of Payments Exceeding ₹ 10,000 in Cash:

x Clauses 21(d)(A) and 21(d)(B) of Form 3CD, requires tax auditor to scrutinize on the basis of the

examination of books of account and other relevant documents/evidence, whether the

expenditure covered under sections 40A(3) and 40A(3A) respectively read with rule 6DD were

made by account payee cheque drawn on a bank or account payee bank draft. If not, the same has

to be reported under abovementioned clauses.

x As per section 40A(3) of the Income Tax Act, 1961, an expenditure is disallowed if the assessee

incurs any expenses in respect of which payment or aggregate of payments made to a person in a

day, otherwise than by an account payee cheque drawn on bank or account payee draft, exceeds

₹ 10,000. However, in case of payment made for plying, hiring or leasing of goods carriage, limit

is ₹ 35,000 instead of ₹ 10,000.

x As per section 40A(3A) of the Income Tax Act, 1961, where an allowance has been made in the

assessment for any year in respect of any liability incurred by the assessee for any expenditure

and subsequently during any previous year the assessee makes payment in respect thereof,

otherwise than by an account payee cheque drawn on a bank or account payee bank draft, the

payment so made shall be deemed to be the profits and gains of business or profession and](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-23-2048.jpg)

![Chapter 15 Audit under Fiscal Laws

15.19

accordingly chargeable to income-tax as income of the subsequent year if the payments made to

a person in a day, exceeds ₹ 10,000 (₹ 35,000 in case of plying, hiring or leasing of goods

carriages).

x Based on the abovementioned provisions, following conclusion may be drawn:

(i) Reporting required under Clause 21(d)(B) w.r.t. payment of ₹ 50,000.

(ii) Reporting required under Clause 21(d)(A) w.r.t. each payment as individual payment made

on a day exceeds ₹10,000.

Note: Limit of ₹ 35,000 is not applicable as this limit is applicable when the payee is engaged

in the business of plying of goods carriages. In this case, payer is engaged in the business of

plying of goods carriages hence, limit of ₹ 10,000 will be applicable assuming that payee is not

engaged in business of plying of goods carriages.

Q.33 Mr. Sharma carries on the business of dealing and export of diamonds. For the year ended 31st

March 2021, you as the tax auditor find that the entire exports are to another firm in U.S.A. which is

owned by Mr. Sharma’s brother. Comment.

Ans.: Export Payments to a Relative:

x Clause 23 of Form 3CD, requires the tax auditor to specify particulars of payments made to

persons specified u/s 40(A)(2)(b) of the Income Tax Act, 1961. Persons specified in the said

section are relatives of an assessee and sister concerns, etc.

x In the instant case, however, Mr. Sharma has not made any payments to his brother. On the

contrary, he must have received payments from him against exports made and, thus, this clause

would not be applicable to him.

Auditor will nonetheless be still as a part of his normal audit planning would be required to verify

whether the exports are genuine, i.e., whether the diamonds have been delivered by verifying the

necessary delivery documents, relevant invoices, etc., the reasonableness of the price and whether the

export realisations have been received.

Q.34 As a tax auditor how would you deal and report the following: An assessee has paid rent to his

brother ₹ 2,50,000 and paid interest to his sister ₹ 4,00,000. [Nov. 11 (2 Marks)]

Or

As an auditor appointed under section 44AB of the Income Tax Act, 1961, how would you verify and

report on the following: The assessee has paid rent of ₹ 5 lakhs for premises to his brother.

[Nov. 17 (3 Marks)]

Ans.: Reporting of payment of rent and interest to relative:

Clause 23 of Form 3CD requires the tax auditor to furnish the particulars of payments made to

persons specified under Section 40A(2)(b) of the Income Tax Act, 1961. In relation to an individual,

the specified persons include any relative of the assessee (i.e. Husband, Wife, Brother, Sister or any

other Lineal Ascendant or Descendant).

In the present case, an assessee has paid rent to his brother and interest to his sister which may be

disallowed if, in the opinion of the Assessing Officer, such expenditure is excessive or unreasonable

having regard to:

1. the fair market value of the goods, services or facilities for which the payment is made; or

2. for the legitimate needs of business or profession of the assessee; or

3. the benefit derived by or accruing to the assessee from such expenditure.

