This document provides instructions for configuring taxation procedures in SAP from TAXINJ to TAXINN. Key steps include:

1. Assigning the TAXINN tax procedure at the country level in SPRO.

2. Configuring TAXINN and maintaining excise defaults.

3. Classifying condition types for excise determination.

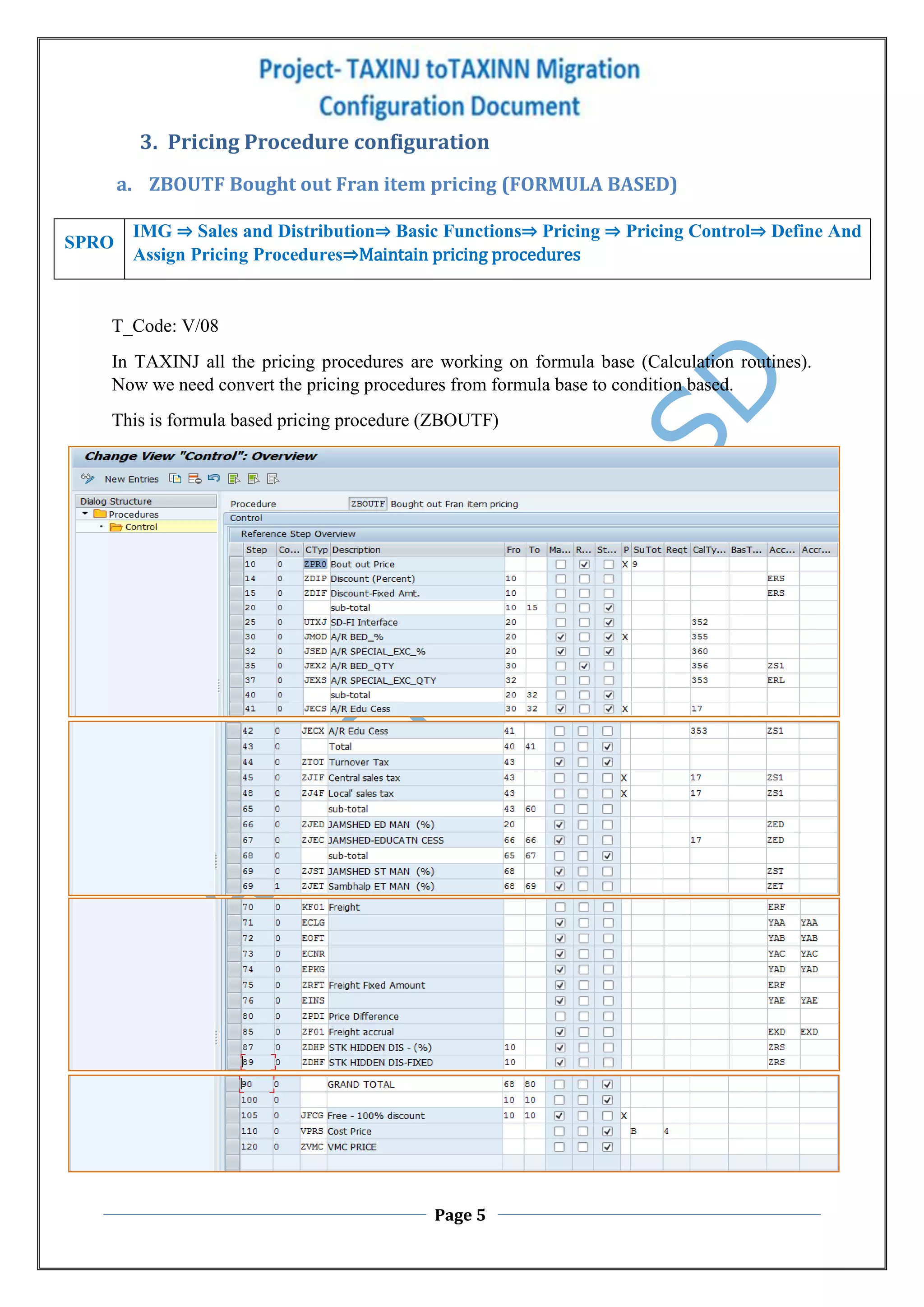

