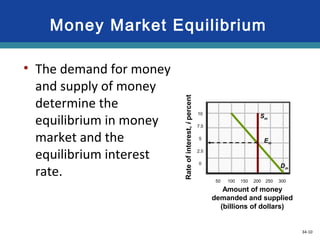

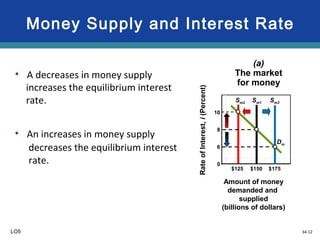

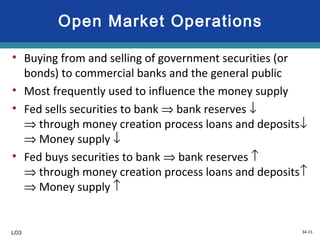

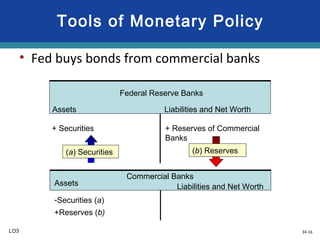

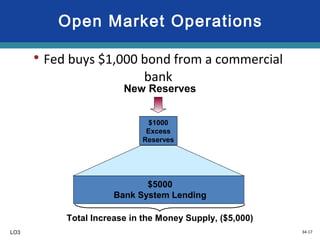

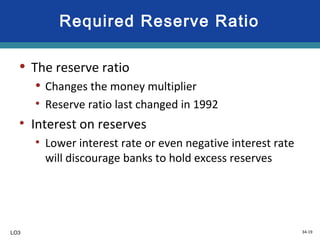

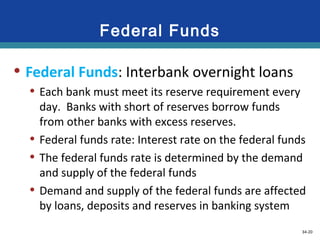

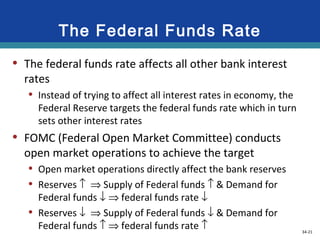

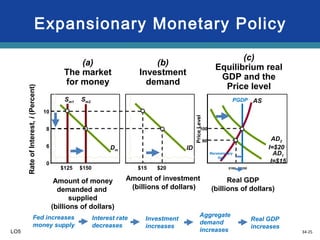

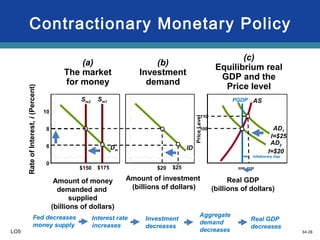

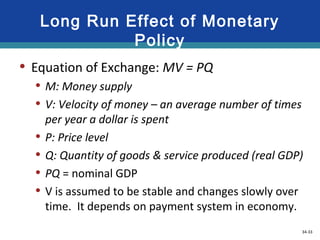

The document provides an overview of monetary policy and how central banks use tools like open market operations and required reserve ratios to influence money supply and interest rates. It discusses how expansionary and contractionary monetary policy can be used to achieve goals like price stability and full employment. Expansionary policy works by increasing money supply, lowering interest rates, and boosting aggregate demand and economic growth. Contractionary policy does the opposite by decreasing money supply, raising interest rates, and reducing aggregate demand and inflationary pressures.