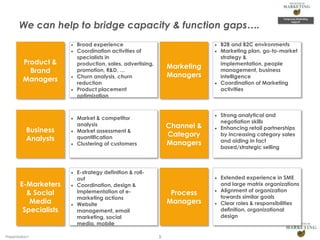

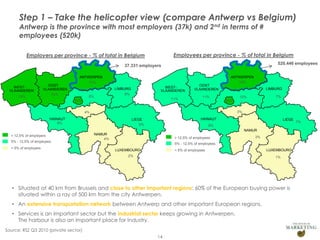

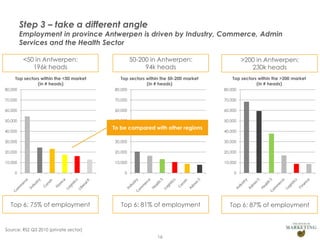

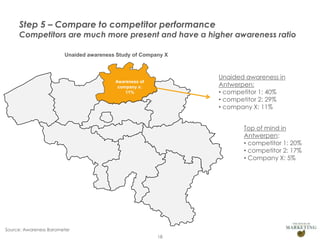

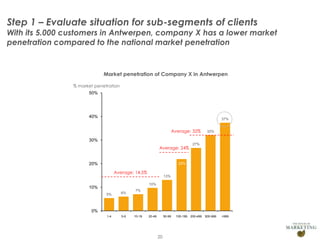

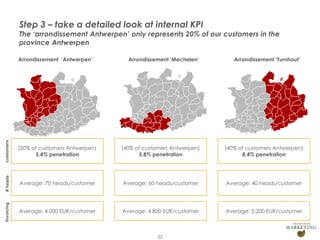

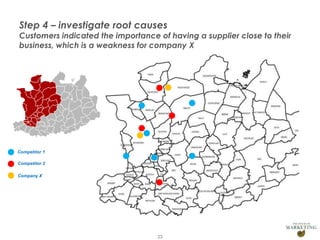

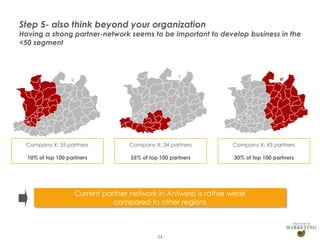

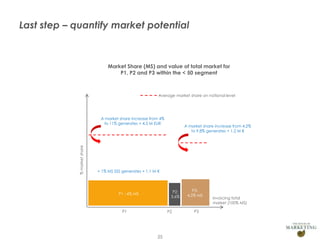

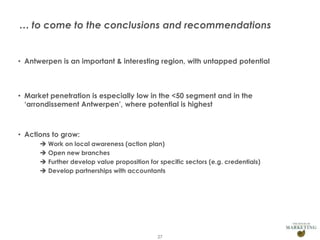

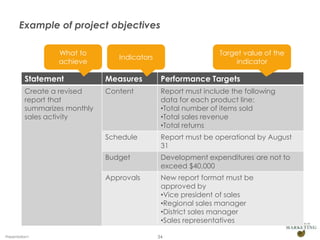

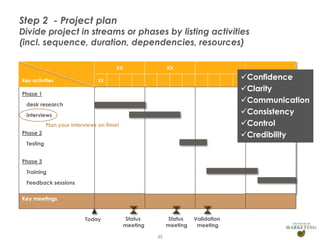

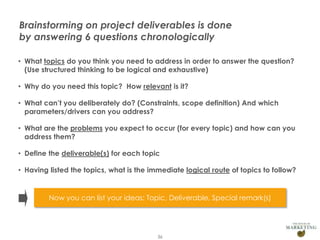

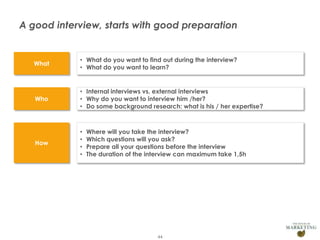

This document outlines an agenda for a market research project presentation. It begins with an introduction to The House of Marketing and its services, including temporary marketing support, marketing consultancy, and marketing talent development. It then discusses a case study of a market research project for Company X in the HR services sector. The presentation walks through the steps that would be taken to approach the research question of whether the company should invest in the region of Antwerp. This includes taking a helicopter view of the market potential and penetration in Antwerp, zooming into specific details, comparing to competitors, investigating root causes, and quantifying the potential market size. It emphasizes gathering information through desk research, data analysis, and interviews to make conclusions and recommendations