Embed presentation

Download to read offline

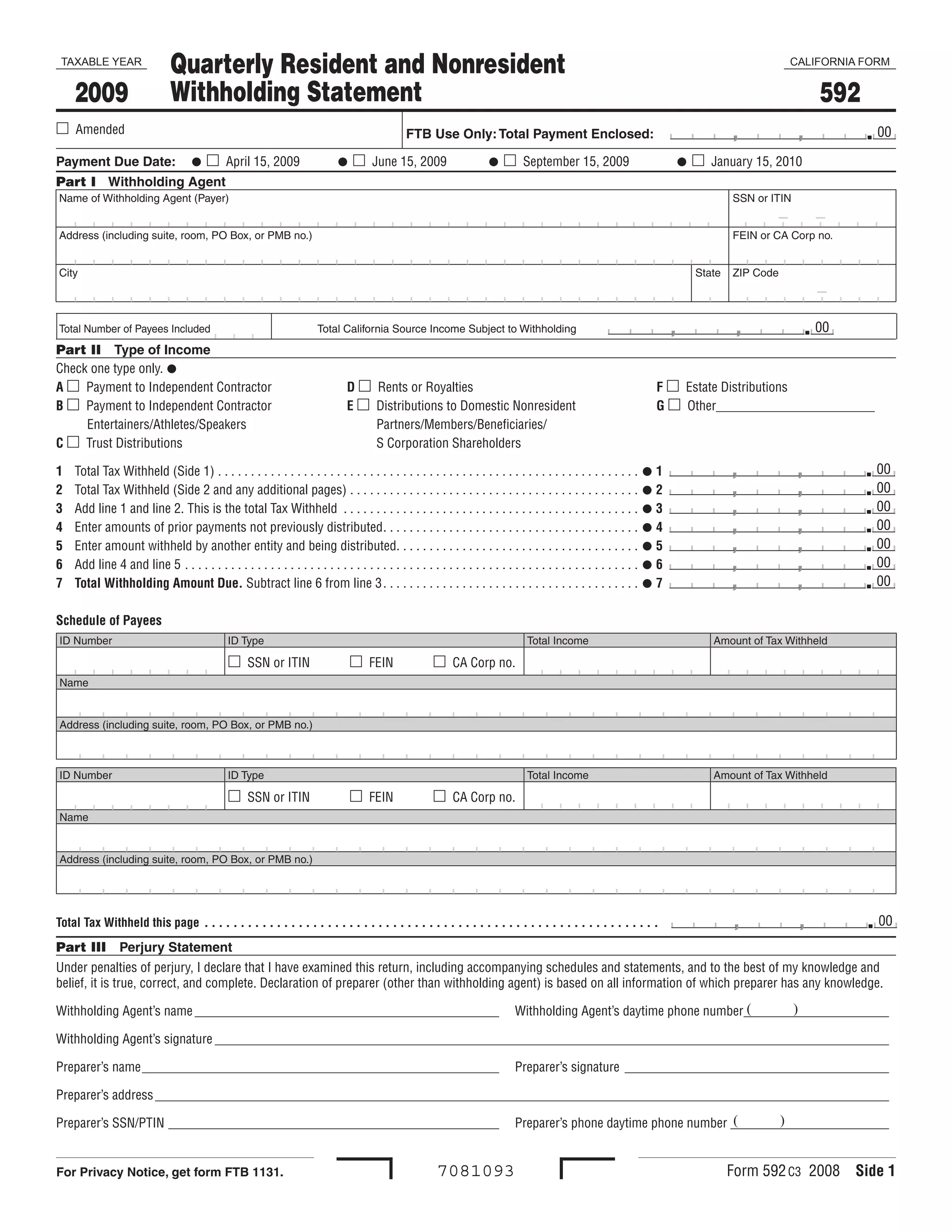

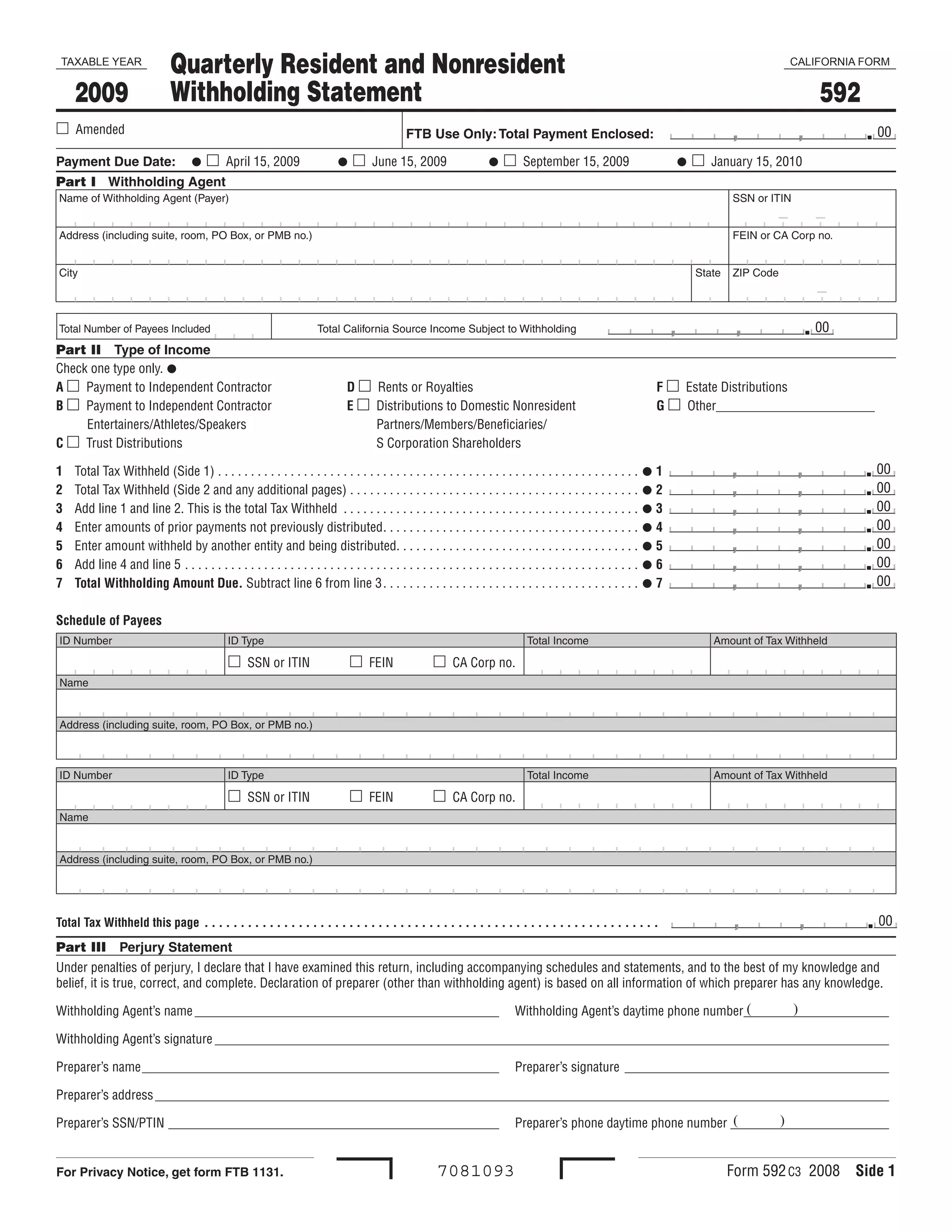

This document is a Quarterly Resident and Nonresident Withholding Statement form for tax year 2009. It is used to report tax amounts withheld from payments made to independent contractors, recipients of rents/royalties, distributions to shareholders/partners/beneficiaries, and other types of income. The form includes sections to enter information about the withholding agent, types of income, amounts of tax withheld and due, and a schedule of payees listing details of payments made and tax withheld for each recipient. Instructions are provided on filing deadlines, common errors to avoid, electronic filing requirements, interest and penalties.