Embed presentation

Download to read offline

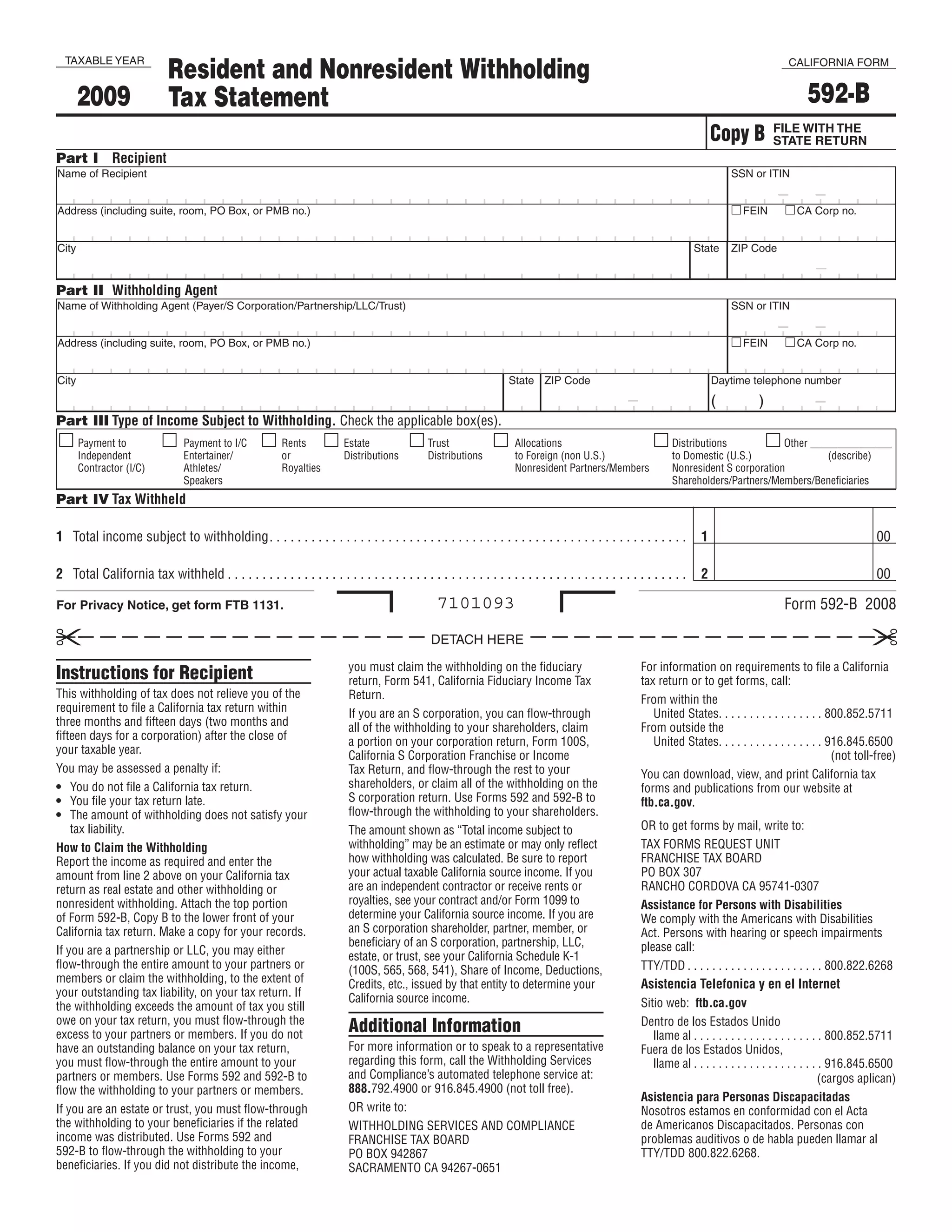

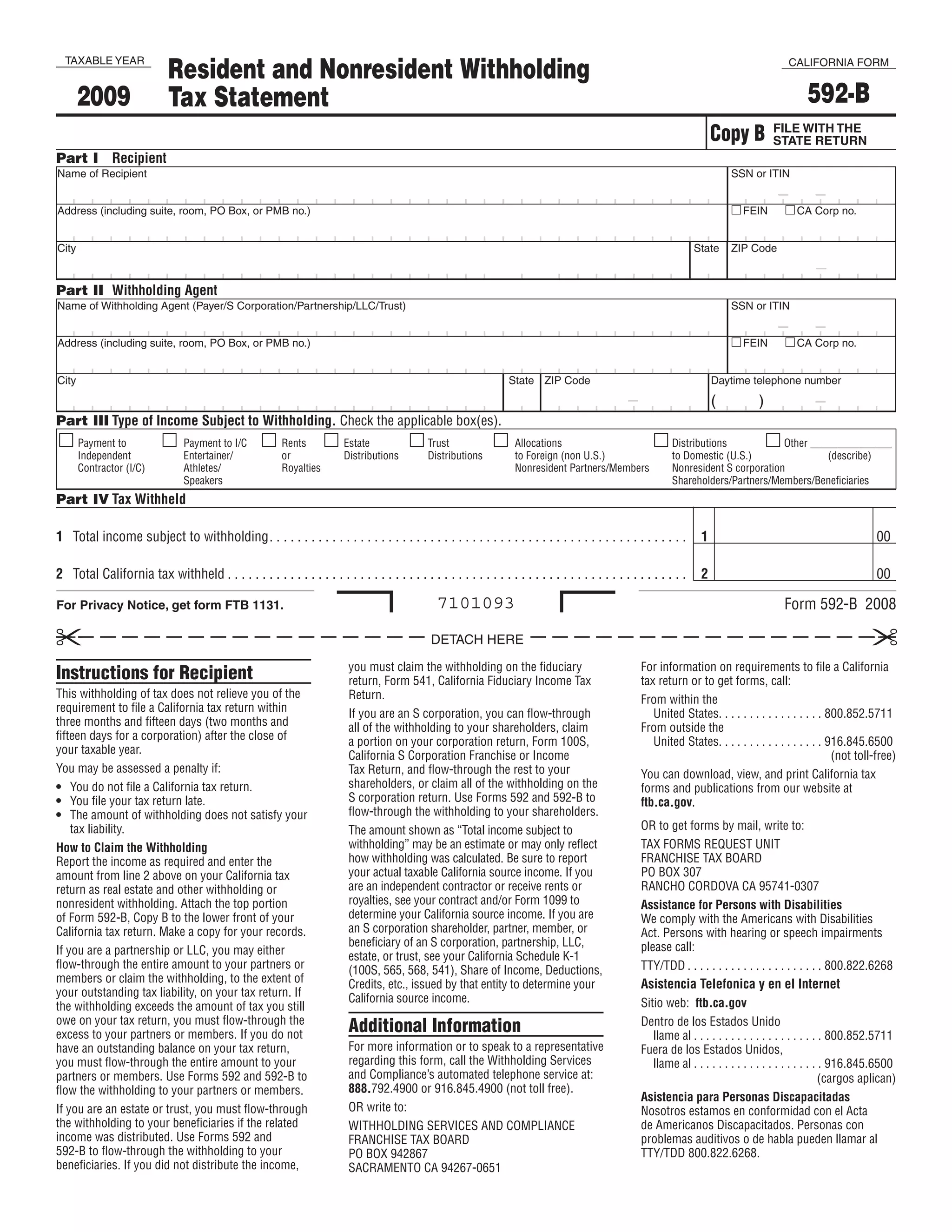

This document is a California Form 592-B for the tax year 2009. It provides instructions for withholding agents and recipients regarding nonresident and resident withholding. Key details include: - Form 592-B is used to report income subject to withholding and the amount of California tax withheld. - It must be provided to recipients by January 31 and to foreign partners by the 15th day of the 4th month following the close of the taxable year. - The recipient should attach Copy B to their California tax return to claim the withholding amount.