The document discusses various monetary standards, their definitions, objectives, and types, including metallic and paper currency standards. It covers the principles of note issuance, notable systems for issuing currency, and the qualities of a good monetary system. Additionally, it concludes with observations on stability and future prospects of the gold standard compared to other systems.

![MONETARY

STANDARDS.

ECONOMICS-2.

MUNAZZA,

1ST YEAR, BA.LLB

2ND SEMESTER [2022-23],

SCHOOL OF LAW,

UNIVERSITY OF MYSORE.](https://image.slidesharecdn.com/monetarystandards-230824150125-17e2edb7/75/MONETARY-STANDARDS-pptx-1-2048.jpg)

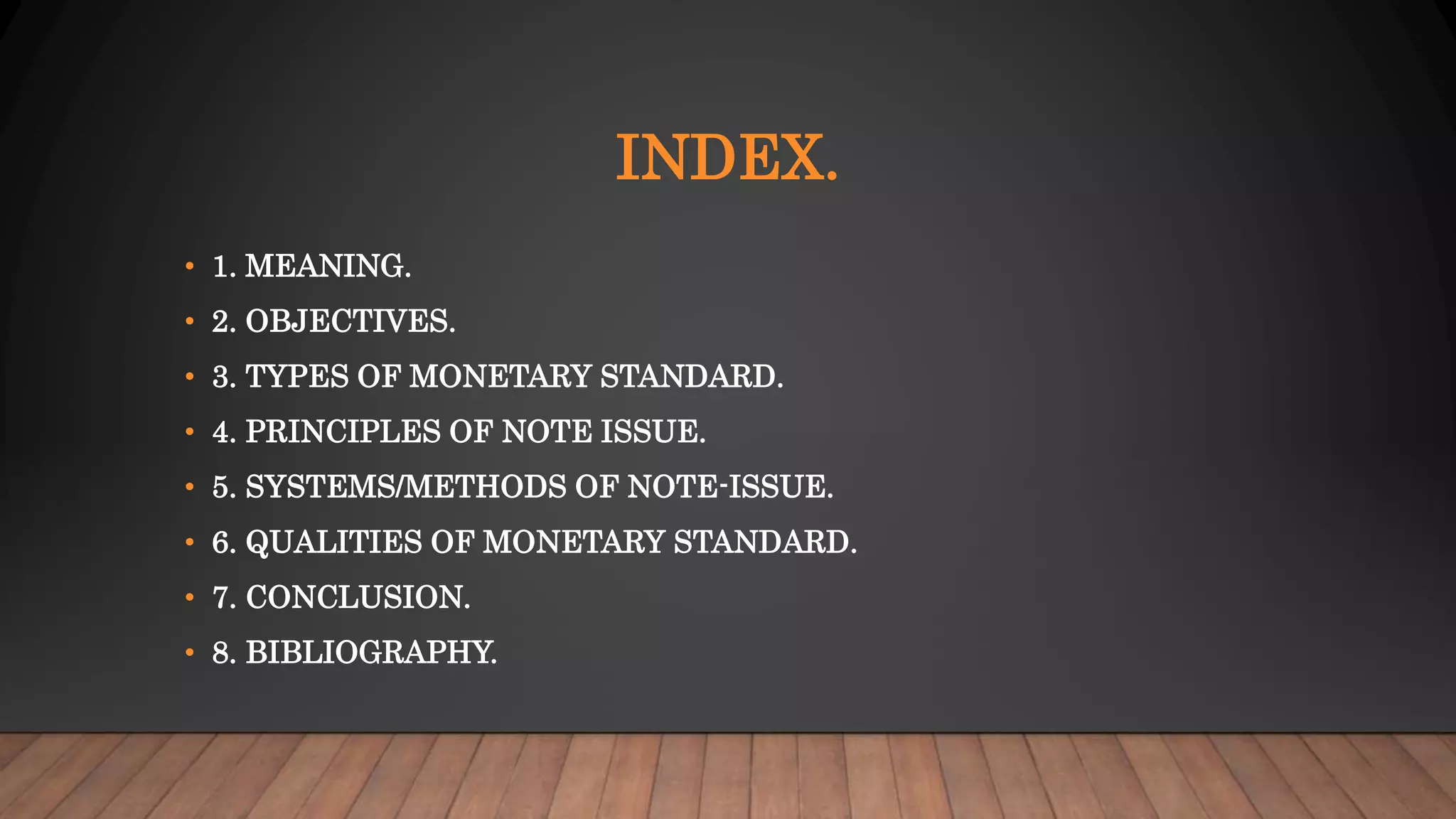

![2. OBJECTIVES:

• MONETARY STANDARD HAS 2 MAIN OBJECTIVES:

1] MAINTAIN STABILITY OF THE INTERNAL PRICE LEVEL.

