Embed presentation

Download to read offline

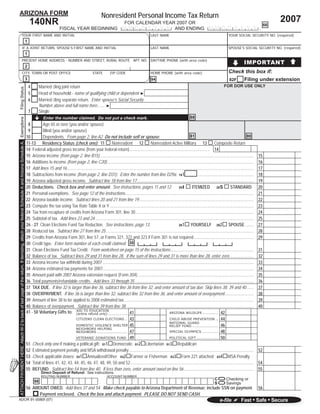

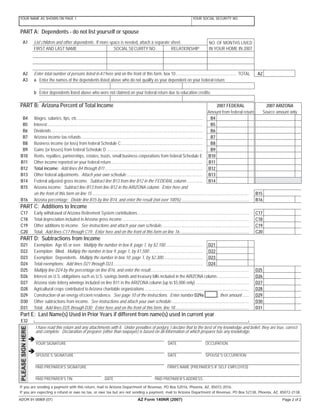

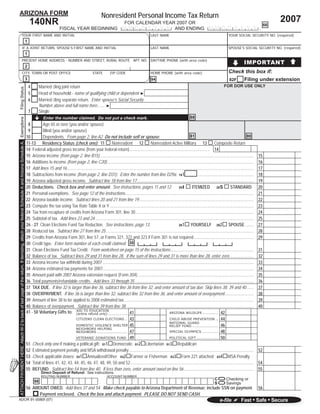

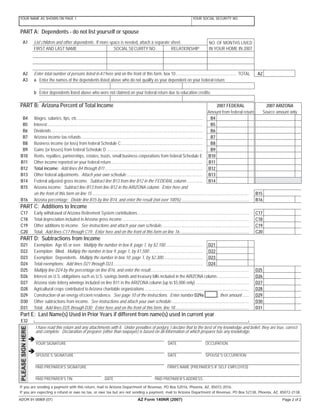

This document is an Arizona Form 140NR for the 2007 tax year. It is the Arizona nonresident personal income tax return. The form provides instructions for filing as a nonresident of Arizona and calculating Arizona-source income, deductions, exemptions, tax credits, and tax owed or refund amount. Key sections include reporting of income, deductions, personal exemptions, tax calculation, credits, payments, amounts owed or refunded.