Embed presentation

Download to read offline

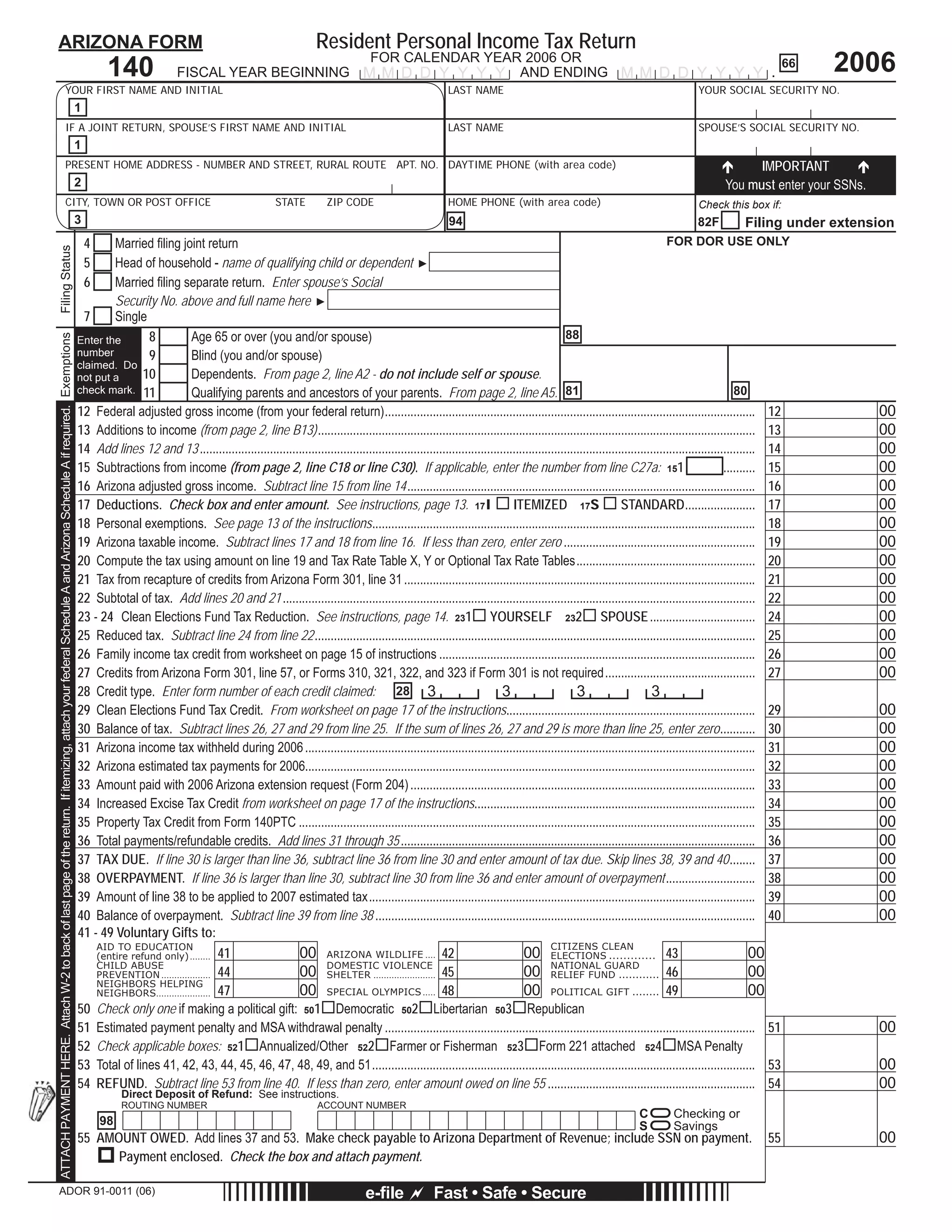

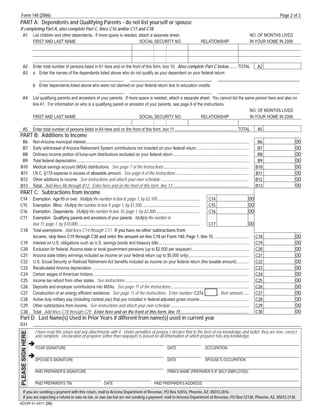

This document is an Arizona state personal income tax return form for the 2006 tax year. It requests basic personal information such as name, address, social security number. It also requests filing status, exemptions, income and deduction amounts to calculate tax liability. The taxpayer can claim various tax credits and make donations. The form must be signed to certify the accuracy of the information provided.