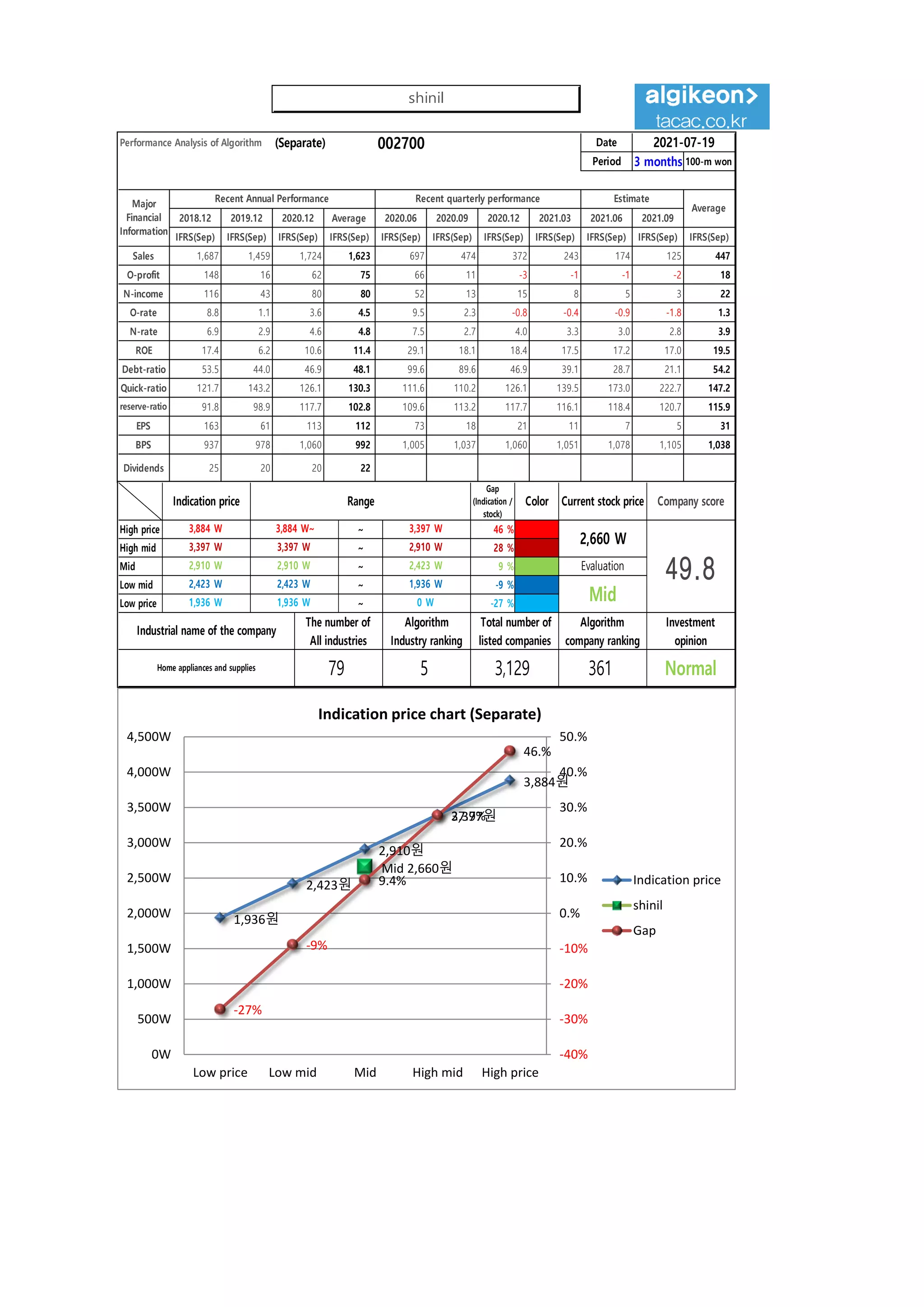

This document provides a performance analysis of an algorithm company over a 3 month period from 2018-2021. It includes sales, operating profit, net income, profitability ratios, debt ratios, liquidity ratios, earnings per share and book value per share on a quarterly and annual basis. It also shows the company's current stock price, indication price range, and analysis of the company's stock price rise probability score and investment opinion going forward.

![[Price for scheduled purchasing]

Arbitrarily made

Algorithm stocks Trading Strategies (Separate) 002700 Date

Period

Gap

(Indication /

stock)

Color

2021-07-19

3 months

Current stock price Evaluation

Stock price rise

probability score

Investment opinion Prospective purchase amount

2,660 W Mid 35.7 Normal 4,000,000 W

Suggested Purchase

Amount 1,611,722 W

Number of stocks

purchased 606

Indication price Range Buying / Selling Buying / Selling [Stocks]

High price 3,884 W 3,884 W~ ~ 3,397 W 46 % -741,395 W -191

High mid 3,397 W 3,397 W ~ 2,910 W 28 % -446,392 W -131

Mid 2,910 W 2,910 W ~ 2,423 W 9 % -151,389 W -52

Low mid 2,423 W 2,423 W ~ 1,936 W -9 % 143,613 W 59

low price 1,936 W 1,936 W ~ 0 W -27 % 438,616 W 227

2021.02.23 2021.03.24 2021.04.21 2021.05.21 2021.06.18 2021.07.16

35.0 42.9 32.0

Stock price rise

probability score

A Sector 50.0 48.1 51.8 47.6 49.6 41.5

35.7

B Sector 32.1 49.2 47.6 47.6 36.3 22.5

Total average 41.0 48.6 33.8

18 % -34 %

2021.03.24 2021.04.21 2021.05.21 2021.06.18 2021.07.16

Total of

increase rate

Total score

A Sector -4 % 7 % -9 % 4 % -19 %

-8 % 41.0

B Sector 35 % -211 % 67 % -31 % -61 %

Total average 16 % -44 % 3 %

-4% 7%

-9% 4%

-19%

35%

-211%

67%

-31%

-61%

16%

-44%

3%

18%

-34%

-250%

-200%

-150%

-100%

-50%

0%

50%

100%

2021.03.24 2021.04.21 2021.05.21 2021.06.18 2021.07.16

Increase rate of stock price rise

A sector

B sector

Total average

shinil

50 48

52

48 50

41

32

49

16

48

36

23

41

49

34 35

43

32

0

10

20

30

40

50

60

2021.02.23 2021.03.24 2021.04.21 2021.05.21 2021.06.18 2021.07.16

Stock price rise probability score

A sector

B sector

Total average](https://image.slidesharecdn.com/shinil002700algorithminvestmentreport-210719013304/75/shinil-002700-Algorithm-Investment-Report-2-2048.jpg)