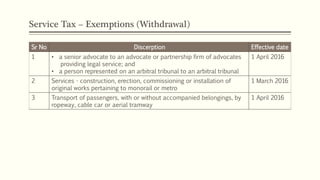

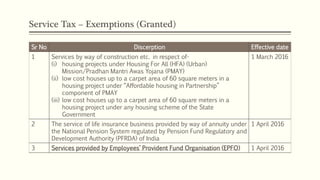

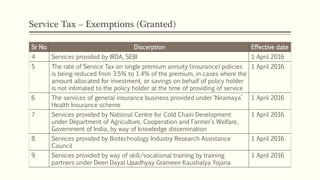

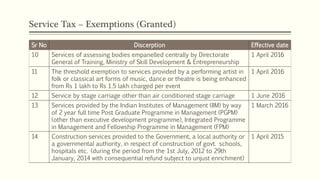

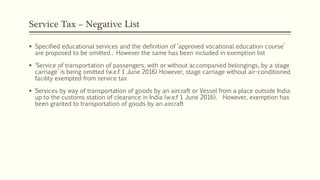

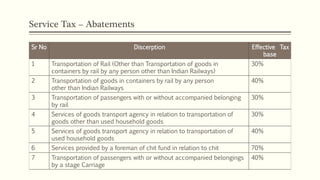

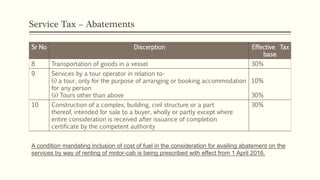

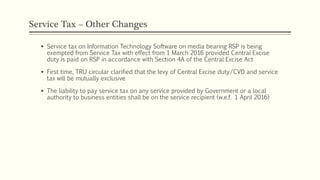

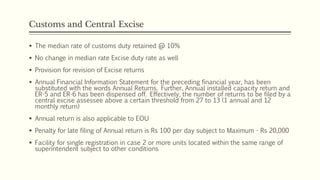

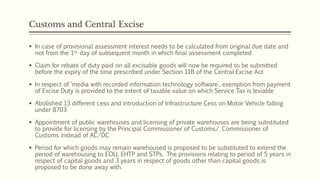

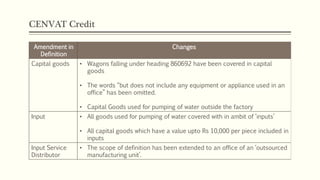

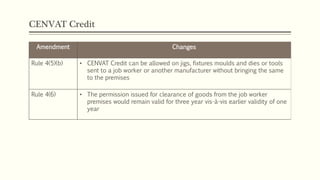

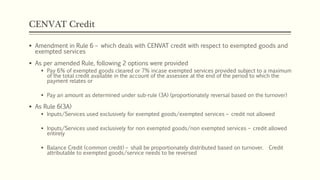

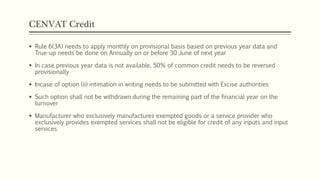

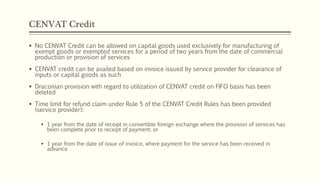

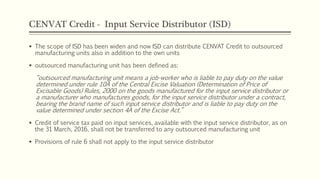

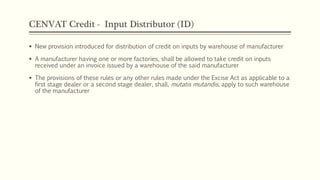

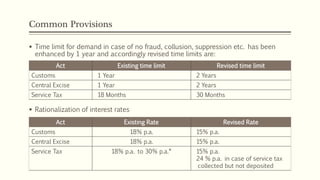

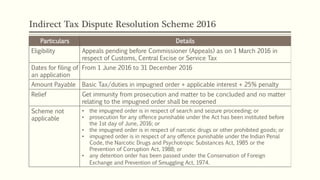

The Union Budget 2016 includes key indirect tax proposals such as the introduction of a new cess (Krishi Kalyan Cess at 0.5%) and amendments aimed at aligning current tax provisions with the forthcoming Goods and Services Tax (GST). Notable changes involve the rationalization of interest rates for various taxes, revised conditions for CENVAT credit, and a dispute resolution scheme to reduce litigation. Additionally, several exemptions and abatements have been introduced or revised, impacting service tax calculations and classifications.