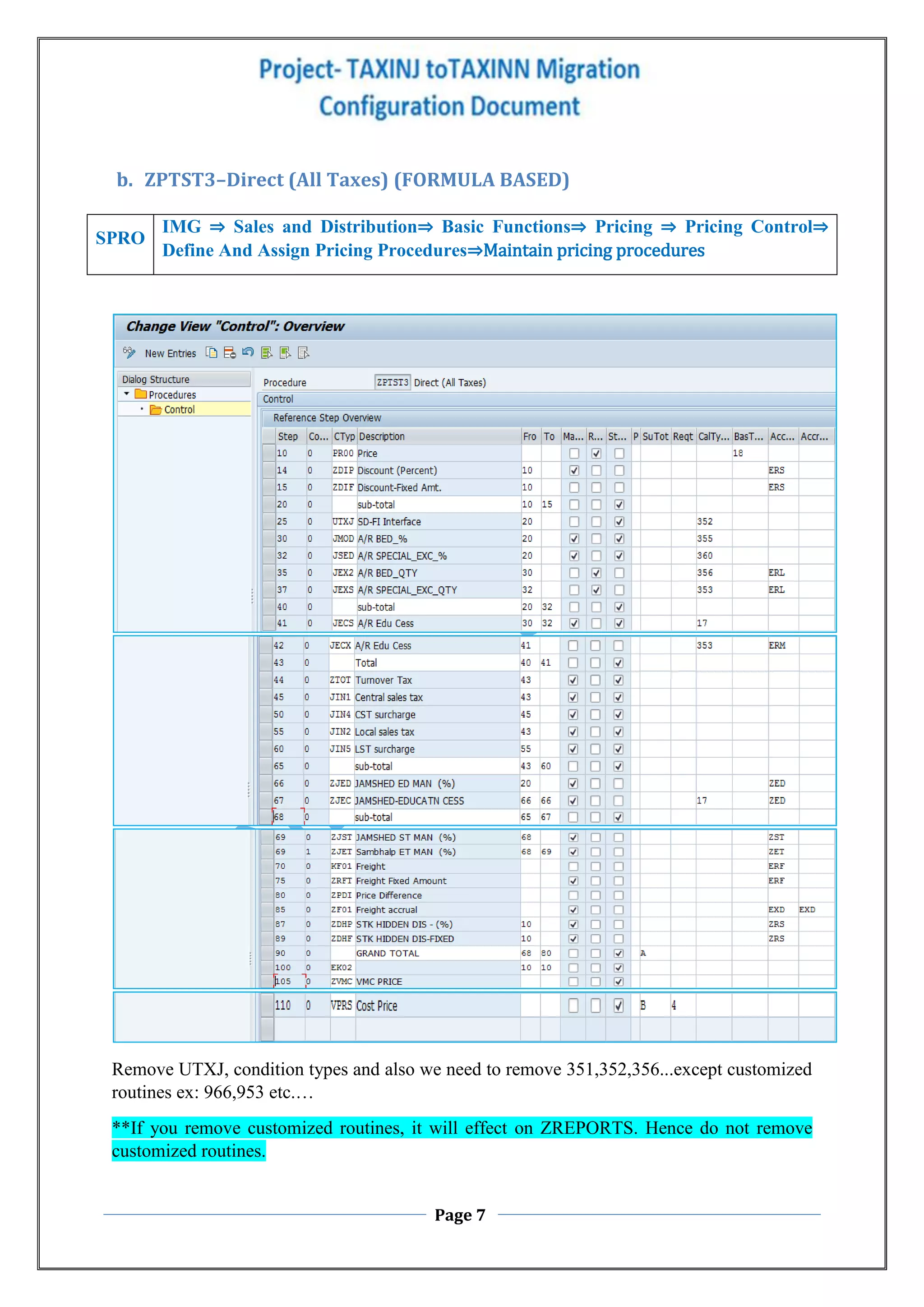

4. Converting formula-based pricing procedures to condition-based by removing tax routines.

