Embed presentation

Download to read offline

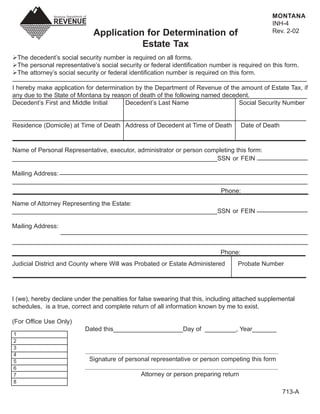

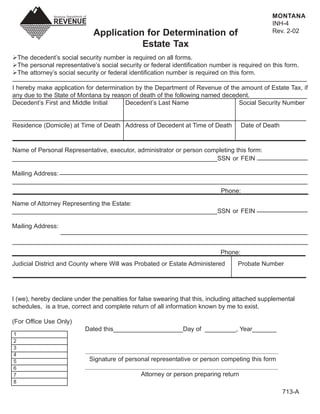

This document is an application for determining estate tax due to the state of Montana upon a decedent's death. It requests information about the decedent, their property and estate, and the personal representative overseeing the estate. The second page provides instructions for completing the form and calculating the ratio of Montana property to total property value in order to determine the portion of the federal estate tax credit allocable to Montana. Any tax due is to be paid within 18 months of the date of death.