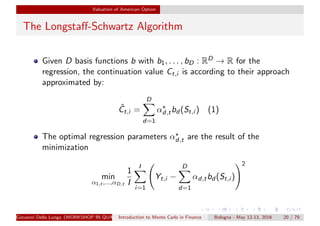

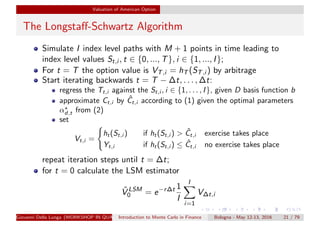

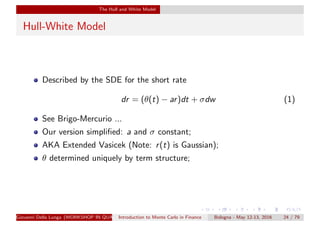

The document discusses valuation of American options using Monte Carlo simulation. It begins by explaining how the Longstaff-Schwartz algorithm can be used to value American options through regression of continuation values. It then provides details on implementing the algorithm, including simulating asset price paths, regressing continuation values against simulated values, and determining whether to exercise or continue holding the option at each time step. The document also discusses using the Hull-White model to simulate interest rates under the risk-neutral measure for use in Monte Carlo simulations.

![Valuation of American Option

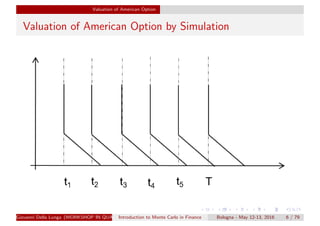

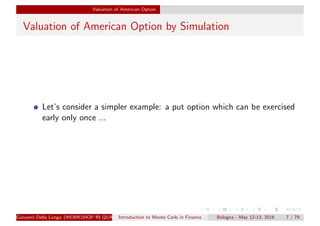

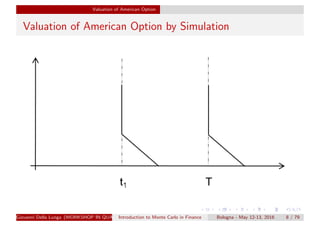

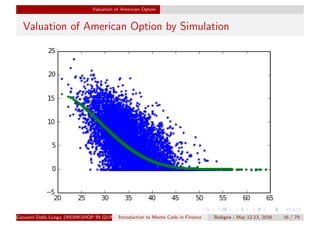

Valuation of American Option by Simulation

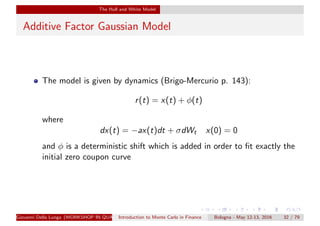

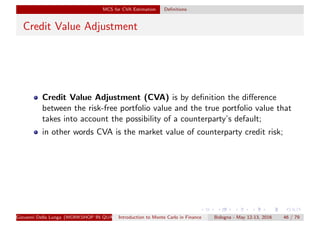

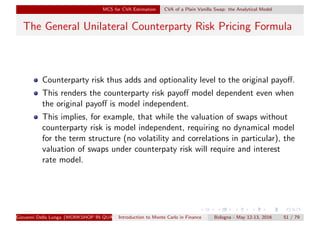

At this point the investor could exercise. How does he know if it is

convenient?

In case of exercise he knows exactly the payoff he’s getting.

In case he continues, he knows that it is the same of having a

European Put Option.

So, in mathematical terms we have the following payoff in t1

max [K − S(t1), P(t1, T; S(t1), K)]

where P(t1, T; S(t1), K) is the price of a Put which we compute

analytically! In the jargon of american products, P is called the

continuation value, i.e. the value of holding the option instead of

early exercising it.

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 10 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-10-320.jpg)

![Valuation of American Option

Valuation of American Option by Simulation

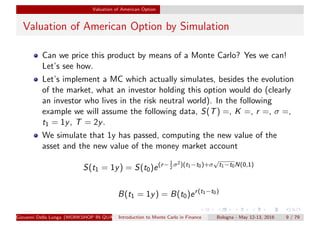

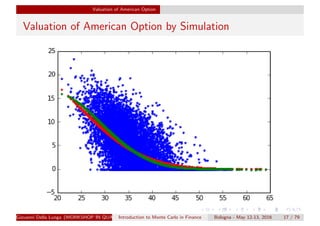

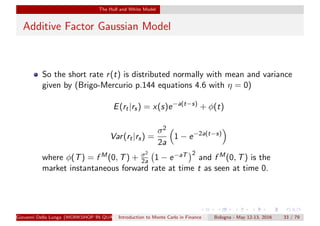

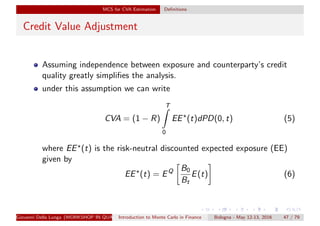

So the premium of the option is the average of this discounted payoff

calculated in each iteration of the Monte Carlo procedure.