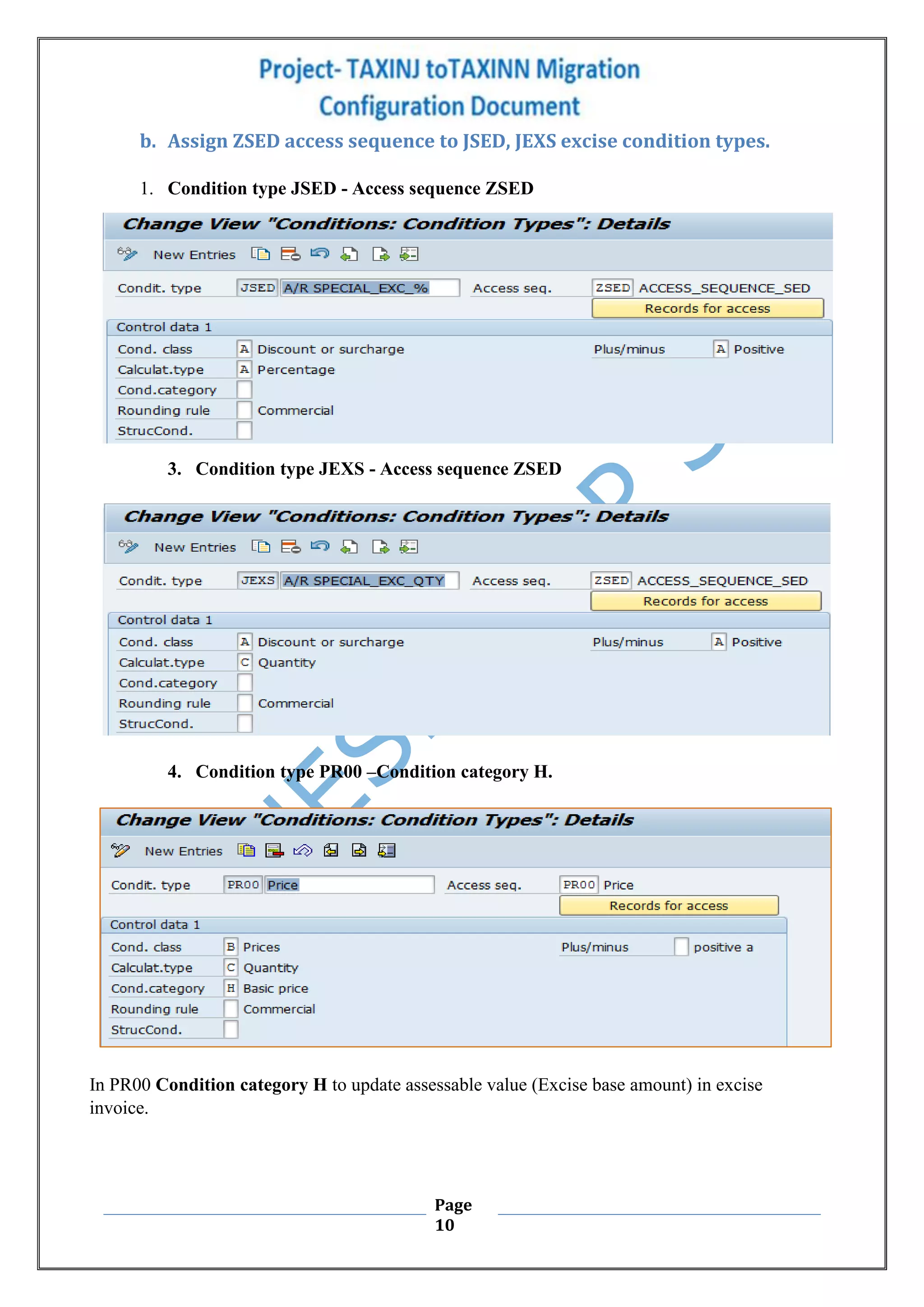

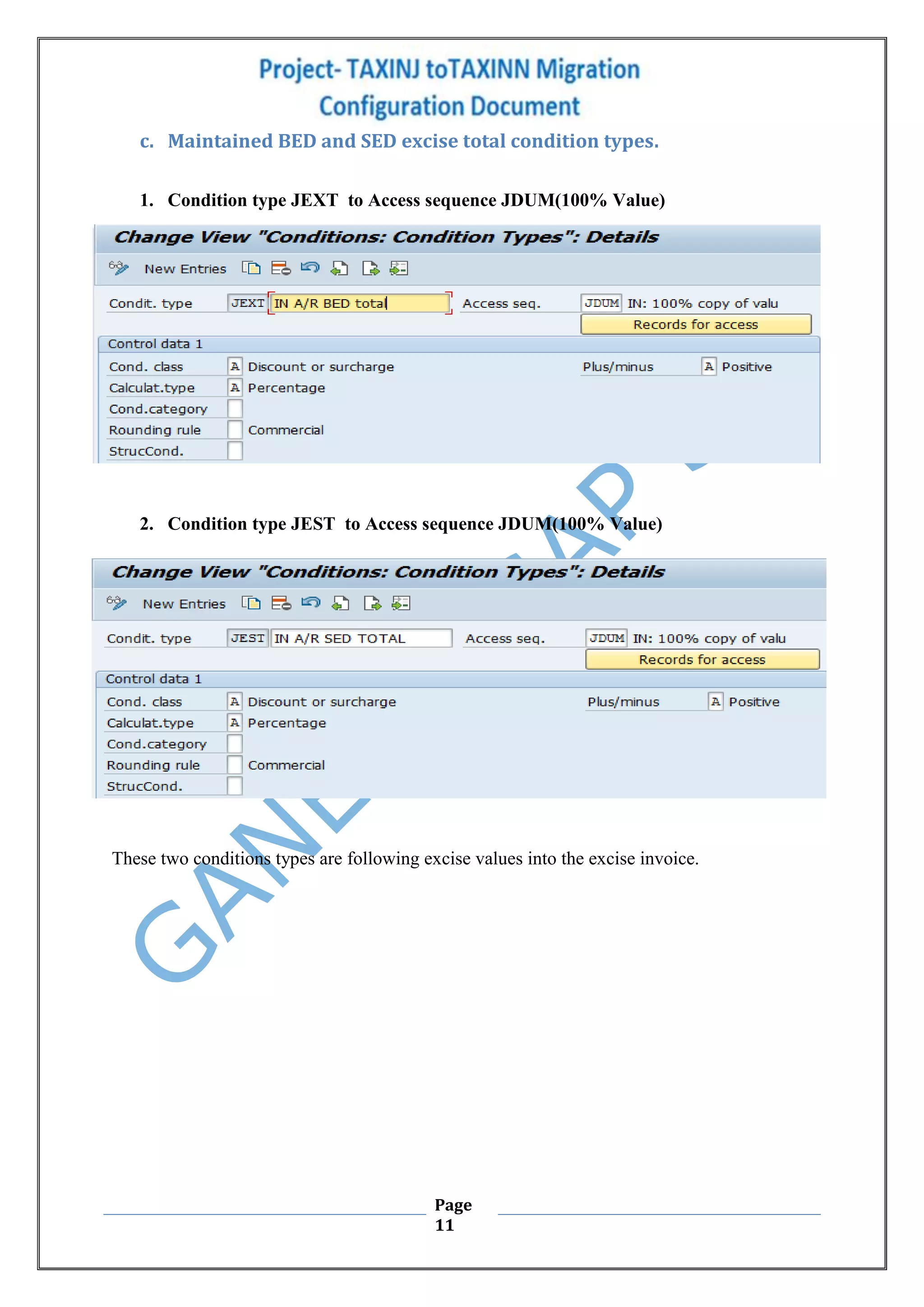

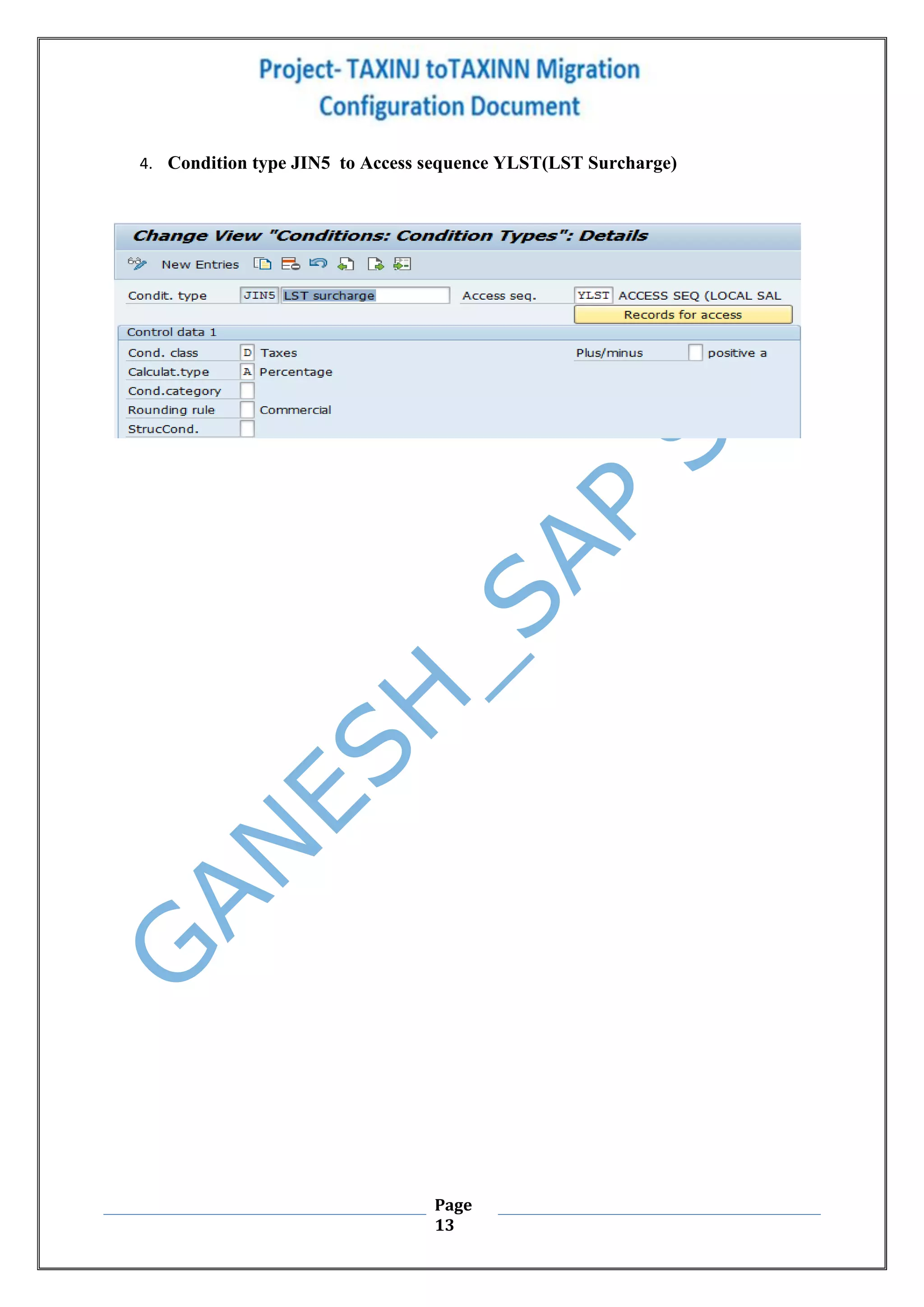

