Embed presentation

Download to read offline

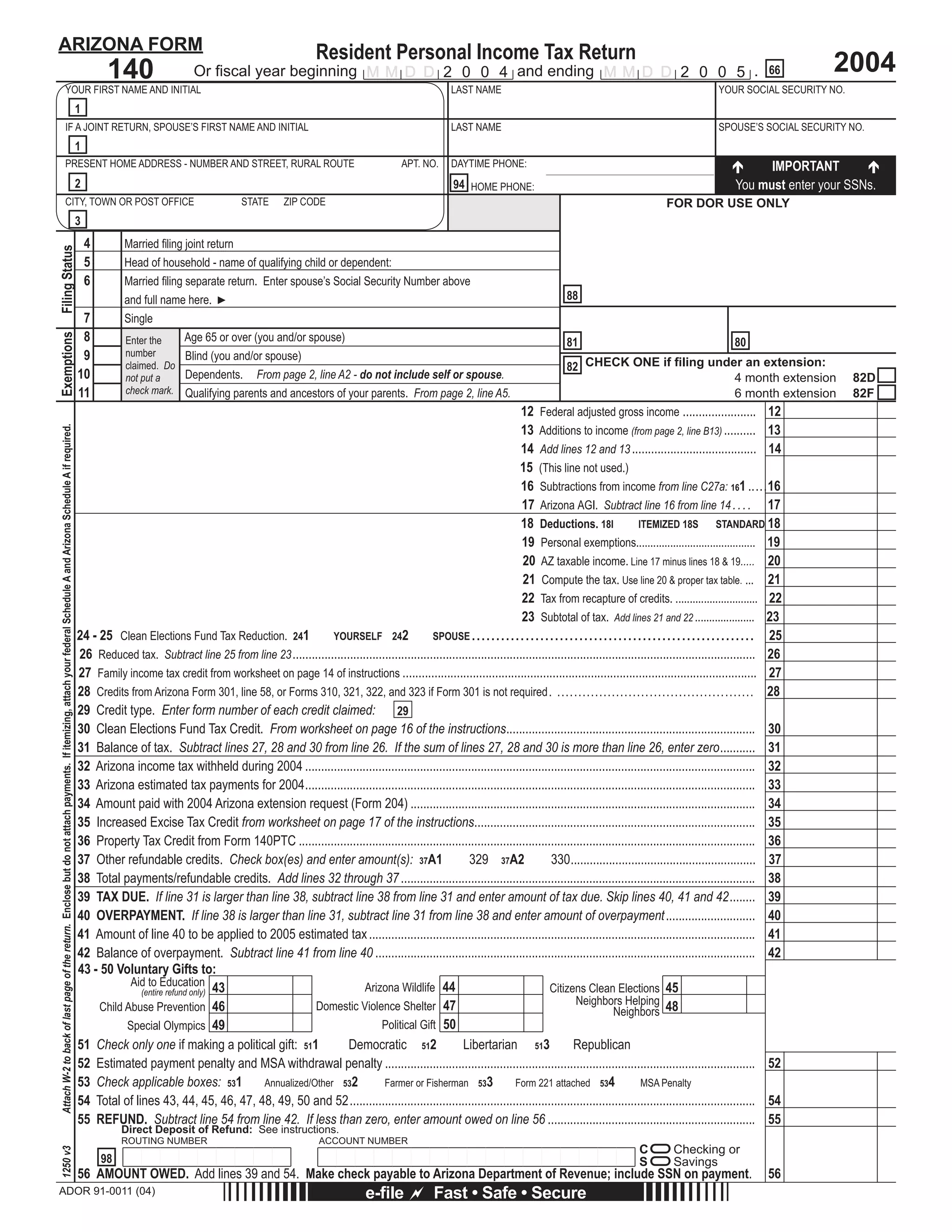

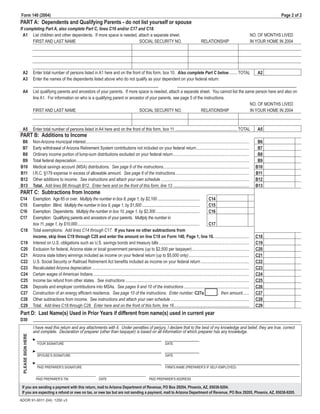

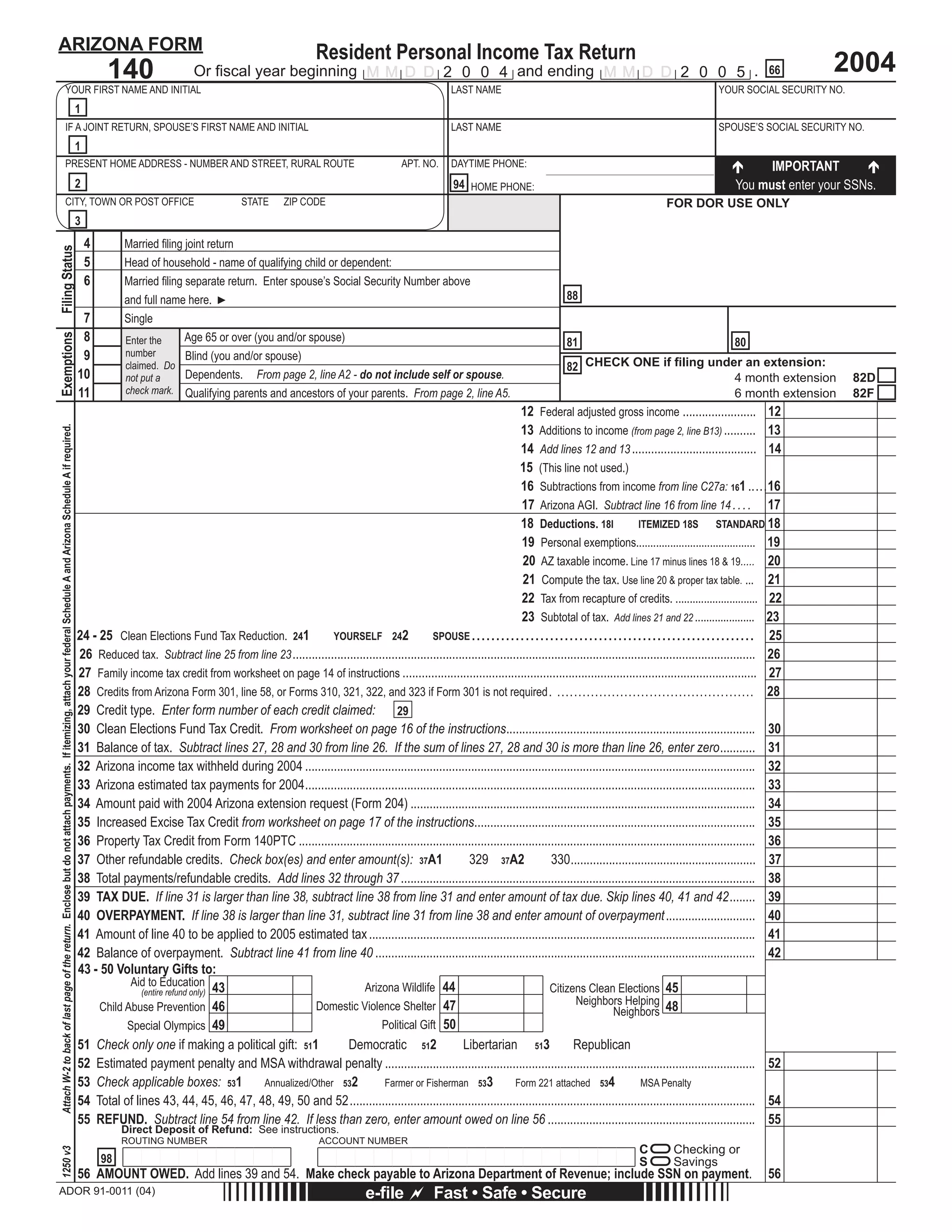

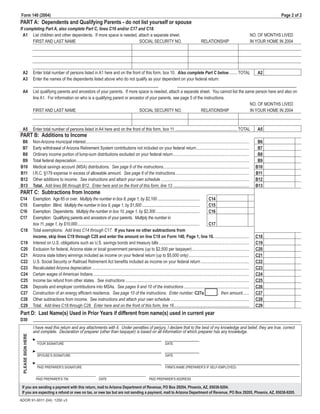

This document appears to be an Arizona state personal income tax return form from 2004. It contains fields for entering personal information like names, addresses, social security numbers, as well as financial information like income, deductions, credits, payments and the amount of refund or tax owed. The form provides instructions for how to fill it out and includes sections for listing dependents, additions to income, subtractions from income, and signatures.