Embed presentation

Download to read offline

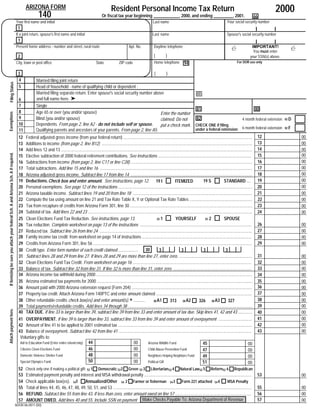

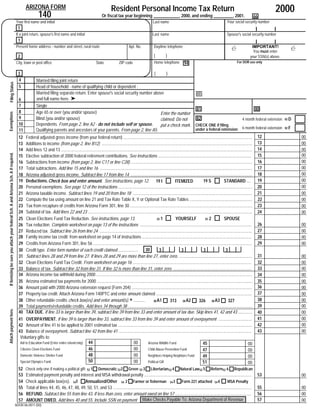

This document is an Arizona state personal income tax return form for the 2000 tax year. It includes sections to provide personal information and filing status, claim exemptions and deductions, report income and additions or subtractions to income, calculate tax liability, claim tax credits, and request a refund or pay additional tax owed. The taxpayer is filing as single and reports $0 in federal adjusted gross income, standard deduction of $0, and personal exemptions of $0, resulting in $0 Arizona taxable income and $0 tax due.