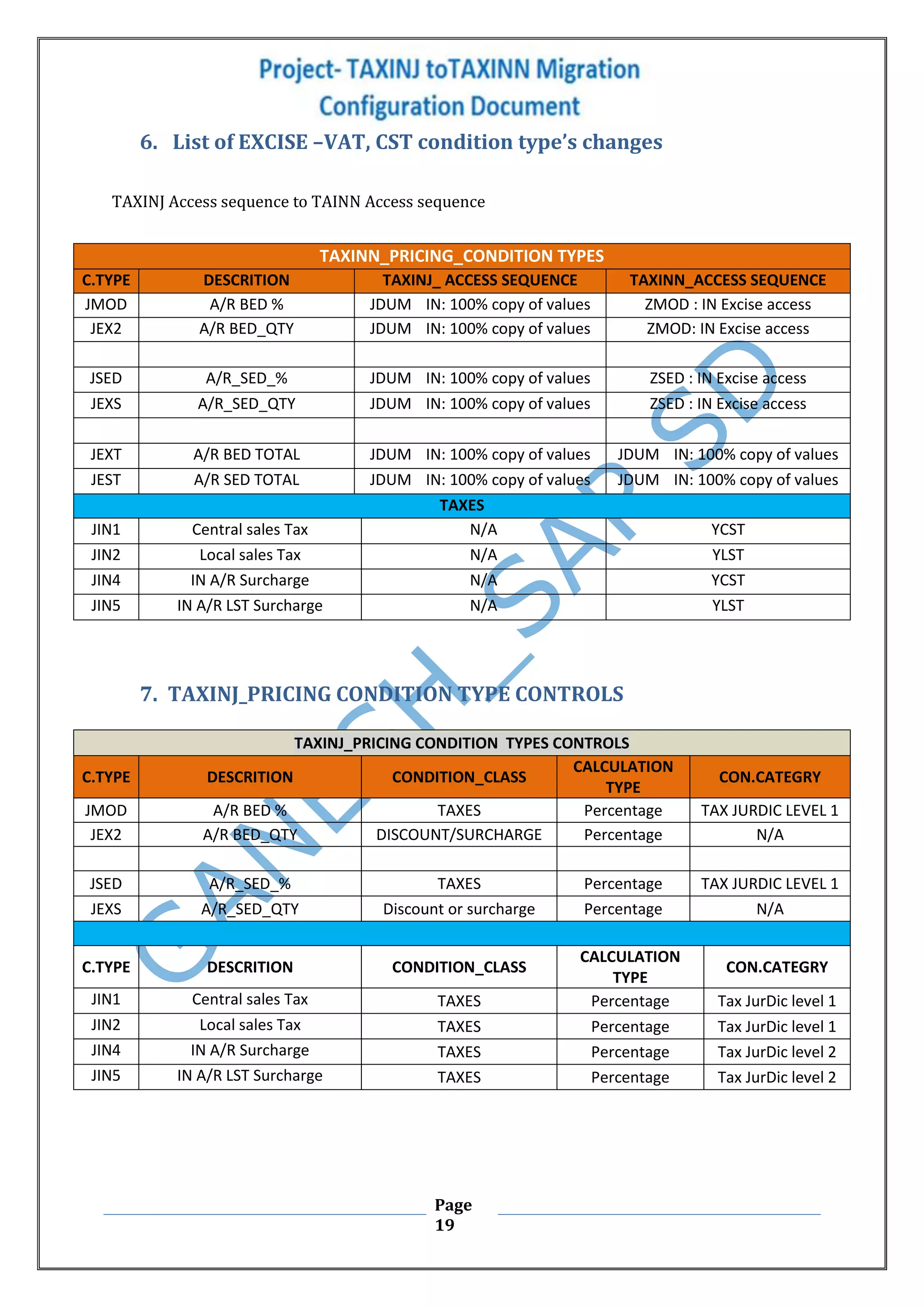

5. Assigning access sequences for excise condition types and maintaining total