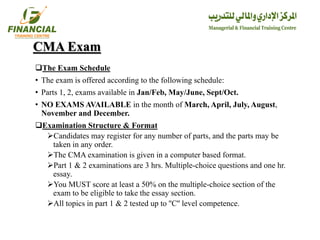

The document provides information about the Certified Management Accountant (CMA) certification. It discusses that the CMA demonstrates expertise in financial planning, analysis, control, decision support, and ethics. Achieving the CMA is focused on critical business skills, respected by leading employers, and results in higher compensation. The CMA exams are administered worldwide and consist of two parts that can be taken in any order. The certification requires membership in IMA, a bachelor's degree, two years of professional experience, and passing both exam parts. The Managerial and Financial Training Center offers courses to help candidates prepare for the CMA exams.