Embed presentation

Download to read offline

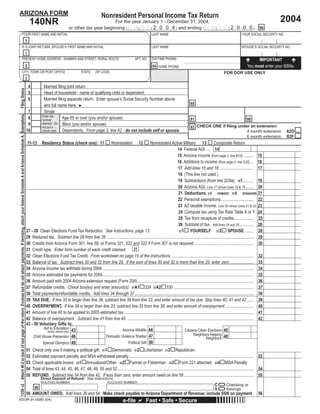

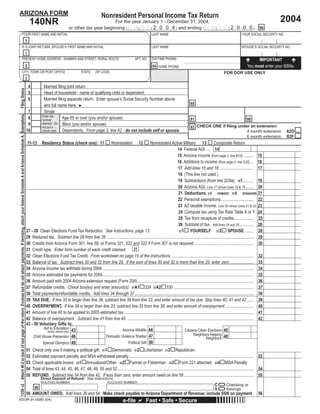

This document is an Arizona nonresident personal income tax return form for tax year 2004. It contains instructions for completing the form, including entering personal information, filing status, exemptions, income and deductions. The taxpayer must sign to declare the information provided is true and complete. The form is to be filed with the Arizona Department of Revenue to report nonresident income earned in Arizona and calculate tax liability or refund amount.