1

N

i

max [K − Si (t1), P(t1, T; Si (t1), K)]

Some considerations are in order.

We could have priced this product because we have an analytical

pricing formula for the put. What if we didn’t have it?

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 11 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-11-320.jpg)

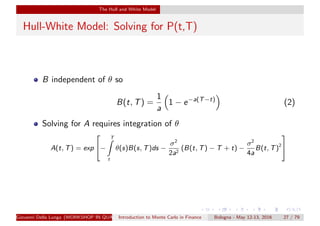

![The Hull and White Model

Hull-White Model: Determining θ

We have

− log P(0, T) =

T

0

θ(s)B(s, T)ds +

σ2

2a2

[B(0, T) − T] +

σ2

4a

B(0, T)2

+ B(0, T)r0

Differentiating and using that B(T, T) = 1 and ∂T B − 1 = −aB we

get

f (0, T) =

T

0

θ(s)∂T B(s, T)ds−

σ2

2a2

B(0, T)+

σ2

2a2

B(0, T)∂T B(0, T)+∂T B(0, T)r0

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 29 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-29-320.jpg)

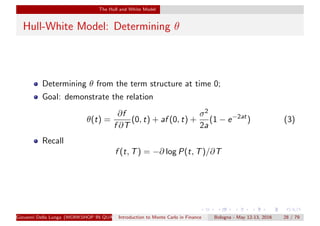

![The Hull and White Model

Hull-White Model: Determining θ

Differentiating again, get:

∂T f (0, T) = θ(T) +

T

0

θ(s)∂TT B(s, T)ds

−

σ2

2a2

∂T B(0, T)

+

σ2

2a2

[(∂T B(0, T))2

+ B(0, T)∂TT B(0, T)]

+ ∂TT B(0, T)r0

(4)

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 30 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-30-320.jpg)

![The Hull and White Model

Hull-White Model: Determining θ

Combine these equations, and use a∂T B + ∂TT B = 0;

Get:

af (0, T) + ∂T f (0, T) = θ(T) −

σ2

2a

(aB + ∂T B) +

σ2

2a

[aB∂T B + (∂T B)2

+ B∂TT B]

Substitute formula for B and simplify to get

af (0, T) + ∂T f (0, T) = θ(T) −

σ2

2a

(1 − e−2aT

)

QED

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 31 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-31-320.jpg)

![The Hull and White Model

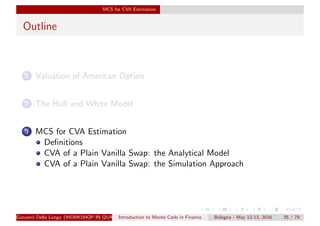

Additive Factor Gaussian Model

Model discount factors are calculated as in Brigo-Mercurio (section

4.2):

P(t, T) =

PM(0, T)

PM(0, t)

exp (A(t, T))

A(t, T) =

1

2

[V (t, T) − V (0, T) + V (0, t)] −

1 − e−a(T−t)

a

x(t)

where

V (t, T) =

σ2

a2

T − t +

2

a

e−a(T−t)

−

1

2a

e−2a(T−t)

−

3

2a

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 34 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-34-320.jpg)

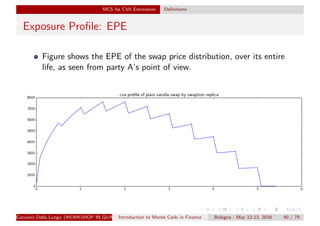

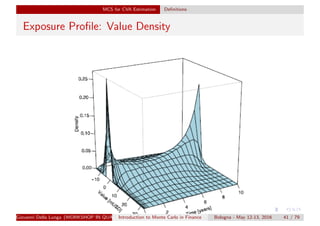

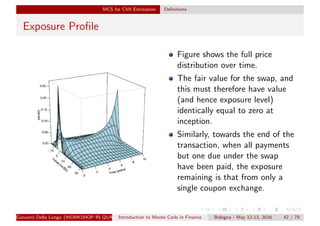

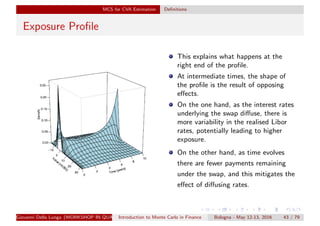

![MCS for CVA Estimation Definitions

Example: CVA of plain vanilla Interest-Rate Swap

Therefore, if B were to default at a point in the life of the trade when

swap rates had increased, then A would need to replace in the

market—at higher cost than the fixed amount being paid to B—the

floating cashflows promised and not delivered by B.

To compute the credit exposure for the swap, we would need to

estimate the values the swap could take in different market scenarios

at points in the future.

