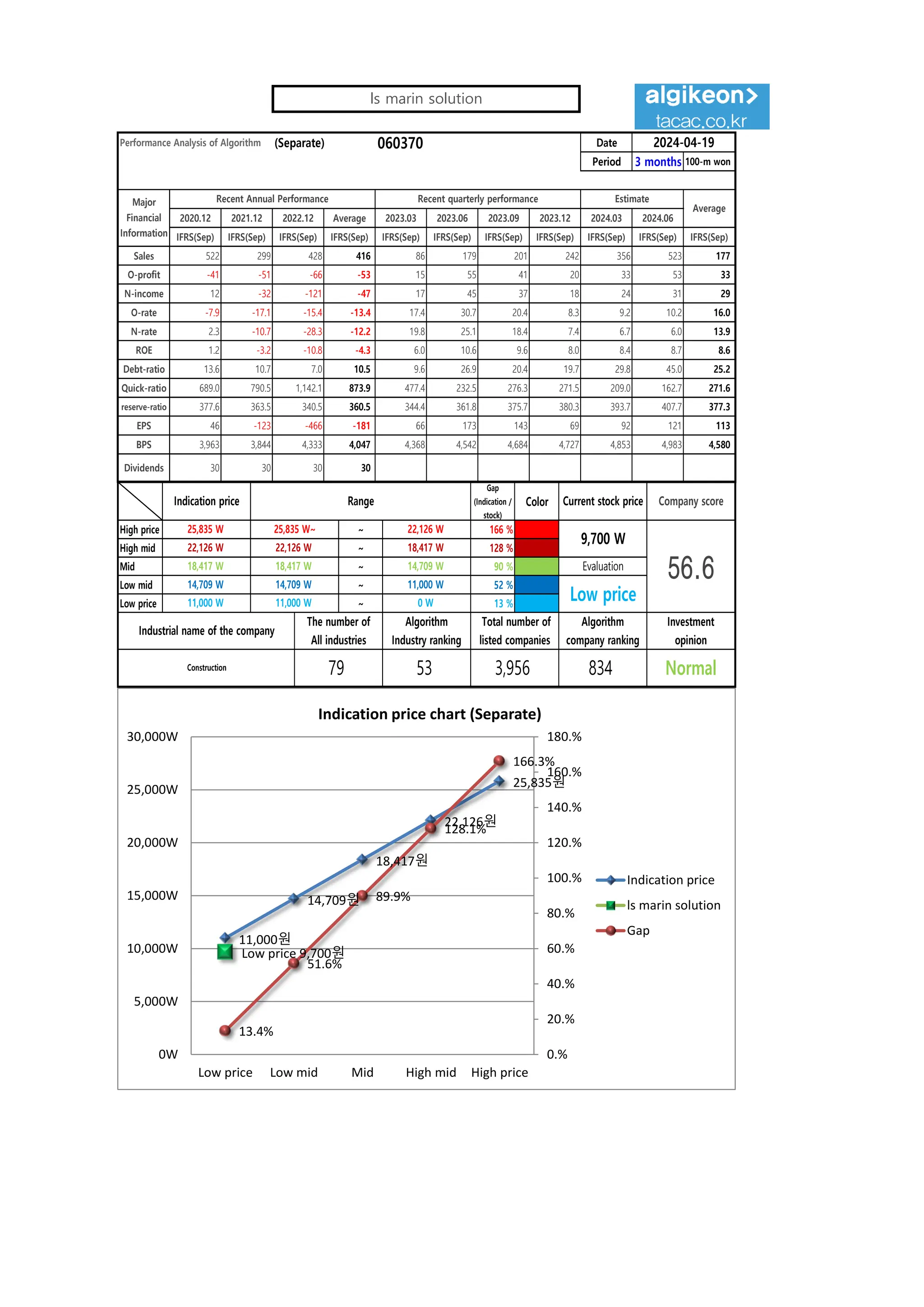

The document provides a detailed performance analysis of an algorithm over a three-month period, including key financial metrics such as sales, profit margins, net income, and stock price evaluations. It presents investment opinions, price ranges, and various sector performance predictions, while noting the limitations and responsibilities regarding the accuracy of the data provided. Compliance and legal disclaimers are also included, emphasizing the importance of user discretion in investment decisions.

![[Price for scheduled purchasing]

Arbitrarily made

Algorithm stocks Trading Strategies (Separate) 060370 Date

Period

Gap

(Indication /

stock)

Color

low price 11,000 W 11,000 W ~ 0 W 13 % -726,369 W -66

Low mid 14,709 W 14,709 W ~ 11,000 W 52 % -2,797,950 W -190

Mid 18,417 W 18,417 W ~ 14,709 W 90 % -4,869,532 W -264

High mid 22,126 W 22,126 W ~ 18,417 W 128 % -6,941,113 W All selling

Suggested Purchase

Amount 5,418,382 W

Number of stocks

purchased 559

Indication price Range Buying / Selling Buying / Selling [Stocks]

High price 25,835 W 25,835 W~ ~ 22,126 W 166 % -9,012,695 W All selling

2024-04-19

3 months

Current stock price Evaluation

Stock price rise

probability score

Investment opinion Prospective purchase amount

9,700 W Low price 74.1 Normal 10,000,000 W

Stock price rise

probability score

A Sector 45.5 50.6 45.7 46.4 44.3 53.6

74.1

B Sector 19.2 26.3 46.4 46.4 22.5 30.8

Total average 32.3 38.4 41.2 20.0 33.4 42.2

2023.11.21 2023.12.19 2024.01.19 2024.02.20 2024.03.20 2024.04.18

2024.01.19 2024.02.20 2024.03.20 2024.04.18

Total of

increase rate

Total score

A Sector 10 % -11 % 2 % -5 % 17 %

-4 % 55.0

B Sector 27 % 28 % 21 % -106 % 27 %

Total average 16 % 7 % -106 % 40 % 21 %

2023.12.19

10%

-11%

2% -5%

17%

27% 28% 21%

-106%

27%

16%

7%

-106%

40%

21%

-150%

-100%

-50%

0%

50%

2023.12.19 2024.01.19 2024.02.20 2024.03.20 2024.04.18

Increase rate of stock price rise

A sector

B sector

Total average

ls marin solution

45

51

46 46 44

54

19

26

37

46

23

31

32

38

41

20

33

42

0

10

20

30

40

50

60

2023.11.21 2023.12.19 2024.01.19 2024.02.20 2024.03.20 2024.04.18

Stock price rise probability score

A sector

B sector

Total average](https://image.slidesharecdn.com/lsmarinesolution060370algoritminvestmentreport-240419012707-d85c8a4a/75/ls-marine-solution-060370-Algoritm-Investment-Report-2-2048.jpg)