Embed presentation

Download to read offline

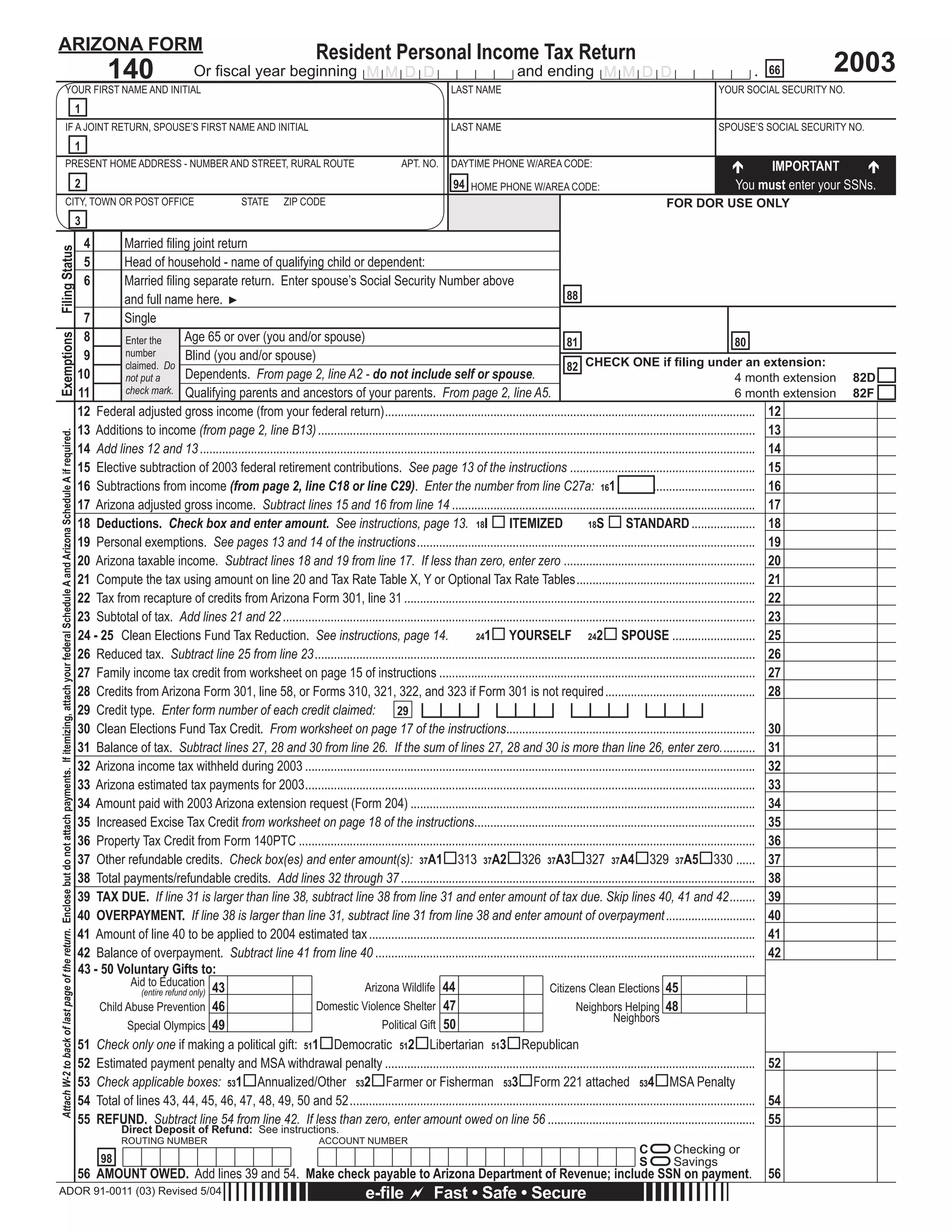

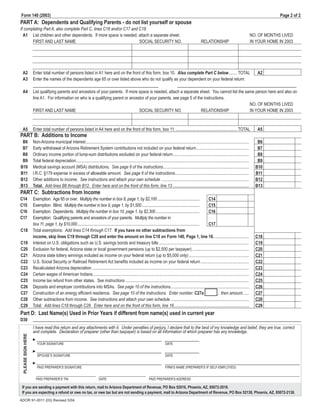

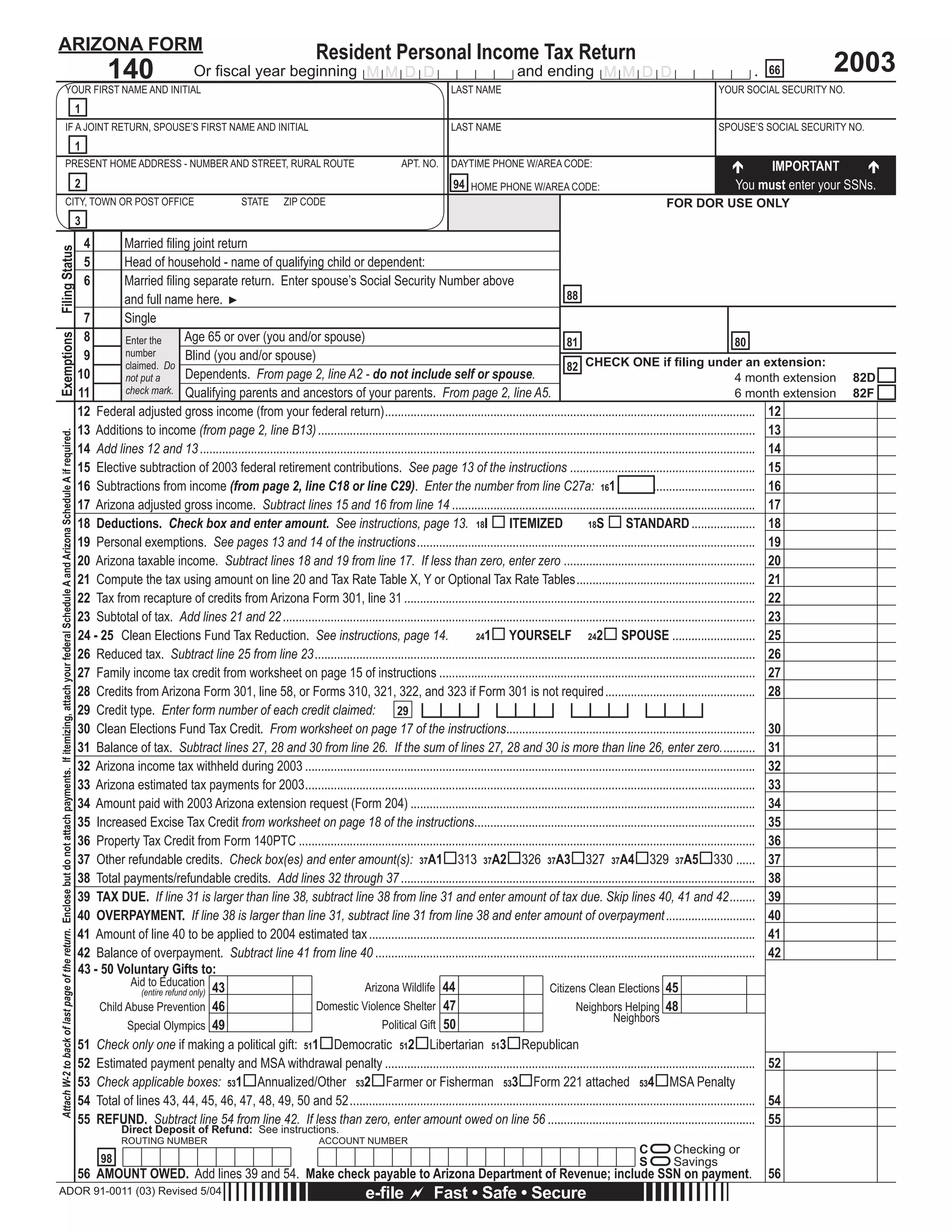

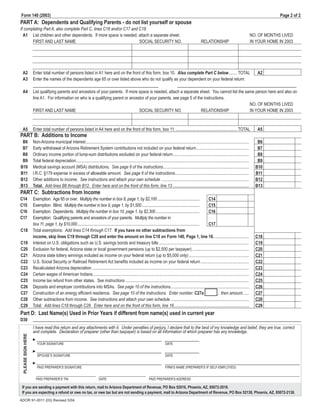

This document is an Arizona state personal income tax return form for the year 2003. It contains sections to provide personal identification information, filing status, exemptions, income and adjustments to income, tax calculations, credits and payments, and a signature section. The second page contains additional sections to list dependents and qualifying parents, additions to income, subtractions from income, and last names used in prior years if different from the current filing.