excise condition types.

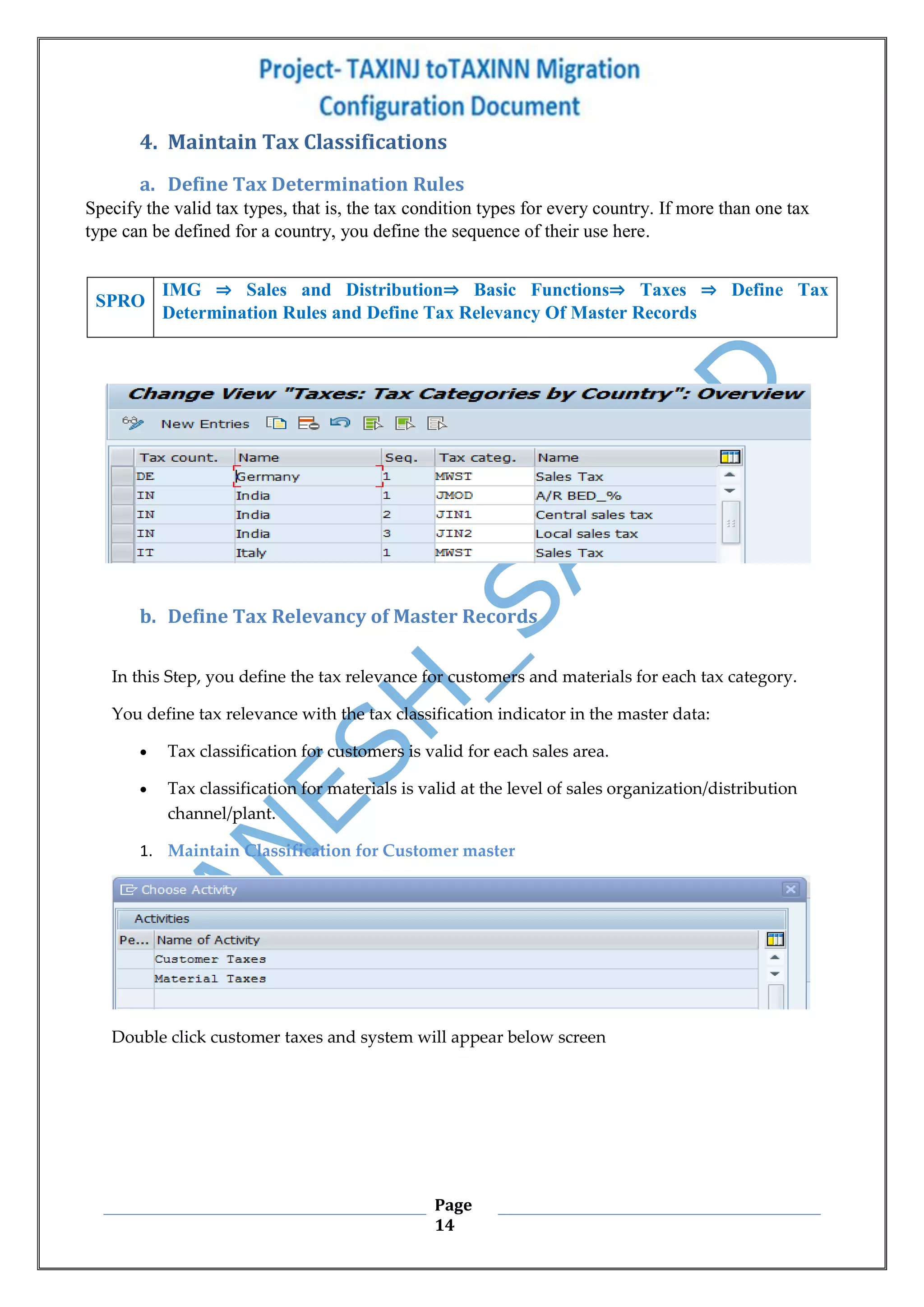

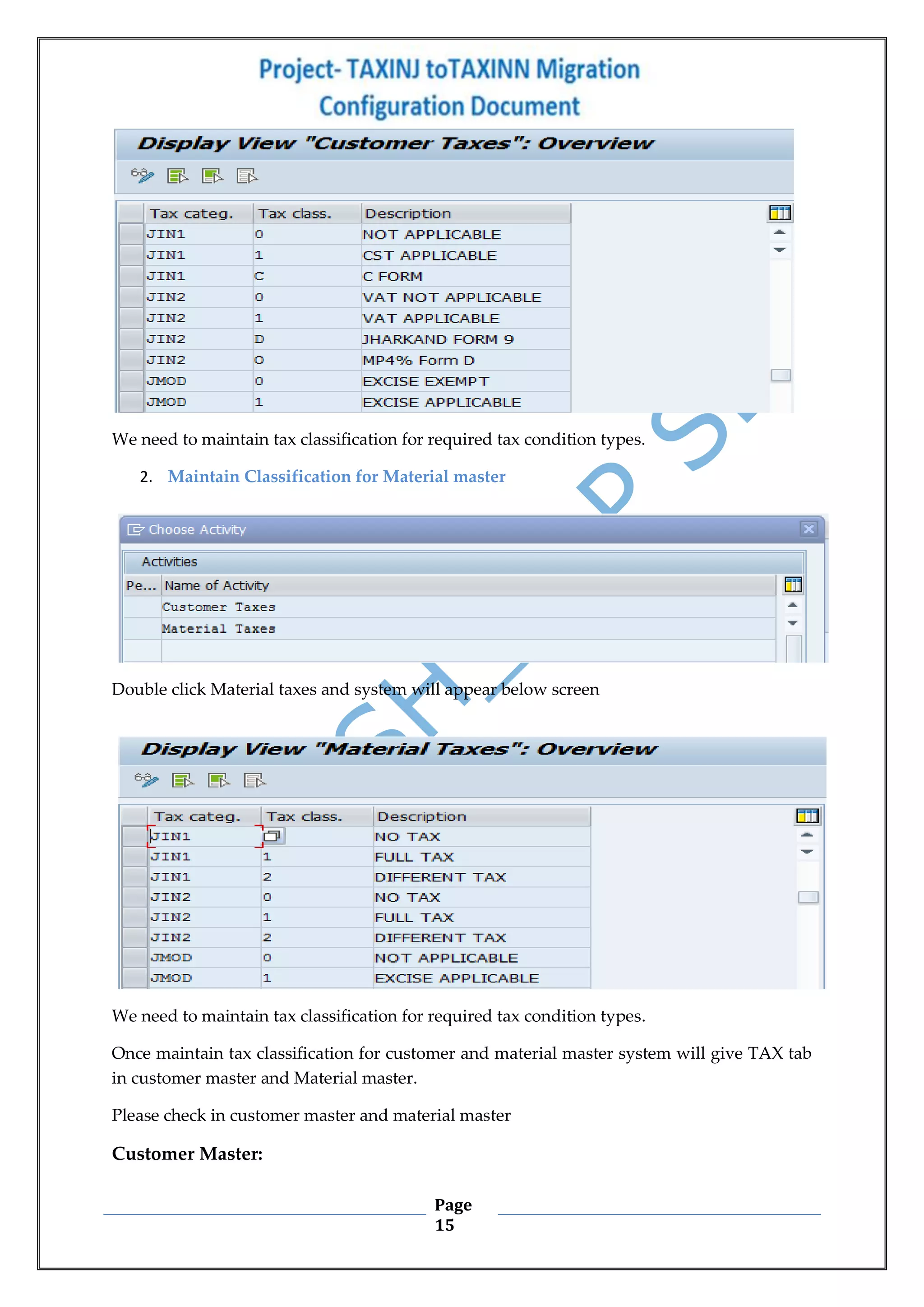

