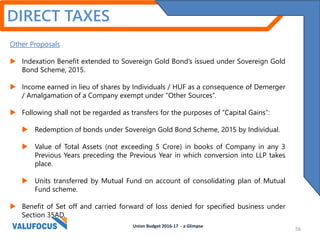

The Union Budget for FY 2016-17 emphasizes growth and introduces tax reforms aimed at rationalizing exemptions and supporting initiatives like Make in India and Digital India. Key changes in indirect and direct taxes include new service tax rates, the introduction of the Krishi Kalyan Cess, and modifications to the CENVAT credit rules, affecting various sectors. The budget also aims to resolve tax disputes and enhance compliance through adjustments in penalties and procedural rules.

![CENTRAL EXCISE

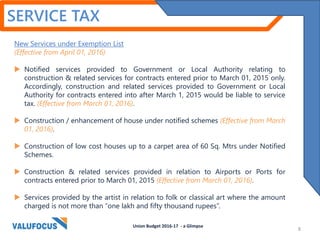

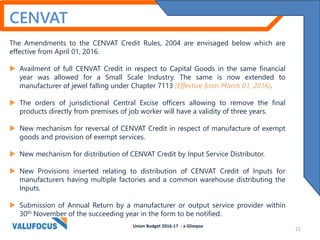

Legislative Changes

Exemption from duty of excise in respect of Disposable sterilized dialyzer and micro

barrier of artificial kidney.

Excise duty exemption on remnant kerosene, presently available for manufacture of

Linear alkyl Benzene [LAB] and heavy alkylate [HA] is being extended to N-paraffin

arising in the course of manufacture of LAB and HA also.

Unconditional Exemption in respect of Improved Cook Stoves including Smokeless

Chulhas for burning wood, agrowaste, cowdung, briquettes, and coal.

Area based exemptions in respect of production of gold & Silver from Gold dore,

silver dore, or any other raw materials is being withdrawn prospectively.

Union Budget 2016-17 - a Glimpse

26](https://image.slidesharecdn.com/unionbudget-2016-160229222724/85/Union-budget-2016-26-320.jpg)

![CENTRAL EXCISE

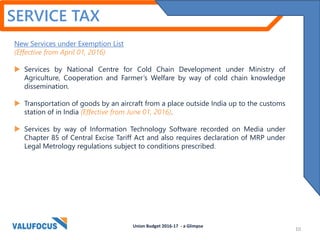

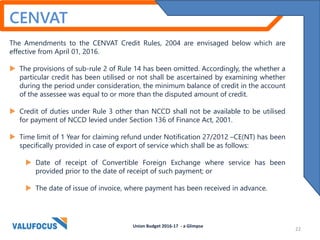

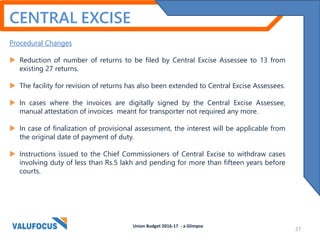

Changes in Excise Duty Rates

(Effective from March 01, 2016)

Description of Goods New Rate Old Rate

Rubber Sheets & Resin Rubber Sheets for Soles & Heels 6% 12.5%

PSF/PFY manufactured from plastic scrap or Plastic waste including

waste PET Bottles

2% without CENVAT

Credit or 12.5% with

CENVAT Credit

2% without CENVAT

Credit or 6% with

CENVAT Credit

Articles of Jewellery [excluding articles of silver jewellery, other than

those studded with diamonds, ruby, emerald or sapphire]

1% (without Cenvat

Credit) and 12.5%

(with Cenvat Credit)

12.5%

Gold Bars manufactured from Gold ore or concentrate, gold dore bar

and silver dore bar

9.5% 9%

Gold Bars & Gold Coins of Purity not below 99.5% produced during

process of Copper smelting

9.5% 9%

Silver manufactured from silver ore or concentrate: silver dore bar

gold dore bar

8.5% 8%

Silver in any form except silver coins of purity below 99.9%, produced

during the process of copper smelting

8.5% 8%

Rubber Sheets & Resin Rubber Sheets for Soles & Heels 6% 12.5%

Union Budget 2016-17 - a Glimpse

32](https://image.slidesharecdn.com/unionbudget-2016-160229222724/85/Union-budget-2016-32-320.jpg)

