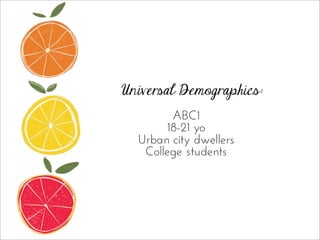

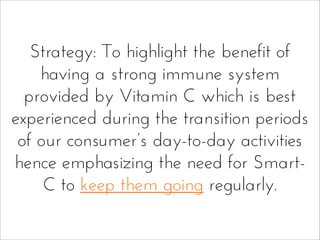

The document discusses strategies to increase market penetration for Smart C, a ready-to-drink juice with vitamin C, focusing on consumer habits and preferences among Filipinos, particularly college students. It highlights the need to make Smart C part of consumers' 'evoked set' of drinks by emphasizing its health benefits and incorporating it into their daily lives. The plan includes various marketing executions ranging from rebranding and digital media to in-store activations and consumer engagement initiatives to boost brand relevance and sales.

![[Def]: Continue uninterrupted

Keep G ing](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-71-320.jpg)

![REINTRODUCTION

[June-September]

REPACKAGE

PRESENCE IN CAFETERIAS

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-77-320.jpg)

![REINTRODUCTION

[June-September]

SHOPPER’S MARKETING

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-78-320.jpg)

![REINTRODUCTION

[June-September]

SHOPPER’S MARKETING

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-79-320.jpg)

![REINTRODUCTION

[June-September]

DIGITAL MEDIA

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-80-320.jpg)

![REINTRODUCTION

[June-September]

TVC

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-81-320.jpg)

![REINTRODUCTION

[June-September]

ACTIVATION: Midterm

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-82-320.jpg)

![REINTRODUCTION

[June-September]

FREEBIES

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-83-320.jpg)

![REINTRODUCTION

[June-September]

AMBIENT ADS

PHASE 1](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-84-320.jpg)

![PHASE 2

CONSUMER ENGAGEMENT

[October-January]

ACTIVATION: Pre-Finals Week

Student Organizations:

“Who can distribute the stress balls most

creatively?”](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-86-320.jpg)

![PHASE 2

CONSUMER ENGAGEMENT

[October-January]

ACTIVATION: Pre-Finals Week](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-87-320.jpg)

![CONSUMER ENGAGEMENT

[October-January]

RADIO

PHASE 2](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-88-320.jpg)

![CONSUMER ENGAGEMENT

[October-January]

PR: Sponsorships of Fairs and Orgs

PHASE 2](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-89-320.jpg)

![CONSUMER ENGAGEMENT

[October-January]

Digital: “Keep App”

PHASE 2](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-90-320.jpg)

![CONSUMER ENGAGEMENT

[October-January]

SOCIAL MEDIA

PHASE 2

How do you #keepgoing? @OishiSmartC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-91-320.jpg)

![CONSUMER ENGAGEMENT

[October-January]

SOCIAL MEDIA

PHASE 2

How do you #keepgoing? @OishiSmartC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-92-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

TVC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-94-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

TVC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-95-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

TVC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-96-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

DIGITAL MEDIA](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-97-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

SMART Cam](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-98-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

SUMMER:Smart CSR](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-99-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-100-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-101-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-102-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC

6 Universities

5 teams of 3

“How do you keep going?”](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-103-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-104-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-105-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-106-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-107-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-108-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-109-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-110-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-111-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC

WINNER

GETS...](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-112-320.jpg)

![PHASE 3

DEMAND GENERATION

[February-June]

ACTIVATION: BGC](https://image.slidesharecdn.com/smartckeynote-130704133822-phpapp02/85/SMART-C-Beverage-Marketing-Presentation-113-320.jpg)