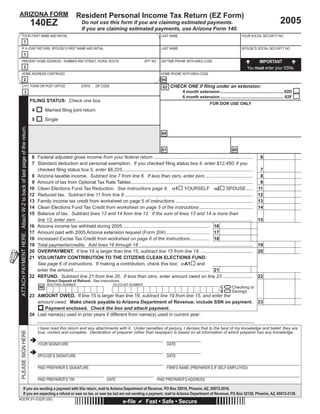

This document is an Arizona state personal income tax return form (Form 140EZ) for the year 2005. It includes instructions for filing as a single or married filing jointly taxpayer. The three-sentence summary is:

This tax form is for filing an Arizona state personal income tax return for 2005 as a single or married filing jointly taxpayer. It uses income and tax information from the federal return to calculate the taxpayer's Arizona taxable income, tax amount, payments and credits, and whether a refund is due or if an amount is owed. The taxpayer provides identification information, income, deduction, credit and payment details to determine their Arizona tax liability for 2005.