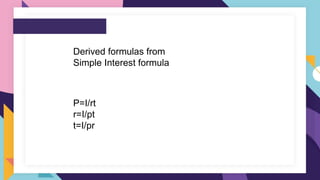

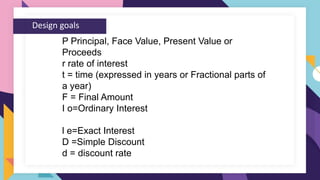

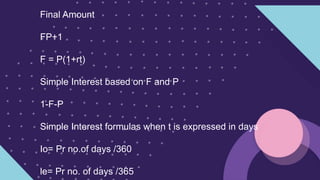

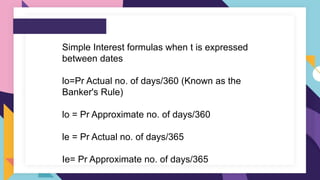

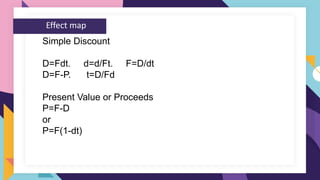

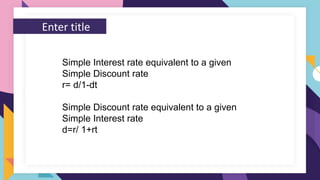

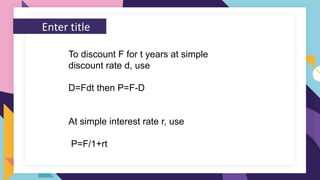

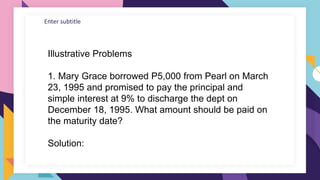

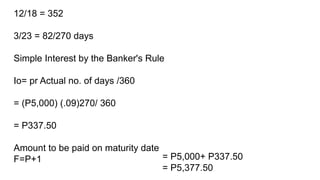

The document defines simple interest and simple discount, providing formulas to calculate both. Simple interest is calculated on the original principal for the full time period at the stated interest rate. Simple discount is a deduction from the maturity value when the obligation is sold before the due date, calculated as a percentage of the maturity value rather than the principal. Formulas and examples are provided to demonstrate calculating simple interest between dates using the banker's rule.