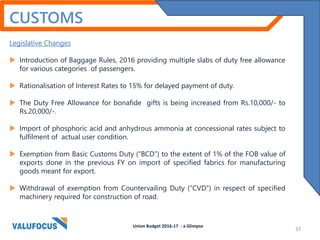

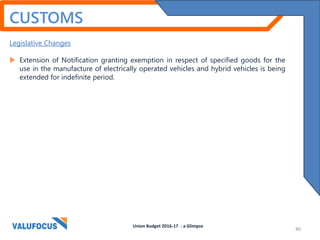

![CUSTOMS

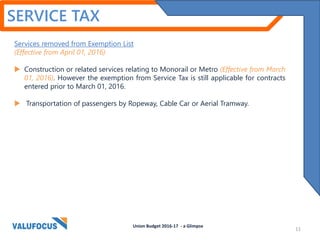

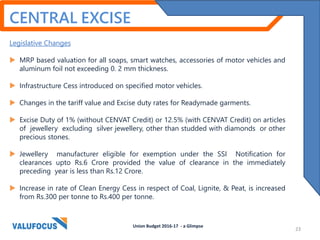

Legislative Changes

Exemption from BCD on import of specified raw materials and capital goods for use

in manufacture of Micro fuses, Sub-miniature fuses, Resettable fuses, and Thermal

fuses.

Exemption from the levy of BCD and Special Additional Duty (“SAD”) on import of

machinery, electrical equipment's, other instruments and their parts [except

populated Printed Circuit Boards] for fabrication of semiconductor wafer and Liquid

Crystal Display (LCD), subject to actual user condition.

Exemption from levy of BCD and SAD on import of machinery, electrical equipment's,

other instruments and their parts [except populated PCBs] falling under chapter 84,

85, 90 for assembly, testing, marking and packaging of semiconductor chips (ATMP),

subject to actual user condition.

Exemption from BCD, CVD & SAD withdrawn with respect to charger/Adopter,

Battery and Wired Headsets/Speakers procured for the purpose of manufacture of

mobile handsets including cellular phones.

Union Budget 2016-17 - a Glimpse

38](https://image.slidesharecdn.com/unionbudget-2016-160229222724/85/Union-budget-2016-38-320.jpg)

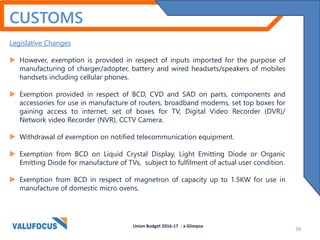

![CUSTOMS

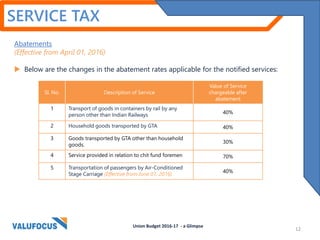

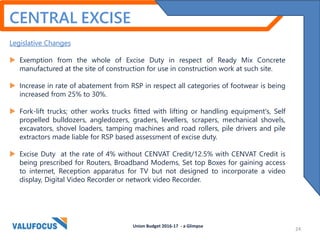

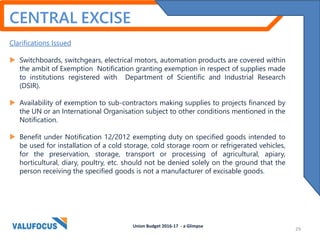

Changes in Duty Rate- Special Additional Duty (“SAD”)

(Effective from March 01, 2016)

Description of Goods New Rate Old Rate

Orthoxylene for use in manufacture of phthalic anhydride 2% 4%

Populated printed circuit boards [PCBs] for manufacture of personal computers

(laptop or desktop) including tablet computer.

4% Exempt

Ppopulated PCBs for use in manufacture of mobile phone or tablet computer 2% Nil

Union Budget 2016-17 - a Glimpse

46](https://image.slidesharecdn.com/unionbudget-2016-160229222724/85/Union-budget-2016-46-320.jpg)