Conclusion: Auditor is required to report the payments made to specified persons.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-24-2048.jpg)

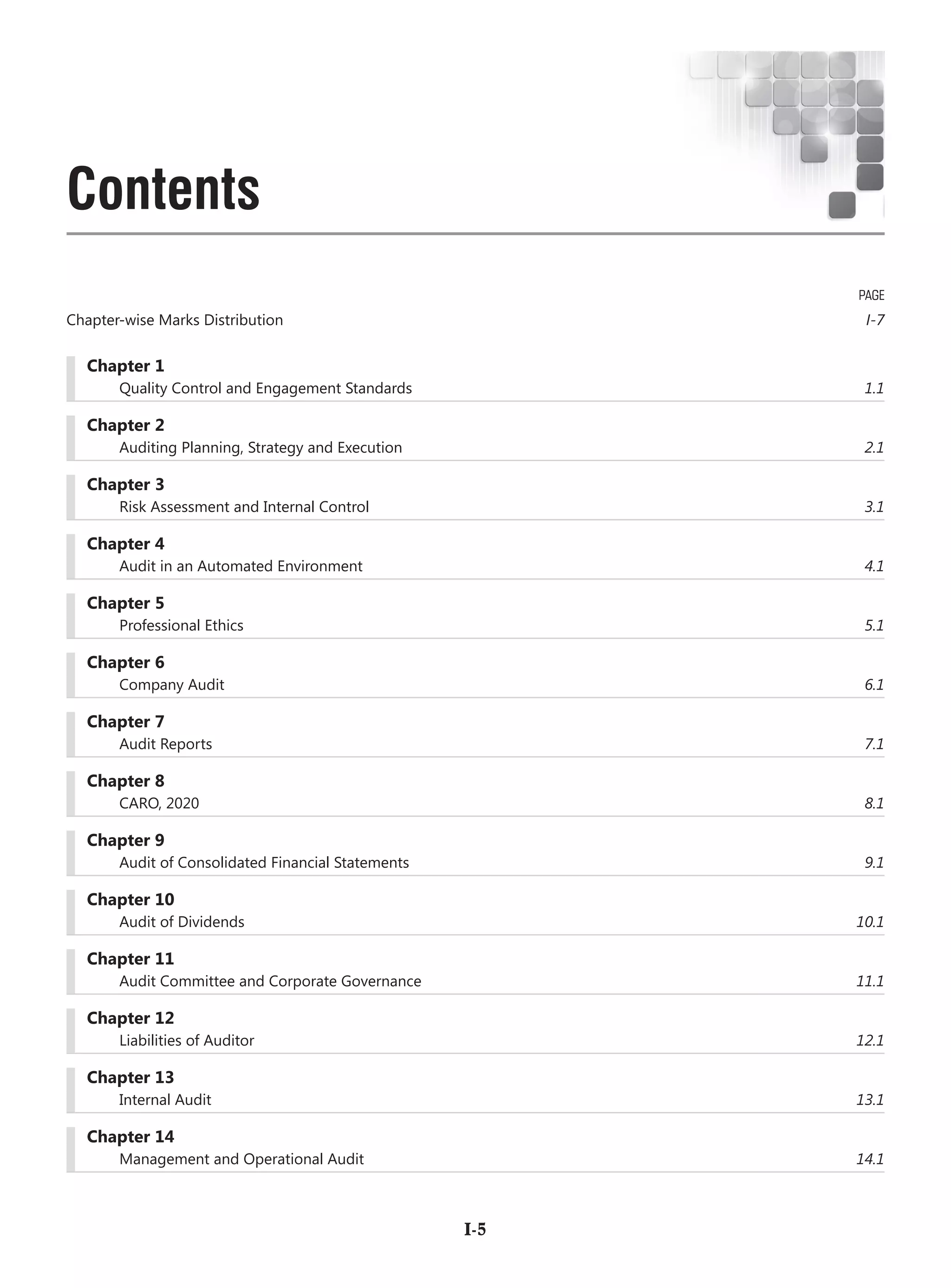

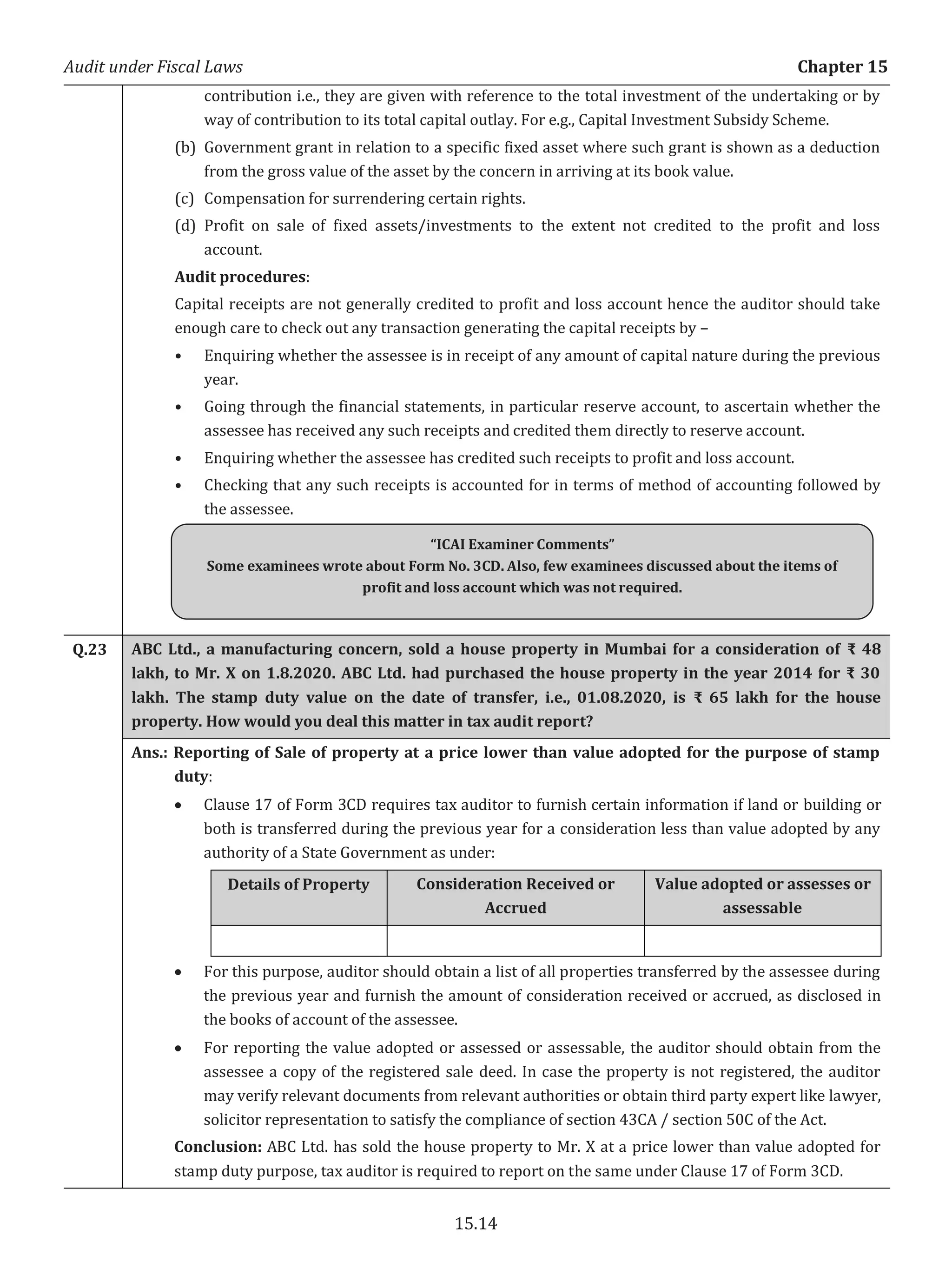

![Audit under Fiscal Laws Chapter 15

15.20

Q.35 You are doing Tax Audit of Private Limited Company for the financial year ending 31st March, 2021.

During audit, you notice that the company is not regular in deposit of VAT/GST and there remains

pendency every year. The details of VAT/GST payable are:

(i) GST payable as on 31/03/2020 of FY 2019-20 was ₹ 200 Lakh and out of which ₹ 100 Lakh was

paid on 15/09/2020 and ₹ 50 Lakh on 30/03/2021 and balance of ₹ 50 Lakh is outstanding.

