Embed presentation

Download to read offline

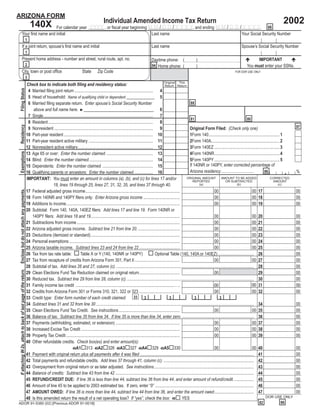

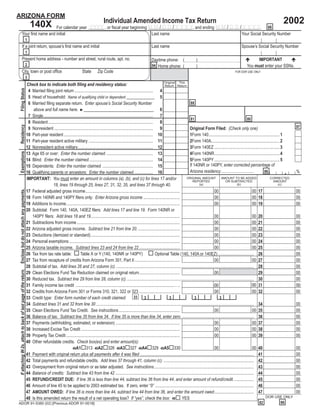

This document is an Arizona individual amended income tax return form for the year 2002. It provides fields to correct or amend information reported on the original 2002 tax return such as income amounts, deductions, exemptions, credits, payments and the amount of refund or tax owed. The form includes sections to report dependent exemptions, qualifying parents/ancestors exemptions, changes to specific line items from the original return and contact information.