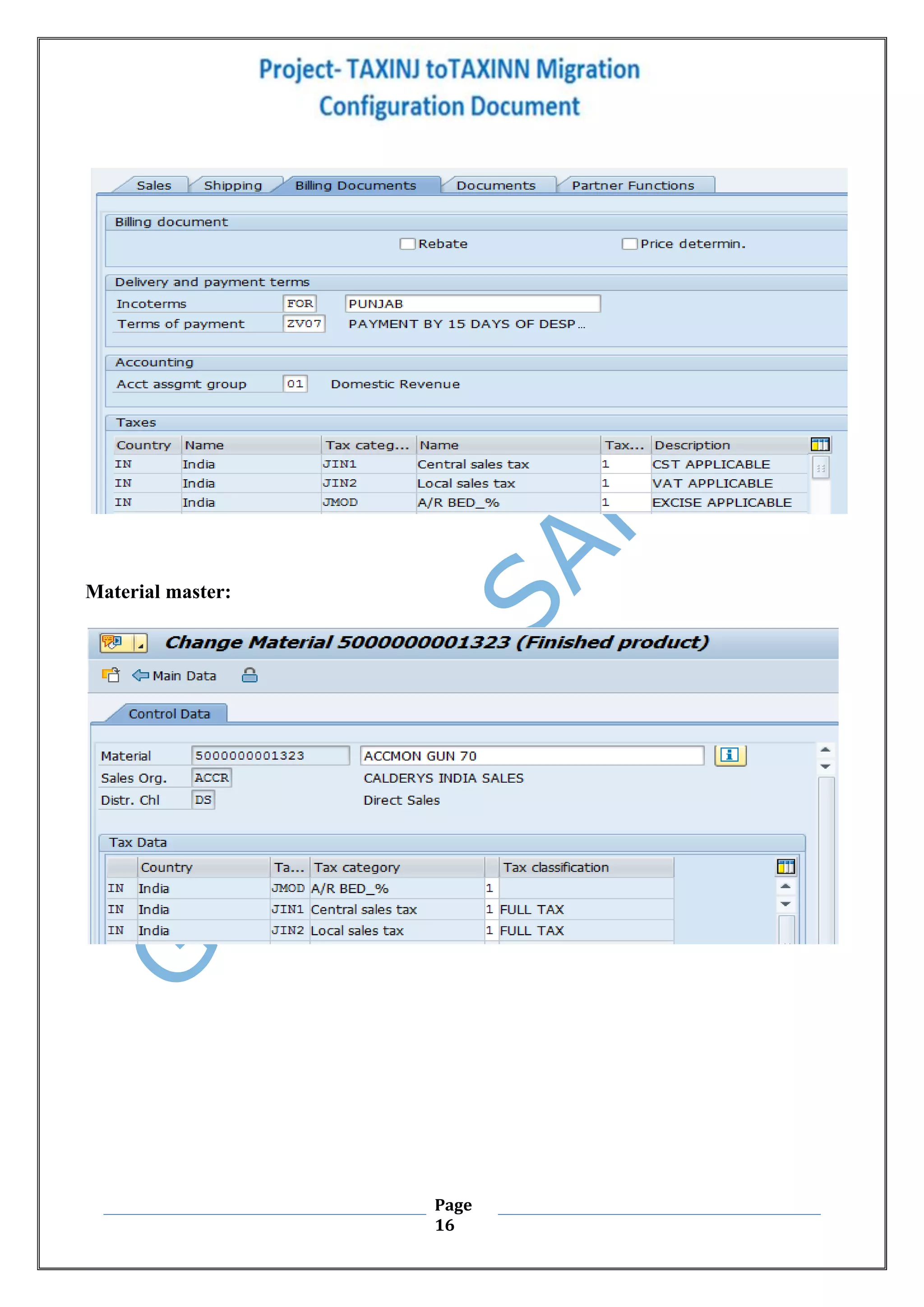

6. Defining tax determination rules and tax relevancy for customer and material master records.