For practical reason it can be useful to characterise the distribution of

values with some quantity which can be useful for various risk

controlling;

For example we could compute the so called Expected Positive

Exposure (more in the following) as

EPEt = E[V +

t ]

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 39 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-39-320.jpg)

![MCS for CVA Estimation CVA of a Plain Vanilla Swap: the Analytical Model

The General Unilateral Counterparty Risk Pricing Formula

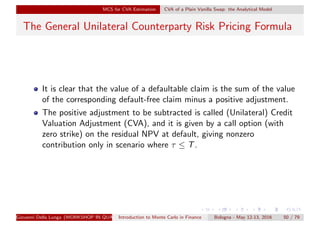

At valuation time t, and provided the counterparty has not defaulted

before t, i.e. on {τ > t}, the price of our payoff with maturity T

under counterparty risk is

Et[¯Π(t, T)] = Et[Π(t, T)] − Et[LGD It≤τ≤T D(t, τ)(NPV (τ))+

]

positive counterparty-risk adjustment

= Et[Π(t, T)] − UCVA(t, T)

(8)

with

UCVA(t, T) = Et[LGD It≤τ≤T D(t, τ)(NPV (τ))+

]

= Et[LGD It≤τ≤T D(t, τ)EAD]

(9)

Where LGD = 1 − REC is the loss given default, and the recovery

fraction REC is assumed to be deterministic.

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 49 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-49-320.jpg)

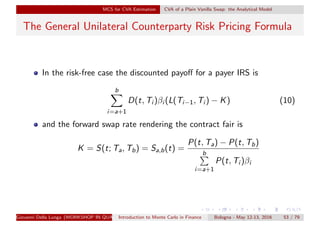

![MCS for CVA Estimation CVA of a Plain Vanilla Swap: the Analytical Model

The General Unilateral Counterparty Risk Pricing Formula

Of course if we consider the possibility that ”C” may default, the

correct spread to be paid in the fixed leg is lower as we are willing to

be rewarded for bearing this default risk.

In particular we have

UCVA(t, Tb) = LGD Et[Iτ≤Tb

D(t, τ)(NPV (τ))+

]

= LGD

Tb

Ta

PS (t; s, Tb, K, S(t; s, Tb), σs,Tb

) dsQ{τ ≤ s}

(11)

being PS (t; s, Tb, K, S(t; s, Tb), σs,Tb

) the price in t of a swaption

with maturity s, strike K underlying forward swap rate S(t; s, Tb),

volatility σs,Tb

and underlying swap with final maturity Tb.

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 54 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-54-320.jpg)

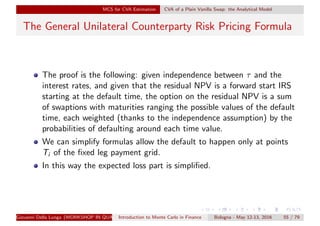

![MCS for CVA Estimation CVA of a Plain Vanilla Swap: the Analytical Model

The General Unilateral Counterparty Risk Pricing Formula

Indeed in the case of postponed (default occour to the first Ti

following τ) payoff we obtain:

UCVA(t, Tb) = LGD Et [Iτ≤Tb

D(t, τ)(NPV (τ))+

]

= LGD

b−1

i=a+1

PS (t; s, Tb, K, S(t; s, Tb), σs,Tb ) (Q{τ ≥ Ti } − Q{τ > Ti })

(12)

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 56 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-56-320.jpg)

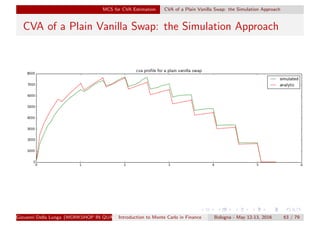

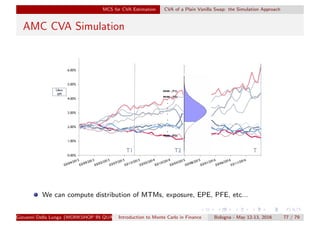

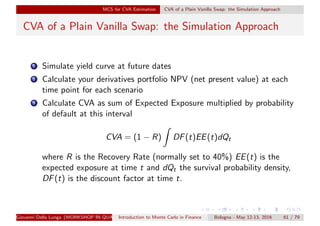

![MCS for CVA Estimation CVA of a Plain Vanilla Swap: the Simulation Approach

CVA of a Plain Vanilla Swap: the Simulation Approach

In this simple example we will use a modified version of Hull White

model to generate future yield curves. In practice many banks use

some yield curve evolution models based on this model.

For each point of time we will generate whole yield curve based on

short rate. Then we will price our interest rate swap on each of these

curves;

To approximate CVA we will use BASEL III formula for regulatory

capital charge approximating default probability [or survival

probability ] as exp(−ST /(1 − R)) so we get

CVA = (1 − R)

i

EE(Ti ) + EE(Ti−1

2

e−S(Ti−1)/(1−R)

− e−S(Ti )/(1−R)

where EE is the discounted Expected Exposure of portfolio.

Giovanni Della Lunga (WORKSHOP IN QUANTITATIVE FINANCE)Introduction to Monte Carlo in Finance Bologna - May 12-13, 2016 62 / 79](https://image.slidesharecdn.com/simulationmethodsfinance2-161104215407/85/Simulation-methods-finance_2-62-320.jpg)