(ii) GST payable of current financial year 2020-21 was ₹100 lakh and out of this, ₹ 40 Lakh was

paid on 25/05/2020 and balance of ₹ 60 Lakh remained unpaid till the due date of return.

The date of Tax Audit report and due date of return was 30th September.

Now as a Tax Auditor, how/where the said transaction will be reflected in Tax Audit Report under

Section 43B(a)? [MTP-Oct. 19, RTP-Nov. 19]

Ans. Reporting in Tax Audit Report:

x Any amount of GST/Tax payable on the last day of previous year (opening balance) as well as on

the last day of current year has to be reported in Tax Audit Report under clauses 26(A) and 26(B)

in reference of section 43B.

x Clause 26(A) dealt GST/VAT payable on the pre-existed of the first day of the previous year but

was not allowed in the assessment of any preceding previous year and was either paid {clause

26(A)(a)}/ or/ and/ not paid during the previous year {clause 26(A)(b)}

x The details will be as under in regard to opening balances:

Liability Pre-existed on the previous year.

Sr. No. Sec. Nature of

Liability

Outstanding

Opening

balance not

allowed in

previous year

Amount

paid /

set-off

during

the year

Amount

written

back to

P&L

Account

Amount

unpaid at

the end of

the year

01 43B(a) VAT / GST 100 lakh 50 lakh 0 50 lakh

It has been assumed that 100 lakh was allowed in last year as it was paid before the due date of

return.

Liability incurred during the previous year

Sr. No. Sec. Nature of

Liability

Amount

incurred in

previous year

but remaining

outstanding on

last day of

previous year.

Amount paid/set-off

before the due date

of filing return/date

upto which reported

in the tax audit

report, whichever is

earlier

Amount unpaid on

the due of filing of

return/date upto

which reported in

the tax audit report,

whichever is earlier

01 43B(a) VAT / GST 100 lakh 40 lakh 60 lakh

“ICAI Examiner Comments”

Examinees have discussed generally on vouching and verification aspects instead of mentioning

the reporting requirements of Tax auditor. Some examinees failed to explain with reference to

Clause 23 of Form 3CD for reporting the particulars of payments made to persons specified under

section 40A(2)(b) of the Income Tax Act, 1961. Instead of explaining Tax audit requirements few

examinees wrongly discussed AS 18 and SA 550 on “Related parties”.](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-25-2048.jpg)

![CRACKER -

Advanced Auditing &

Professional Ethics

Author : Pankaj Garg

Edition : 8th Edition

ISBN No : 9789390831142

Date of Publication : June 2021

Weight (Kgs) : 0.95

No. of papers : 588

Rs. 745 USD 43

Description

Taxmann’s CRACKER for Advanced Auditing & Professional Ethics is prepared

exclusively for the requirement of the Final Level of Chartered Accountancy Examination.

It covers the entire revised, new syllabus as per ICAI.

The Present Publication is the 8th Edition & Updated till 30th April 2021 for CA-Final |

New Syllabus, with the following noteworthy features:

Strictly as per the New Syllabus of ICAI

[1,000+ Questions and Case Studies] with complete answers

[ICAI Examiner Comments] along with Past Exam Questions are included

Coverage of this book includes:

n All Past Exam Questions

l CA Final November 2020 (New Syllabus) – Suggested Answers

l CA Final January 2021 (New Syllabus) – Suggested Answers

n Questions from RTPs and MTPs of ICAI

[Point wise] answers for easy learning

[Chapter-wise] marks distribution for Past Exams

[Most Updated & Amended] This book is updated & amended as per the following:

n Companies (Audit and Auditor’s) Amendment Rules, 2021

n Companies (Amendment) Act 2020

n Companies (Auditor’s Report) Order 2020

n SEBI (LODR) Regulation 2015

n Form 3CD and Form GSTR 9C (Revised)

n Finance Act 2021

n Revised Code of Ethics

n Revised Statement of Peer Review 2020

ORDER NOW](https://image.slidesharecdn.com/advanedauditingprofessionalethicscrackersampleread-210705102017/75/Taxmann-s-CRACKER-Advanced-Auditing-Professional-Ethics-26-2048.jpg)