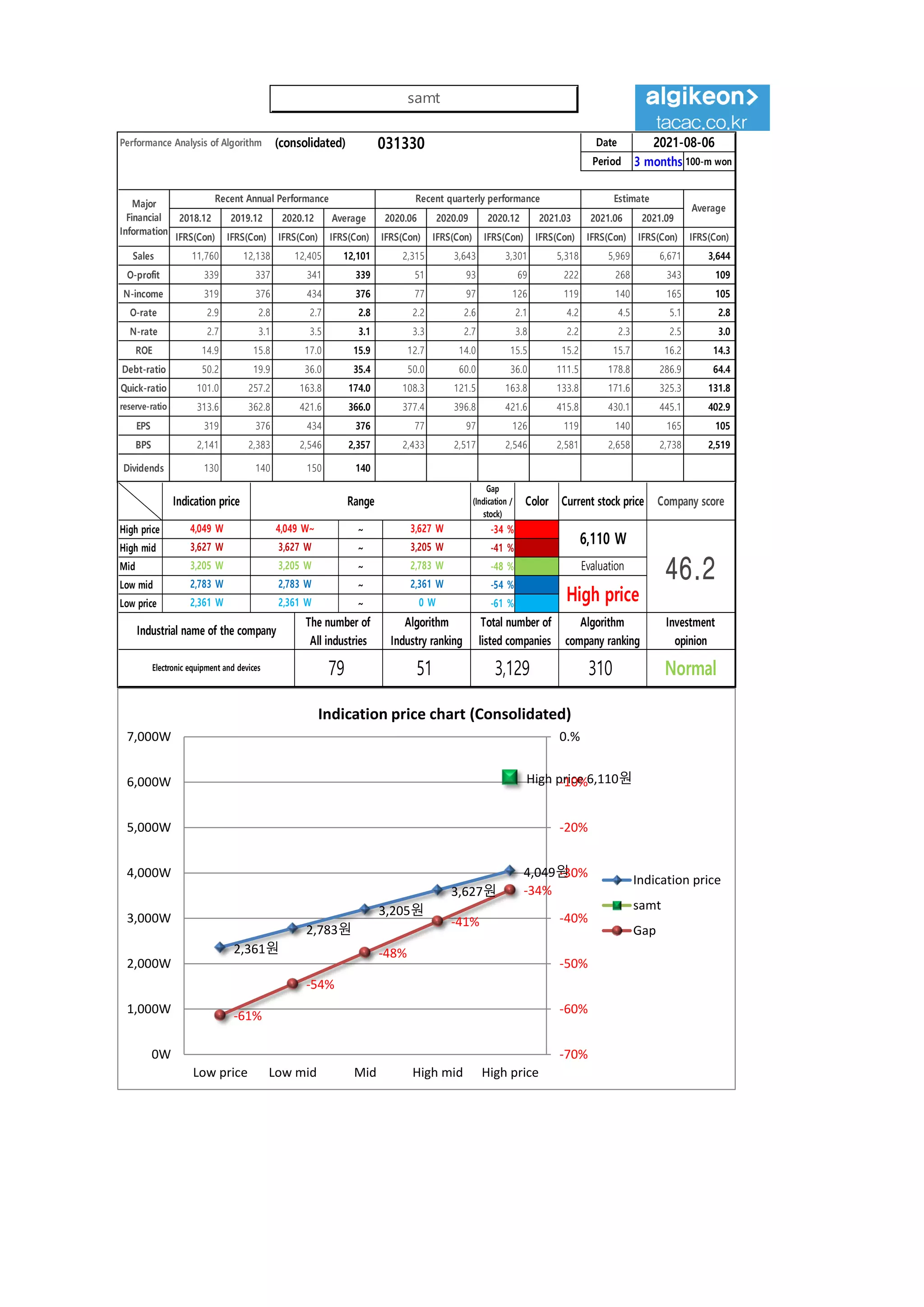

This document provides a summary of financial and stock performance data for a company over several quarters and years. It also includes an analysis of the company's current stock price compared to an indicated price range, recommendations to purchase stock if the price is within certain thresholds of the indicated range, and charts tracking the company's stock price increase probability and rates over time. The analysis aims to help investors determine if and when to purchase this company's stock.

![[Price for scheduled purchasing]

Arbitrarily made

Algorithm stocks Trading Strategies (consolidated) 031330 Date

Period

Gap

(Indication /

stock)

Color

2021-08-06

3 months

Current stock price Evaluation

Stock price rise

probability score

Investment opinion Prospective purchase amount

6,110 W High price 38.7 Normal 3,500,000 W

Suggested Purchase

Amount 1,176,669 W

Number of stocks

purchased 193

Indication price Range Buying / Selling Buying / Selling [Stocks]

High price 4,049 W 4,049 W~ ~ 3,627 W -34 % 396,963 W 98

High mid 3,627 W 3,627 W ~ 3,205 W -41 % 478,214 W 132

Mid 3,205 W 3,205 W ~ 2,783 W -48 % 559,464 W 175

Low mid 2,783 W 2,783 W ~ 2,361 W -54 % 640,715 W 230

low price 2,361 W 2,361 W ~ 0 W -61 % 721,966 W 306

Stock price rise

probability score

A Sector 45.5 51.8 45.2 47.5 53.8 52.8

38.7

B Sector 35.4 32.5 43.8 47.5 30.4 46.3

Total average

2021.03.16 2021.04.13 2021.05.12 2021.06.10 2021.07.08 2021.08.05

40.5 42.2 44.5 23.8 42.1 49.5

44 % 15 %

2021.04.13 2021.05.12 2021.06.10 2021.07.08 2021.08.05

Total of

increase rate

Total score

A Sector 12 % -15 % 5 % 12 % -2 %

-4 % 51.0

B Sector -9 % 26 % 8 % -56 % 34 %

Total average 4 % 5 % -87 %

46

52

45 48

54 53

35

33

44

48

30

46

40 42 44

24

42

50

0

10

20

30

40

50

60

2021.03.16 2021.04.13 2021.05.12 2021.06.10 2021.07.08 2021.08.05

Stock price rise probability score

A sector

B sector

Total average

12%

-15%

5%

12%

-2%

-9%

26%

8%

-56%

34%

4% 5%

-87%

44%

15%

-100%

-80%

-60%

-40%

-20%

0%

20%

40%

60%

2021.04.13 2021.05.12 2021.06.10 2021.07.08 2021.08.05

Increase rate of stock price rise

A sector

B sector

Total average

samt](https://image.slidesharecdn.com/samt031330algorithminvestmentreport-210806015312/85/samt-031330-Algorithm-Investment-Report-2-320.jpg)