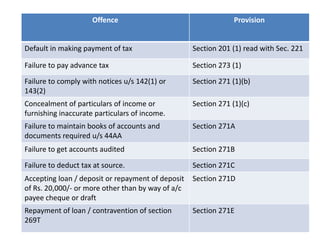

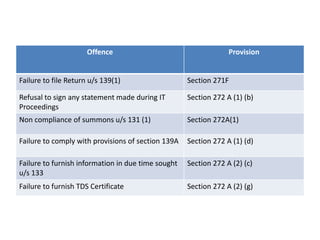

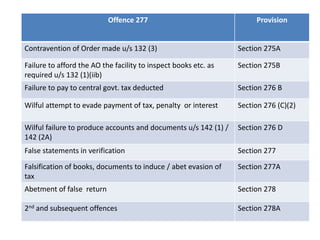

This document outlines income tax offences and provisions for penalties and prosecution in India. It lists various offences related to defaulting on tax payments, failing to comply with notices, concealment of income, failure to maintain proper books and records, and failure to deduct taxes. It provides the corresponding section of the Indian Income Tax Act for each offence. The document also discusses provisions related to prosecution for contravention of orders, failure to provide access to books and records during inspections, failure to pay taxes deducted, willful tax evasion, failure to provide accounts and documents, making false statements, falsifying records to evade tax, abetting false returns, and repeat offenses.