2] MAINTAIN STABILITY OF THE EXTERNAL VALUE i.e., EXCHANGE

VALUE IN TERMS OF FOREIGN CURRENCIES.](https://image.slidesharecdn.com/monetarystandards-230824150125-17e2edb7/75/MONETARY-STANDARDS-pptx-4-2048.jpg)

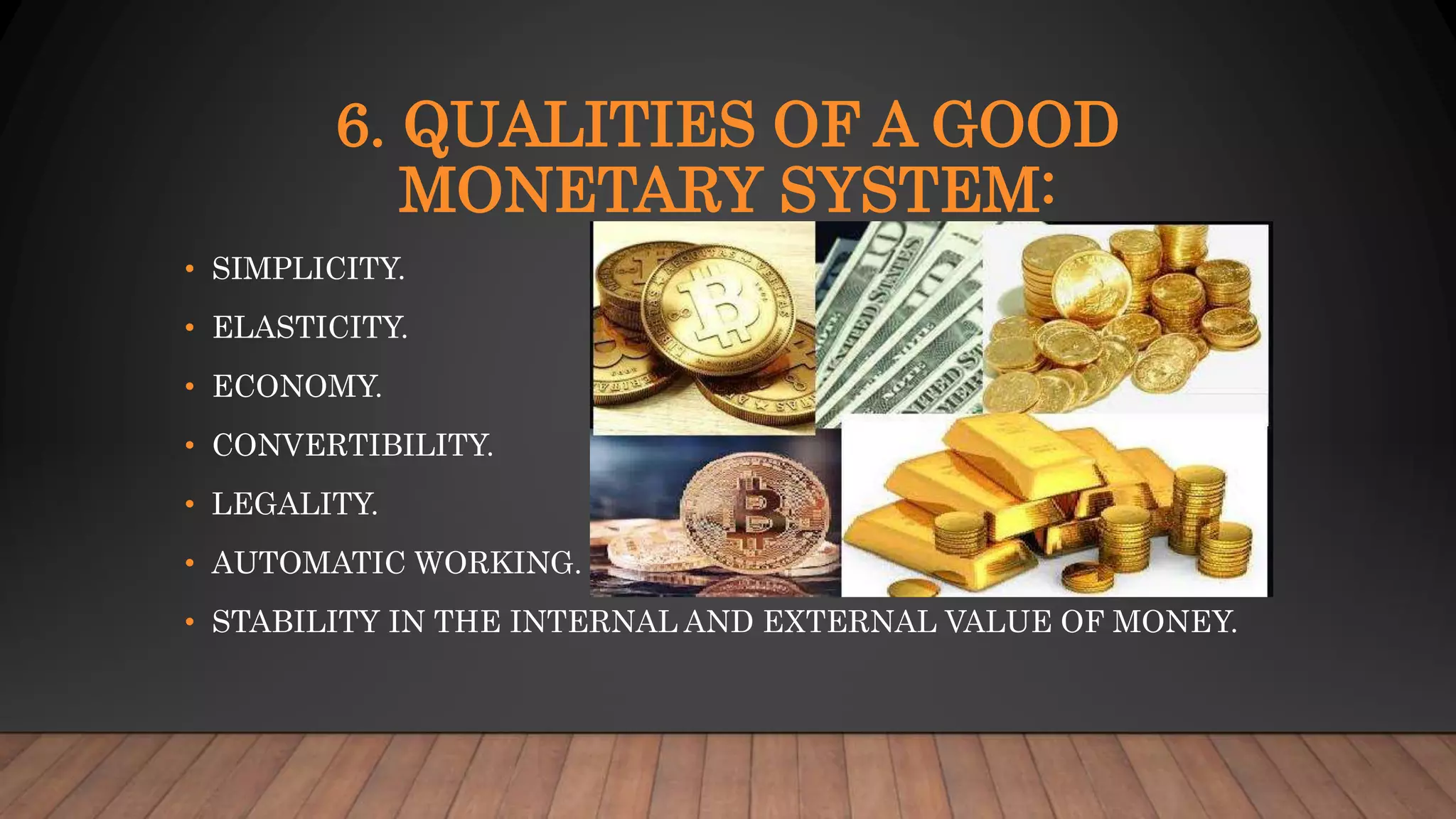

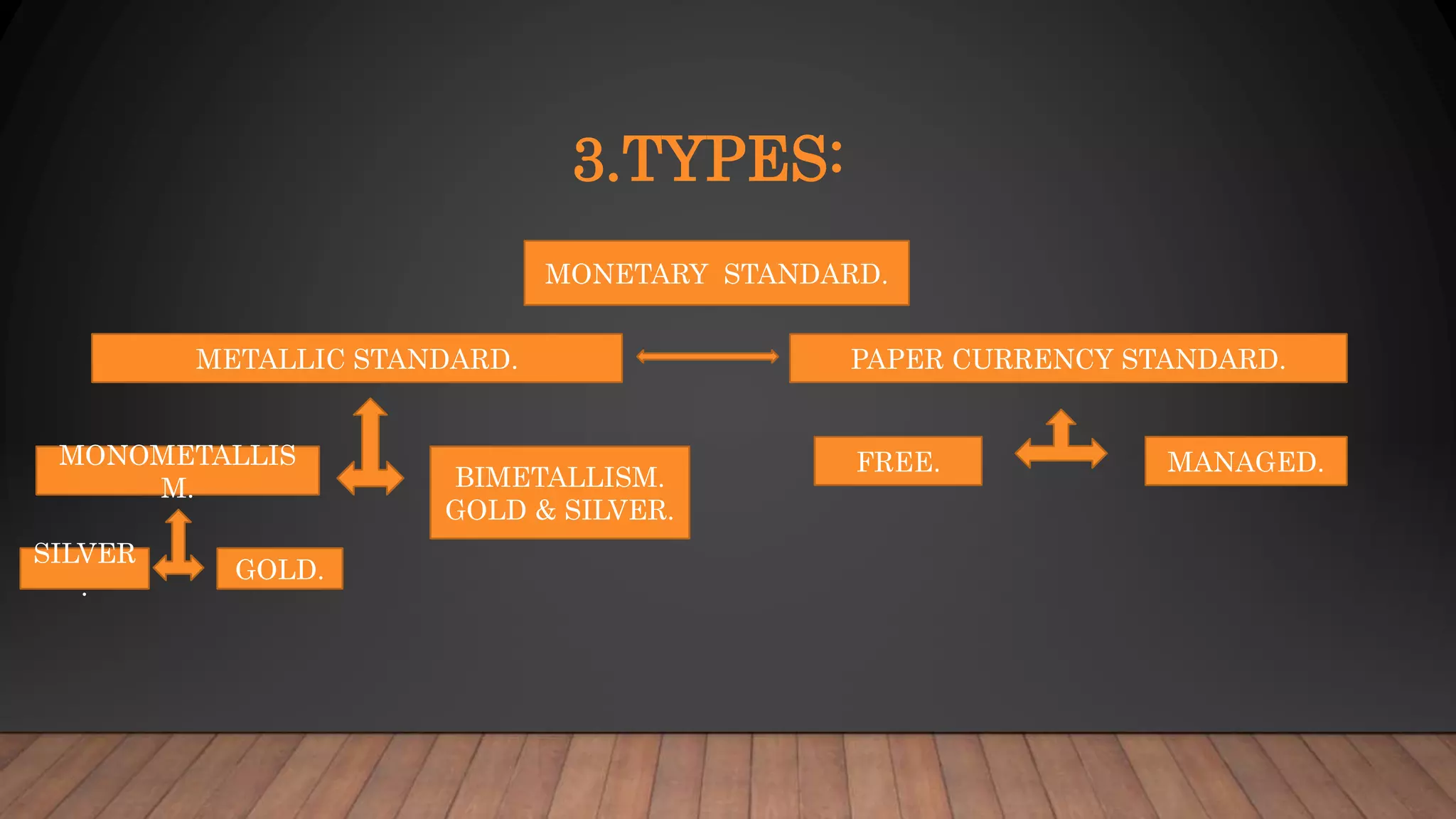

![METALLIC STANDARD

METAL COINS- STANDARD COINS.

MONOMETALLISM. BIMETALLISM.

GOLD & SILVER.

SILVER GOLD.

DIRECT

.

INDIREC

T

A] GOLD BULLION STANDARD.

B] GOLD EXCHANGE

STANDARD.

C] GOLD PARITY STANDARD.

D] GOLD RESERVE STANDARD.](https://image.slidesharecdn.com/monetarystandards-230824150125-17e2edb7/75/MONETARY-STANDARDS-pptx-6-2048.jpg)

![KINDS OF GOLD STANDARDS:

[1] Direct Gold Standard:

It referred to as Gold coin standard or Gold currency standard.

[2] Indirect Gold Standard: of four types;

- (1) The Gold Bullion Standard.

- (2) The Gold Exchange Standard.

- (3) The Gold Reserve Standard.

- (4) The Gold Parity Standard.](https://image.slidesharecdn.com/monetarystandards-230824150125-17e2edb7/75/MONETARY-STANDARDS-pptx-10-2048.jpg)