Embed presentation

Download to read offline

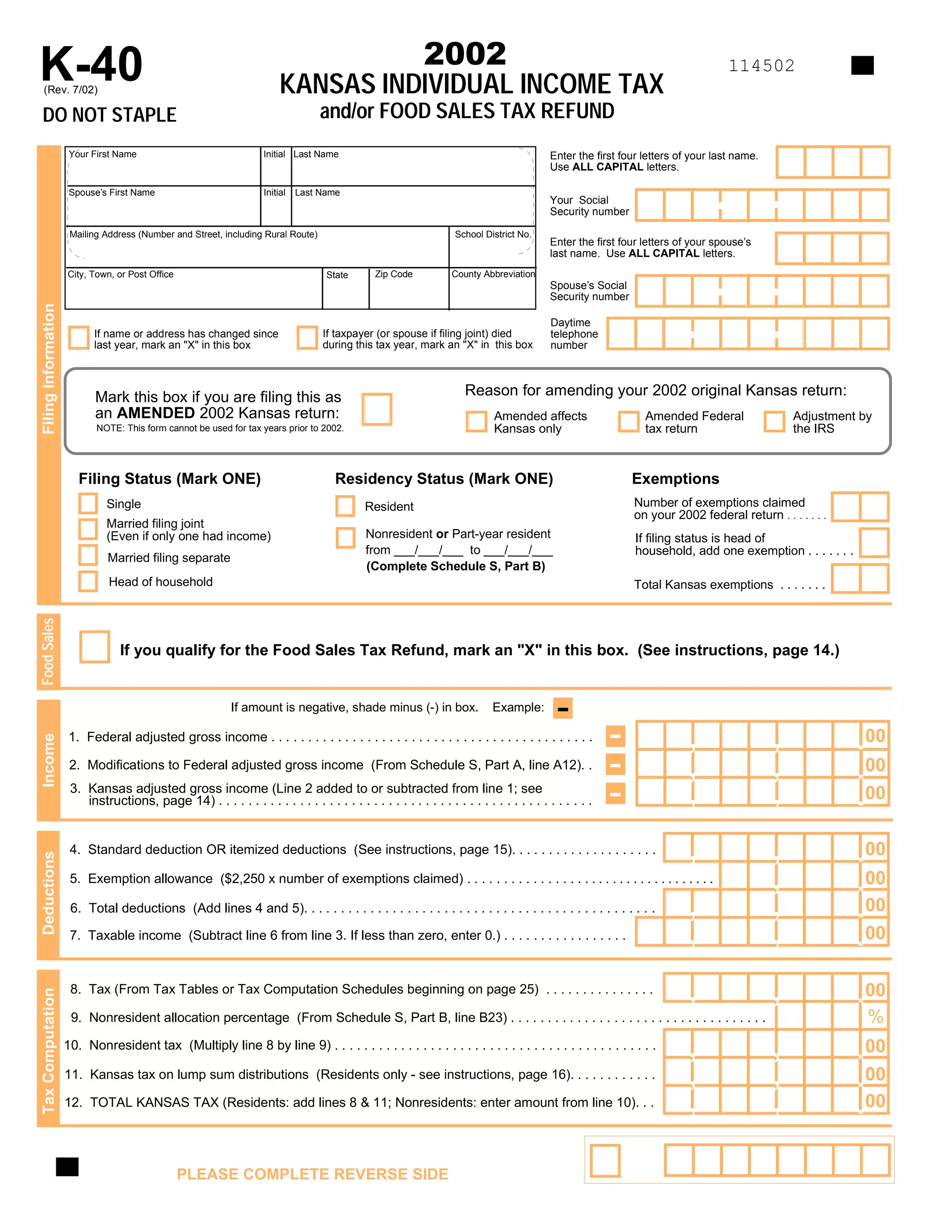

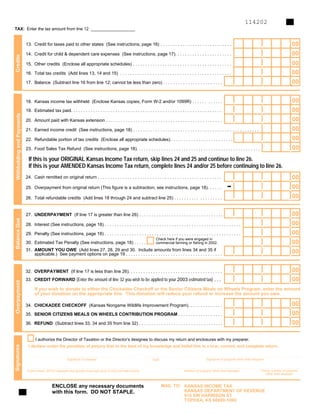

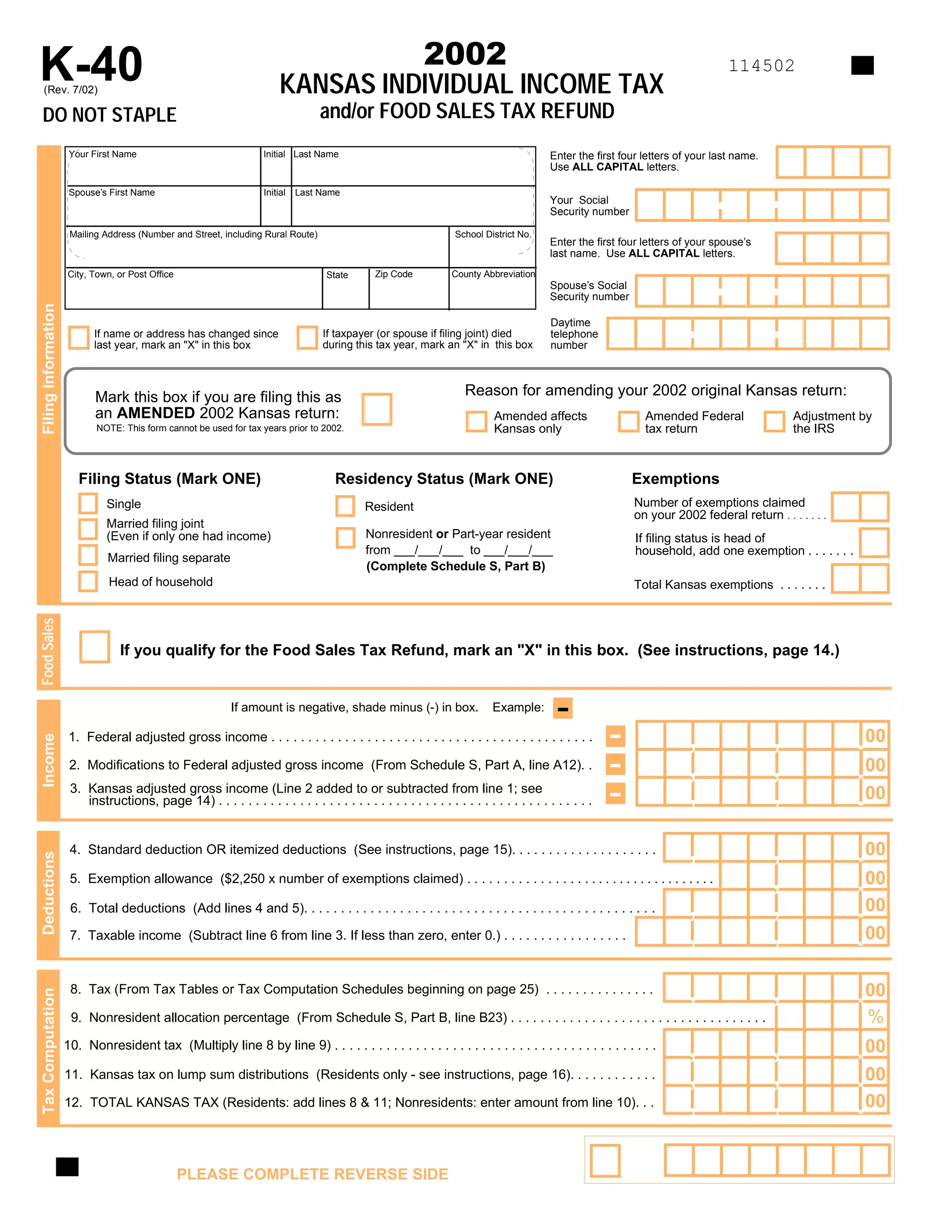

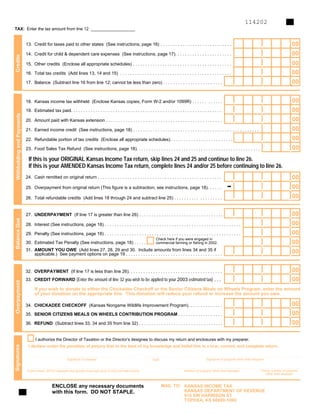

This document appears to be a Kansas individual income tax return form from 2002. It includes fields for providing information like the taxpayer's name, address, social security number, filing status, number of exemptions, federal adjusted gross income, itemized/standard deductions, exemption allowance, taxable income, tax amount, and other tax calculation details. The form is used to calculate the taxpayer's Kansas state income tax liability and/or claim a food sales tax refund for tax year 2002.