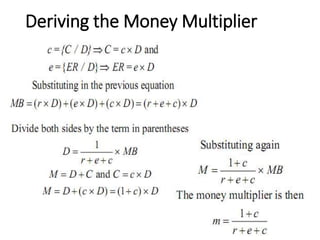

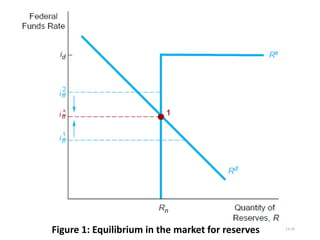

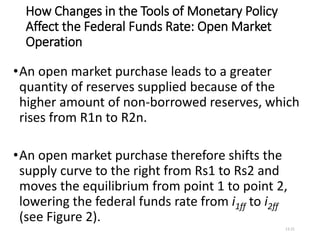

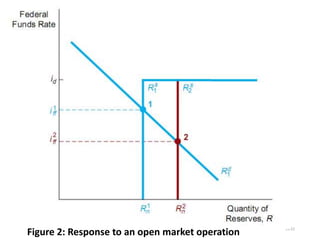

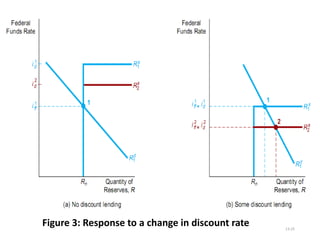

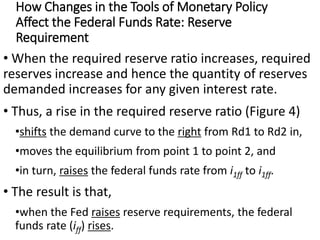

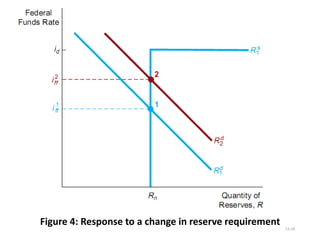

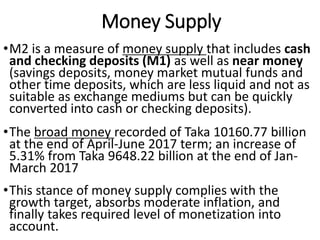

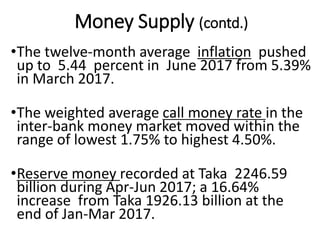

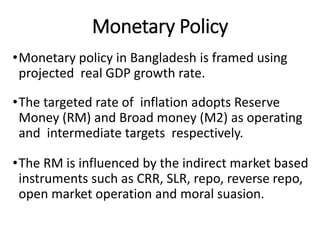

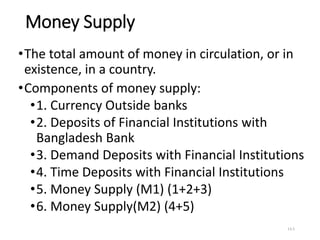

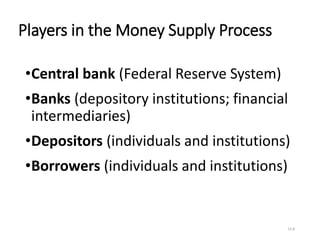

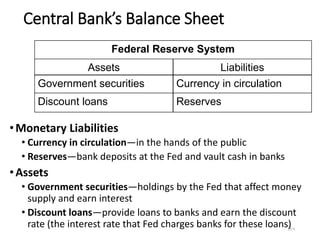

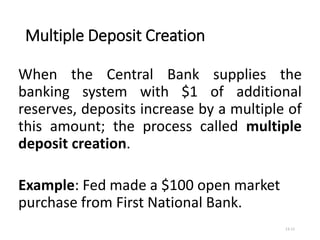

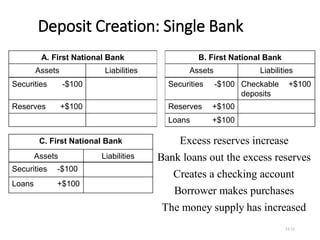

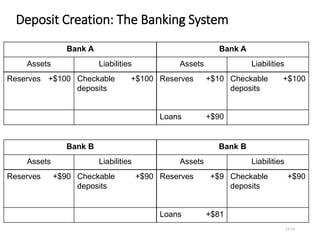

The document discusses monetary policy tools and money supply. It explains that central banks use tools like open market operations, adjusting reserve requirements and the discount rate to influence money supply and interest rates. Changing the monetary base through open market purchases affects money multiplier and money supply. Raising reserve requirements shifts demand for reserves right, raising rates. The discount rate only impacts rates if banks borrow, otherwise it has no effect. Money supply (M2) in Bangladesh grew 5.31% in 2017 to support growth while absorbing inflation.

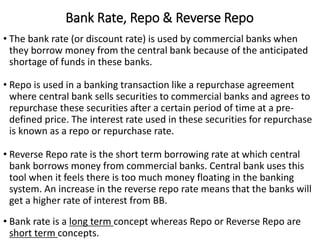

![M m MB

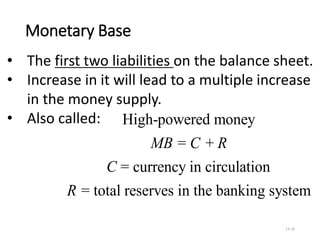

The Money Multiplier

•Define money as currency plus checkable

deposits: M1

•Link the money supply (M) to the monetary

base (MB) [i.e., currency in circulation plus

total reserves in the banking system] and,

• Let m be the money multiplier; which tells us

how much the money supply changes for a

given change in the monetary base MB](https://image.slidesharecdn.com/session-2moneysupplymonetarypolicy-230525171427-b716b73b/85/Session-2-Money-Supply-Monetary-Policy-ppt-16-320.jpg)